This deed, or deed-related form, is for use in property transactions in the designated state. This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and law.

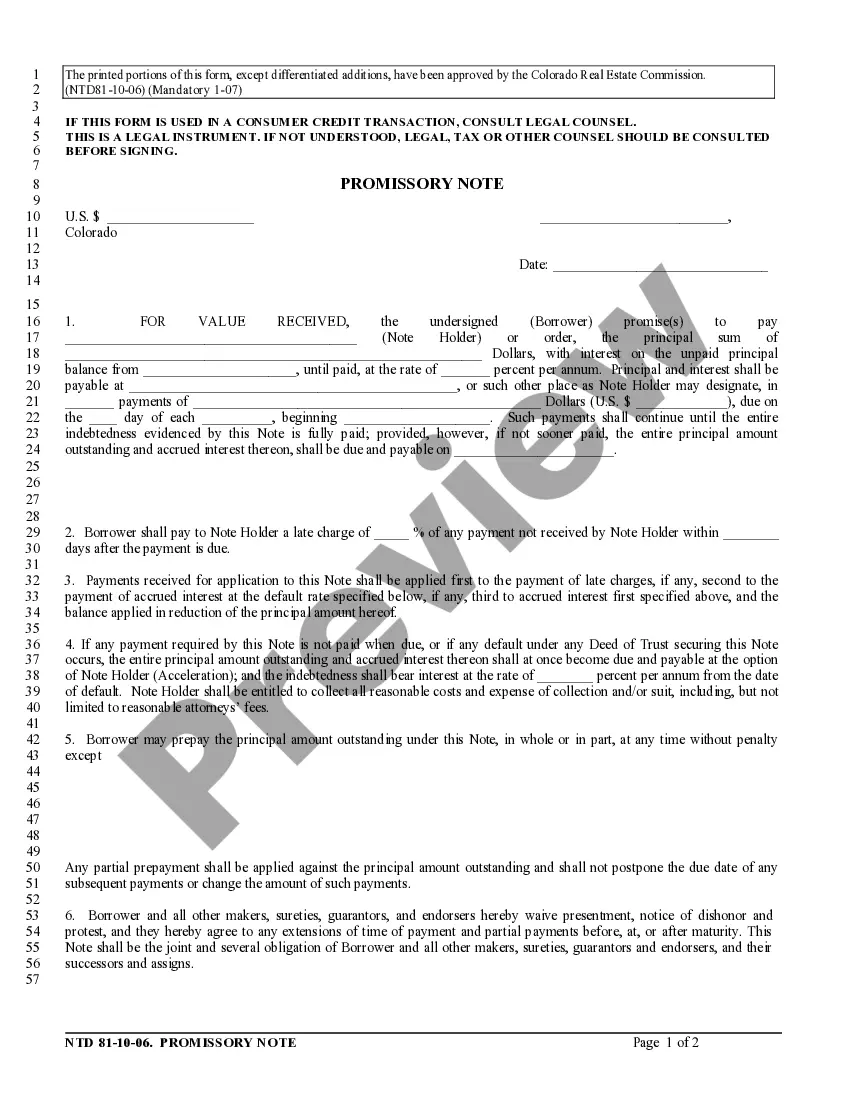

Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate

Description

How to fill out Colorado Promissory Note For Deed Of Trust - UCCC - No Default Rate?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our user-friendly website with a vast array of document templates enables you to locate and acquire nearly any form sample you require.

You can download, complete, and authenticate the Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate in just a few minutes instead of spending hours online searching for a suitable template.

Employing our collection is a fantastic way to enhance the security of your form submission.

- Our skilled legal experts frequently review all documents to ensure that the forms are applicable to a specific state and adhere to new laws and regulations.

- How can you access the Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate? If you possess a profile, simply Log In to your account.

- The Download option will be activated for all the documents you view.

- Additionally, you can retrieve all previously saved forms in the My documents section.

Form popularity

FAQ

For an effective Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate, specific elements must be included. Essential components are the names of the parties, the amount borrowed, interest terms, and repayment schedule. Additionally, the note should clearly state the purpose and any clauses regarding default. Using a platform like US Legal Forms can streamline this process and ensure compliance with Colorado regulations.

In Colorado, an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate does not need to be notarized to be valid. However, notarization can help establish authenticity and protect against potential disputes. While you can create a valid note without a notary, we recommend using US Legal Forms for guidance. This way, you ensure your document meets all legal requirements.

A deed of trust serves as a secured interest in real property, while an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate is a personal promise to repay borrowed funds. The note outlines the borrower's obligation, while the deed of trust establishes the lender’s rights to reclaim property in case of default. Understanding both documents is crucial in real estate transactions.

Yes, you can default on an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate if you fail to make payments as agreed. Defaulting may lead to serious consequences, including potential foreclosure on the property tied to the note. It's important to adhere to the terms to avoid these problems. If you are concerned about defaults, consider consulting with a legal expert.

A deed of trust can become invalid for several reasons, including lack of proper execution, failure to meet state laws, or if the terms are unclear. Additionally, if the property is foreclosed improperly, it may render the deed of trust unenforceable. Understanding the pitfalls is essential when engaging with an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate.

In Colorado, a promissory note does not need notarization to be valid, but it is often recommended to protect the parties involved. Notarizing provides a layer of authenticity and can help in legal disputes. If you are dealing with an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate, considering notarization can be beneficial.

A notice of default on a promissory note is a formal declaration that the borrower has failed to meet their repayment obligations. This notification often signals that the lender is prepared to take action, potentially leading to foreclosure. Understanding the implications of a notice of default is crucial when dealing with an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate.

To collect on a default promissory note, especially one involving an Aurora Colorado Promissory Note for Deed of Trust - UCCC - No Default Rate, you should start by reviewing the terms of the note. It's crucial to send a formal demand letter to the borrower, outlining the amount owed and the due date. If they fail to respond, consider initiating a collection process through legal channels, which might involve mediation or filing a lawsuit. Utilizing platforms like US Legal Forms can help you access the necessary documentation and guidance tailored to your specific situation.