This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

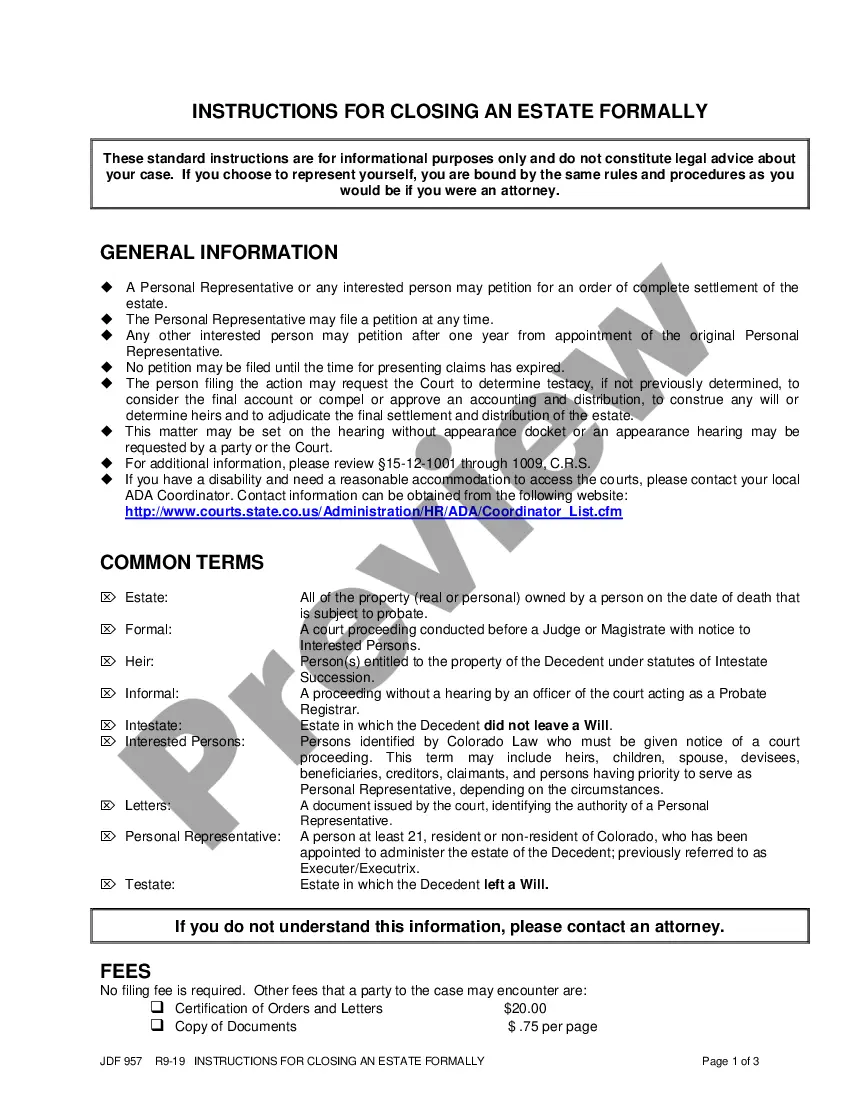

Centennial Colorado Instructions For Closing An Estate Informally

Description

How to fill out Colorado Instructions For Closing An Estate Informally?

Locating authenticated templates tailored to your regional regulations can be difficult unless you access the US Legal Forms repository. It’s a digital collection of over 85,000 legal documents for both personal and professional requirements, as well as various real-life scenarios.

For those who are already familiar with our repository and have utilized it previously, acquiring the Centennial Colorado Instructions For Closing An Estate Informally takes merely a few clicks. All you need to do is Log In to your account, select the document, and click Download to save it onto your device. This process will require a few additional steps for new users.

Follow the instructions below to get started with the most comprehensive online form catalogue.

Maintaining documentation organized and in compliance with legal requirements is crucial. Take advantage of the US Legal Forms library to always have essential document templates for any requirements just at your fingertips!

- Check the Preview mode and form description. Ensure that you’ve selected the right one that fulfills your needs and completely aligns with your local jurisdiction requirements.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You must create an account to gain access to the library’s resources.

- Make your payment. Provide your credit card information or use your PayPal account to settle the subscription fee.

- Download the Centennial Colorado Instructions For Closing An Estate Informally. Save the template onto your device to proceed with its completion and access it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

In Massachusetts, informal probate can vary in duration but typically takes about four to six months to complete. This timeline can depend on the complexity of the estate and the responsiveness of beneficiaries and creditors. While you follow the Centennial Colorado Instructions For Closing An Estate Informally, ensure you maintain clear communication with all parties involved. Using resources from USLegalForms can help you stay organized and on track throughout the process.

Probate is a legal process used to validate a deceased person's will, while informal probate is a simpler, less formal process that often does not require a judge’s direct involvement. Informal probate is generally faster and less costly, making it a preferred choice for many estates. By following the Centennial Colorado Instructions For Closing An Estate Informally, you can navigate this pathway more easily and efficiently. This distinction helps clarify what is needed based on your specific situation.

Informal probate in Centennial, Colorado, typically requires a few essential steps to ensure a smooth process. First, you must file the estate's documents with the local probate court, adhering to the guidelines dictated by state law. Beneficiaries should be notified, and the estate assets must be properly managed during this period. Consulting the Centennial Colorado Instructions For Closing An Estate Informally is crucial to understand your obligations and streamline the process effectively.

Filling out an estate document involves gathering necessary information about the deceased, the beneficiaries, and any assets involved. You will need to accurately input details regarding debts, property, and potential claims. To simplify the process, you can follow the Centennial Colorado Instructions For Closing An Estate Informally, ensuring you meet local guidelines. Additionally, using a platform like USLegalForms can provide templates and guidance to make this task easier.

Closing an estate informally can vary based on several factors, including the estate's complexity and the cooperation of the heirs. Typically, you can expect to close an estate within a few months if all necessary documents are prepared correctly and there are no disputes. By following the Centennial Colorado Instructions For Closing An Estate Informally, you streamline the process and reduce delays. Using platforms like USLegalForms can provide you with the necessary tools and templates to facilitate this process efficiently.

Closing an informal probate requires you to file necessary documents with the court, settle the estate’s debts, and distribute assets to heirs. Keep accurate records throughout the process for transparency. Using the Centennial Colorado Instructions For Closing An Estate Informally will provide guidance and ensure you meet all legal criteria.

To close a deceased bank account, you typically need the account holder's death certificate, proof of your identity, and possibly a court document asserting your authority over the estate. Following the Centennial Colorado Instructions For Closing An Estate Informally, you can collect these documents and navigate the closure smoothly.

Closing an informal estate in Colorado involves settling all debts and distributing the remaining assets to beneficiaries. You will need to compile necessary documents and possibly file a final accounting with the court. By consulting the Centennial Colorado Instructions For Closing An Estate Informally, you can complete this process with confidence.

To conduct an informal probate, gather the deceased's assets, debts, and important documentation like the will. You can then file for informal probate through your local probate court. Following the Centennial Colorado Instructions For Closing An Estate Informally helps you understand the specific requirements and makes the process less daunting.

While hiring a lawyer to close an estate after death can ease the process, it's not always necessary, especially if you follow the informal route. The Centennial Colorado Instructions For Closing An Estate Informally offer clear steps for those who prefer to manage the estate on their own, ensuring you stay compliant with legal obligations.