This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

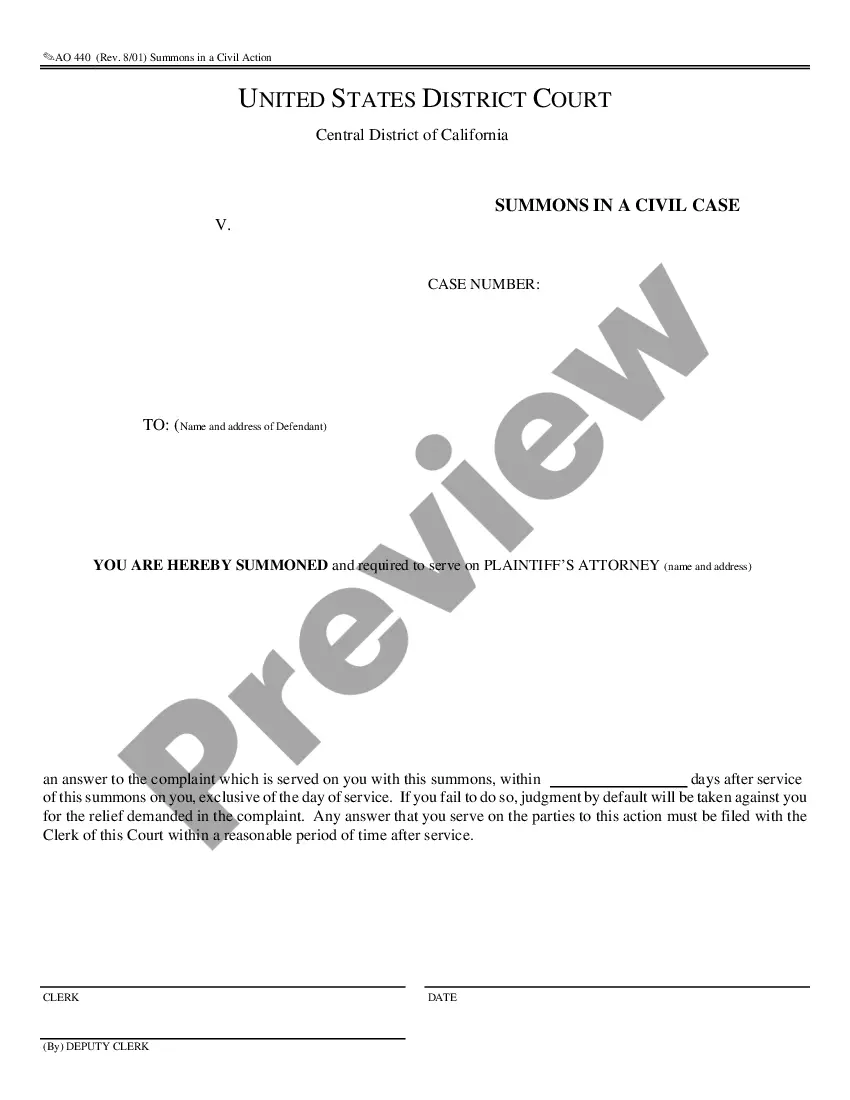

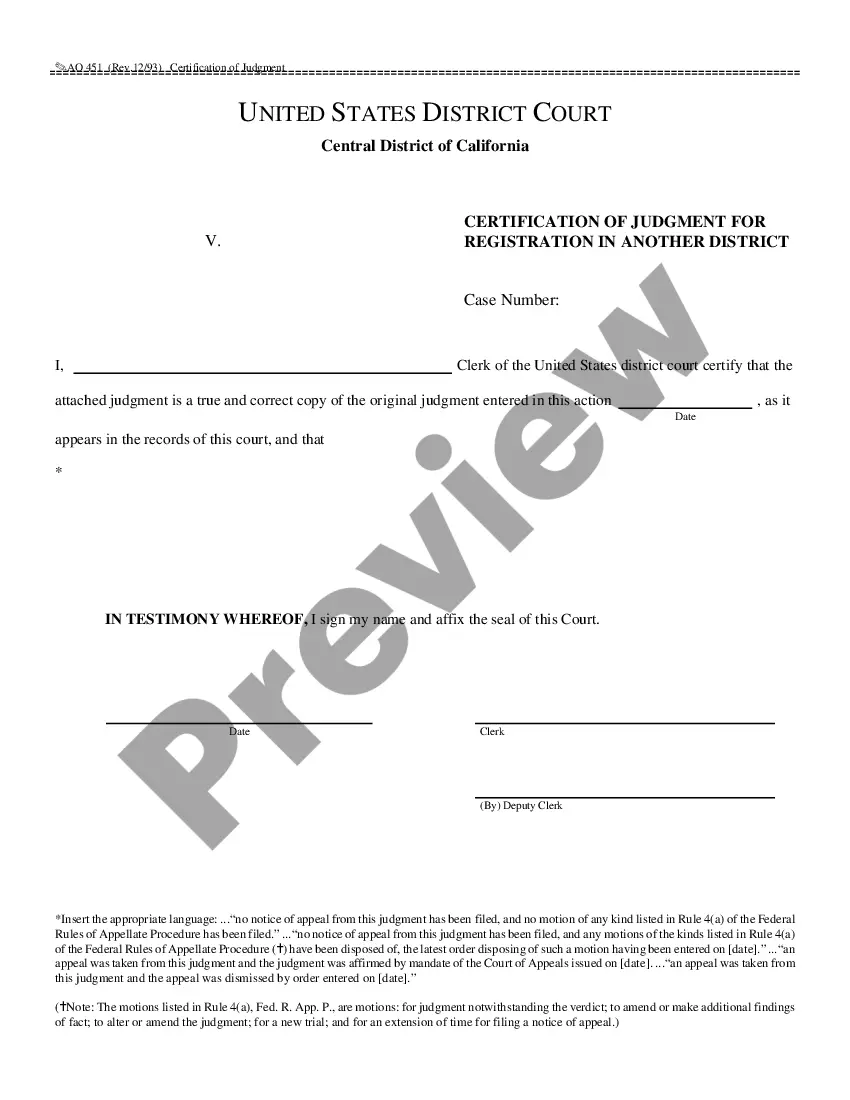

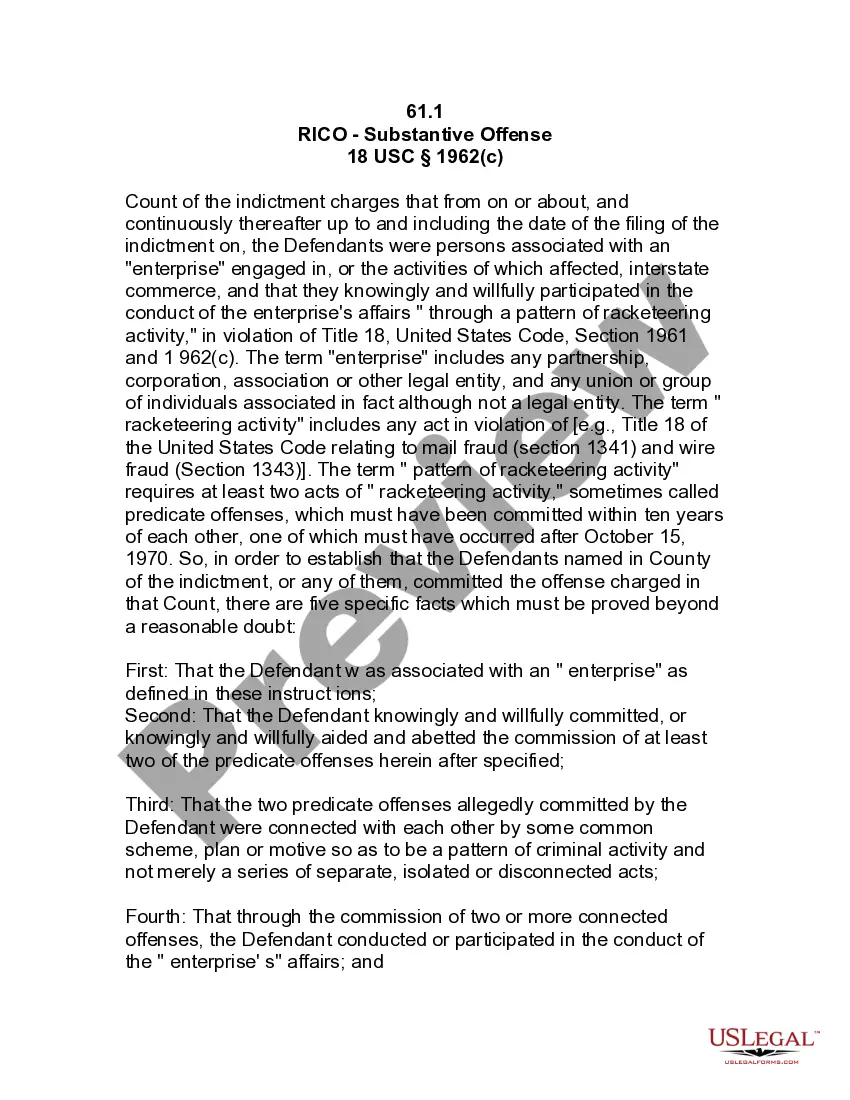

Title: Comprehensive Guide: Instructions For Appealing Property Tax Assessments With The District Court in Colorado Springs, Colorado Introduction: Welcome to our detailed guide on appealing property tax assessments with the District Court in Colorado Springs, Colorado. In this article, we will provide you with an in-depth overview of the appeal process, its requirements, the necessary steps to follow, and potential outcomes. Our aim is to equip you with valuable information and key keywords to navigate the appeal process effectively. 1. Understanding Property Tax Assessments in Colorado Springs: a) Definition and Purpose of Property Tax Assessments b) How Property Tax Assessments are Determined in Colorado Springs c) The Importance of Accurate Property Valuation d) Common Reasons for Disputing Property Tax Assessments 2. Preliminary Steps for Appealing Property Tax Assessments: a) Gathering Relevant Documents and Information b) Valid Grounds for Filing an Appeal c) Deadline and Timeframe for Initiating an Appeal d) Communication with the County Assessor's Office 3. Type 1: Administrative Appeal: a) Description and Eligibility Criteria b) Filing an Administrative Appeal with El Paso County Assessor's Office c) Providing Supporting Evidence d) Review Process and Possible Outcomes 4. Type 2: Judicial Appeal with the District Court: a) Description and Eligibility Criteria b) Initiation of a Judicial Appeal c) Legal Representation and Hiring an Attorney d) Filing a Property Value Complaint/Summons and Complaint with the District Court e) Preparing for Court Proceedings f) Presenting Evidence and Witnesses g) Court Hearing and Decision h) Post-Trial Proceedings and Further Options 5. Seeking Professional Assistance: a) Benefits of Hiring a Property Tax Attorney or Consultant b) Locating and Choosing a Qualified Advocate c) Evaluating Costs and Potential Savings d) Utilizing Online Resources and Self-Help Options Conclusion: Successfully appealing property tax assessments in Colorado Springs is a complex process with certain requirements and deadlines. By understanding the intricacies of administrative and judicial appeals, along with the relevant procedures, you can pursue a fair property valuation and potential tax savings. Remember, seeking professional guidance can greatly enhance your chances of a favorable outcome. Keywords: Colorado Springs Colorado, property tax assessments, District Court, appeal process, appealing property tax assessments, instructions, administrative appeal, judicial appeal, El Paso County Assessor's Office, property valuation, property value complaint, summons and complaint, court hearing, professional assistance, property tax attorney, consultant, deadlines.Title: Comprehensive Guide: Instructions For Appealing Property Tax Assessments With The District Court in Colorado Springs, Colorado Introduction: Welcome to our detailed guide on appealing property tax assessments with the District Court in Colorado Springs, Colorado. In this article, we will provide you with an in-depth overview of the appeal process, its requirements, the necessary steps to follow, and potential outcomes. Our aim is to equip you with valuable information and key keywords to navigate the appeal process effectively. 1. Understanding Property Tax Assessments in Colorado Springs: a) Definition and Purpose of Property Tax Assessments b) How Property Tax Assessments are Determined in Colorado Springs c) The Importance of Accurate Property Valuation d) Common Reasons for Disputing Property Tax Assessments 2. Preliminary Steps for Appealing Property Tax Assessments: a) Gathering Relevant Documents and Information b) Valid Grounds for Filing an Appeal c) Deadline and Timeframe for Initiating an Appeal d) Communication with the County Assessor's Office 3. Type 1: Administrative Appeal: a) Description and Eligibility Criteria b) Filing an Administrative Appeal with El Paso County Assessor's Office c) Providing Supporting Evidence d) Review Process and Possible Outcomes 4. Type 2: Judicial Appeal with the District Court: a) Description and Eligibility Criteria b) Initiation of a Judicial Appeal c) Legal Representation and Hiring an Attorney d) Filing a Property Value Complaint/Summons and Complaint with the District Court e) Preparing for Court Proceedings f) Presenting Evidence and Witnesses g) Court Hearing and Decision h) Post-Trial Proceedings and Further Options 5. Seeking Professional Assistance: a) Benefits of Hiring a Property Tax Attorney or Consultant b) Locating and Choosing a Qualified Advocate c) Evaluating Costs and Potential Savings d) Utilizing Online Resources and Self-Help Options Conclusion: Successfully appealing property tax assessments in Colorado Springs is a complex process with certain requirements and deadlines. By understanding the intricacies of administrative and judicial appeals, along with the relevant procedures, you can pursue a fair property valuation and potential tax savings. Remember, seeking professional guidance can greatly enhance your chances of a favorable outcome. Keywords: Colorado Springs Colorado, property tax assessments, District Court, appeal process, appealing property tax assessments, instructions, administrative appeal, judicial appeal, El Paso County Assessor's Office, property valuation, property value complaint, summons and complaint, court hearing, professional assistance, property tax attorney, consultant, deadlines.