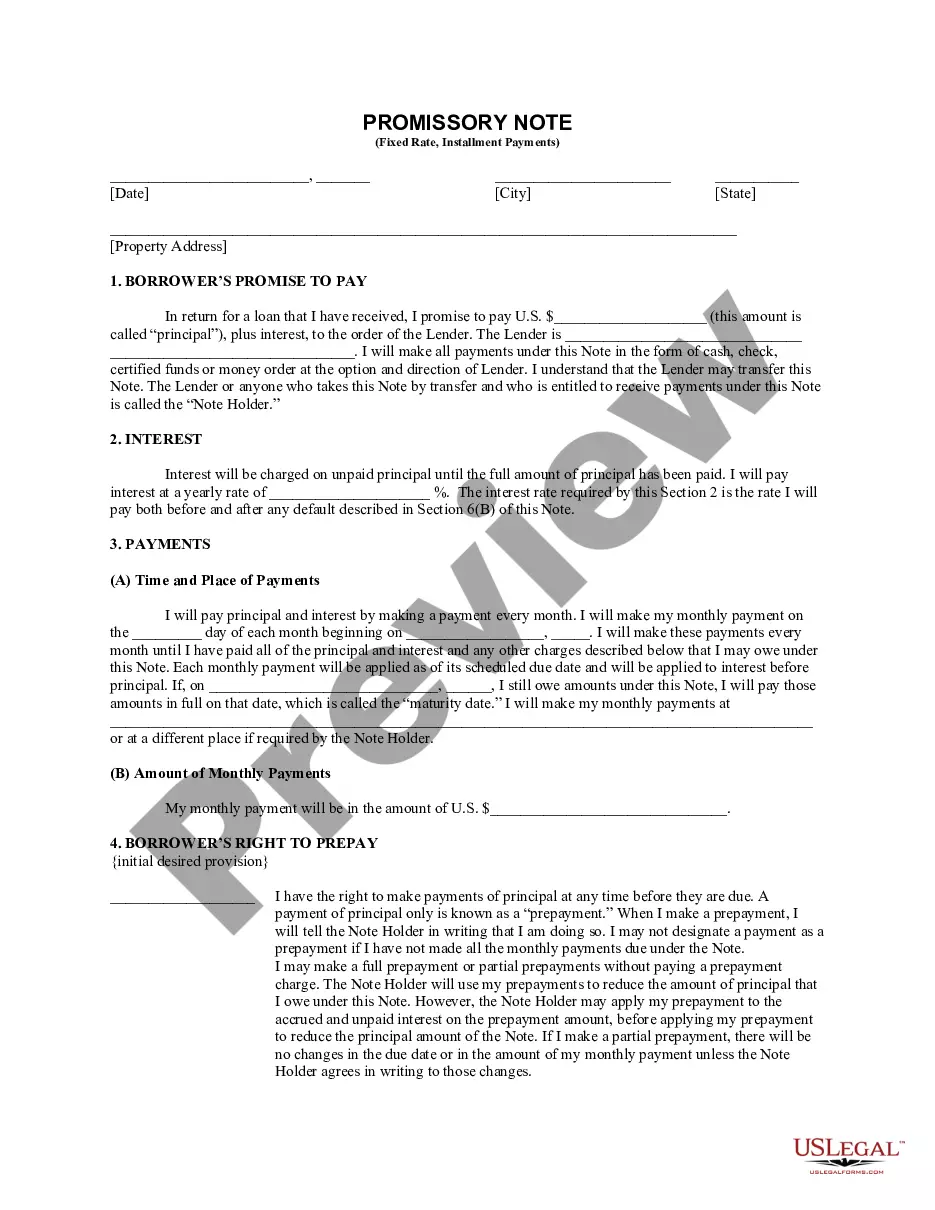

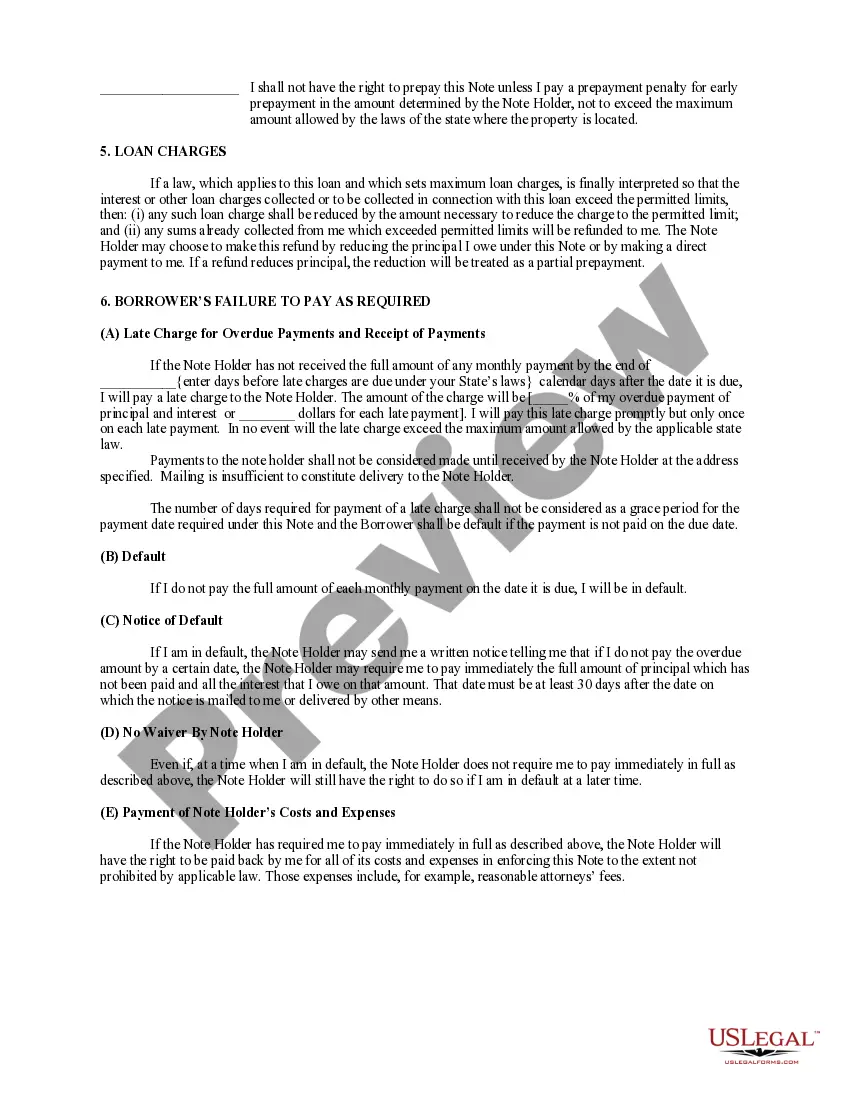

Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan for the purchase or refinance of residential real estate in Westminster, Colorado. This promissory note provides specific details about the repayment structure, interest rates, and the collateral securing the loan. The Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate offers borrowers the flexibility of making regular, fixed monthly payments over a predetermined period. This allows borrowers to effectively plan their finances and manage their budget more effectively. The promissory note specifies that the loan is secured by residential real estate in Westminster, Colorado. This means that the borrower's property serves as collateral for the loan, providing the lender with a guarantee of repayment. In the event of default or non-payment, the lender has the right to foreclose on the property to recover the outstanding debt. Keywords: Westminster Colorado, Installments, Fixed Rate, Promissory Note, Residential Real Estate, Loan, Refinance, Repayment Structure, Interest Rates, Collateral, Foreclosure. Different types of Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate may include variations in the repayment terms, loan amounts, and interest rates. Some common variations include: 1. Short-term Installments Fixed Rate Promissory Note: This type of promissory note typically has a shorter repayment period, usually within 1-5 years. It is ideal for borrowers looking for a quicker loan payoff or for small loan amounts. 2. Long-term Installments Fixed Rate Promissory Note: This promissory note has a longer repayment period, usually spanning over 10 or more years. It suits borrowers who prefer more extended loan terms and lower monthly payments. 3. Adjustable Rate Installments Fixed Rate Promissory Note: This version of the promissory note offers an initial fixed interest rate for a specific period, followed by adjustable rates that fluctuate based on market conditions. It appeals to borrowers who anticipate interest rate changes or plan to refinance after a certain period. 4. Large Loan Installments Fixed Rate Promissory Note: This type of promissory note is designed for substantial loan amounts, typically for luxury properties or multifamily dwellings, where the loan amount exceeds the average residential loan limits. Note: It is crucial to consult legal and financial professionals when entering into any loan agreement to fully understand the terms and conditions, as well as the legal implications associated with Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Westminster Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We always want to minimize or prevent legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for attorney solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Westminster Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate would work for your case, you can pick the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!