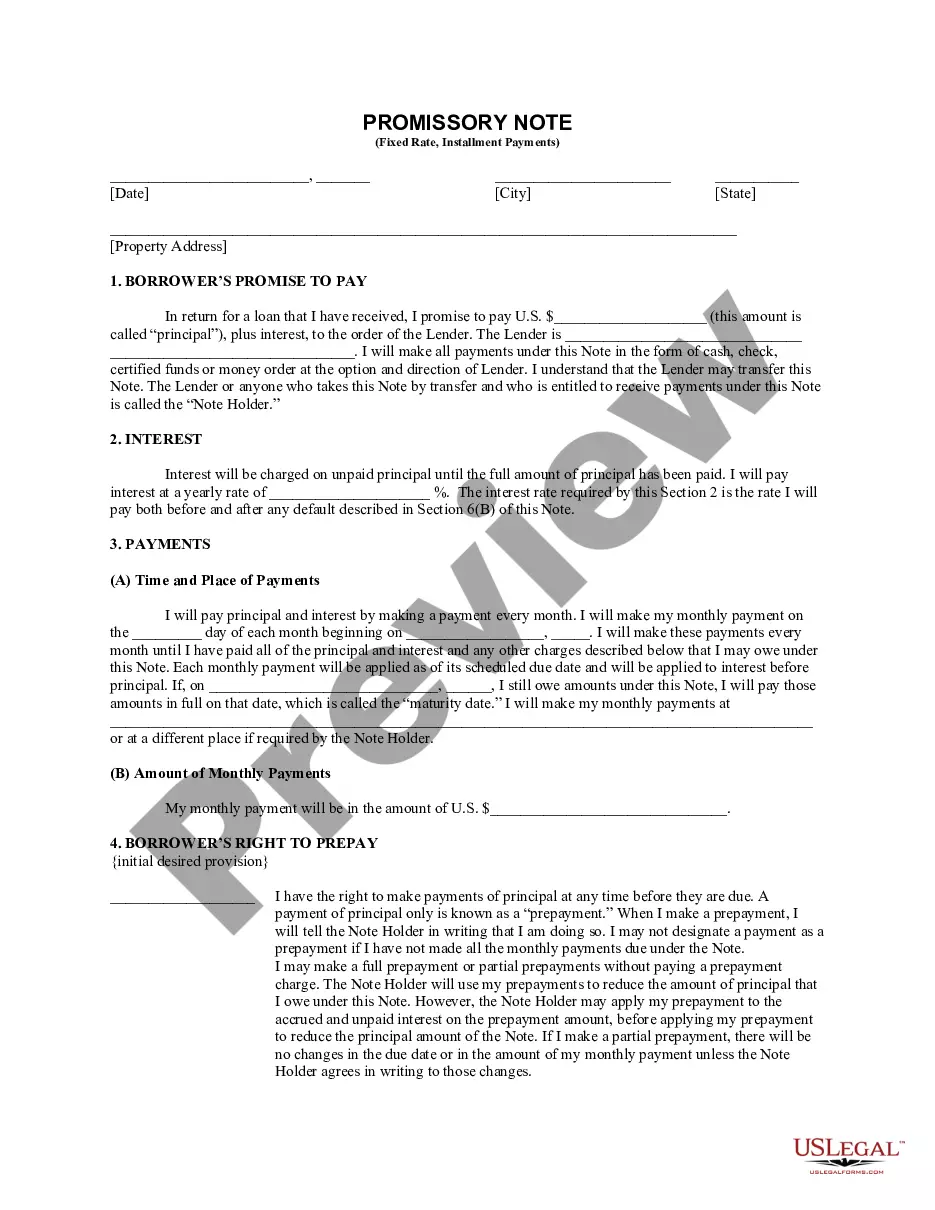

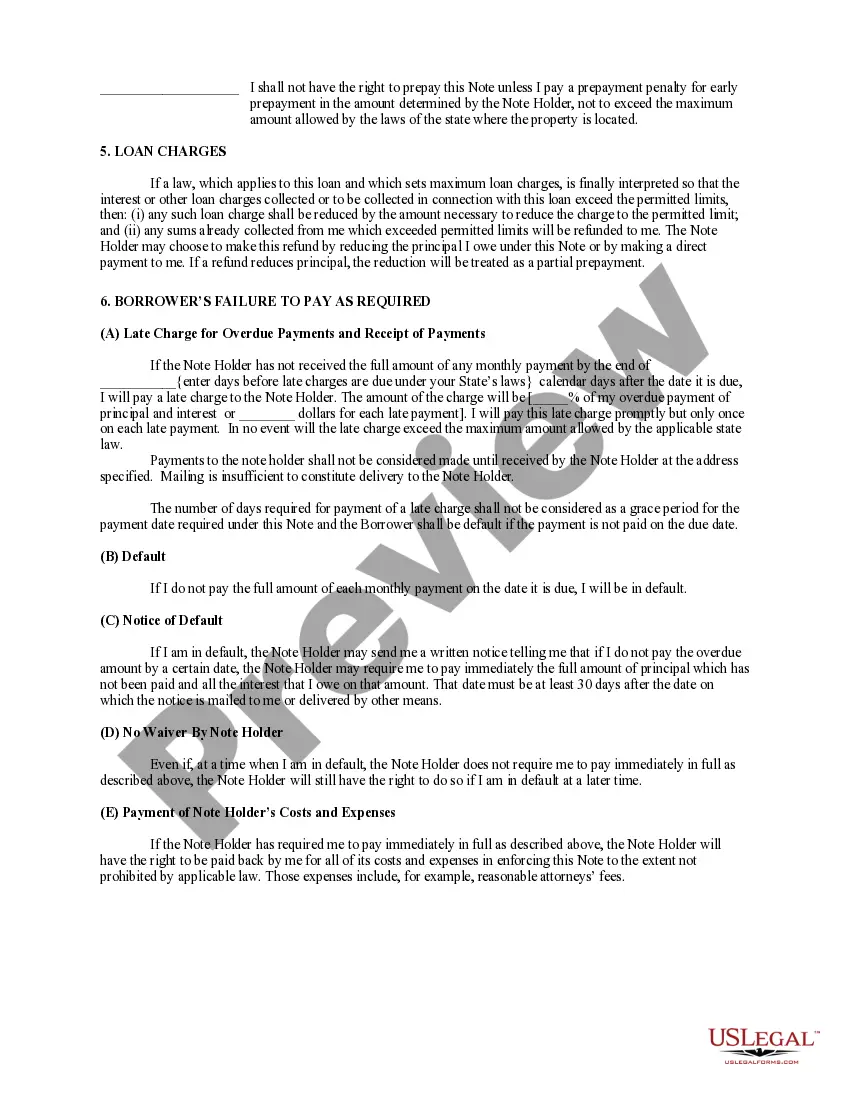

Title: Understanding Centennial, Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate Introduction: Centennial, Colorado is known for its thriving real estate market, which has resulted in the emergence of various financial instruments designed to facilitate property transactions. One such instrument is the Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate. In this article, we will explore the features, benefits, and various types of these promissory notes available in Centennial, Colorado. What is a Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate? A Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding lending agreement used in real estate transactions. It outlines the terms of a loan provided by a lender to a borrower, wherein the borrower promises to repay the loan amount in installments over a fixed period, alongside a fixed interest rate. The promissory note is secured by residential real estate, meaning the property acts as collateral in case of default. Types of Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Traditional Centennial Colorado Installments Fixed Rate Promissory Note: This type of promissory note follows the conventional structure, where a borrower is provided a loan amount by a lender. The borrower then repays the loan through regular monthly installments, including principal and interest. Failure to repay may result in foreclosure on the residential property securing the loan. 2. Centennial Colorado Balloon Payment Promissory Note: In certain cases, borrowers may opt for a Centennial Colorado Installments Fixed Rate Promissory Note with a balloon payment feature. This arrangement allows the borrower to make smaller monthly payments over the loan term but results in a large final payment (balloon payment) due at the end of the agreed period. The residential real estate serves as collateral, providing financial security to the lender. Benefits of Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Access to Financing: These promissory notes offer borrowers the opportunity to access financing for purchasing or refinancing residential properties, making homeownership more attainable. 2. Fixed Interest Rate: Borrowers benefit from a fixed interest rate, providing stability and predictability in their monthly payments. 3. Secure Collateral: Lenders have the peace of mind knowing that the loan is secured by residential real estate, minimizing their risk and potential financial loss. 4. Repayment Flexibility: Different types of promissory notes provide options for borrowers, allowing them to tailor their payment structures to align with their financial strategies and goals. Conclusion: Centennial Colorado Installments Fixed Rate Promissory Notes secured by residential real estate are a significant aspect of the real estate landscape in Centennial, Colorado. They offer borrowers financing options to pursue homeownership, while providing lenders with secure collateral and fixed returns. Understanding the various types and benefits of such promissory notes is essential for both borrowers and lenders alike, ensuring informed decision-making in real estate transactions.

Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Centennial Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no legal background to draft such paperwork from scratch, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you need the Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate quickly using our trusted service. In case you are presently an existing customer, you can proceed to log in to your account to get the needed form.

However, if you are unfamiliar with our platform, make sure to follow these steps prior to obtaining the Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate:

- Be sure the template you have chosen is specific to your location because the rules of one state or county do not work for another state or county.

- Preview the form and read a quick outline (if provided) of scenarios the document can be used for.

- If the one you chosen doesn’t meet your needs, you can start again and look for the needed form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Centennial Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate as soon as the payment is done.

You’re good to go! Now you can proceed to print the form or fill it out online. If you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.