Title: Understanding Lakewood Colorado Advance Notice of Activation of an Income Assignment: Types and Details Introduction: The Lakewood Colorado Advance Notice of Activation of an Income Assignment is a legal document that enables creditors to garnish a debtor's income to satisfy outstanding debts. This detailed description aims to provide a comprehensive overview of the process, including its types, requirements, and implications. Types of Lakewood Colorado Advance Notice of Activation of an Income Assignment: 1. Court-Ordered Income Assignment: This type of income assignment is typically initiated when a creditor files a lawsuit against a debtor and obtains a court order to garnish the debtor's income. The court may approve an assignment to ensure consistent and timely debt repayment. 2. Child Support/Spousal Maintenance Income Assignment: When an individual fails to fulfill their child support or spousal maintenance obligations, the recipient party can obtain an income assignment order from the court. This guarantees regular payment from the obliged's income source. Key Details and Requirements: 1. Creditor's Application: To initiate an income assignment, the creditor must file an application with the appropriate court. This application must include relevant debtor information, details of the debt owed, and supporting documents. 2. Debtor Notification: Upon approval of the assignment, the debtor is required to receive an Advance Notice of Activation of an Income Assignment. This notice informs them of their rights, obligations, and options for subsequent action. 3. Income Withholding: The income assignment order will direct the debtor's employer, retirement account administrator, or other sources of income to withhold a specific amount from each paycheck. This amount is sent directly to the creditor. 4. Exemptions and Limits: Certain types of income, such as Social Security or welfare benefits, may be exempt from income assignments. Additionally, Federal and state laws enforce limits on the amount that can be garnished, depending on the debtor's income and circumstances. 5. Dispute and Appeal: Debtors have the right to dispute the income assignment within a specified timeframe if they believe it is unjustified or exceeds the legal limits. They can present evidence to support their claims and request a hearing. Implications: 1. Credit Impact: An income assignment can negatively impact a debtor's creditworthiness, making it difficult to secure future loans or credit facilities until the debt is paid off. 2. Legal Consequences: Failure to comply with an income assignment order may lead to legal consequences such as additional fines or penalties, and potentially even contempt of court charges. Conclusion: The Lakewood Colorado Advance Notice of Activation of an Income Assignment is a crucial legal tool for creditors to recover outstanding debts. Understanding the various types, requirements, and implications of such income assignments is essential for both debtors and creditors to navigate the process effectively and ensure fair outcomes.

Lakewood Colorado Advance Notice of Activation of an Income Assignment

State:

Colorado

City:

Lakewood

Control #:

CO-JDF-1806

Format:

Word;

PDF;

Rich Text

Instant download

Description

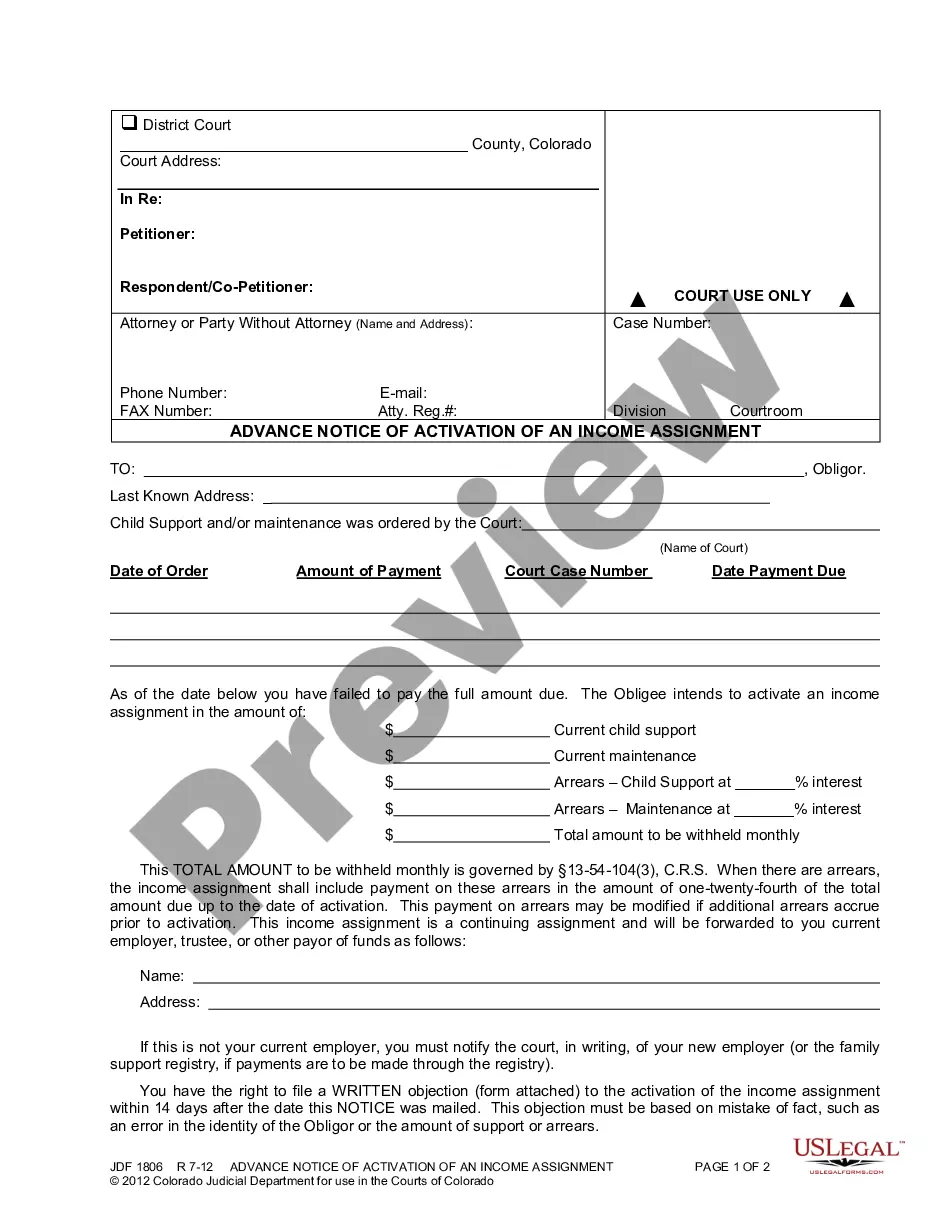

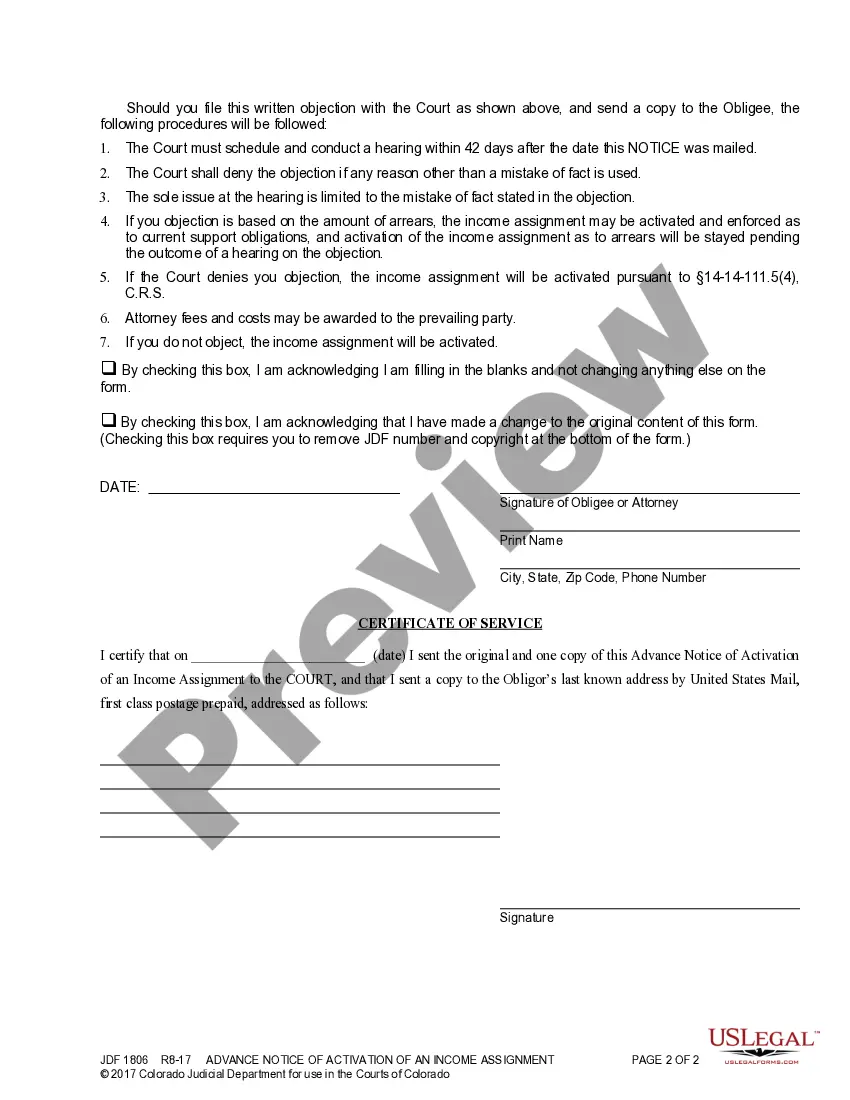

Advance Notice of Activation of an Income Assignment: This is an official form from the Colorado District Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado District Court forms as is required by Colorado statutes and law.

Title: Understanding Lakewood Colorado Advance Notice of Activation of an Income Assignment: Types and Details Introduction: The Lakewood Colorado Advance Notice of Activation of an Income Assignment is a legal document that enables creditors to garnish a debtor's income to satisfy outstanding debts. This detailed description aims to provide a comprehensive overview of the process, including its types, requirements, and implications. Types of Lakewood Colorado Advance Notice of Activation of an Income Assignment: 1. Court-Ordered Income Assignment: This type of income assignment is typically initiated when a creditor files a lawsuit against a debtor and obtains a court order to garnish the debtor's income. The court may approve an assignment to ensure consistent and timely debt repayment. 2. Child Support/Spousal Maintenance Income Assignment: When an individual fails to fulfill their child support or spousal maintenance obligations, the recipient party can obtain an income assignment order from the court. This guarantees regular payment from the obliged's income source. Key Details and Requirements: 1. Creditor's Application: To initiate an income assignment, the creditor must file an application with the appropriate court. This application must include relevant debtor information, details of the debt owed, and supporting documents. 2. Debtor Notification: Upon approval of the assignment, the debtor is required to receive an Advance Notice of Activation of an Income Assignment. This notice informs them of their rights, obligations, and options for subsequent action. 3. Income Withholding: The income assignment order will direct the debtor's employer, retirement account administrator, or other sources of income to withhold a specific amount from each paycheck. This amount is sent directly to the creditor. 4. Exemptions and Limits: Certain types of income, such as Social Security or welfare benefits, may be exempt from income assignments. Additionally, Federal and state laws enforce limits on the amount that can be garnished, depending on the debtor's income and circumstances. 5. Dispute and Appeal: Debtors have the right to dispute the income assignment within a specified timeframe if they believe it is unjustified or exceeds the legal limits. They can present evidence to support their claims and request a hearing. Implications: 1. Credit Impact: An income assignment can negatively impact a debtor's creditworthiness, making it difficult to secure future loans or credit facilities until the debt is paid off. 2. Legal Consequences: Failure to comply with an income assignment order may lead to legal consequences such as additional fines or penalties, and potentially even contempt of court charges. Conclusion: The Lakewood Colorado Advance Notice of Activation of an Income Assignment is a crucial legal tool for creditors to recover outstanding debts. Understanding the various types, requirements, and implications of such income assignments is essential for both debtors and creditors to navigate the process effectively and ensure fair outcomes.

Free preview

How to fill out Lakewood Colorado Advance Notice Of Activation Of An Income Assignment?

If you’ve already used our service before, log in to your account and save the Lakewood Colorado Advance Notice of Activation of an Income Assignment on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Lakewood Colorado Advance Notice of Activation of an Income Assignment. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!