Fort Collins Colorado Sworn Financial Statement - Supporting Schedules

Description

How to fill out Colorado Sworn Financial Statement - Supporting Schedules?

Do you require a dependable and affordable provider of legal forms to obtain the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish guidelines for cohabitating with your partner or a collection of forms to facilitate your divorce through the court, we have you covered. Our site features over 85,000 current legal document templates for individual and business use. All templates we provide are not universal and are tailored to meet the requirements of specific states and regions.

To acquire the document, you must Log In to your account, find the necessary template, and click the Download button beside it. Please remember that you can download your previously purchased document templates anytime in the My documents tab.

Are you a newcomer to our platform? No problem. You can set up an account with ease, but first, ensure you do the following.

Now you can create your account. Then select the subscription choice and proceed to payment. Once the payment is finalized, download the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules in any available format. You may revisit the website at any time and redownload the document without any additional costs.

Finding current legal forms has never been more straightforward. Try US Legal Forms today, and stop wasting your precious time searching for legal paperwork online once and for all.

- Check if the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules meets the laws of your state and local jurisdiction.

- Review the form’s specifics (if available) to understand who and what the document is suitable for.

- Restart the search if the template does not apply to your particular situation.

Form popularity

FAQ

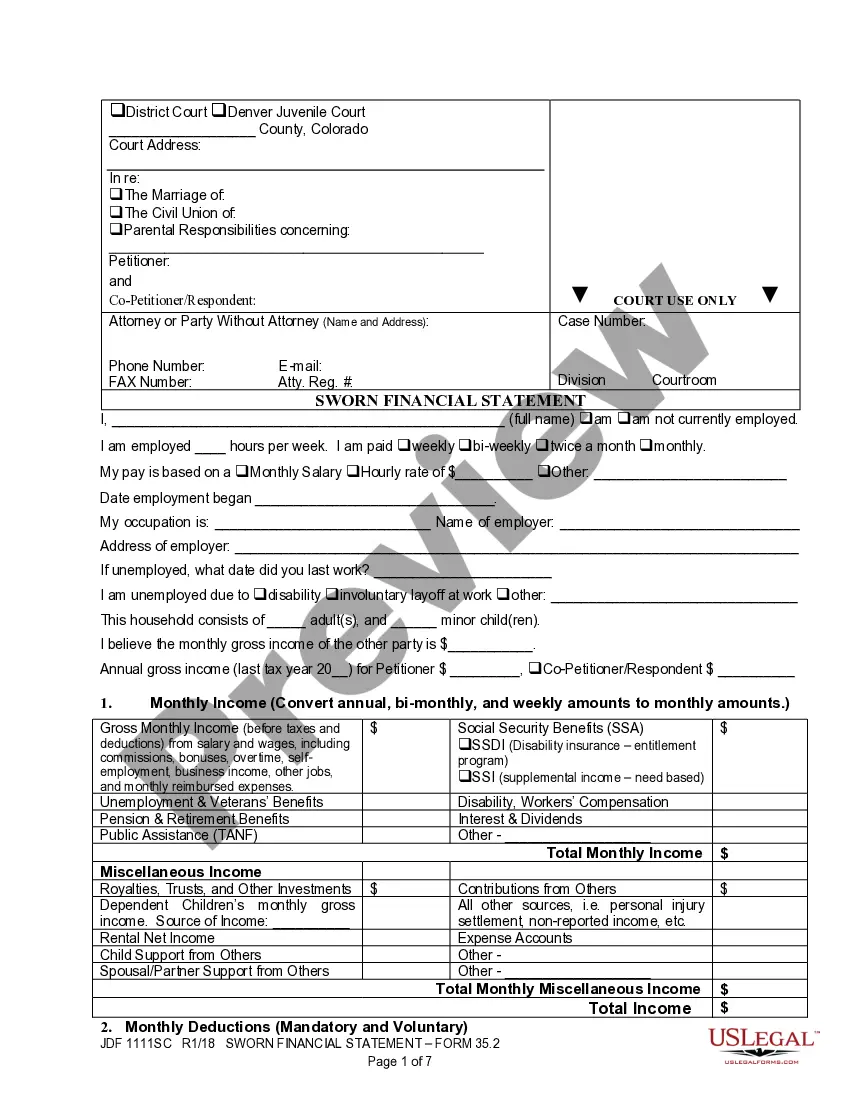

A JDF document is a legal form used in Colorado for various procedural filings. These forms are standardized and include essential information required by the court, ensuring clarity and compliance. In the context of a Fort Collins Colorado Sworn Financial Statement - Supporting Schedules, these documents are crucial for presenting financial data in family law cases. Using uslegalforms can help you efficiently navigate these requirements and ensure proper documentation.

JDF 1111 SS is the form that accompanies the financial statement affidavit to provide detailed financial support. It includes line items for various expenses and income sources, giving a comprehensive view of an individual's financial health. This document plays a vital role in the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules. To simplify this process, uslegalforms offers an easy way to access and complete necessary forms.

JDF 76 refers to a specific form used in Colorado that aids individuals in filing their financial disclosures. This form is critical in family law cases, especially during divorce or custody proceedings. It includes essential financial data and is part of the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules. You can access this form through resources like uslegalforms to simplify your filing process.

A financial statement affidavit is a legal document that declares your financial situation under oath. This affidavit lists your assets, liabilities, and income to provide a complete picture of your finances. In Fort Collins, Colorado, this document often includes Supporting Schedules to detail various financial aspects. Using a professional service can help ensure your Fort Collins Colorado Sworn Financial Statement - Supporting Schedules are accurate and compliant with legal standards.

A supporting schedule for financial statements provides detailed information to clarify the main entries in your Fort Collins Colorado Sworn Financial Statement - Supporting Schedules. These schedules breakdown your financial data, such as income, expenses, and assets, allowing for better understanding and transparency. They are crucial during legal proceedings, as they provide a complete view of your financial situation. Utilizing resources from uslegalforms can help you create accurate supporting schedules tailored to your needs.

Yes, you can file for divorce electronically in Colorado. This process simplifies paperwork and speeds up the submission of your Fort Collins Colorado Sworn Financial Statement - Supporting Schedules. By using e-filing, you can ensure timely processing of your documents and stay organized. Platforms like uslegalforms provide guidance and assistance to help you manage your forms effectively.

In Colorado, mandatory financial disclosures typically include details about income, expenses, assets, and debts. These disclosures are essential in divorce cases and other legal matters, ensuring that all parties have an accurate understanding of the financial landscape. The Fort Collins Colorado Sworn Financial Statement - Supporting Schedules encapsulates these disclosures, supporting the transparency needed for fair legal proceedings.

A sworn financial statement is a formal declaration of your financial condition, made under oath. This document includes essential information such as income, liabilities, and assets, serving as a crucial tool in legal and financial matters. When designing your Fort Collins Colorado Sworn Financial Statement - Supporting Schedules, consider its importance for clarity and support in various legal processes.

A sworn financial statement in a divorce is a legal document that reports your financial situation under oath. It includes details about income, expenses, assets, and debts, providing a complete overview to the court. Utilizing the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules ensures that the information is transparent and accurate, which can significantly influence your divorce settlement.

Supporting schedules are additional documents that provide detailed breakdowns of specific financial information mentioned in your primary financial statement. These may include schedules for income, expenses, assets, and liabilities. Including the Fort Collins Colorado Sworn Financial Statement - Supporting Schedules enhances clarity and supports the accuracy of the overall financial picture.