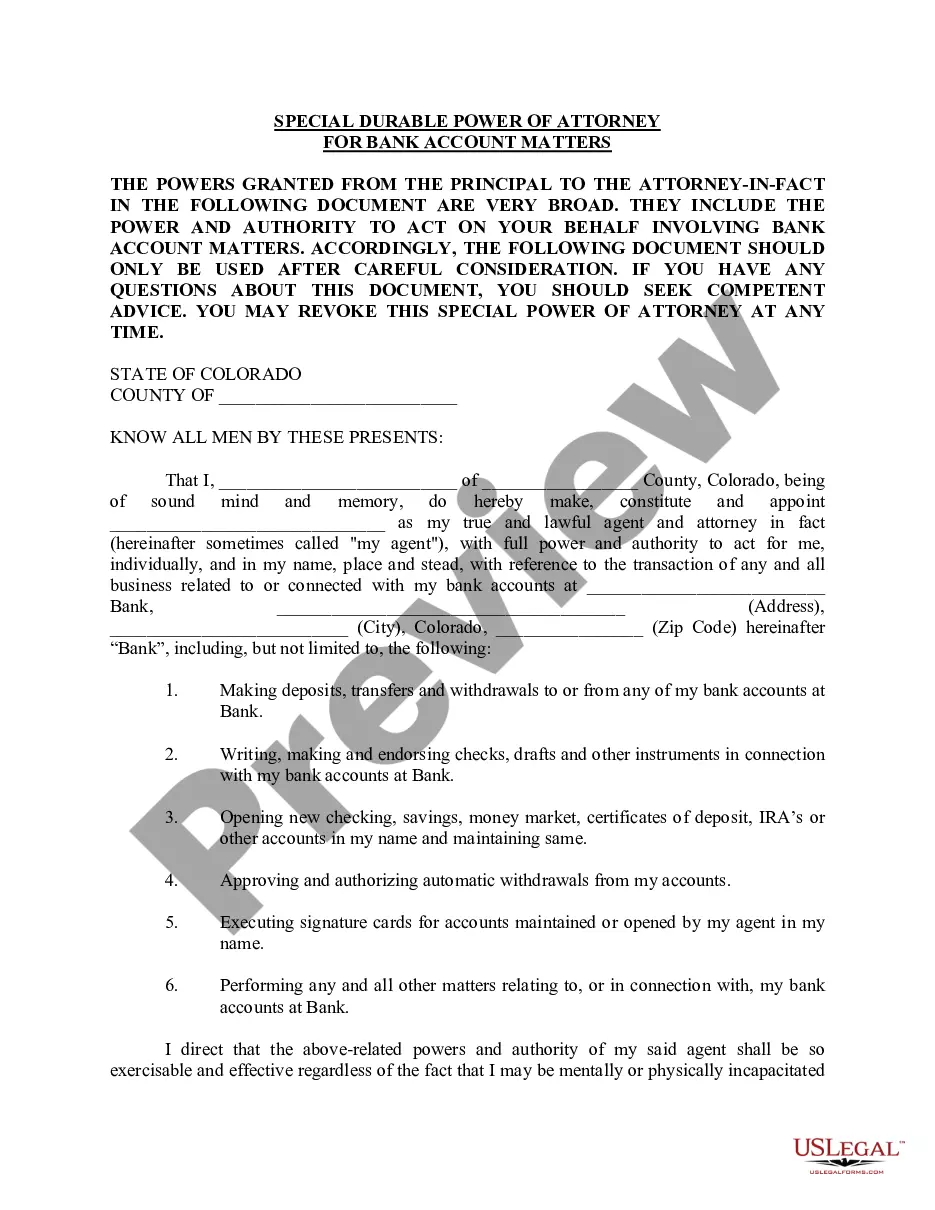

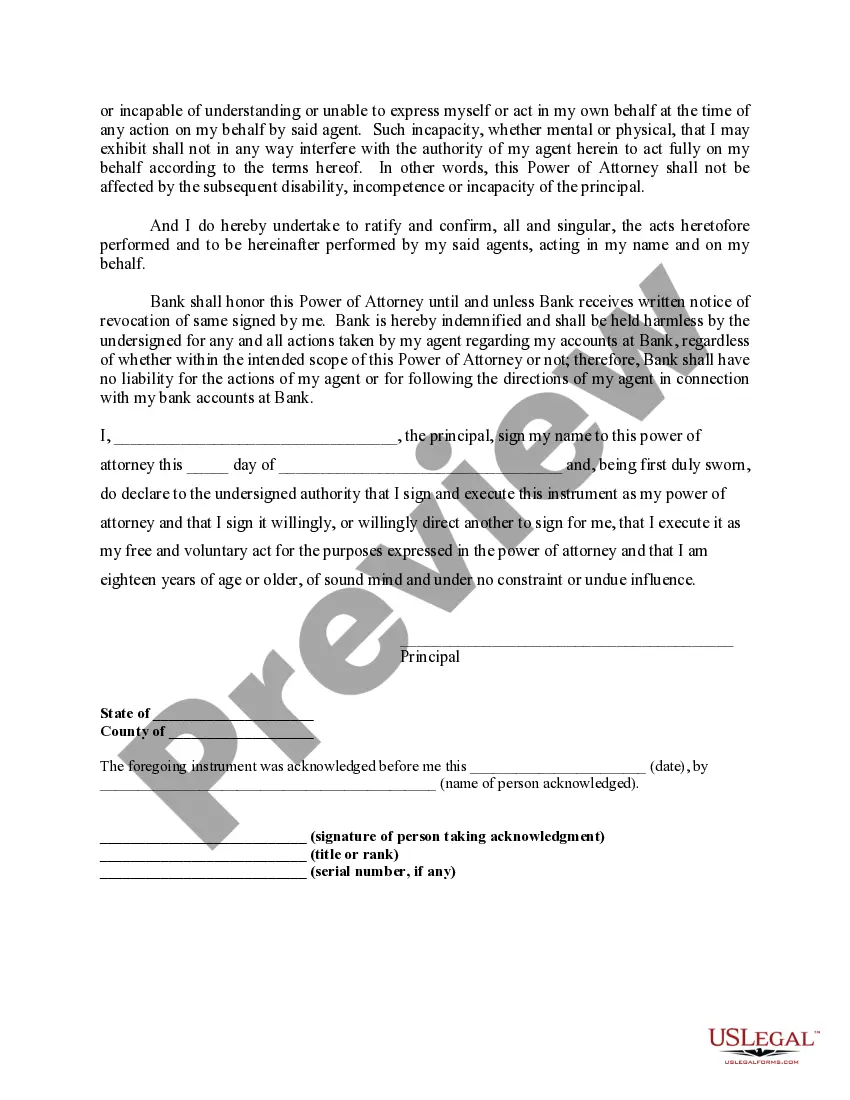

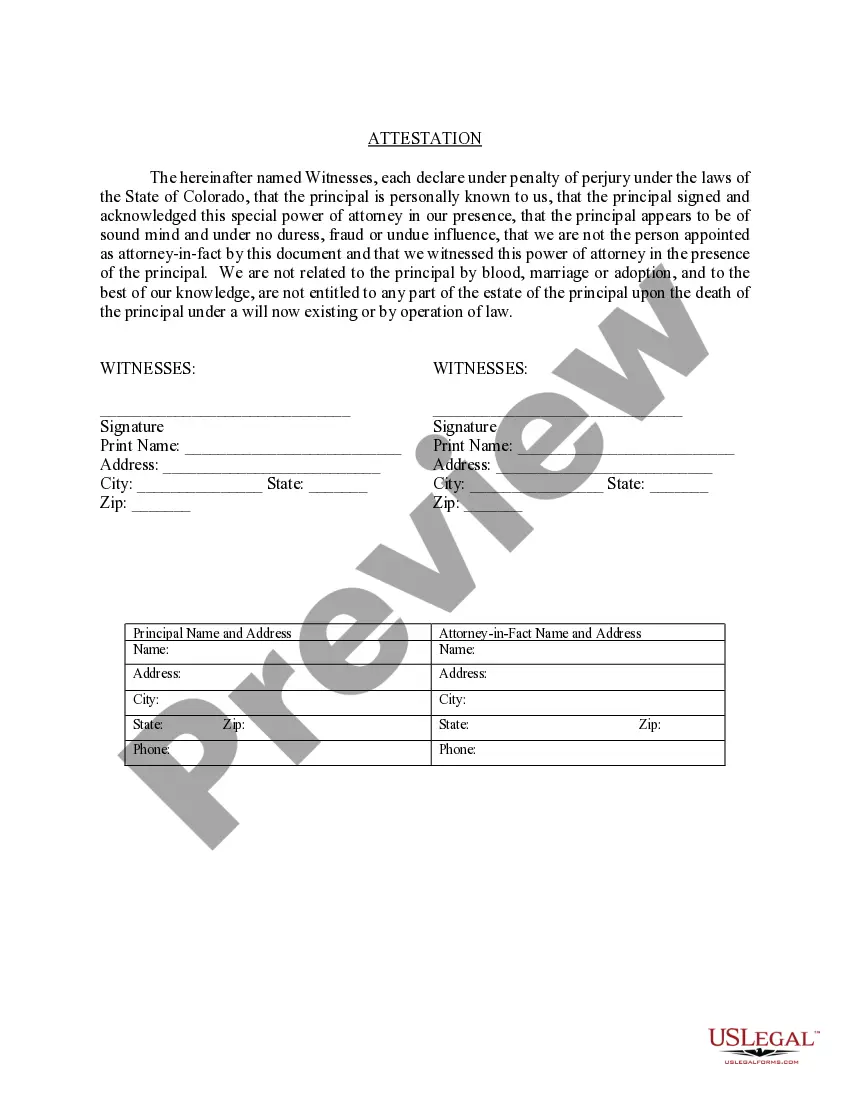

Title: Understanding Thornton Colorado Special Durable Power of Attorney for Bank Account Matters Description: The Thornton Colorado Special Durable Power of Attorney for Bank Account Matters is a legal document that allows an appointed individual (known as the agent or attorney-in-fact) to make financial decisions and manage bank accounts on behalf of the principal in specific situations. This power of attorney ensures that the principal's best interests are upheld when they are unable to act or make decisions due to incapacity or unavailability. Keywords: Thornton Colorado, Special Durable Power of Attorney, Bank Account Matters, legal document, agent, attorney-in-fact, financial decisions, manage bank accounts, principal, incapacity, unavailability. Types of Thornton Colorado Special Durable Power of Attorney for Bank Account Matters: 1. Limited Authority Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent limited authority to handle specific banking matters on behalf of the principal. The authority can be specified and restricted to certain types of transactions, accounts, or time duration. 2. General Authority Special Durable Power of Attorney for Bank Account Matters: In this type, the agent has broad powers to manage all financial transactions and make decisions regarding the principal's bank accounts. The agent can act on behalf of the principal without any specific limitations, providing a comprehensive scope of authority. 3. Springing Special Durable Power of Attorney for Bank Account Matters: The springing power of attorney becomes effective only when a specific triggering event occurs, such as the principal's incapacity. This type of power of attorney ensures that the agent's authority is activated only when necessary, providing protection and control to the principal's bank accounts. 4. Specific Use Special Durable Power of Attorney for Bank Account Matters: This specialized power of attorney grants the agent specific authority to carry out particular transactions related to the principal's bank accounts. The document clearly outlines the scope of authority granted to the agent, ensuring that they can only act within the specified limits. 5. Co-Agents Special Durable Power of Attorney for Bank Account Matters: In certain cases, the principal may appoint multiple agents to act jointly or separately. These co-agents share the responsibility of managing the principal's bank accounts, providing checks and balances within the power of attorney arrangement. 6. Revocable Special Durable Power of Attorney for Bank Account Matters: The principal retains the authority to revoke or cancel this power of attorney at any time, granting flexibility and control over the agent's powers. This type allows the principal to make changes or choose a new agent if circumstances change or if they are no longer satisfied with the existing arrangement. By understanding the various types of Thornton Colorado Special Durable Power of Attorney for Bank Account Matters, individuals can customize their powers of attorney to suit their specific requirements and ensure their financial affairs are managed effectively when they are unable to do so themselves.

Thornton Colorado Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Thornton Colorado Special Durable Power Of Attorney For Bank Account Matters?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Thornton Colorado Special Durable Power of Attorney for Bank Account Matters? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Thornton Colorado Special Durable Power of Attorney for Bank Account Matters conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to learn who and what the form is intended for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Thornton Colorado Special Durable Power of Attorney for Bank Account Matters in any provided file format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting your valuable time learning about legal paperwork online for good.