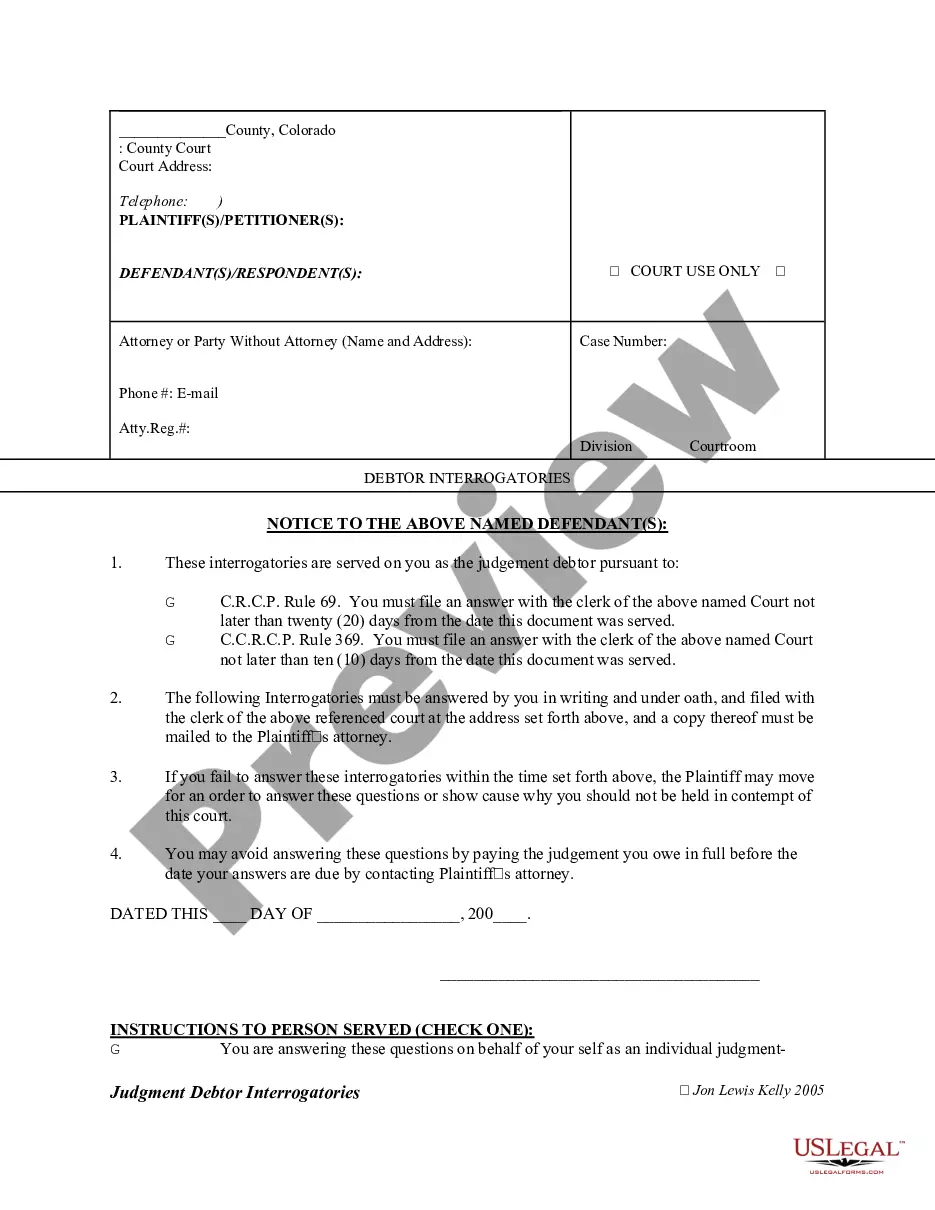

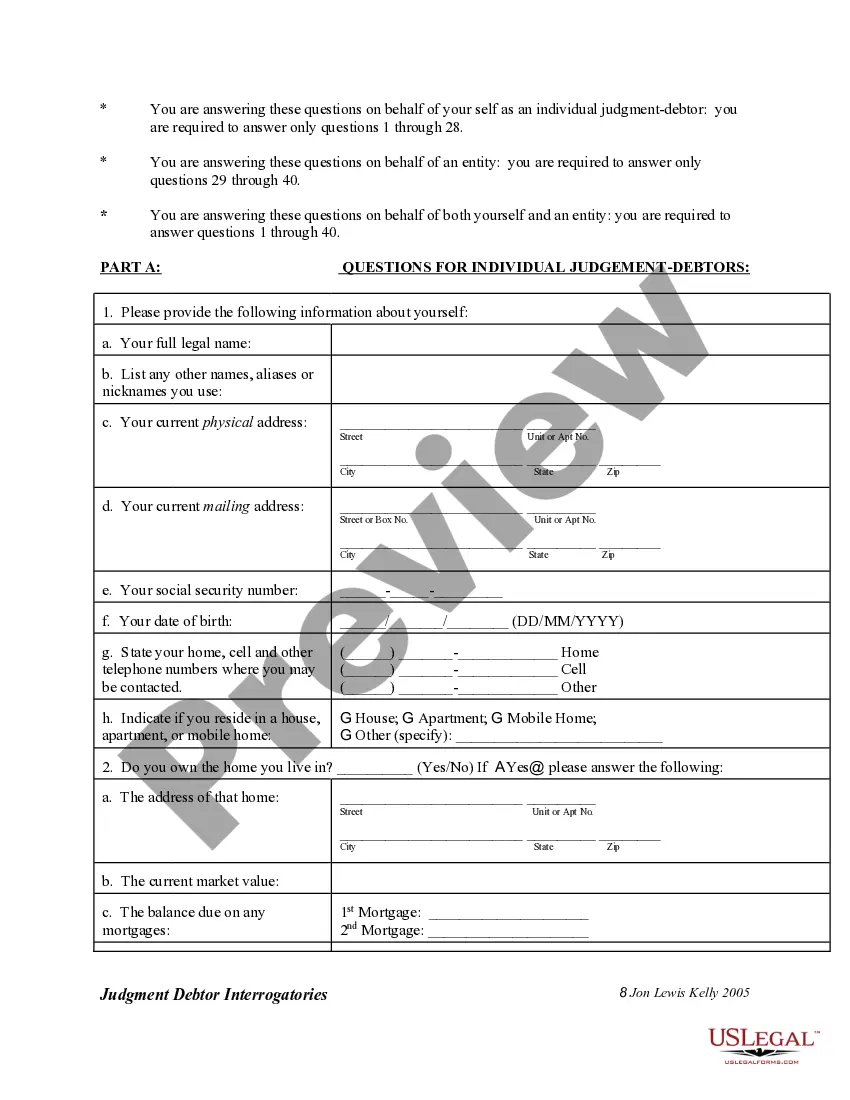

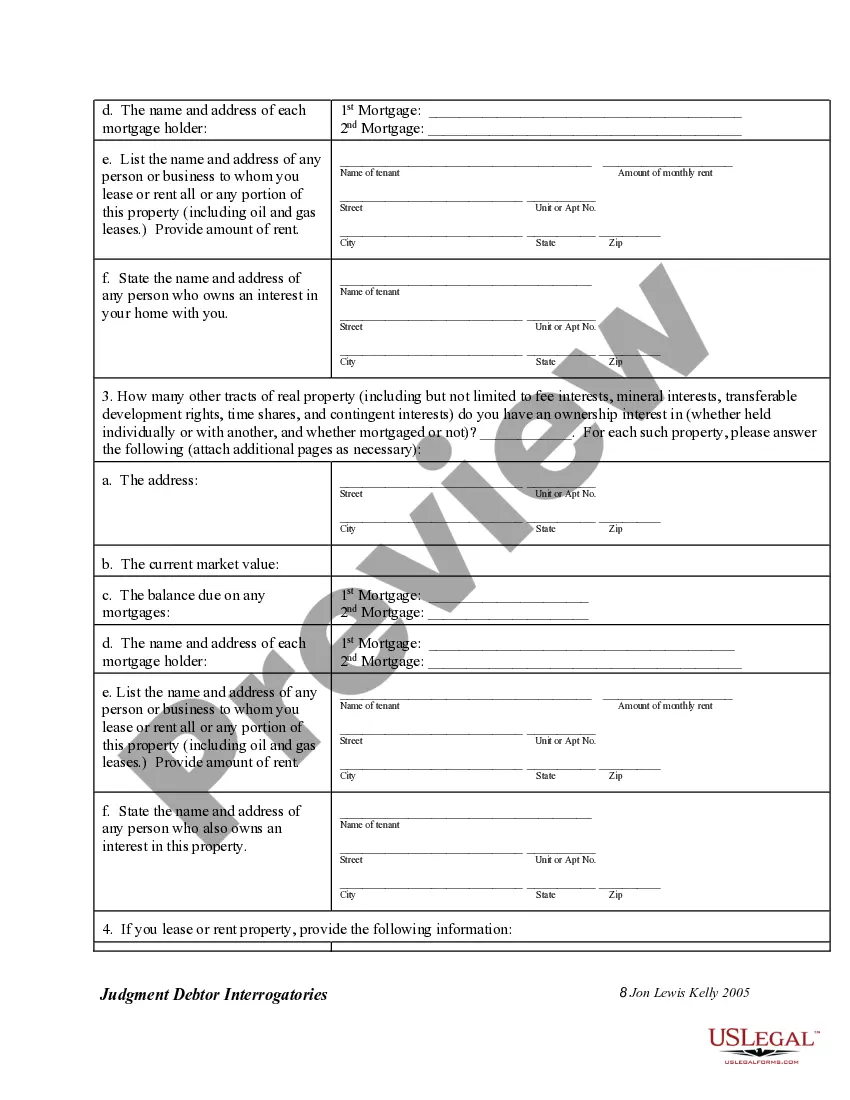

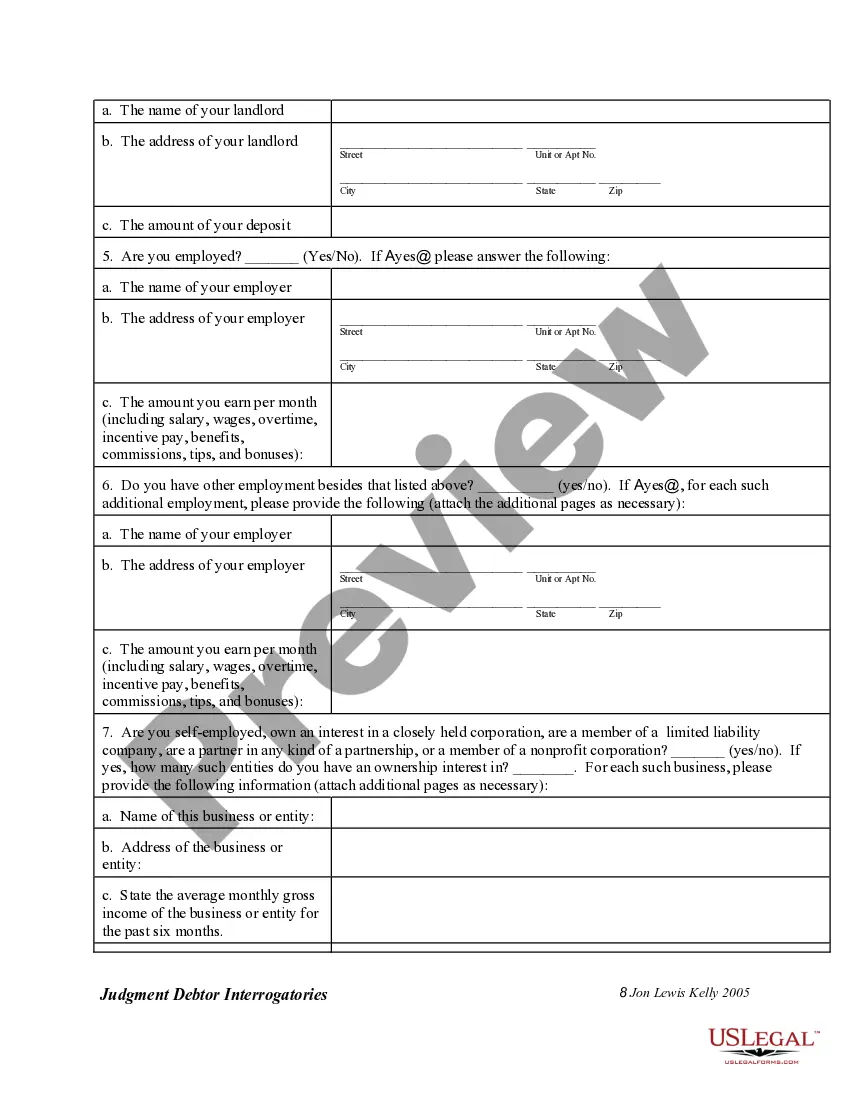

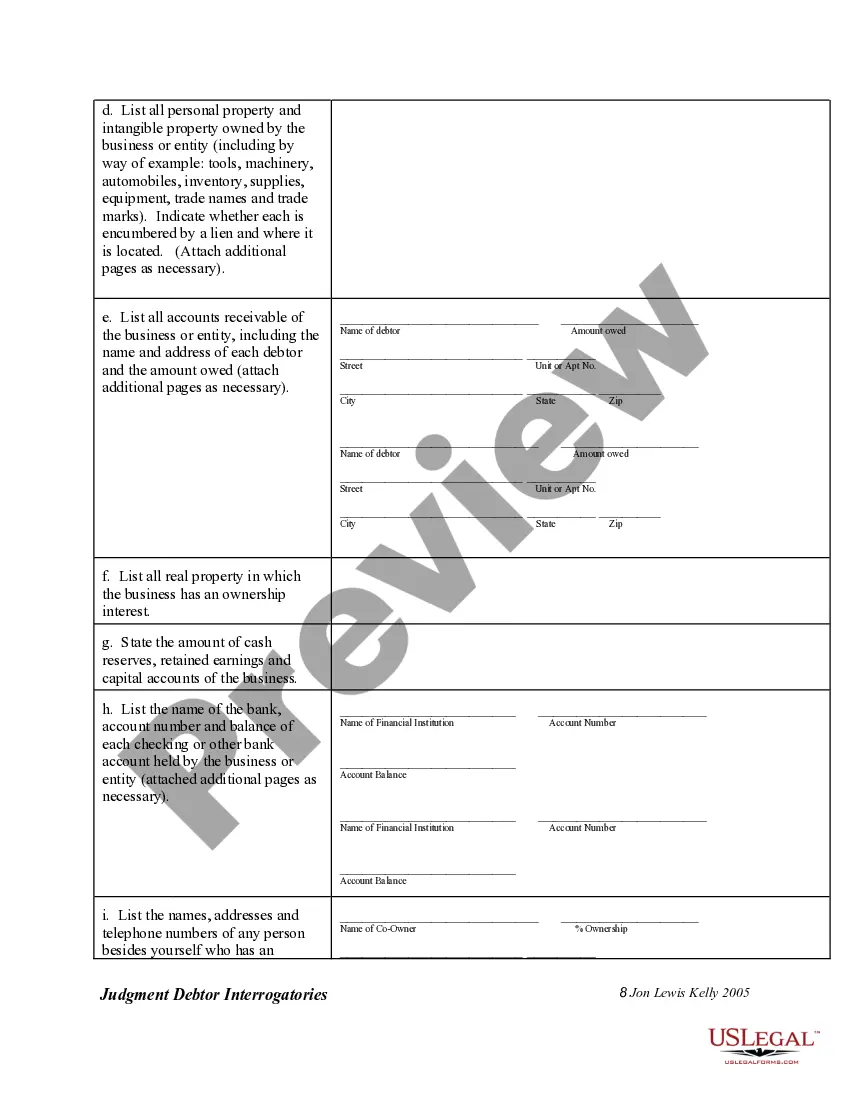

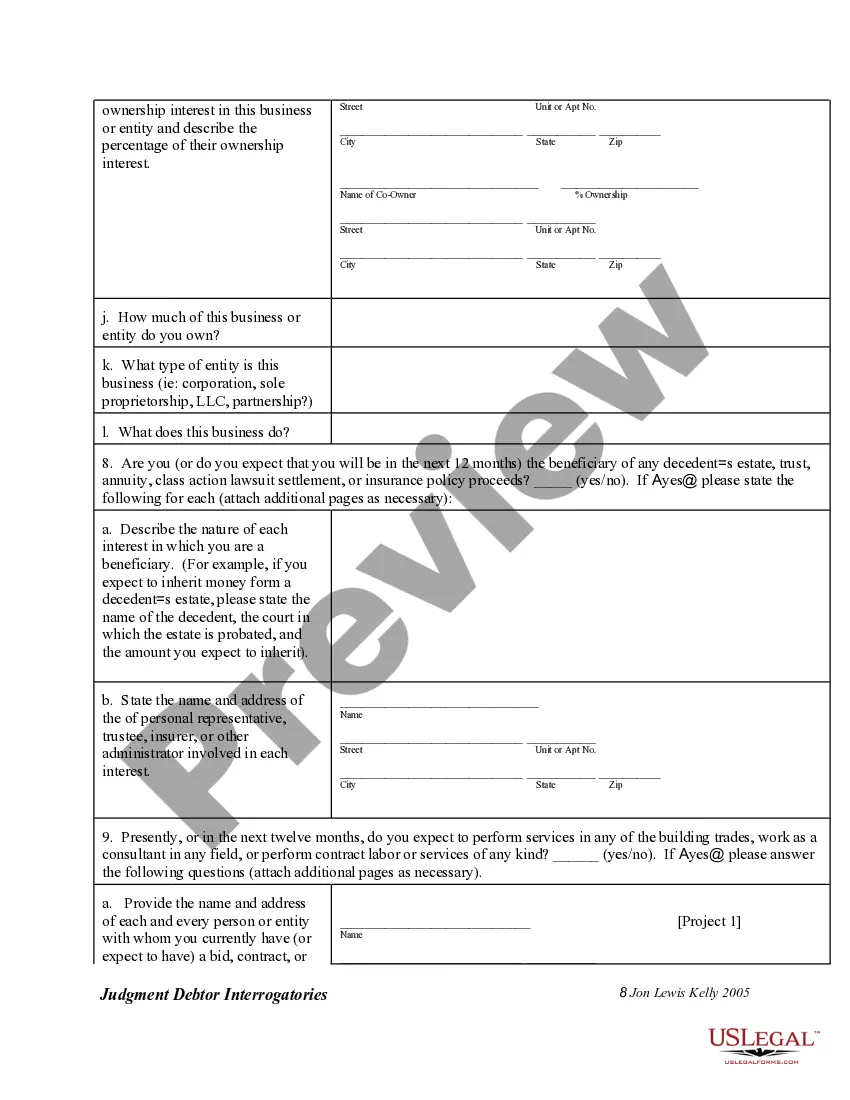

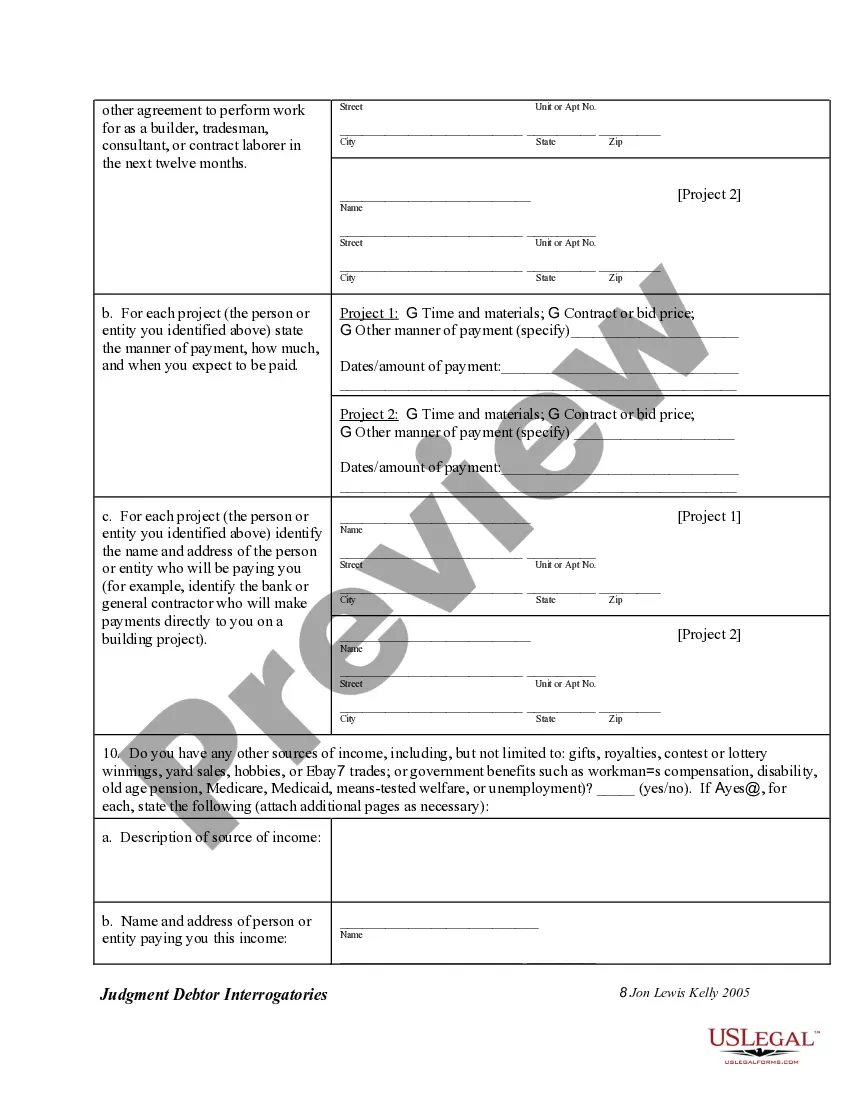

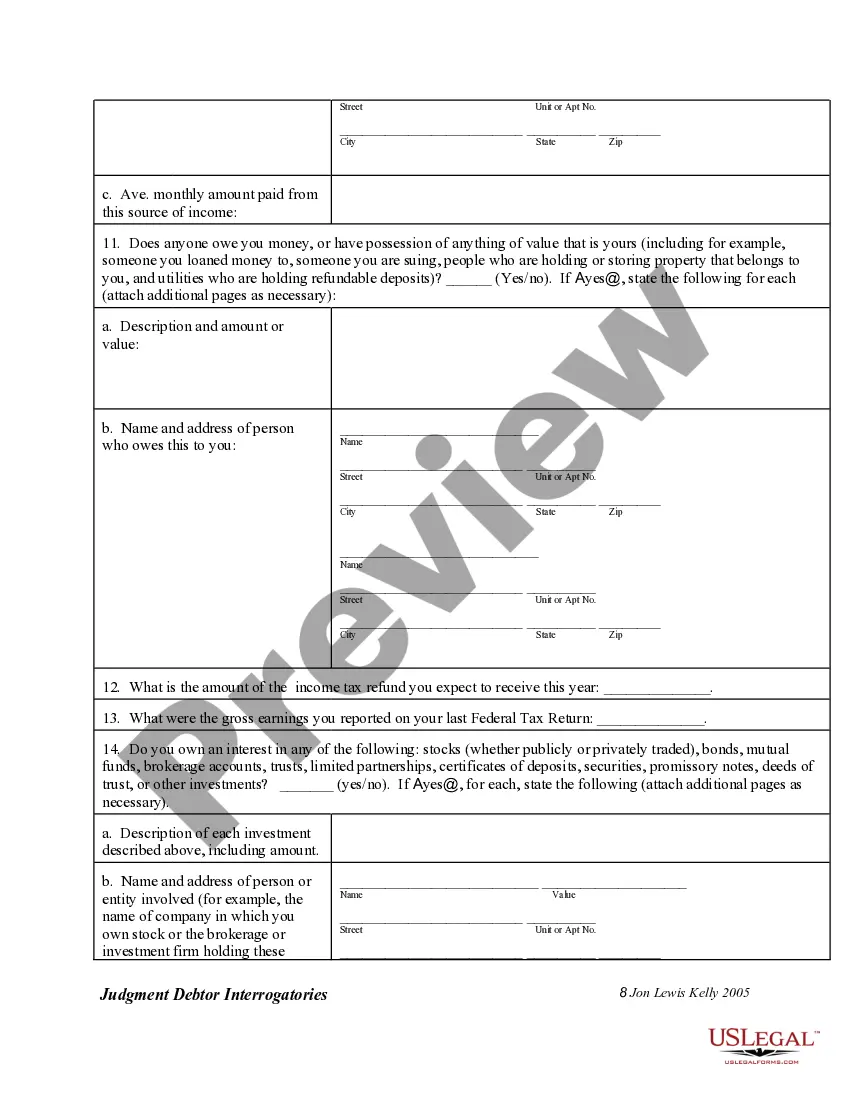

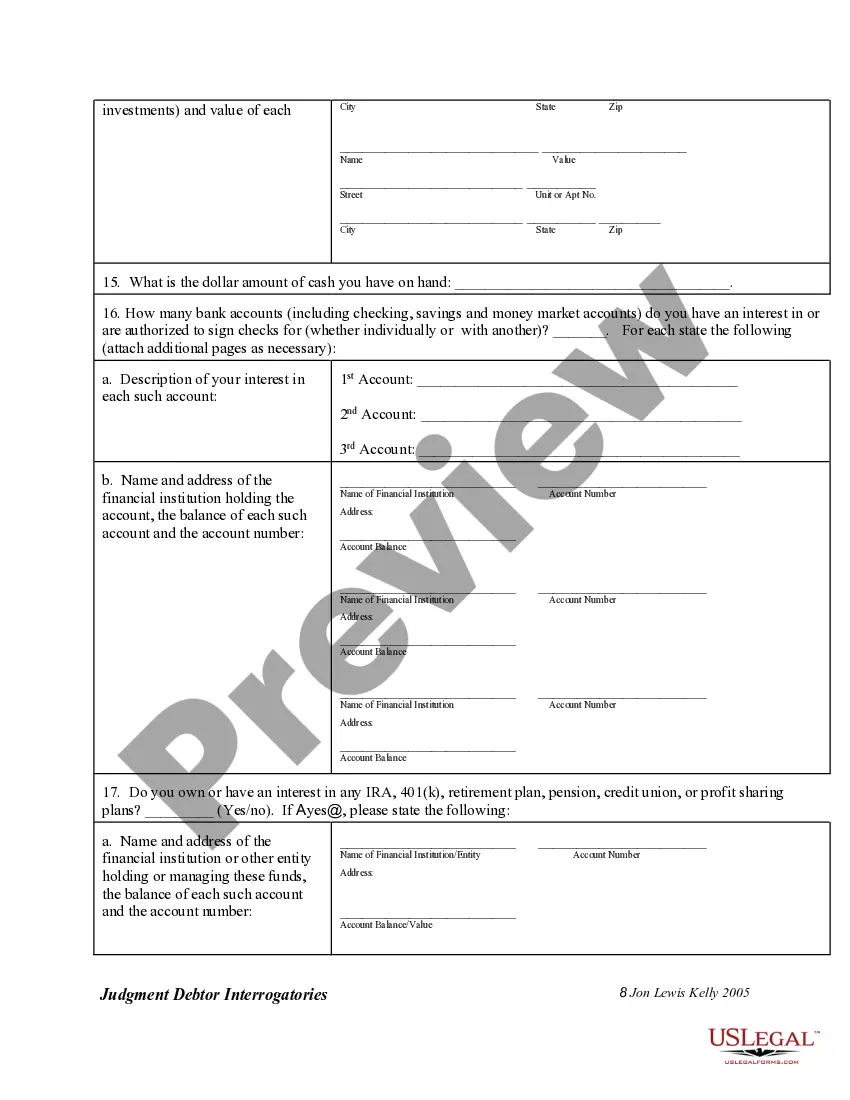

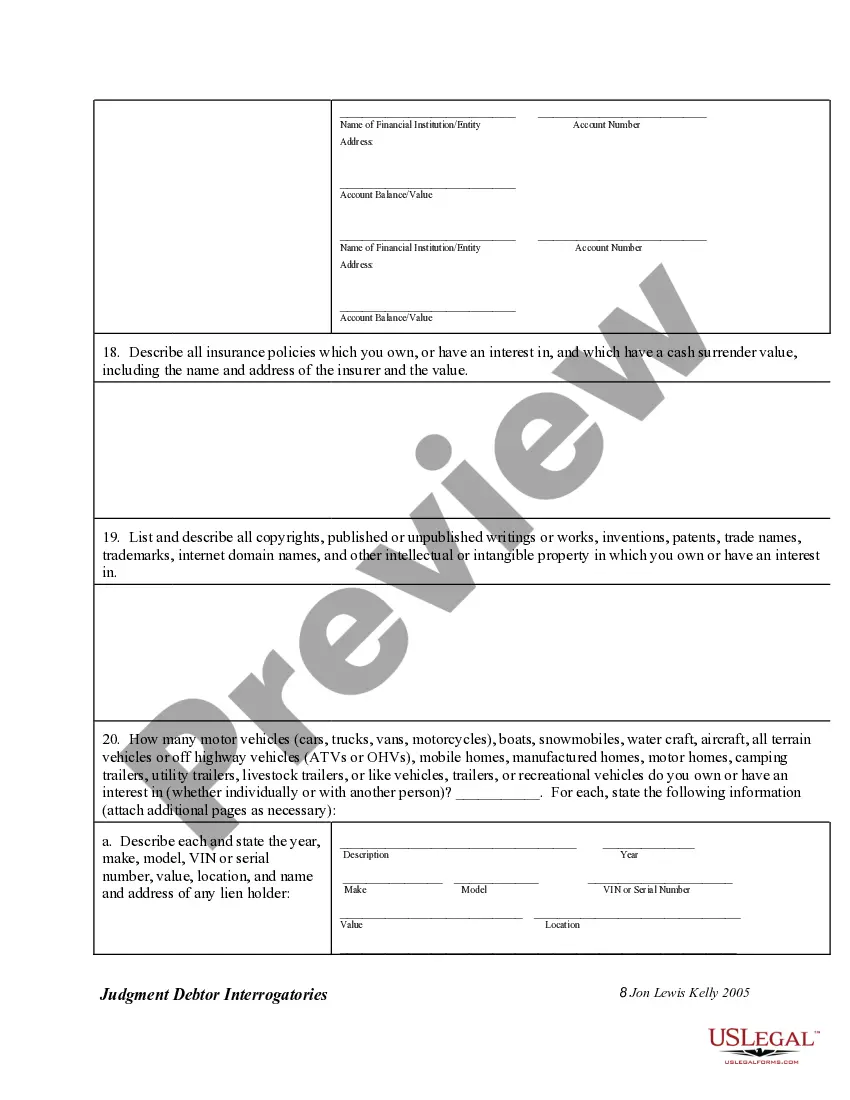

Fort Collins Colorado Interrogatories to Judgment Debtor: A Comprehensive Overview In Fort Collins, Colorado, when a judgment has been awarded to a creditor against a debtor, the creditor may utilize a legal tool known as "interrogatories to judgment debtor." These interrogatories are a set of written questions that the judgment creditor can serve the debtor to gather crucial information about their assets, income sources, and other relevant financial details in order to aid in the collection of the outstanding debt. These interrogatories serve as a crucial step in the legal process, enabling the creditor to gain insight into the debtor's financial situation and identify potential avenues for debt recovery. By serving interrogatories to the judgment debtor, creditors can initiate a formal inquiry into the debtor's ability to pay, the nature of their assets, and any income streams that may be available for the satisfaction of the judgment. Types of Fort Collins Colorado Interrogatories to Judgment Debtor: 1. General Interrogatories: This type of interrogatory is prepared to obtain comprehensive information about the debtor's financial status. These questions typically cover various aspects of their financial situation, including income, employment history, bank accounts, real estate holdings, personal property, and other potential sources of income. 2. Garnishment Interrogatories: In cases where the creditor seeks to implement wage garnishment, interrogatories specific to garnishment may be employed. These questions aim to uncover details about the debtor's employer, current salary, employment benefits, and other pertinent information. It is crucial to ensure compliance with federal and state laws while formulating garnishment interrogatories. 3. Tax Interrogatories: When a judgment creditor explores the possibility of initiating a tax refund garnishment, special interrogatories may be used. These inquiries focus on gaining insights into the debtor's tax returns, withholding amounts, refund status, and any potential federal or state tax liens. 4. Information Subpoena Interrogatories: An information subpoena is a legal tool employed to elicit financial information from a judgment debtor. In this case, interrogatories will be tailored specifically to gather data about the debtor's financial accounts, including bank accounts, brokerage accounts, and any outstanding debts. In Fort Collins, Colorado, the process of serving interrogatories to a judgment debtor involves preparing the set of questions and sending them to the debtor via certified mail or through their attorney, if they have one. The debtor is generally given a specific timeframe, typically 30 days, to respond to the interrogatories. Compliance with interrogatories is mandatory, and failure to respond or providing false information may subject the debtor to legal consequences. Once the creditor receives the debtor's responses, they can assess the debtor's financial capabilities and explore further actions for debt collection, such as wage garnishment, bank account levies, or asset seizure. In conclusion, Fort Collins Colorado Interrogatories to Judgment Debtor play a fundamental role in the debt collection process. They provide creditors with valuable insights into the debtor's financial situation, enabling them to strategize and determine the most effective methods for recovering the outstanding debt. Understanding and utilizing the various types of interrogatories available can significantly enhance a creditor's chances of achieving successful debt collection in Fort Collins, Colorado.

Fort Collins Colorado Interrogatories to Judgment Debtor

Description

How to fill out Fort Collins Colorado Interrogatories To Judgment Debtor?

If you have previously utilized our service, sign in to your account and obtain the Fort Collins Colorado Interrogatories to Judgment Debtor on your device by selecting the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward instructions to acquire your document.

You have lifelong access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and download any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Review the description and utilize the Preview feature, if present, to verify if it aligns with your requirements. If it isn't suitable, use the Search function above to find the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process the payment. Input your credit card information or use the PayPal option to finalize the transaction.

- Retrieve your Fort Collins Colorado Interrogatories to Judgment Debtor. Choose the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

If a person does not respond to your interrogatories in Fort Collins, Colorado, it can lead to complications in your case. You may file a motion to compel them to respond, which prompts the court to intervene and require the party to answer. Seeking assistance from professionals familiar with Fort Collins Colorado Interrogatories to Judgment Debtor can streamline this process. Additionally, failing to respond may result in penalties, including possible judgment against the non-responsive party.

To fill out an interrogatories form, begin with your personal information and then proceed to answer each question clearly. Ensure that each response aligns with your understanding of the matter at hand. If you need guidance, utilizing platforms such as USLegalForms can streamline the process for Fort Collins Colorado Interrogatories to Judgment Debtor.

The best way to answer interrogatories is to be direct and comprehensive. Take time to review each question and organize your thoughts before responding. When handling Fort Collins Colorado Interrogatories to Judgment Debtor, aim to provide all necessary details while adhering to legal guidelines, potentially with the help of resources like USLegalForms.

An example of an interrogatory is: 'Please describe any assets you own and their locations.' This type of question seeks specific information that can impact legal proceedings. When dealing with Fort Collins Colorado Interrogatories to Judgment Debtor, such questions help in assessing the debtor's financial situation.

Filling out form interrogatories involves understanding each question and providing concise responses. Review the instructions carefully and provide detailed answers while staying relevant to the case context. For Fort Collins Colorado Interrogatories to Judgment Debtor, it's helpful to refer to examples and templates available on platforms like USLegalForms.

To properly answer interrogatories, read each question carefully and respond truthfully. If you lack certain information, indicate this clearly but provide as much detail as possible. When dealing with Fort Collins Colorado Interrogatories to Judgment Debtor, it is beneficial to consult with legal experts to ensure your responses are accurate and complete.

To write a good interrogatory, focus on clarity and precision. Start by defining the scope of your inquiry and ensure that each question is relevant to your case. For Fort Collins Colorado Interrogatories to Judgment Debtor, tailor your questions to extract essential information that can lead to the collection of debts.

When drafting interrogatories for judgment debtors in Fort Collins, Colorado, focus on questions that reveal the debtor's financial status. You might inquire about bank accounts, employment details, property ownership, and any other assets. Well-structured interrogatories can lead to a clearer understanding of the debtor's capability to satisfy the judgment.

Interrogatories for debt collection are a set of formal questions that creditors use to gather information from debtors in Fort Collins, Colorado. These inquiries typically focus on the debtor's financial situation and assets. By answering these interrogatories, debtors provide creditors with valuable insights that can facilitate the collection process.

In Fort Collins Colorado Interrogatories to Judgment Debtor, you cannot ask questions that are irrelevant to the case, privilege-related inquiries, or those that may invade personal privacy. It's crucial to maintain the focus on necessary information that pertains directly to the judgment debtor's financial situation. Additionally, any questions that are overly broad or compound may also be deemed inappropriate.

Interesting Questions

More info

As I said, the vast majority of cases settle before trial before a hearing, but it is possible for a case to go to court but for settlement. It might be possible to settle out of court, but this is very rare. An arbitrator is chosen by a special arbitrator committee which includes a representative from the parties to the dispute. The arbitrator's decision is binding on everyone. The arbitrator's decision is decided upon by three (3) arbitrators. If two arbitrators decide in favor of the party with the less money, the whole case is ended and the arbitrators come to a decision about the amount of the money each had to pay and this is a binding precedent. One of the arbitrators will decide how much money each could pay, but it all depends on the rules of arbitration. If the arbitrators vote that they both think they should pay the same for the case, no further action takes place. If one of them thinks they should pay more, this decision goes to litigation.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.