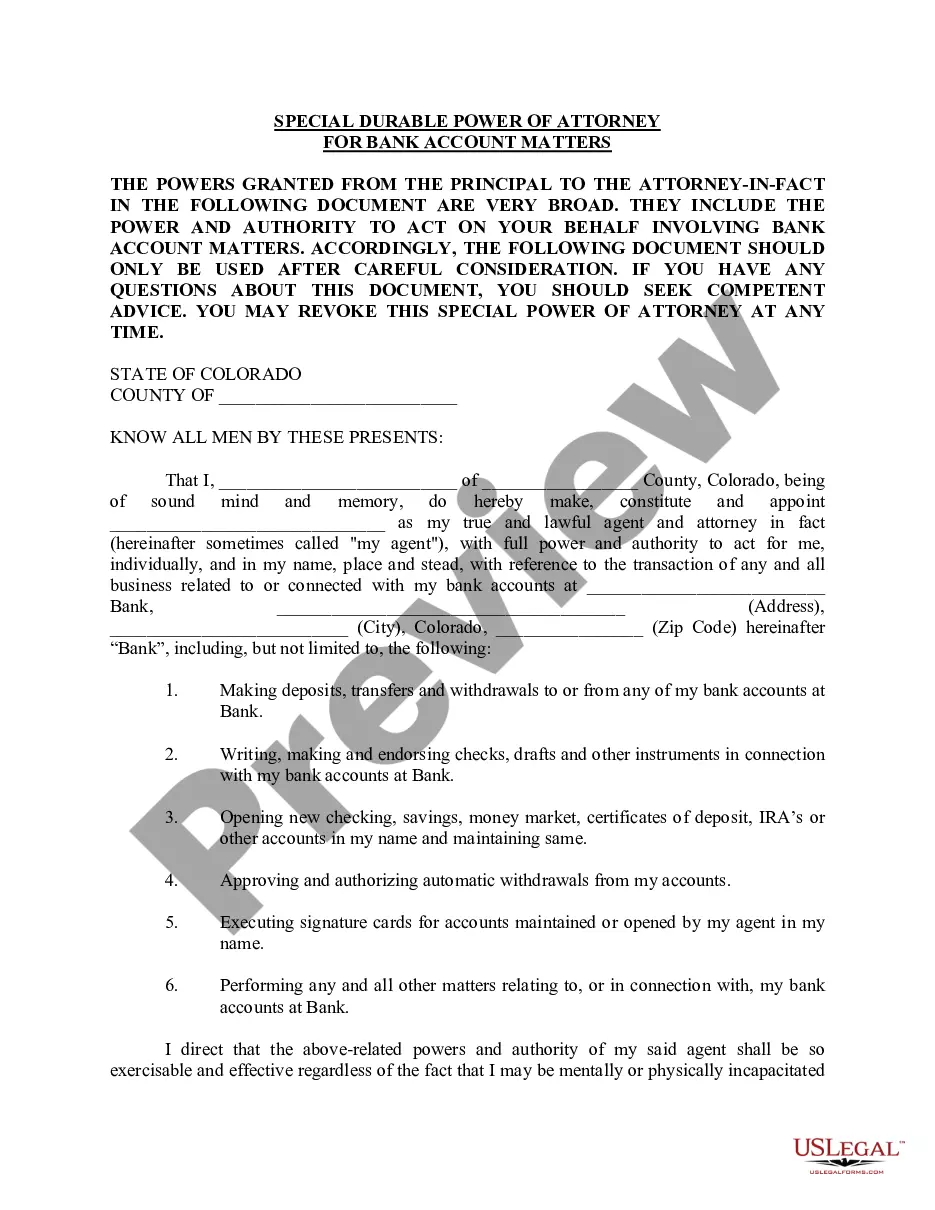

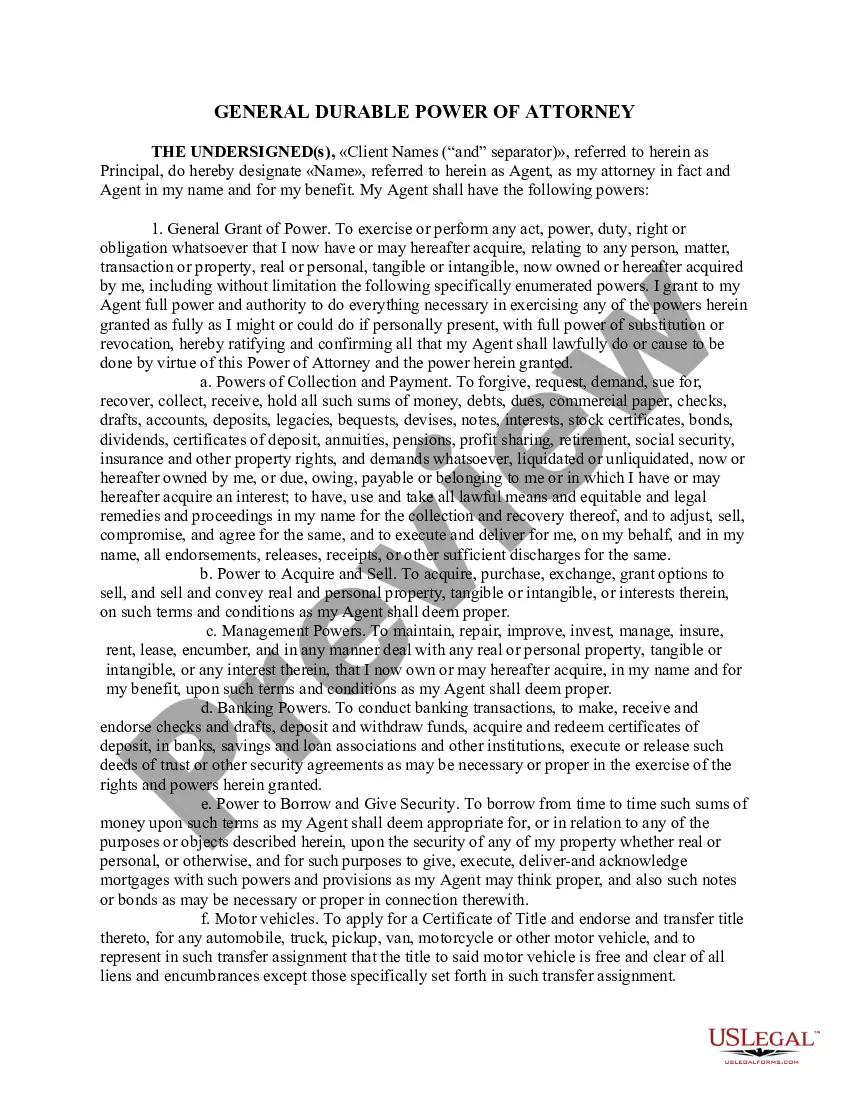

A Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters is a legal document that grants authority to a designated person, referred to as the attorney-in-fact or agent, to manage specific banking tasks on behalf of the principal. This type of power of attorney is specifically tailored to handle matters related to bank accounts and financial transactions. It empowers the agent to make decisions and take actions regarding the principal's bank accounts, investments, and other monetary affairs. The agent appointed by the principal gains the ability to perform a range of activities, which may include: 1. Accessing bank accounts: The agent can access the principal's bank accounts, including checking, savings, and money market accounts, to make deposits, withdrawals, and transfers. 2. Paying bills: The agent can pay bills, loans, and other financial obligations on behalf of the principal using funds from their bank accounts. 3. Managing investments: If authorized, the agent can handle investment accounts, which may involve buying or selling stocks, bonds, or other securities. 4. Conducting transactions: The agent can execute financial transactions on behalf of the principal, such as opening or closing accounts, applying for loans, and negotiating terms with financial institutions. 5. Organizing records: The agent may have the authority to maintain and organize financial records, including statements, receipts, and tax-related documents. There are different types of Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters that can cater to specific needs. These variations include: 1. Limited Power of Attorney: This allows the agent to handle only specific financial tasks mentioned in the document, such as paying bills or managing investments. 2. General Power of Attorney: This provides the agent with broad authority to manage all banking and financial matters on behalf of the principal. It covers a wide range of tasks and can remain in effect even if the principal becomes incapacitated. 3. Springing Power of Attorney: This type of power of attorney becomes effective only upon the occurrence of a specified event, such as the principal's incapacitation. Until then, the agent does not have any powers. It is important to consult with a qualified attorney to draft a Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters that aligns with your specific needs and ensures the legal validity of the document. Keep in mind that laws and requirements regarding powers of attorney may vary across jurisdictions, so it is crucial to obtain local legal advice.

Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Colorado Special Durable Power Of Attorney For Bank Account Matters?

Are you in search of a reliable and affordable provider of legal forms to obtain the Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Affairs? US Legal Forms is your prime choice.

Whether you require a straightforward arrangement for establishing guidelines for living with your partner or a collection of documents to facilitate your divorce through the judicial system, we've got you covered. Our site features over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are tailored based on the specifications of specific states and regions.

To acquire the form, you must Log In to your account, find the required template, and click the Download button adjacent to it. Please remember that you can download your previously bought form templates anytime from the My documents section.

Is it your first time visiting our platform? No problem. You can create an account in just a few minutes, but before that, ensure that you do the following.

Now you can register for your account. Then, choose a subscription plan and continue to payment. Once the payment is processed, download the Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Affairs in any available format. You can revisit the website anytime and redownload the form at no additional cost.

Obtaining updated legal documents has never been simpler. Try US Legal Forms now and say goodbye to wasting your precious time searching for legal paperwork online.

- Verify if the Colorado Springs Colorado Special Durable Power of Attorney for Bank Account Affairs complies with your state and local regulations.

- Review the form’s description (if available) to understand who it is intended for and what it is suitable for.

- Restart your search if the template does not fit your particular situation.

Form popularity

FAQ

Banks and other organisations (such as utility companies and pension providers) will ask for proof that you are an attorney. Use your lasting power of attorney to prove you can act for the donor. You may need to prove other details, such as: your name, address and date of birth.

A medical power of attorney should be created with the help of your lawyer and while we encourage you to have the document signed by witnesses and notarized, this is not required in Colorado in order for the document to be legal. The medical power of attorney covers more than a living will.

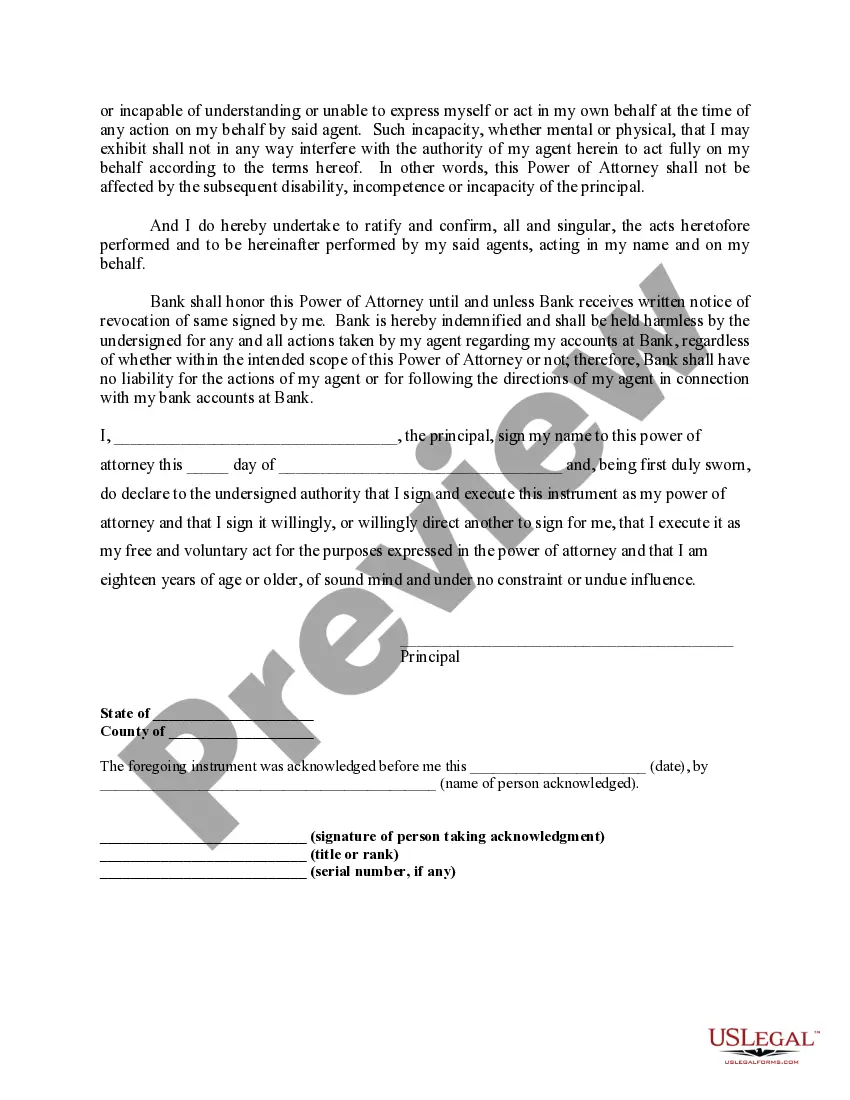

Colorado law does not require a power of attorney to be witnessed or notarized. Despite the law, it is considered best practice to have the document signed, notarized, and witnessed by two people. Why? The signature is presumed to be genuine if the power of attorney is notarized.

Does a Power of Attorney Need to be Notarized or Witnessed? Colorado law does not require a power of attorney to be witnessed or notarized. Despite the law, it is considered best practice to have the document signed, notarized, and witnessed by two people.

Generally, there are no formalities for POAs and they may be given orally or in writing. However, if the act which the Principal requires the Agent to perform has certain prescribed formalities, then the POA will need to comply with the same formalities.

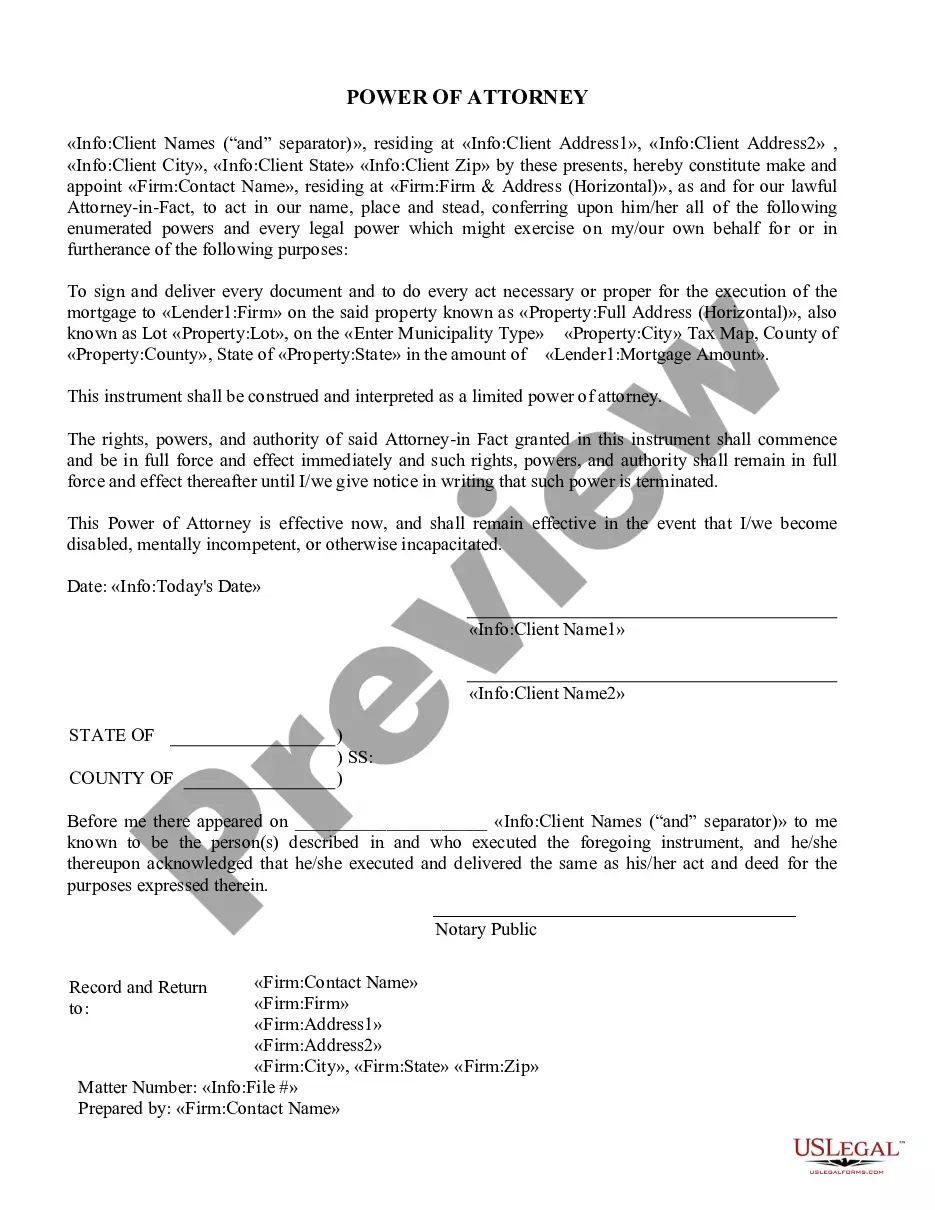

Property and financial affairs lasting power of attorney A property and financial affairs LPA can give someone the authority to deal with and make decisions about things like: buying or selling property. bank, building society and other financial accounts.

What is a durable power of attorney? A ?durable? power of attorney permits an agent to make decisions even if the princi- pal becomes incapacitated. Powers of attorney signed after January 1, 2010, are durable unless the document provides that it is terminated by the incapacity of the principal.

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

Steps for Making a Financial Power of Attorney in Colorado Create the POA Using a Statutory Form, Software, or Attorney.Sign the POA in the Presence of a Notary Public.Store the Original POA in a Safe Place.Give a Copy to Your Agent or Attorney-in-Fact.File a Copy With the Recorder's Office.

In Colorado, the law does require that a Financial Power of Attorney be notarized, but no witnesses are necessary.