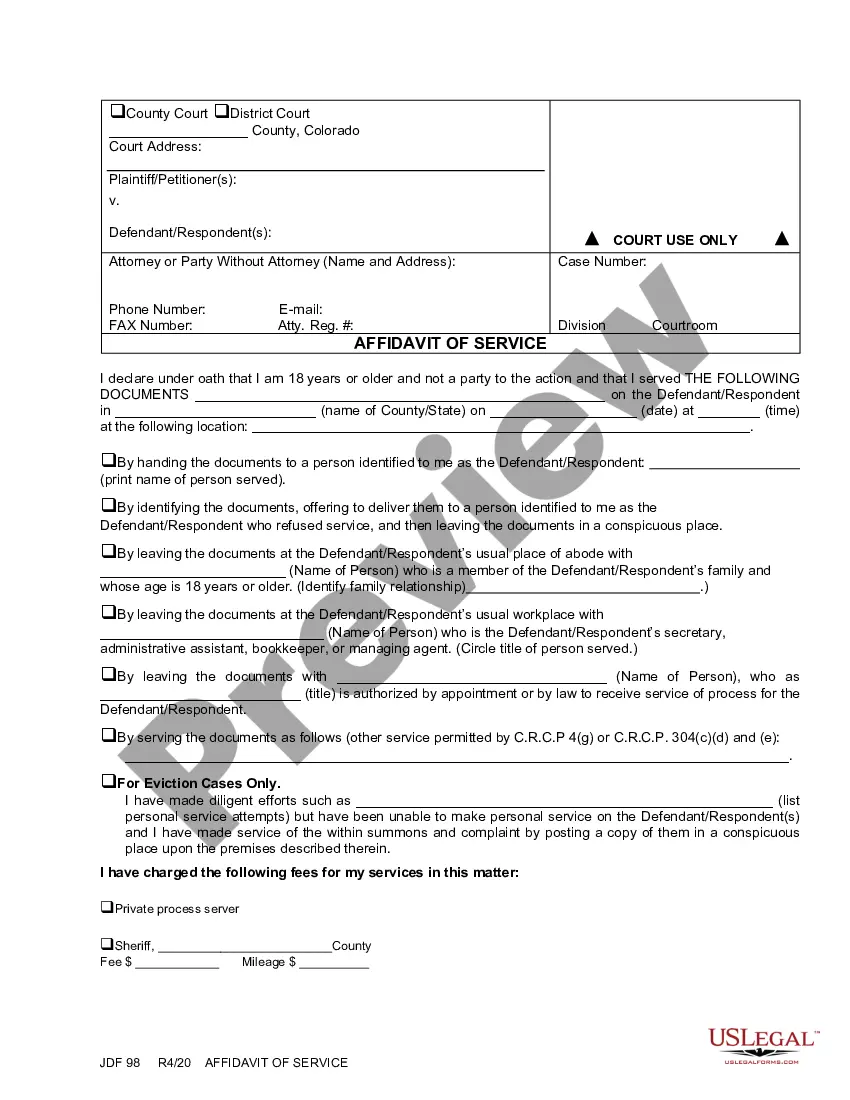

This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Detailed Description of Fort Collins Colorado Instructions for Re-Opening an Estate When a loved one passes away, there are certain legal procedures that need to be followed for the proper administration of their estate. In Fort Collins, Colorado, there are specific instructions that must be adhered to when re-opening an estate. Whether it is a formal or informal administration, the process can be complex, requiring careful attention to detail and compliance with state laws. Formal Administration Process in Fort Collins, Colorado: 1. Petition for Re-Opening: To initiate the re-opening of an estate, a petition must be filed with the appropriate court in Fort Collins, Colorado. This petition should clearly state the reason for re-opening and provide all necessary information, including the deceased's name, date of death, and case number of the previously closed estate. 2. Appointment of Personal Representative: Once the petition is filed, the court will review the application and appoint a personal representative (also known as an executor or administrator) for the estate. This individual is responsible for managing the estate's assets and ensuring that all debts, taxes, and expenses are paid. 3. Notice to Interested Parties: After the appointment of a personal representative, a notice must be sent to all interested parties, including beneficiaries named in the will, potential heirs, and creditors. This notice informs them of the re-opening of the estate and provides an opportunity to contest or make claims against the estate if necessary. 4. Inventory and Appraisal of Assets: The personal representative must prepare a comprehensive inventory listing all assets owned by the deceased at the time of death. Additionally, a professional appraisal may be required for certain assets, such as real estate or valuable personal property, to determine their fair market value. 5. Debts and Taxes: All debts owed by the deceased must be identified and paid from the estate's assets. This includes outstanding loans, medical bills, and any other liabilities. Furthermore, the personal representative must ensure that all necessary taxes, such as estate taxes and income taxes, are filed and paid promptly. 6. Distribution of Assets: Once all debts, taxes, and expenses have been settled, the remaining assets can be distributed to the beneficiaries according to the terms of the deceased's will or Colorado's intestacy laws if there is no will. The personal representative is responsible for overseeing the fair and equitable distribution of these assets. Informal Administration Process in Fort Collins, Colorado: Fort Collins also offers an informal administration process, which is less formal and time-consuming compared to formal administration. However, it is only available under specific circumstances and when all interested parties agree to proceed with this method. The informal administration process involves working directly with the court clerk and does not require a court hearing or formal appointment of a personal representative. In conclusion, the re-opening of an estate in Fort Collins, Colorado requires a thorough understanding of the legal procedures and compliance to state laws. Whether choosing a formal or informal administration process, it is advisable to seek the guidance of an experienced probate attorney who can provide clear instructions and guidance throughout the often complex estate administration process. By following the appropriate instructions and complying with the legal requirements, the re-opened estate can be effectively managed, ensuring the orderly distribution of assets and the resolution of any outstanding obligations.Detailed Description of Fort Collins Colorado Instructions for Re-Opening an Estate When a loved one passes away, there are certain legal procedures that need to be followed for the proper administration of their estate. In Fort Collins, Colorado, there are specific instructions that must be adhered to when re-opening an estate. Whether it is a formal or informal administration, the process can be complex, requiring careful attention to detail and compliance with state laws. Formal Administration Process in Fort Collins, Colorado: 1. Petition for Re-Opening: To initiate the re-opening of an estate, a petition must be filed with the appropriate court in Fort Collins, Colorado. This petition should clearly state the reason for re-opening and provide all necessary information, including the deceased's name, date of death, and case number of the previously closed estate. 2. Appointment of Personal Representative: Once the petition is filed, the court will review the application and appoint a personal representative (also known as an executor or administrator) for the estate. This individual is responsible for managing the estate's assets and ensuring that all debts, taxes, and expenses are paid. 3. Notice to Interested Parties: After the appointment of a personal representative, a notice must be sent to all interested parties, including beneficiaries named in the will, potential heirs, and creditors. This notice informs them of the re-opening of the estate and provides an opportunity to contest or make claims against the estate if necessary. 4. Inventory and Appraisal of Assets: The personal representative must prepare a comprehensive inventory listing all assets owned by the deceased at the time of death. Additionally, a professional appraisal may be required for certain assets, such as real estate or valuable personal property, to determine their fair market value. 5. Debts and Taxes: All debts owed by the deceased must be identified and paid from the estate's assets. This includes outstanding loans, medical bills, and any other liabilities. Furthermore, the personal representative must ensure that all necessary taxes, such as estate taxes and income taxes, are filed and paid promptly. 6. Distribution of Assets: Once all debts, taxes, and expenses have been settled, the remaining assets can be distributed to the beneficiaries according to the terms of the deceased's will or Colorado's intestacy laws if there is no will. The personal representative is responsible for overseeing the fair and equitable distribution of these assets. Informal Administration Process in Fort Collins, Colorado: Fort Collins also offers an informal administration process, which is less formal and time-consuming compared to formal administration. However, it is only available under specific circumstances and when all interested parties agree to proceed with this method. The informal administration process involves working directly with the court clerk and does not require a court hearing or formal appointment of a personal representative. In conclusion, the re-opening of an estate in Fort Collins, Colorado requires a thorough understanding of the legal procedures and compliance to state laws. Whether choosing a formal or informal administration process, it is advisable to seek the guidance of an experienced probate attorney who can provide clear instructions and guidance throughout the often complex estate administration process. By following the appropriate instructions and complying with the legal requirements, the re-opened estate can be effectively managed, ensuring the orderly distribution of assets and the resolution of any outstanding obligations.