Title: Unveiling Thornton Colorado Interrogatories to Judgment Debtor: Types, Process, and Importance Meta description: Learn about Thornton Colorado's Interrogatories to Judgment Debtor, including its types, purpose, and how it aids in debt collection. Discover how these interrogatories can effectively assist in recovering owed funds. Keywords: Thornton Colorado, Interrogatories to Judgment Debtor, debt collection, judgment enforcement, types, process, recovery, owed funds. Introduction: When seeking to recover owed funds in Thornton, Colorado, the legal process often involves utilizing specific mechanisms, such as Interrogatories to Judgment Debtor. These interrogatories are an essential tool for judgment enforcement, helping creditors gather vital information about judgment debtors. In this article, we will delve into the different types of Thornton Colorado Interrogatories to Judgment Debtor, their purpose, and the vital role they play in the debt collection process. I. Overview of Interrogatories to Judgment Debtor: Interrogatories to Judgment Debtor are a set of written questions posed to the debtor, aimed at extracting detailed information about their financial situation and assets. These interrogatories serve as a powerful means for judgment creditors to discover the debtor's ability to repay the outstanding debt through available assets or income streams. II. Types of Thornton Colorado Interrogatories: 1. Standard Interrogatories: Standard Interrogatories are a set of predefined questions typically issued by the judgment creditor or their attorney. These questions cover a broad range of financial aspects, including employment status, income sources, bank accounts, and property ownership, among others. The judgment creditor can tailor these interrogatories to suit their specific case requirements while adhering to legal guidelines. 2. Special Interrogatories: Special Interrogatories allow judgment creditors to customize and craft individualized questions to address unique aspects relevant to their case. These interrogatories dive deeper into financial details, going beyond generic queries. For instance, special interrogatories may inquire about hidden assets, loans, or any other financial information the creditor deems necessary to uncover. 3. Post-Judgment Interrogatories: Post-judgment Interrogatories come into play after a judgment has been issued and the debtor fails to satisfy the owed debt voluntarily. These interrogatories can help the creditor explore the debtor's financial situation further while also providing an opportunity to gather evidence for garnishment or lien placement. III. The Process of Issuing Interrogatories to Judgment Debtor: 1. Preparation: The judgment creditor, or their attorney, drafts the Interrogatories to Judgment Debtor document, tailoring the questions to their case requirements. It is crucial to ensure the questions are concise, specific, and relevant to maximize the effectiveness of this legal tool. 2. Serving the Interrogatories: The Interrogatories document is served to the judgment debtor, either in person or via certified mail. Proof of service is vital to validate the legal process. 3. Responding to Interrogatories: The judgment debtor is obligated to respond to the Interrogatories promptly, typically within a specified timeframe. Failure to respond truthfully and thoroughly may lead to legal consequences. IV. Importance of Interrogatories to Judgment Debtor: 1. Unveiling Hidden Assets: By gathering detailed financial information through Interrogatories, creditors can discover undisclosed assets, which may be subject to seizure, increasing the chances of debt recovery. 2. Guiding Further Legal Action: Interrogatory responses provide insights into the debtor's financial capacity, aiding the creditor in deciding whether to pursue garnishment, liens, or other legal actions to satisfy the outstanding debt. 3. Strengthening Negotiations: Interrogatory responses can act as leverage during negotiations with the judgment debtor, encouraging them to settle the debt voluntarily or negotiate a repayment plan. Conclusion: Thornton Colorado Interrogatories to Judgment Debtor offer a powerful mechanism for creditors seeking to recover owed funds. By leveraging different types of interrogatories, creditors can gain in-depth knowledge about the debtor's financial standing, guiding their decision-making process and enabling fruitful negotiations. Understanding the importance and process of issuing interrogatories brings creditors one step closer to securing the repayment they rightfully deserve.

Thornton Colorado Interrogatories to Judgment Debtor

State:

Colorado

City:

Thornton

Control #:

CO-INT-JK

Format:

Word;

Rich Text

Instant download

Description

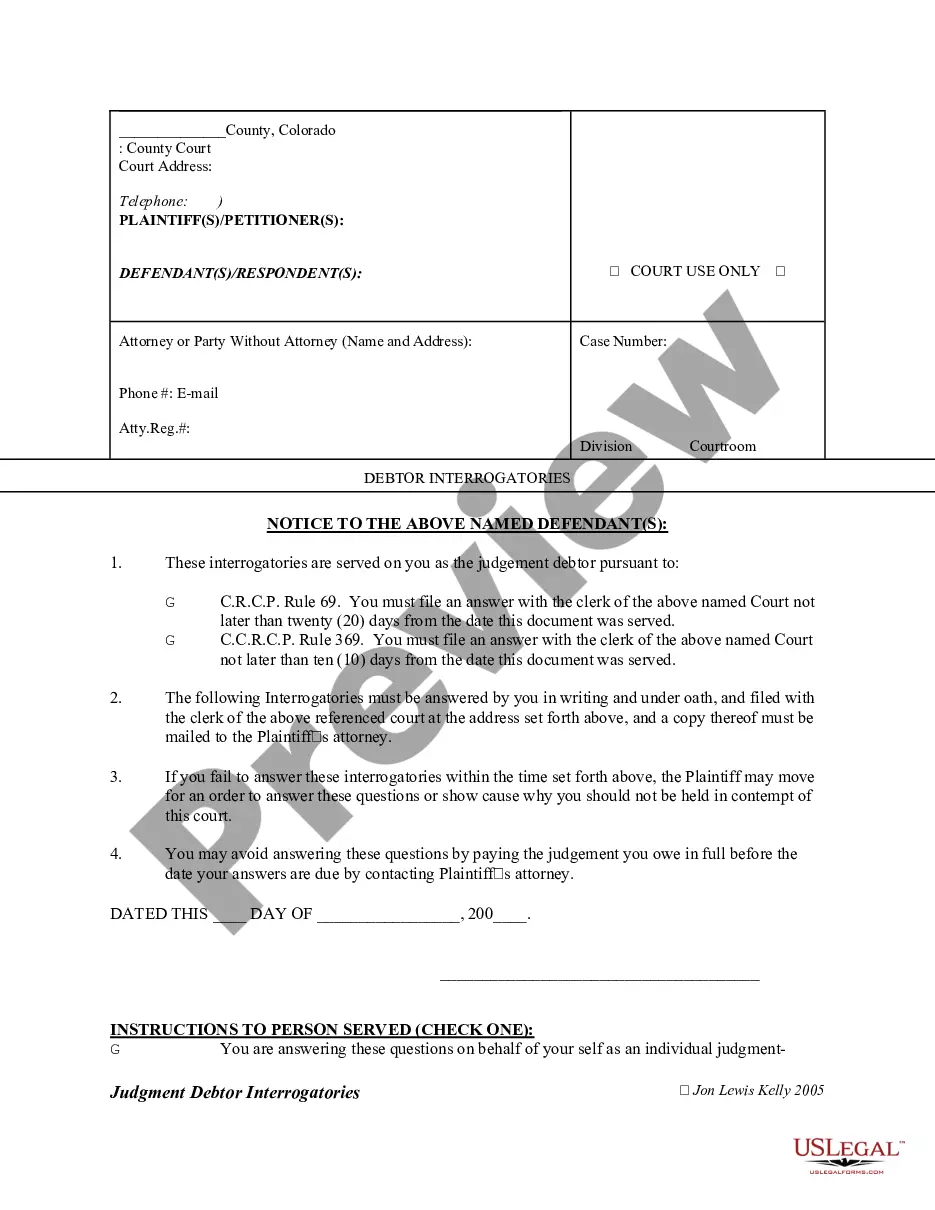

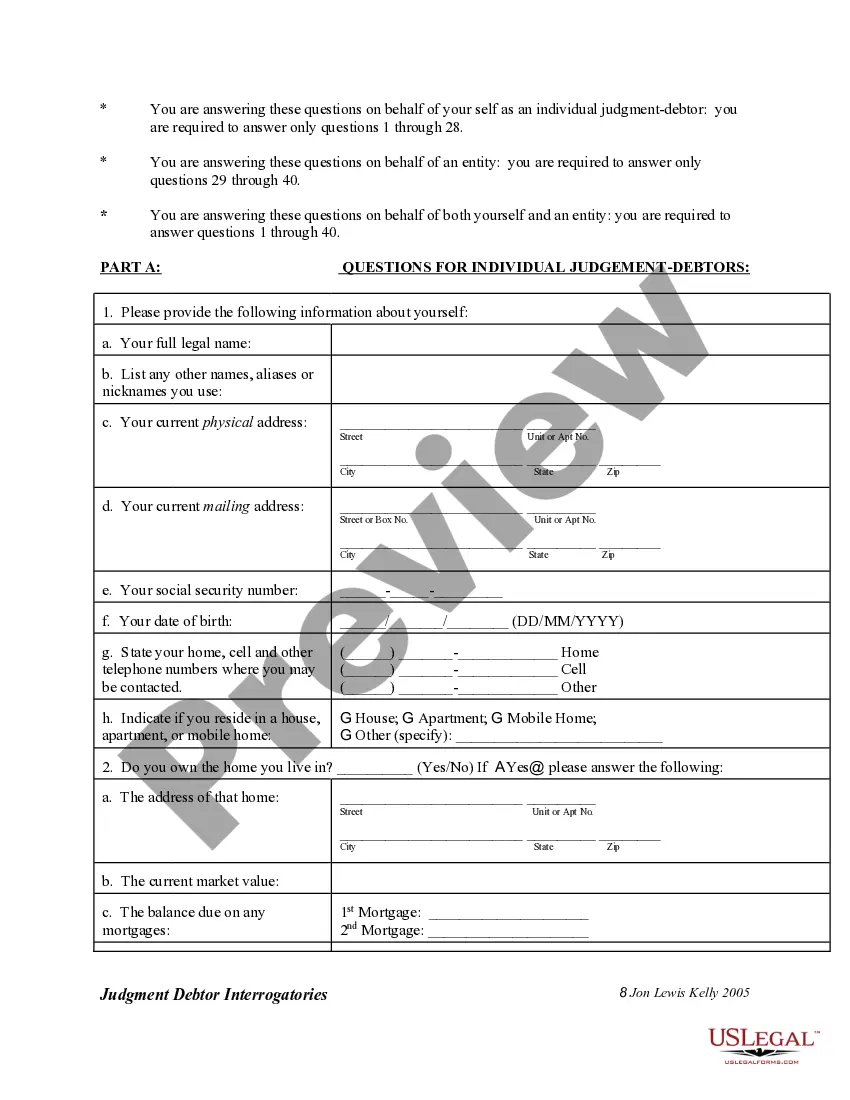

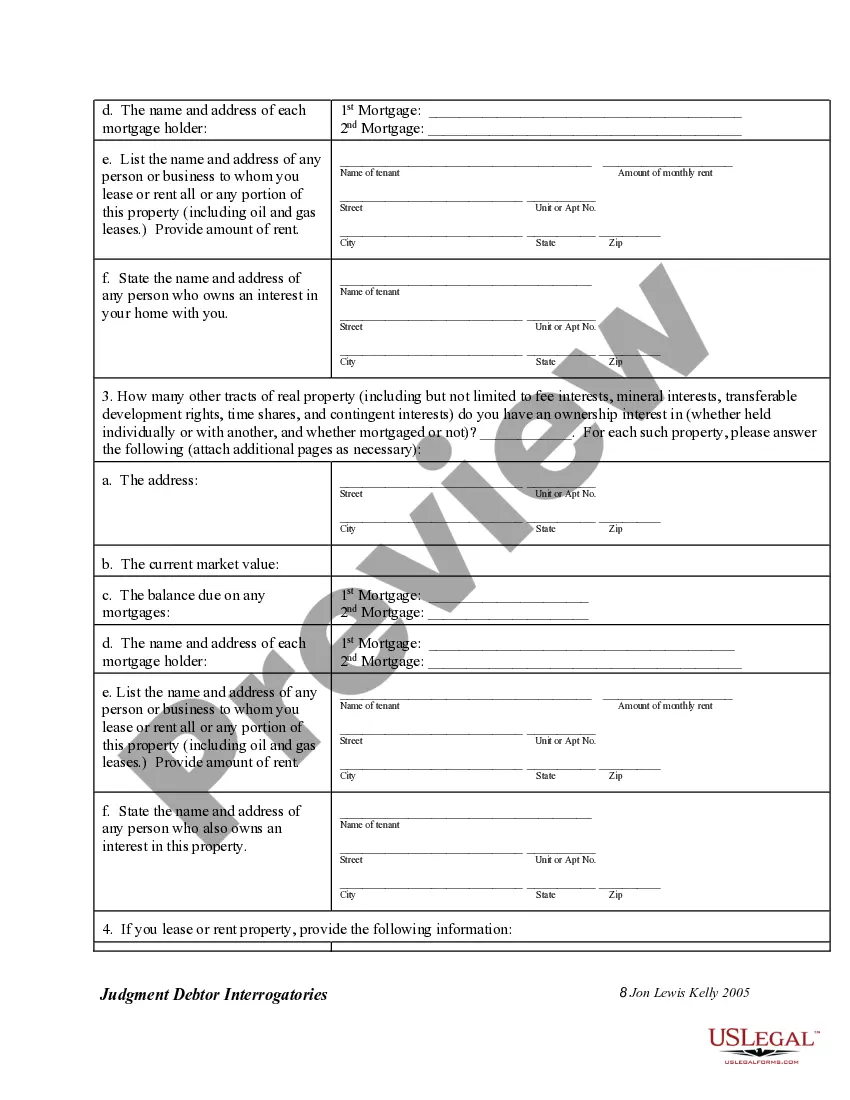

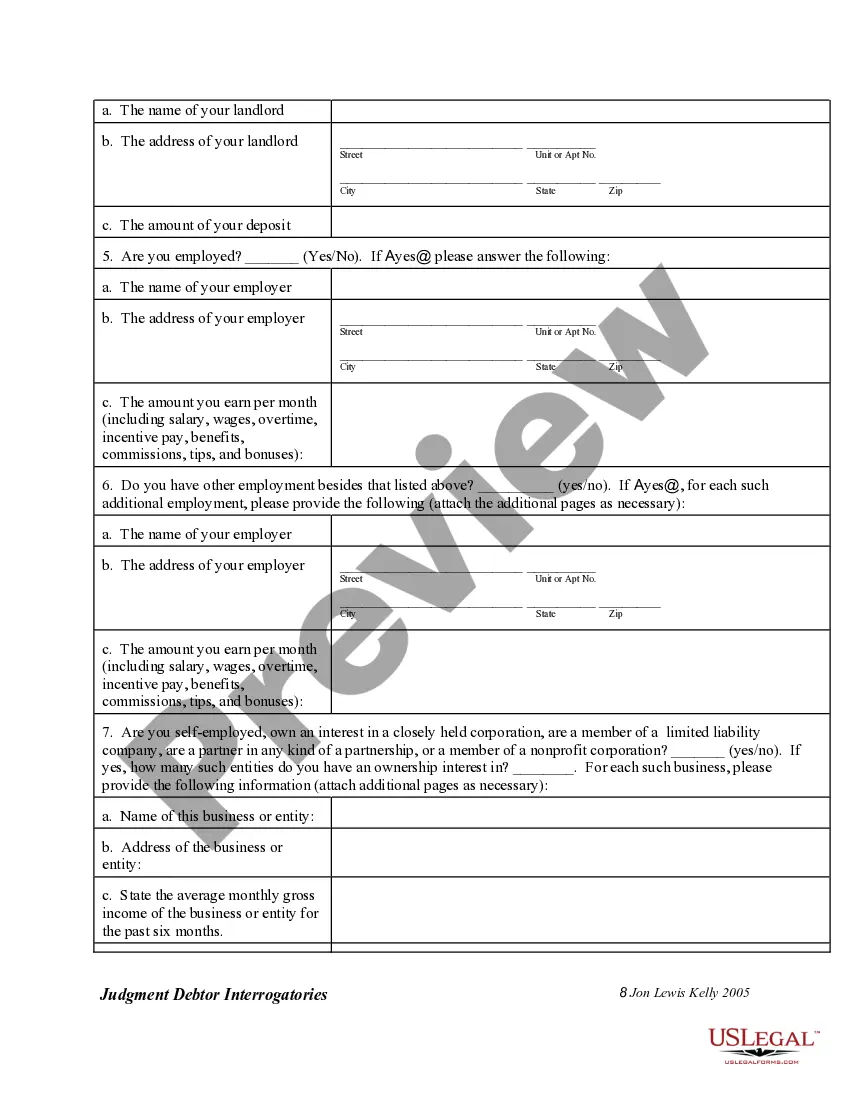

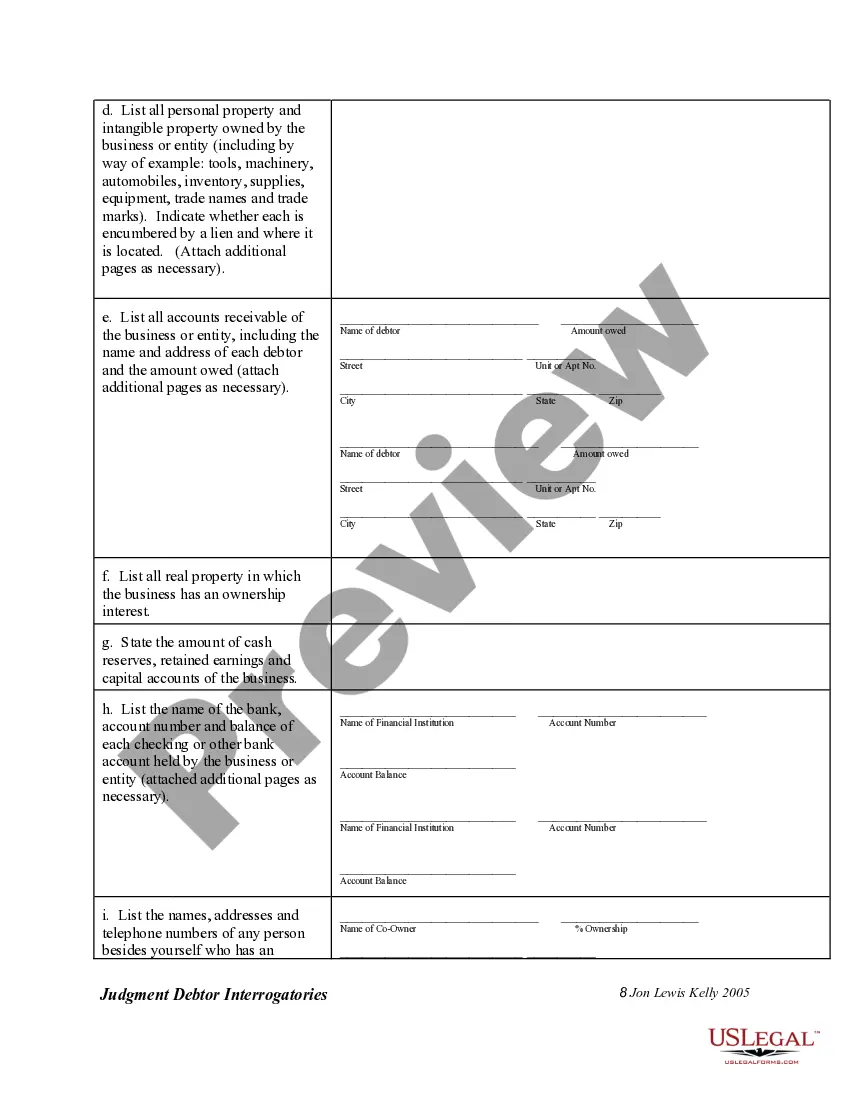

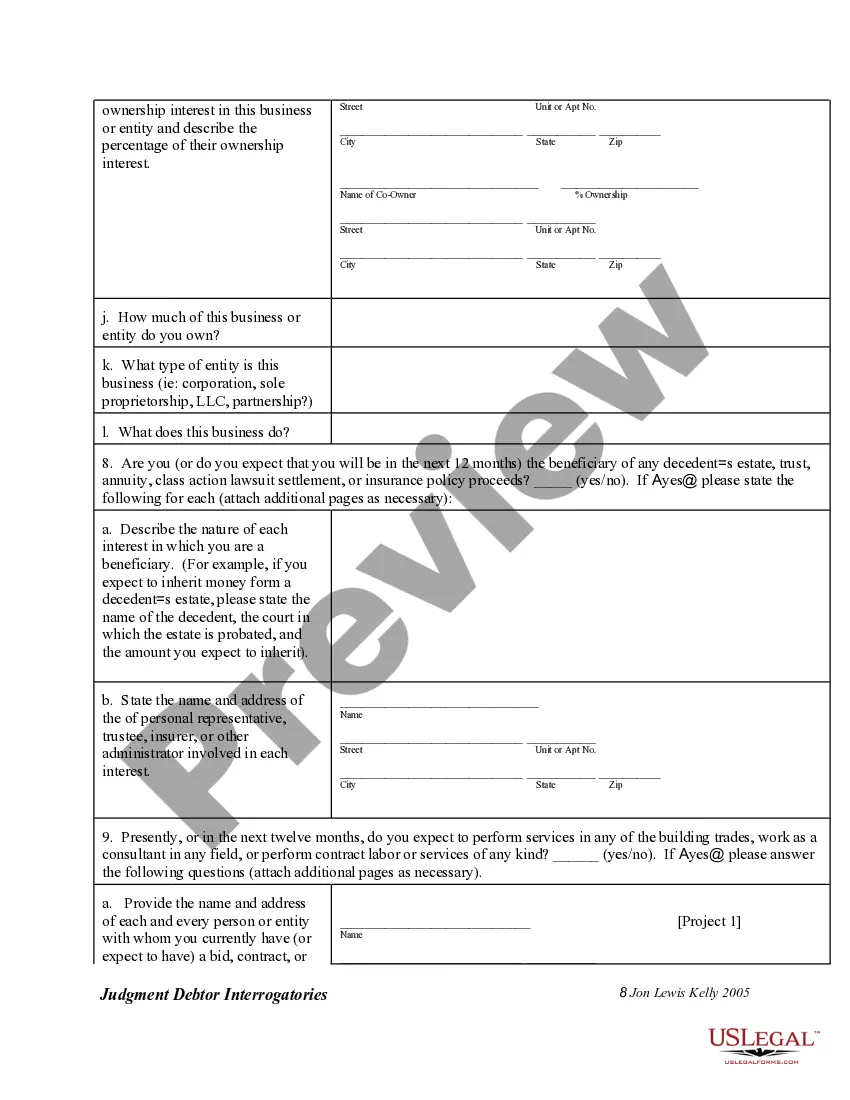

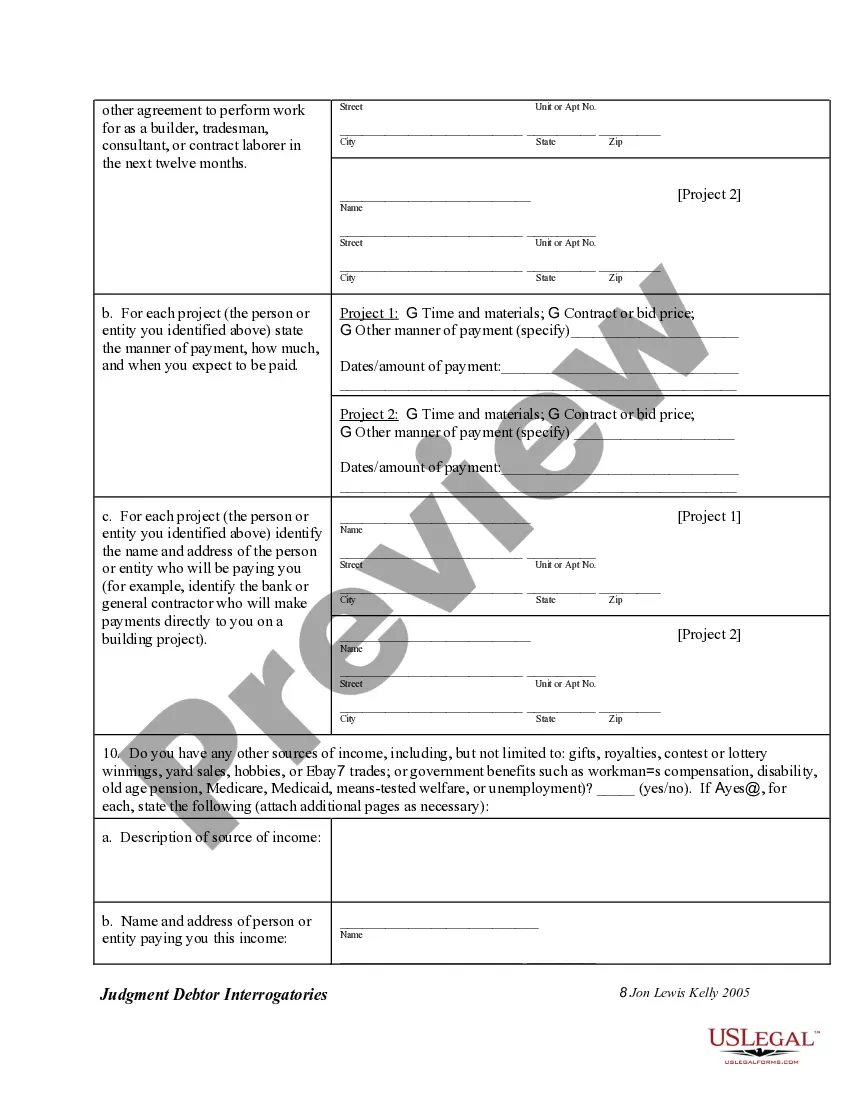

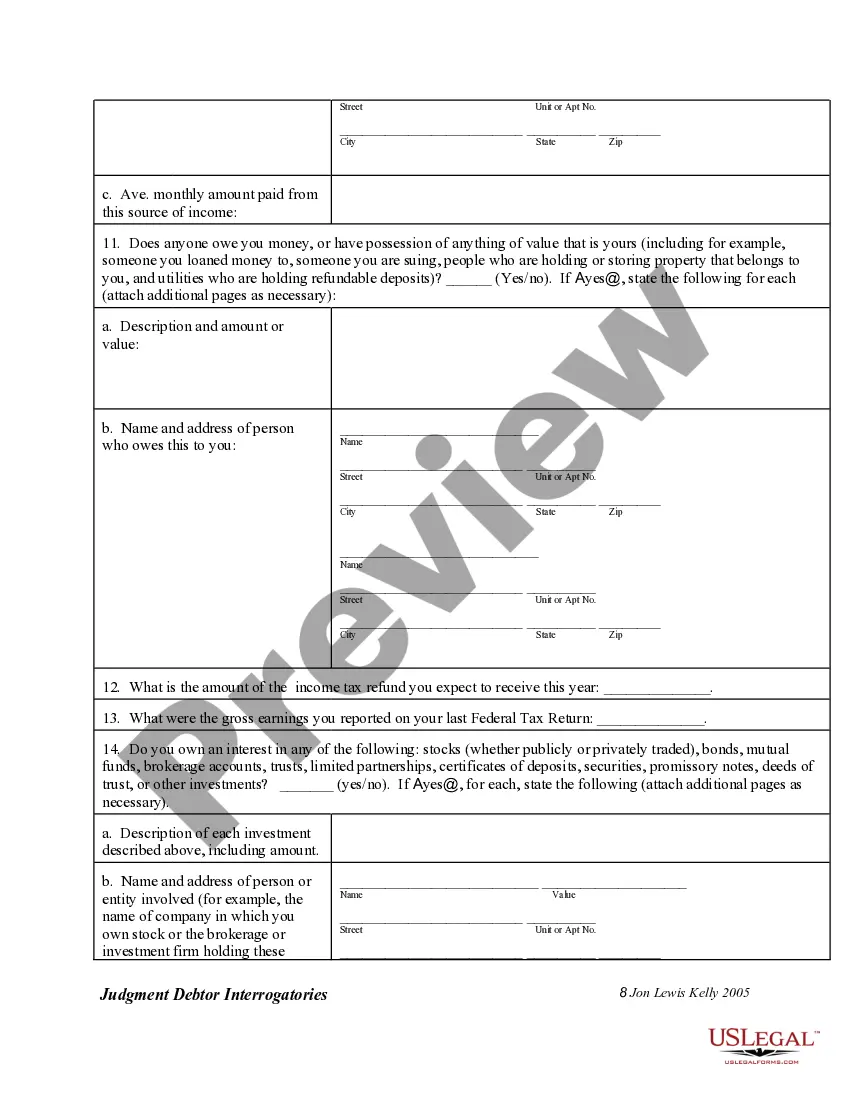

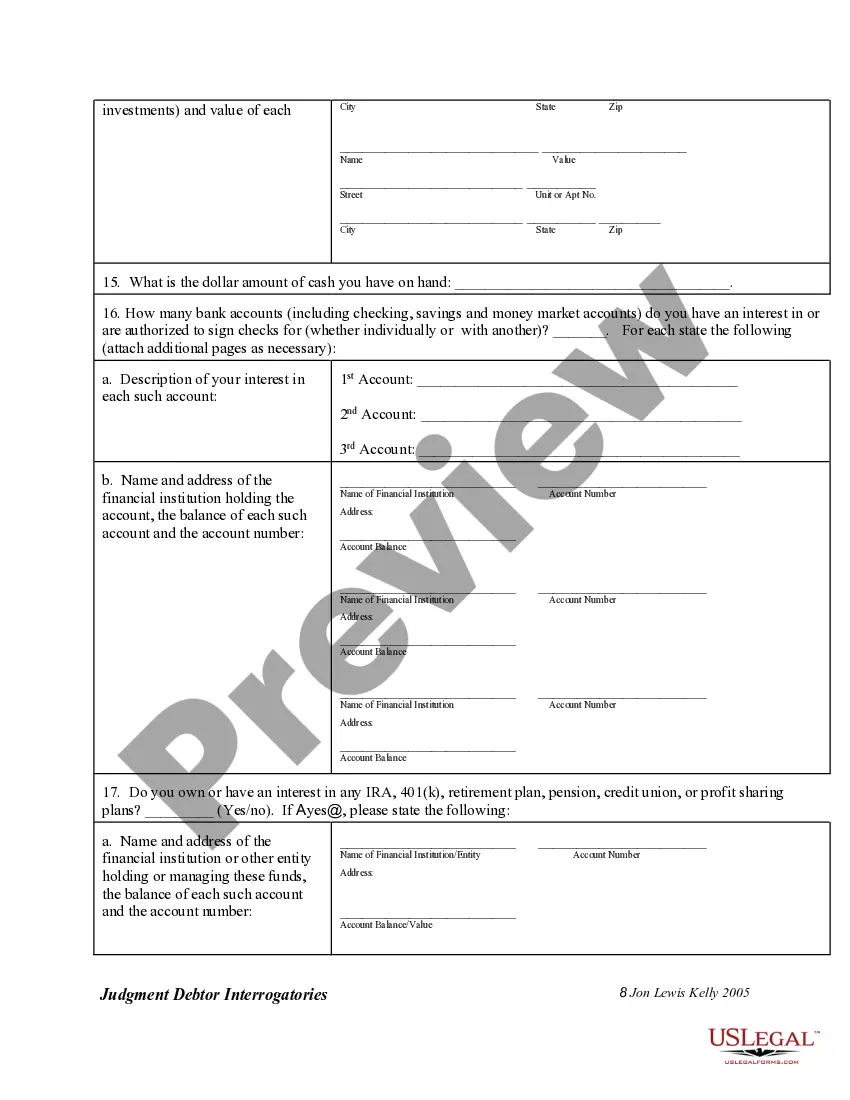

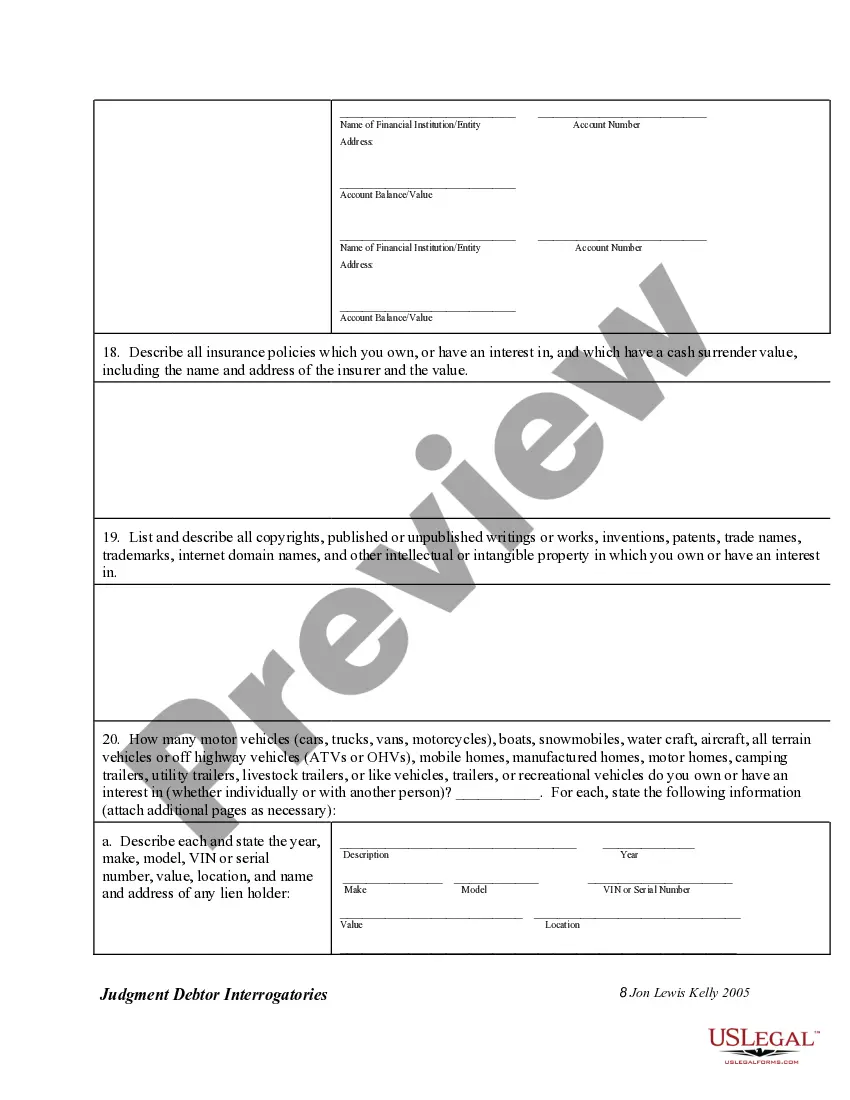

This a sample set of interrogatories which are to be directed to the Judgment Debtor. They are merely a sample and certain questions should either by omitted or added to fit your particular cause of action.

Title: Unveiling Thornton Colorado Interrogatories to Judgment Debtor: Types, Process, and Importance Meta description: Learn about Thornton Colorado's Interrogatories to Judgment Debtor, including its types, purpose, and how it aids in debt collection. Discover how these interrogatories can effectively assist in recovering owed funds. Keywords: Thornton Colorado, Interrogatories to Judgment Debtor, debt collection, judgment enforcement, types, process, recovery, owed funds. Introduction: When seeking to recover owed funds in Thornton, Colorado, the legal process often involves utilizing specific mechanisms, such as Interrogatories to Judgment Debtor. These interrogatories are an essential tool for judgment enforcement, helping creditors gather vital information about judgment debtors. In this article, we will delve into the different types of Thornton Colorado Interrogatories to Judgment Debtor, their purpose, and the vital role they play in the debt collection process. I. Overview of Interrogatories to Judgment Debtor: Interrogatories to Judgment Debtor are a set of written questions posed to the debtor, aimed at extracting detailed information about their financial situation and assets. These interrogatories serve as a powerful means for judgment creditors to discover the debtor's ability to repay the outstanding debt through available assets or income streams. II. Types of Thornton Colorado Interrogatories: 1. Standard Interrogatories: Standard Interrogatories are a set of predefined questions typically issued by the judgment creditor or their attorney. These questions cover a broad range of financial aspects, including employment status, income sources, bank accounts, and property ownership, among others. The judgment creditor can tailor these interrogatories to suit their specific case requirements while adhering to legal guidelines. 2. Special Interrogatories: Special Interrogatories allow judgment creditors to customize and craft individualized questions to address unique aspects relevant to their case. These interrogatories dive deeper into financial details, going beyond generic queries. For instance, special interrogatories may inquire about hidden assets, loans, or any other financial information the creditor deems necessary to uncover. 3. Post-Judgment Interrogatories: Post-judgment Interrogatories come into play after a judgment has been issued and the debtor fails to satisfy the owed debt voluntarily. These interrogatories can help the creditor explore the debtor's financial situation further while also providing an opportunity to gather evidence for garnishment or lien placement. III. The Process of Issuing Interrogatories to Judgment Debtor: 1. Preparation: The judgment creditor, or their attorney, drafts the Interrogatories to Judgment Debtor document, tailoring the questions to their case requirements. It is crucial to ensure the questions are concise, specific, and relevant to maximize the effectiveness of this legal tool. 2. Serving the Interrogatories: The Interrogatories document is served to the judgment debtor, either in person or via certified mail. Proof of service is vital to validate the legal process. 3. Responding to Interrogatories: The judgment debtor is obligated to respond to the Interrogatories promptly, typically within a specified timeframe. Failure to respond truthfully and thoroughly may lead to legal consequences. IV. Importance of Interrogatories to Judgment Debtor: 1. Unveiling Hidden Assets: By gathering detailed financial information through Interrogatories, creditors can discover undisclosed assets, which may be subject to seizure, increasing the chances of debt recovery. 2. Guiding Further Legal Action: Interrogatory responses provide insights into the debtor's financial capacity, aiding the creditor in deciding whether to pursue garnishment, liens, or other legal actions to satisfy the outstanding debt. 3. Strengthening Negotiations: Interrogatory responses can act as leverage during negotiations with the judgment debtor, encouraging them to settle the debt voluntarily or negotiate a repayment plan. Conclusion: Thornton Colorado Interrogatories to Judgment Debtor offer a powerful mechanism for creditors seeking to recover owed funds. By leveraging different types of interrogatories, creditors can gain in-depth knowledge about the debtor's financial standing, guiding their decision-making process and enabling fruitful negotiations. Understanding the importance and process of issuing interrogatories brings creditors one step closer to securing the repayment they rightfully deserve.

Free preview

How to fill out Thornton Colorado Interrogatories To Judgment Debtor?

If you’ve already utilized our service before, log in to your account and download the Thornton Colorado Interrogatories to Judgment Debtor on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Thornton Colorado Interrogatories to Judgment Debtor. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!