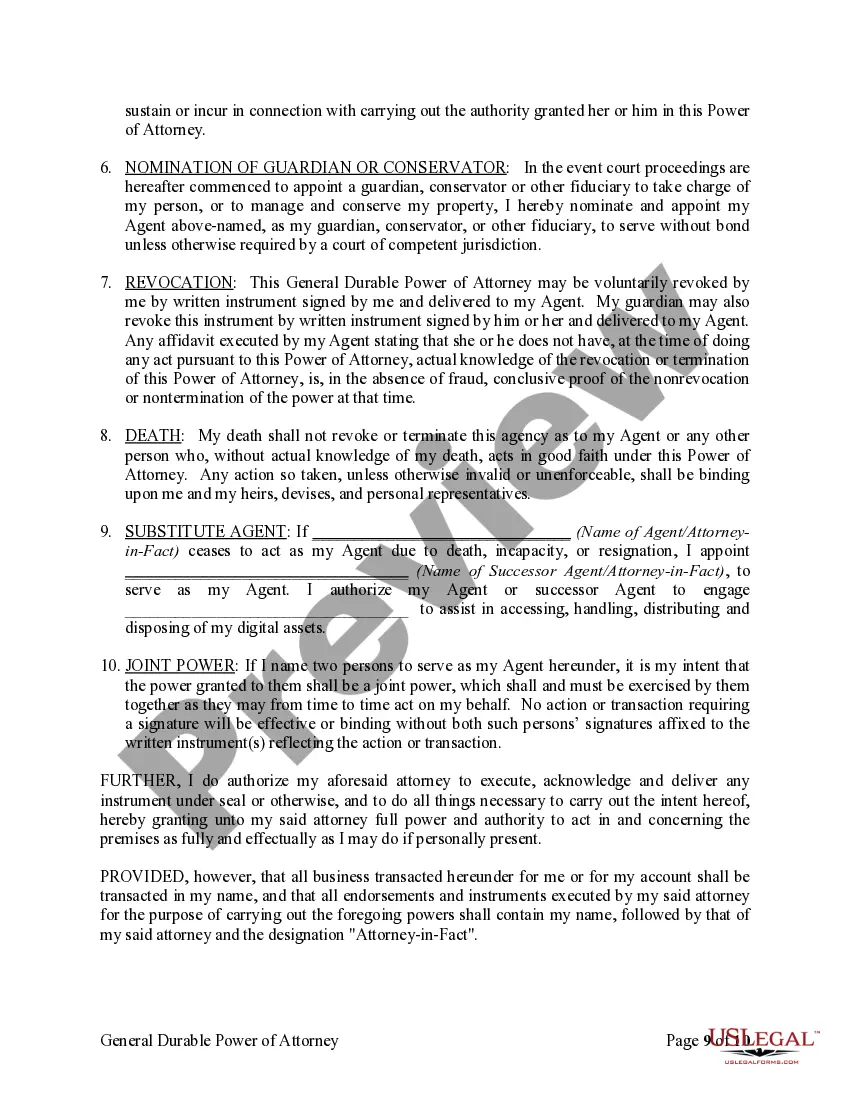

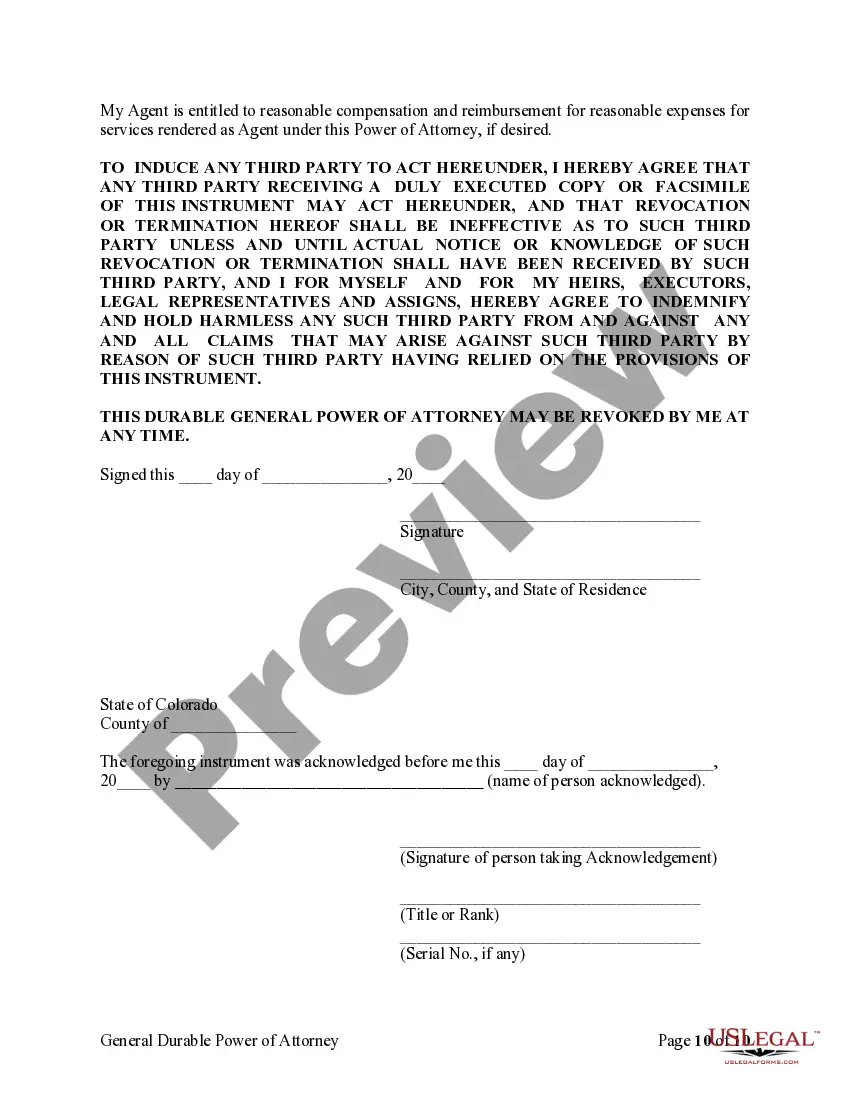

Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability is a legal document that grants someone the authority to make important financial decisions and handle property matters on behalf of another individual, referred to as the principal, in the event of their disability. This type of power of attorney is specifically designed to come into effect when the principal becomes incapacitated or unable to manage their own affairs. The Aurora Colorado General Durable Power of Attorney grants the designated agent, also known as an attorney-in-fact, the power to handle various financial matters, including but not limited to: 1. Property Management: The attorney-in-fact can manage and make decisions regarding the principal's real estate properties and other assets. This may involve buying or selling property, leasing, collecting rent, making repairs, and paying property-related expenses. 2. Banking and Financial Transactions: The agent can access the principal's financial accounts, including bank accounts, investment portfolios, and retirement funds. They can perform tasks such as paying bills, depositing or withdrawing funds, investing, and managing other financial transactions. 3. Tax Matters: The attorney-in-fact can file the principal's tax returns, claim refunds, interact with tax authorities, and make tax-related decisions on their behalf. 4. Personal Property Management: This includes managing personal possessions, such as vehicles, valuable items, and personal belongings. The agent can handle tasks such as maintenance, insurance, and sale or purchase of personal property. 5. Debt and Financial Obligations: The agent can manage the principal's debts and financial obligations, such as loans, mortgages, and credit card payments. They can make payments, negotiate with creditors, and handle any legal matters related to the principal's financial liabilities. There may be different variations or specific types of Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability, depending on the individual's needs. Some specific types may include: 1. Limited Power of Attorney: This grants the agent authority only over specified financial matters, for a limited period or specific purpose. For example, if the principal requires assistance only with managing their investment portfolio, they can grant limited power of attorney for that specific purpose. 2. Springing Power of Attorney: Unlike the traditional durable power of attorney, a springing power of attorney becomes effective only when a triggering event occurs, such as the principal's incapacity. Once the specified condition is met, the agent's authority is activated. 3. Statutory Power of Attorney: In Colorado, there are specific forms and guidelines provided by state laws that comply with statutory requirements. These forms ensure consistency and compliance with legal regulations when creating a durable power of attorney. It is crucial to consult with an attorney who specializes in estate planning or elder law to ensure that the Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability is tailored to specific needs and complies with state laws. This legal document protects the principal's interests and provides peace of mind to both the principal and the appointed agent.

Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability

Description

How to fill out Aurora Colorado General Durable Power Of Attorney For Property And Finances Or Financial Effective Upon Disability?

Take advantage of the US Legal Forms and get instant access to any form you require. Our useful platform with a huge number of documents simplifies the way to find and get virtually any document sample you require. It is possible to download, fill, and certify the Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability in just a couple of minutes instead of browsing the web for several hours trying to find an appropriate template.

Utilizing our library is a wonderful strategy to raise the safety of your form filing. Our professional attorneys on a regular basis review all the documents to make sure that the forms are relevant for a particular state and compliant with new laws and polices.

How can you obtain the Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Find the template you require. Ensure that it is the template you were hoping to find: verify its name and description, and utilize the Preview option if it is available. Otherwise, use the Search field to look for the needed one.

- Launch the saving process. Select Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the document. Select the format to obtain the Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability and edit and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and trustworthy form libraries on the internet. We are always ready to help you in virtually any legal case, even if it is just downloading the Aurora Colorado General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability.

Feel free to make the most of our platform and make your document experience as straightforward as possible!