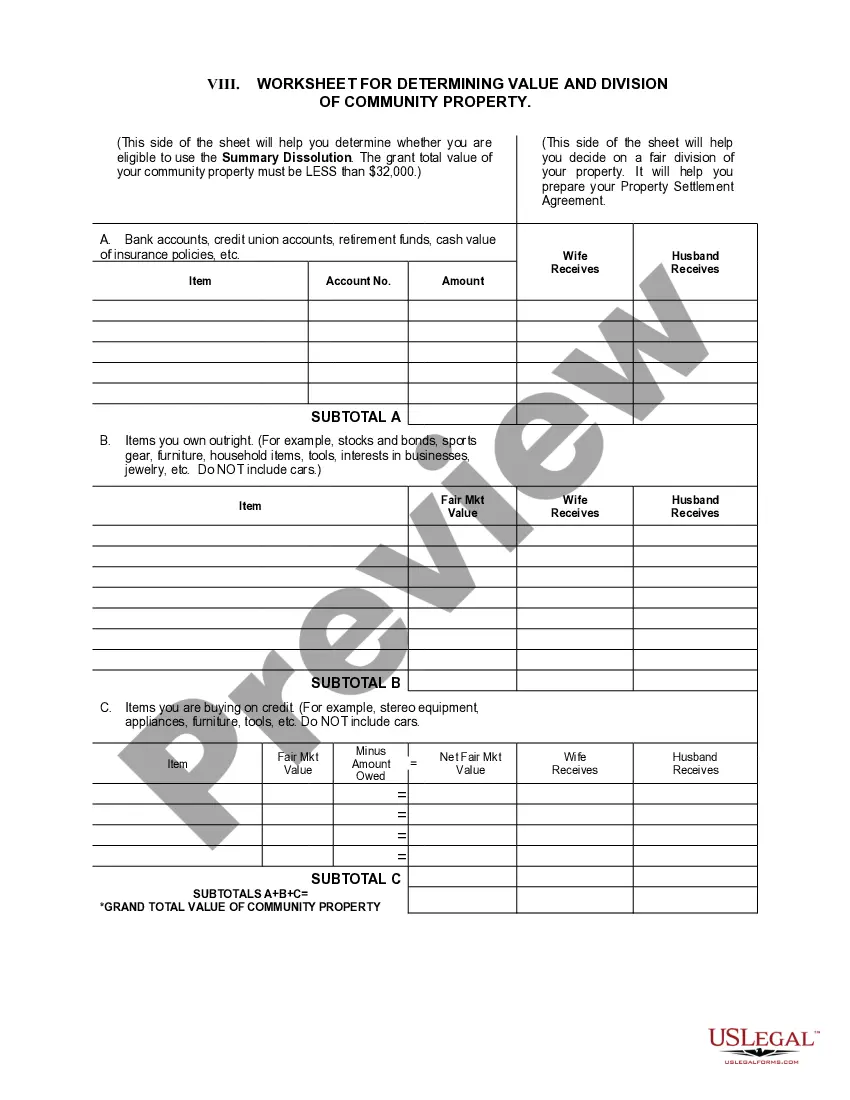

The Aurora Colorado Summary of Receipts and Expenditures Only — Interim or Final Accounting is a detailed financial report that provides a comprehensive overview of the city's financial transactions and activities. This accounting document serves as both a record and a tool to assess the city's fiscal health, allowing stakeholders to understand how funds are allocated and managed. The Summary of Receipts and Expenditures Only — Interim or Final Accounting encompasses various types, including: 1. Interim Accounting: This refers to a periodic financial report prepared at specific intervals, usually quarterly or semi-annually, throughout the fiscal year. Interim accounting provide timely updates on the city's financial performance and allow for mid-year assessment and adjustments if necessary. 2. Final Accounting: This is the comprehensive summary of all financial receipts and expenditures for a specific fiscal year. Prepared at the end of the financial year, the final accounting provides a complete picture of the city's financial position and is often audited to ensure accuracy and compliance with regulatory requirements. Key components of the Aurora Colorado Summary of Receipts and Expenditures Only — Interim or Final Accounting include: 1. Revenue Receipts: This section details the various sources of income for the city, such as taxes, fees, grants, and other revenue streams. It highlights the amount collected from each source and provides a breakdown by category or department. 2. Expenditures: This section outlines the city's spending across different departments, programs, and services. It includes salaries, benefits, operations, maintenance, capital expenditures, debt service payments, and any other significant expenses. The expenses are categorized to offer a clear view of where the city's funds are allocated. 3. Fund Balances: This part presents the balances available in each fund at the end of the reporting period. It highlights the financial reserves or deficits in various funds such as the General Fund, Capital Improvement Fund, and Enterprise Funds. Fund balances help evaluate the city's ability to meet future financial obligations and assess fiscal sustainability. 4. Capital Projects: If applicable, this section provides an overview of ongoing or completed capital projects, detailing the costs incurred, projected budgets, and the funding sources utilized. It helps track progress and assess the efficiency of utilizing resources for infrastructure development. 5. Comparative Analysis: To facilitate analysis, the report often includes a comparative analysis of relevant financial data from previous years or budgeted figures. This comparison assists in identifying trends, variations, and areas of improvement in financial management. Overall, the Aurora Colorado Summary of Receipts and Expenditures Only — Interim or Final Accounting is a vital financial document that ensures transparency, accountability, and efficient resource allocation within the city. It enables both internal stakeholders, such as city council members and department heads, as well as external stakeholders, including taxpayers and potential investors, to evaluate the city's financial performance and make informed decisions.

Aurora Colorado Summary of Receipts and Expenditures Only - Interim or Final Accounting

Description

How to fill out Aurora Colorado Summary Of Receipts And Expenditures Only - Interim Or Final Accounting?

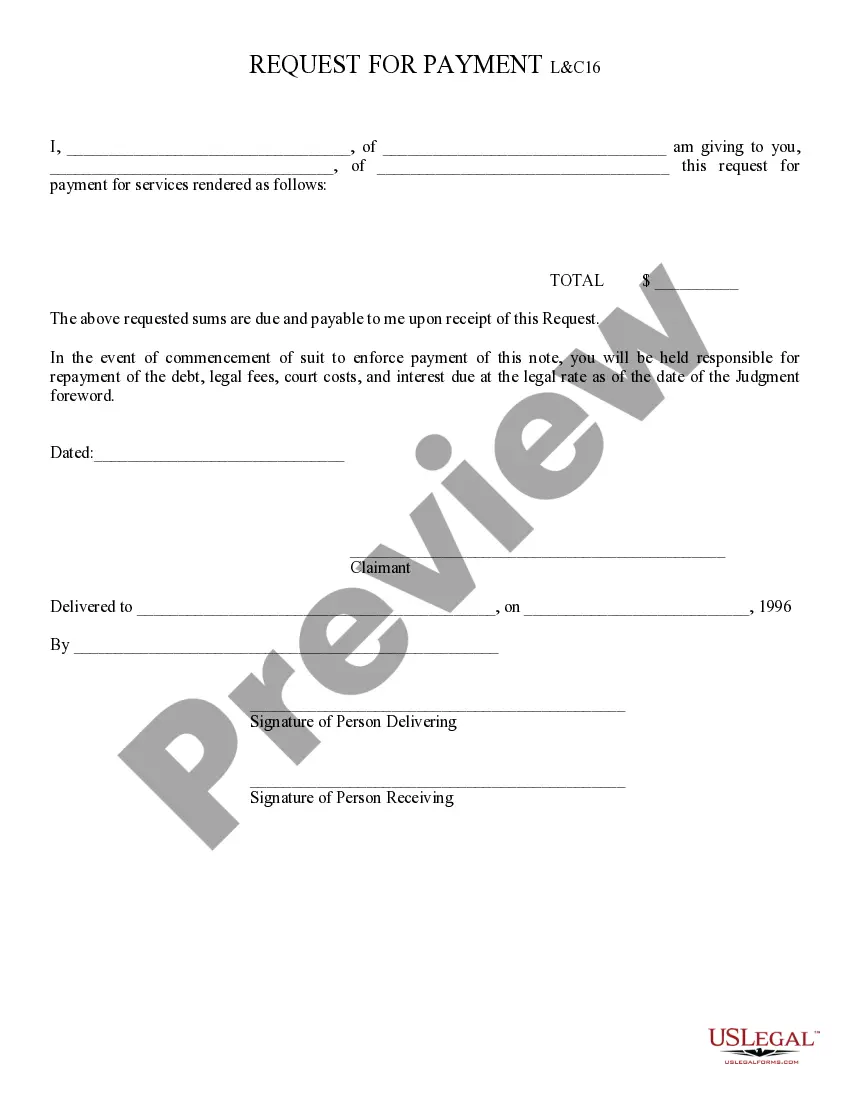

Do you need a reliable and inexpensive legal forms provider to buy the Aurora Colorado Summary of Receipts and Expenditures Only - Interim or Final Accounting? US Legal Forms is your go-to option.

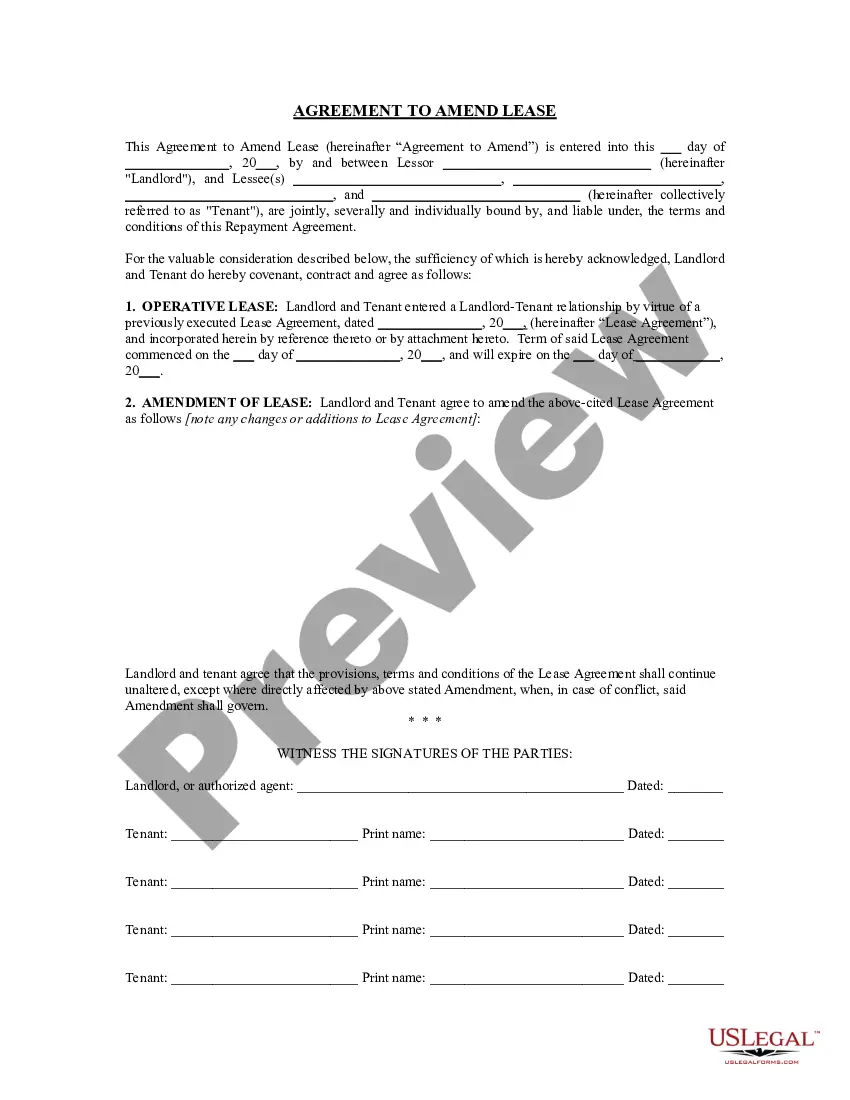

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Aurora Colorado Summary of Receipts and Expenditures Only - Interim or Final Accounting conforms to the laws of your state and local area.

- Read the form’s description (if available) to find out who and what the form is good for.

- Restart the search in case the template isn’t good for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Aurora Colorado Summary of Receipts and Expenditures Only - Interim or Final Accounting in any available format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal paperwork online for good.