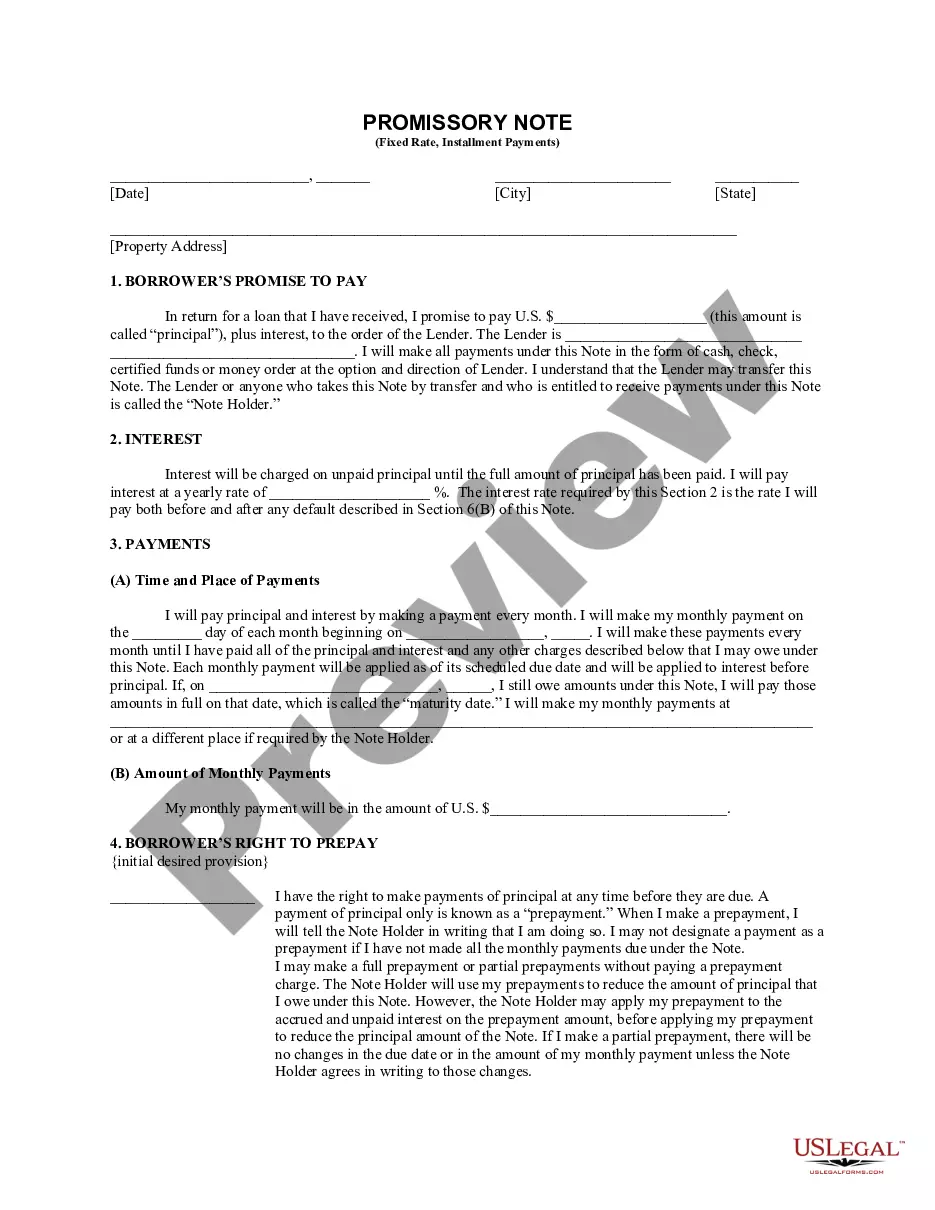

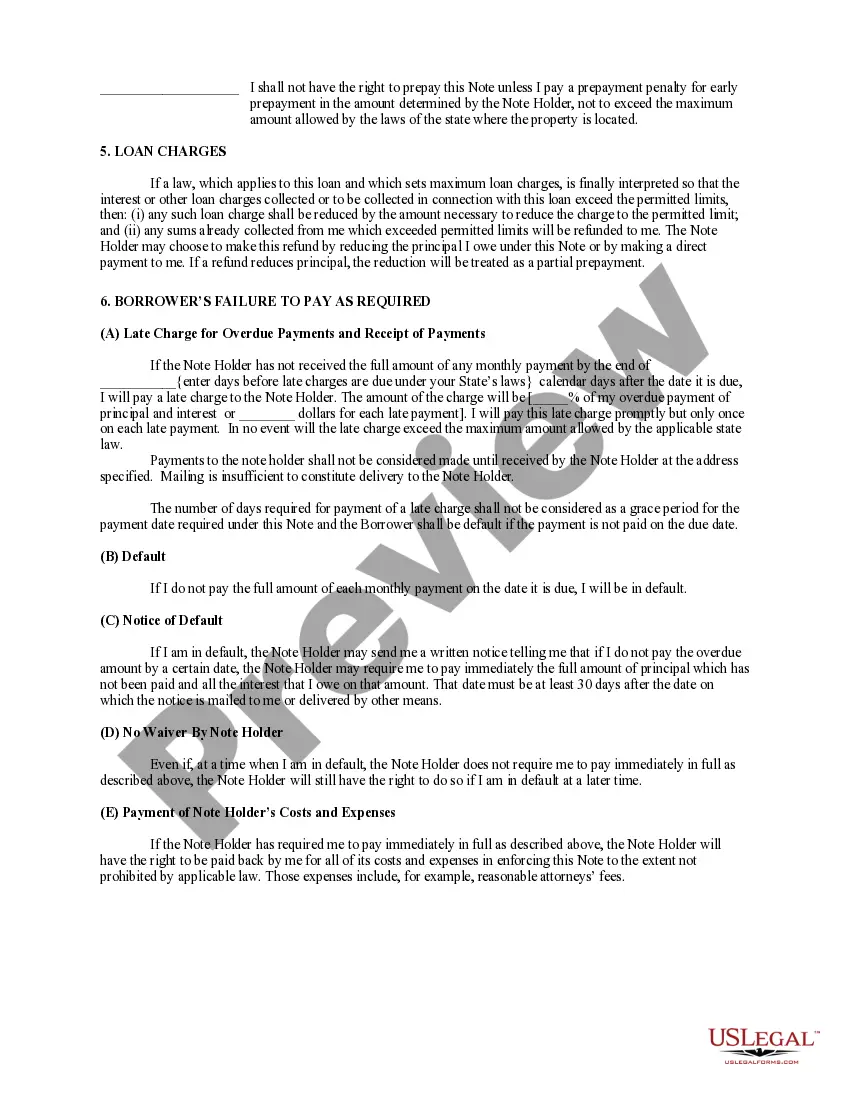

A Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal agreement that outlines the terms and conditions of a loan provided for the purchase or refinancing of residential real estate in Fort Collins, Colorado. This type of promissory note serves as evidence of the borrower's promise to repay the loan amount plus interest to the lender. The key components of a Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate include: 1. Loan details: The promissory note specifies the loan amount, interest rate, and repayment terms. It outlines whether the loan is for a fixed rate or adjustable rate, depending on the agreement between the borrower and lender. 2. Installment payments: The repayment of the loan is structured in installments, which are typically made on a monthly basis. The promissory note states the length of the repayment period, such as 15, 20, or 30 years, during which the borrower makes regular payments to the lender. 3. Security: The promissory note is secured by the residential real estate property being financed. This means that in case of default, the lender has the right to foreclose on the property to recover the outstanding loan amount. 4. Default and remedies: The promissory note outlines the conditions under which the borrower would be considered in default, such as a failure to make timely payments. It also specifies the legal remedies available to the lender in such cases, including foreclosure and collection of any remaining balance. Other types of Fort Collins Colorado Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may include: 1. Second mortgage promissory note: This type of promissory note is used when there is already an existing first mortgage on the property. The second mortgage note secures a subordinate loan, typically used for home improvements or debt consolidation. 2. Balloon payment promissory note: A promissory note with a balloon payment includes a larger payment due at the end of the loan term, in addition to regular installments. This option allows borrowers to have lower monthly payments for a certain period, but requires a lump sum payment at maturity. 3. Adjustable rate promissory note: Unlike a fixed rate note, an adjustable rate promissory note features an interest rate that can vary over time. The interest rate may be linked to an index and adjusted periodically according to predefined terms. In summary, a Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal contract that defines the terms of a loan used for residential real estate financing in Fort Collins, Colorado. It provides clarity on repayment obligations, interest rates, and loan security, serving as a binding agreement between the borrower and lender.

Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Fort Collins Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Are you looking for a reliable and inexpensive legal forms supplier to get the Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate? US Legal Forms is your go-to solution.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the document is intended for.

- Start the search over if the template isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the Fort Collins Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate in any available file format. You can return to the website when you need and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours learning about legal papers online once and for all.