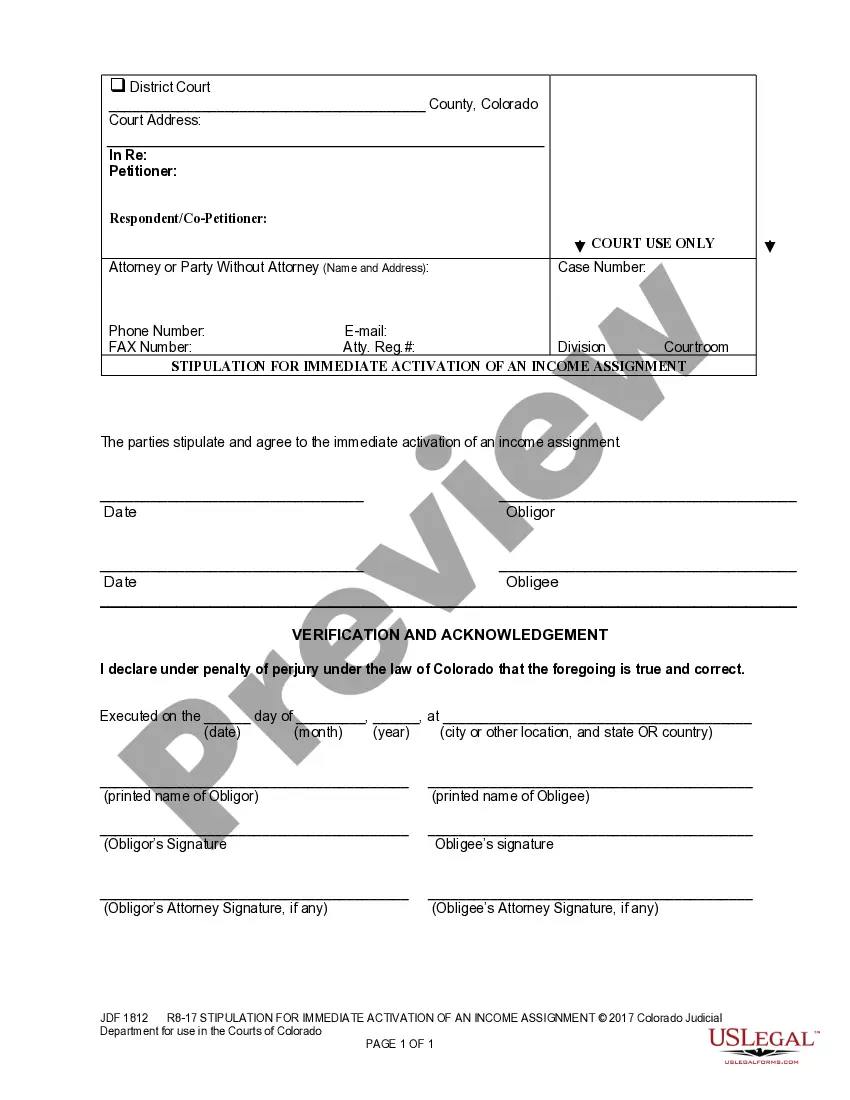

Colorado Springs Colorado Stipulation for Immediate Activation of an Income Assignment is a legal document that outlines the provisions and conditions for the immediate activation of an income assignment in the state of Colorado. This stipulation is relevant for individuals and entities involved in income assignments, such as lenders, debtors, and assignees. The Colorado Springs Colorado Stipulation for Immediate Activation of an Income Assignment serves to enforce the prompt assignment of income by a debtor to a creditor, ensuring timely repayment of a debt or obligation. This document includes specific clauses and provisions that govern the assignment process, including the activation date, payment terms, and any additional conditions that may be agreed upon by the parties involved. Some key elements typically included in a Colorado Springs Colorado Stipulation for Immediate Activation of an Income Assignment are: 1. Activation Date: This section specifies the effective date on which the income assignment becomes active and obligates the debtor to direct a portion of their income to the creditor. The activation date is crucial as it determines when the income assignment takes effect. 2. Payment Terms: This section outlines the payment terms agreed upon by the parties, including the amount or percentage of the debtor's income that will be assigned, the frequency of payments (e.g., weekly, monthly), and the method of payment (e.g., direct deposit, check). 3. Notification Process: This provision stipulates the procedures for notifying the debtor's employer or mayor of the income assignment. It may require the creditor or their legal representative to provide a copy of the stipulation to the employer, ensuring they are aware of the debtor's obligations and know how to comply with the income assignment requirements. 4. Modification or Termination: This clause outlines the conditions under which the stipulation can be modified, terminated, or revoked. It may require written consent from both parties or specify circumstances that allow for modification or termination, such as full repayment of the debt or the debtor's financial hardship. 5. Default and Remedies: This section outlines the consequences in case of default by the debtor, such as late or missed payments. It may specify the remedies available to the creditor, including the right to pursue legal action or impose penalties on the debtor. Though there might not be different types of Colorado Springs Colorado Stipulation for Immediate Activation of an Income Assignment, variations of this document can be tailored to suit the specific needs and circumstances of the parties involved. It is important to consult a legal professional to ensure that the stipulation adheres to the applicable laws and regulations in Colorado Springs, Colorado.

Colorado Springs Colorado Stipulation for Immediate Activation of an Income Assignment

Description

How to fill out Colorado Springs Colorado Stipulation For Immediate Activation Of An Income Assignment?

Finding confirmed templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world situations.

All the materials are appropriately categorized by area of application and jurisdiction, making it easy and quick to find the Colorado Springs Colorado Stipulation for Immediate Activation of an Income Assignment.

Organizing documents neatly and in accordance with legal standards is crucial. Utilize the US Legal Forms library to ensure you always have vital document templates for any requirements readily available!

- Examine the Preview mode and form explanation.

- Ensure you’ve chosen the right one that fulfills your requirements and fully aligns with your local jurisdiction criteria.

- Search for an alternate template, if necessary.

- As soon as you discover any discrepancy, use the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

In Colorado, a parent with primary custody of minor children has the right to move out of state with them, without the other parent's consent. This does not constitute parental kidnapping. However, the non-custodial parent has the right to petition the court to prohibit the removal of children from the state.

Call Law Enforcement Often the police will enforce a court order on your behalf. However, before calling law enforcement, it's recommended that you call the other parent to let them know that they are violating a court order, and you will call the police if they do not provide the child immediately.

If your child support order was issued in Colorado, emancipation occurs and child support ends when the child reaches 19 years of age in most cases. However, if the child is still in high school or an equivalent program, support continues until the end of the month after graduation but not beyond the age of 21.

Child support terminates automatically only when the last (or only) child turns 19 or emancipates. In all other situations, a court order is required.

Colorado has specific laws in place regarding low-income parents divorcing. If parents earn less than $1,100 per month in combined income, the Colorado family court provides minimum support payments unless both parents have at least 93 overnights with the children each year.

File a Motion & Affidavit for Citation for Contempt of Court (Form JDF 1816) signed in front of a notary public or court clerk. Complete an Order to Issue Citation and Citation to Show Cause (JDF 1817) Send or take the forms to the court in person.

The Colorado Courts E-Filing system allows authorized users to file and serve documents electronically in the Colorado Courts.

Here's a step-by-step walkthrough: Download and complete the required forms. These are available online on the Colorado court website.File the completed forms with the court.Provide the other party with a copy of the motion by mail. Wait for further updates from the court on hearings or direct rulings.

Colorado courts do not allow parents to waive child support obligations, even if they both agree payment from one parent to the other based on their unique circumstances makes this their preference.

In Colorado, the only time a parent is not required to pay child support is when they have sole physical custody of the child ? that is, if the court decides that the child stays with them full-time.