Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note serves as evidence of the borrower's promise to repay the loan amount, along with the agreed-upon interest, over a fixed period of time through scheduled installment payments. The terms and conditions of the Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate may vary depending on the specifics agreed upon by the parties involved. However, the note typically includes key elements such as the loan amount, interest rate, repayment schedule, late payment penalties, and any additional fees or charges. One type of Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is the Short-Term Unsecured Installment Note. This type of promissory note is typically used for smaller loan amounts with a repayment period ranging from a few months to a year. It offers borrowers the convenience of repaying the loan through fixed monthly installments over a shorter duration. Another type is the Long-Term Unsecured Installment Note, which is suitable for larger loan amounts that require a longer repayment period. This installment note is designed to offer borrowers flexibility in repaying the loan over an extended period, usually several years, with fixed monthly installments that include both principal and interest. It's important to note that an unsecured promissory note means there is no collateral attached to the loan. This means that in the event of default, the lender may have limited avenues to recover the loan amount. As a result, lenders may require higher interest rates or stricter eligibility criteria to mitigate the risk associated with unsecured loans. In conclusion, the Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate serves as a vital legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. With different types available, borrowers can select the one that suits their loan amount and repayment duration requirements.

Lakewood Colorado Unsecured Installment Payment Promissory Note for Fixed Rate

Category:

State:

Colorado

City:

Lakewood

Control #:

CO-NOTE-2

Format:

Word;

Rich Text

Instant download

Description

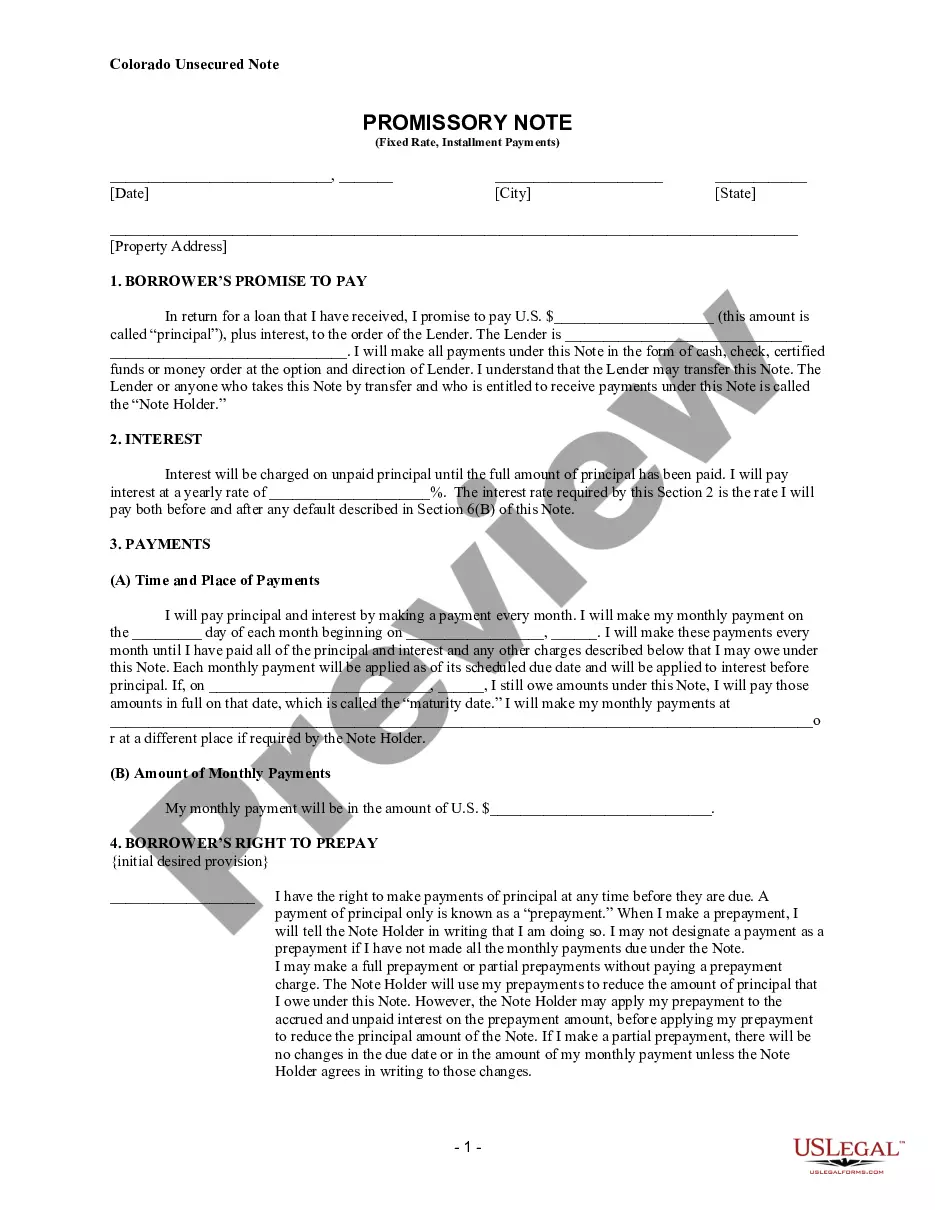

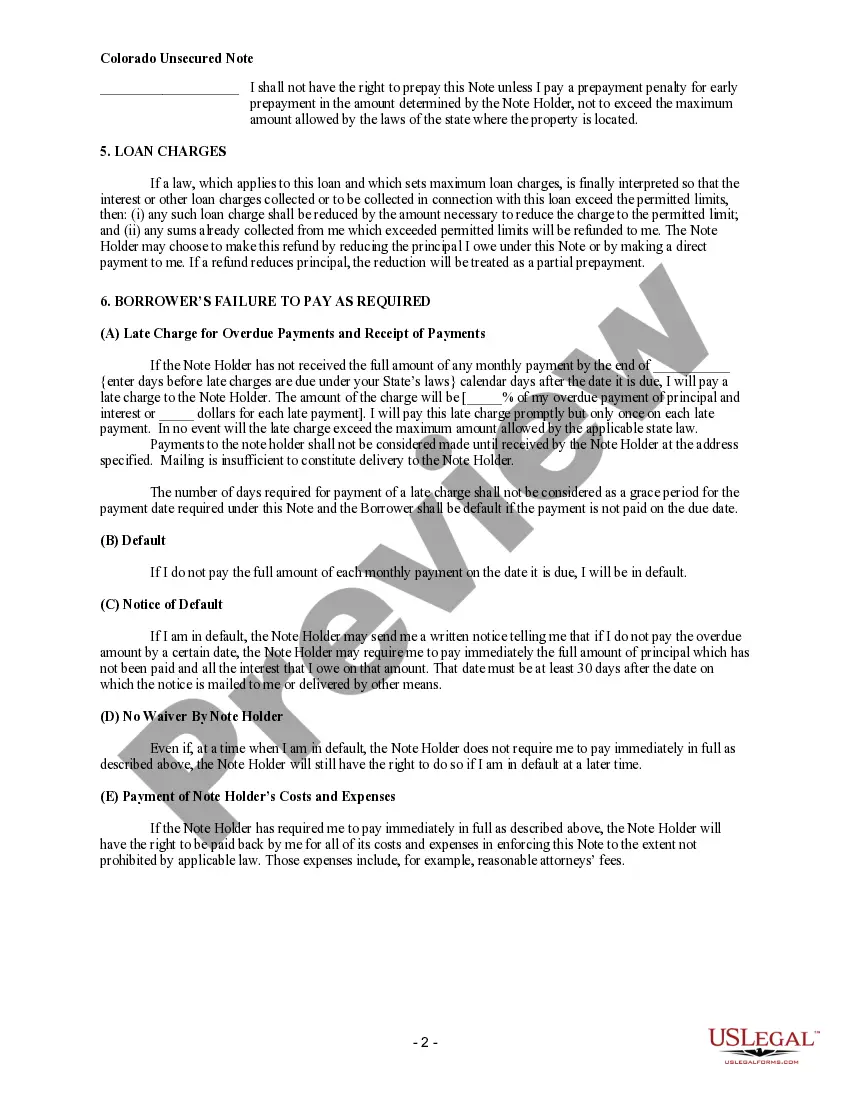

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note serves as evidence of the borrower's promise to repay the loan amount, along with the agreed-upon interest, over a fixed period of time through scheduled installment payments. The terms and conditions of the Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate may vary depending on the specifics agreed upon by the parties involved. However, the note typically includes key elements such as the loan amount, interest rate, repayment schedule, late payment penalties, and any additional fees or charges. One type of Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is the Short-Term Unsecured Installment Note. This type of promissory note is typically used for smaller loan amounts with a repayment period ranging from a few months to a year. It offers borrowers the convenience of repaying the loan through fixed monthly installments over a shorter duration. Another type is the Long-Term Unsecured Installment Note, which is suitable for larger loan amounts that require a longer repayment period. This installment note is designed to offer borrowers flexibility in repaying the loan over an extended period, usually several years, with fixed monthly installments that include both principal and interest. It's important to note that an unsecured promissory note means there is no collateral attached to the loan. This means that in the event of default, the lender may have limited avenues to recover the loan amount. As a result, lenders may require higher interest rates or stricter eligibility criteria to mitigate the risk associated with unsecured loans. In conclusion, the Lakewood, Colorado Unsecured Installment Payment Promissory Note for Fixed Rate serves as a vital legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. With different types available, borrowers can select the one that suits their loan amount and repayment duration requirements.

Free preview

How to fill out Lakewood Colorado Unsecured Installment Payment Promissory Note For Fixed Rate?

If you’ve already used our service before, log in to your account and save the Lakewood Colorado Unsecured Installment Payment Promissory Note for Fixed Rate on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Lakewood Colorado Unsecured Installment Payment Promissory Note for Fixed Rate. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!