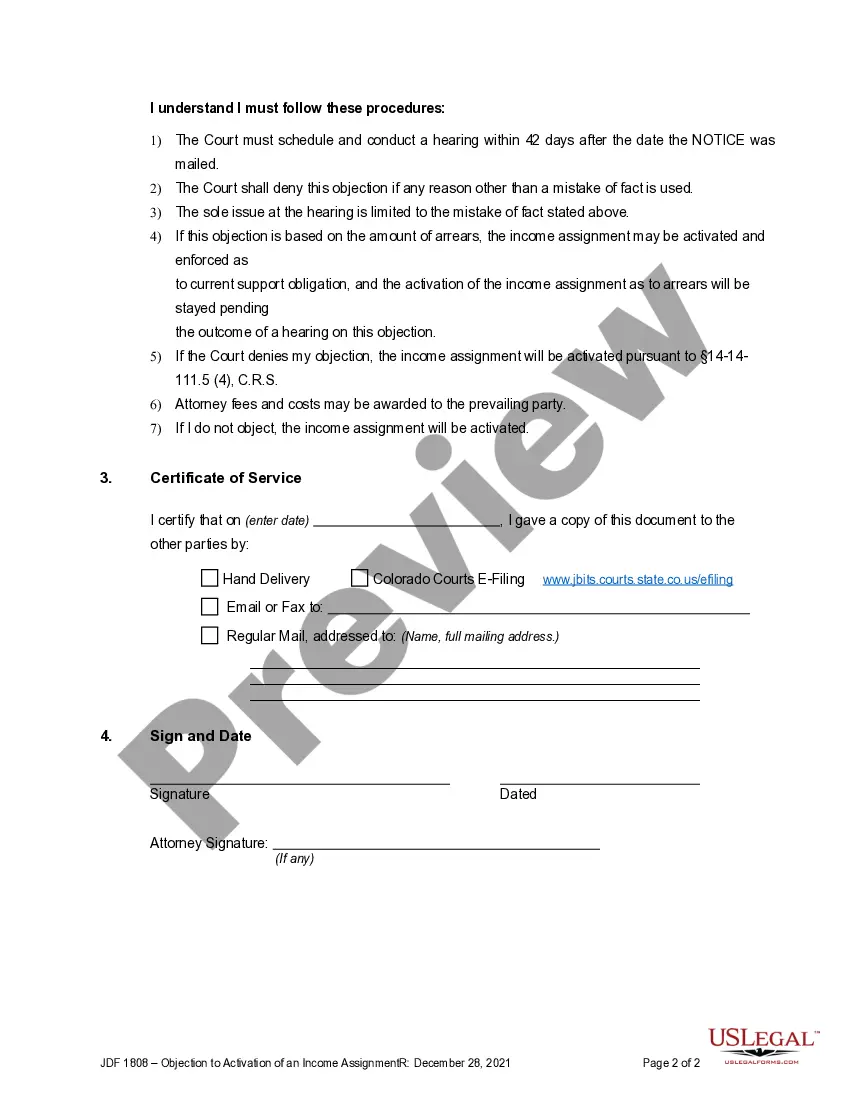

In Centennial, Colorado, a common legal matter pertaining to income assignments is the objection to their activation. An income assignment refers to a legal process wherein a portion of an individual's income is assigned to another party, typically to satisfy a debt or obligation. However, there may be instances where Centennial residents may have legitimate objections to the activation of such assignments. This article aims to provide a detailed description of what Centennial, Colorado, objections to the activation of an income assignment entail, along with relevant keywords that may be associated with this topic. Centennial Colorado Objections to the Activation of an Income Assignment: 1. Legal Framework: Understanding the legal framework governing income assignments in Centennial, Colorado is crucial. Key terms associated with this framework may include income garnishment, income withholding orders, or wage assignments. 2. Valid Objections: An objection to the activation of an income assignment can occur due to various reasons. It is essential to explore the valid objections that Centennial residents may have, such as insufficient notification, mistaken identity, improper procedure, procedural irregularities, or legality concerns. 3. Reviewing Terms and Conditions: Prior to objecting to the activation of an income assignment, it is important for individuals to review the terms and conditions of the assignment agreement thoroughly. Familiarizing oneself with applicable statutes, contractual obligations, and legal rights can strengthen the objection process. 4. Seeking Professional Advice: Centennial residents facing an objection to the activation of an income assignment should consider seeking legal advice from experienced professionals in the field. Attorneys specializing in family law, debt collection, or consumer rights can provide essential guidance throughout the objection process. 5. Gathering Evidence: To support objections, individuals may need to gather evidence. This may involve collecting relevant documents such as income statements, assignment notices, court orders, or communication records. Maintaining a well-documented trail can strengthen objections against improper income assignment activation. 6. Filing an Objection: Once individuals have determined their objection grounds and gathered necessary evidence, they must file an objection with the appropriate authority. This may involve submitting objection letters or specific forms to the court or agency overseeing the income assignment. 7. Objection Hearing: If the objection is accepted, a hearing may be scheduled to evaluate the merits of the objection. It is important to prepare for this hearing by organizing evidence, identifying witnesses, and possibly consulting legal representation. 8. Potential Outcomes: Following the objection hearing, potential outcomes may vary. The income assignment may be modified, terminated, or allowed to proceed as originally planned. Understanding the possible results can help individuals make informed decisions and plan accordingly. 9. Enforcing Rights: Should Centennial residents disagree with the outcome of the objection process, they may explore further legal options such as appealing the decision or seeking recourse through additional legal avenues. In summary, Centennial, Colorado, objections to the activation of an income assignment encompass various aspects of the legal process associated with income garnishment or assignment orders. By understanding the applicable legal framework, valid objections, and necessary procedures, individuals can effectively navigate the objection process. Seeking professional advice, gathering evidence, filing an objection, and preparing for a potential hearing are vital steps in asserting objections to the activation of an income assignment.

Centennial Colorado Objection to the Activation of an Income Assignment

Description

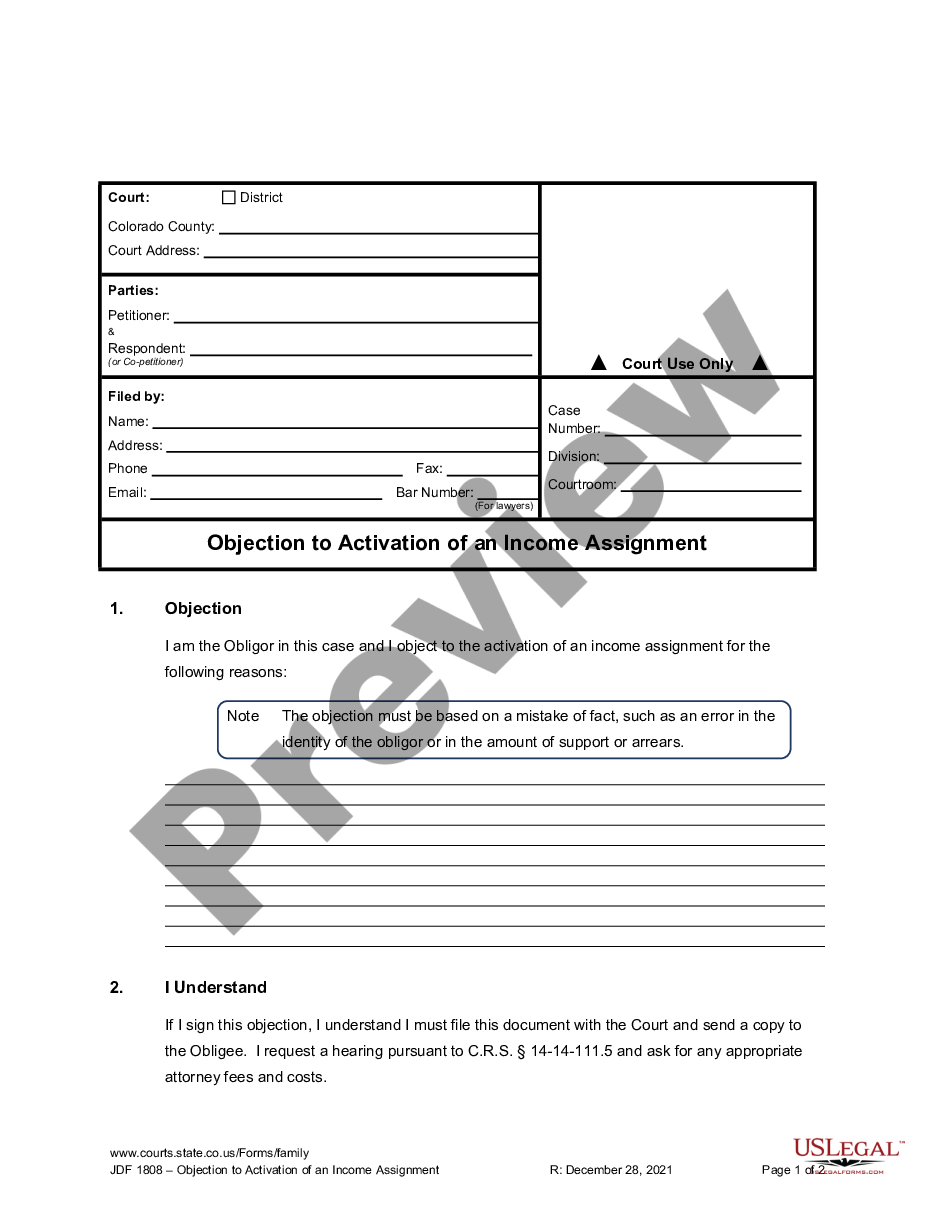

How to fill out Centennial Colorado Objection To The Activation Of An Income Assignment?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any law background to draft such papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you require the Centennial Colorado Objection to the Activation of an Income Assignment or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Centennial Colorado Objection to the Activation of an Income Assignment in minutes using our reliable service. In case you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our library, make sure to follow these steps prior to obtaining the Centennial Colorado Objection to the Activation of an Income Assignment:

- Ensure the template you have found is specific to your location since the regulations of one state or area do not work for another state or area.

- Preview the document and read a short description (if available) of scenarios the paper can be used for.

- If the form you selected doesn’t meet your needs, you can start over and search for the suitable form.

- Click Buy now and choose the subscription plan you prefer the best.

- Log in to your account credentials or create one from scratch.

- Select the payment method and proceed to download the Centennial Colorado Objection to the Activation of an Income Assignment once the payment is through.

You’re good to go! Now you can go on and print the document or complete it online. Should you have any problems locating your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.