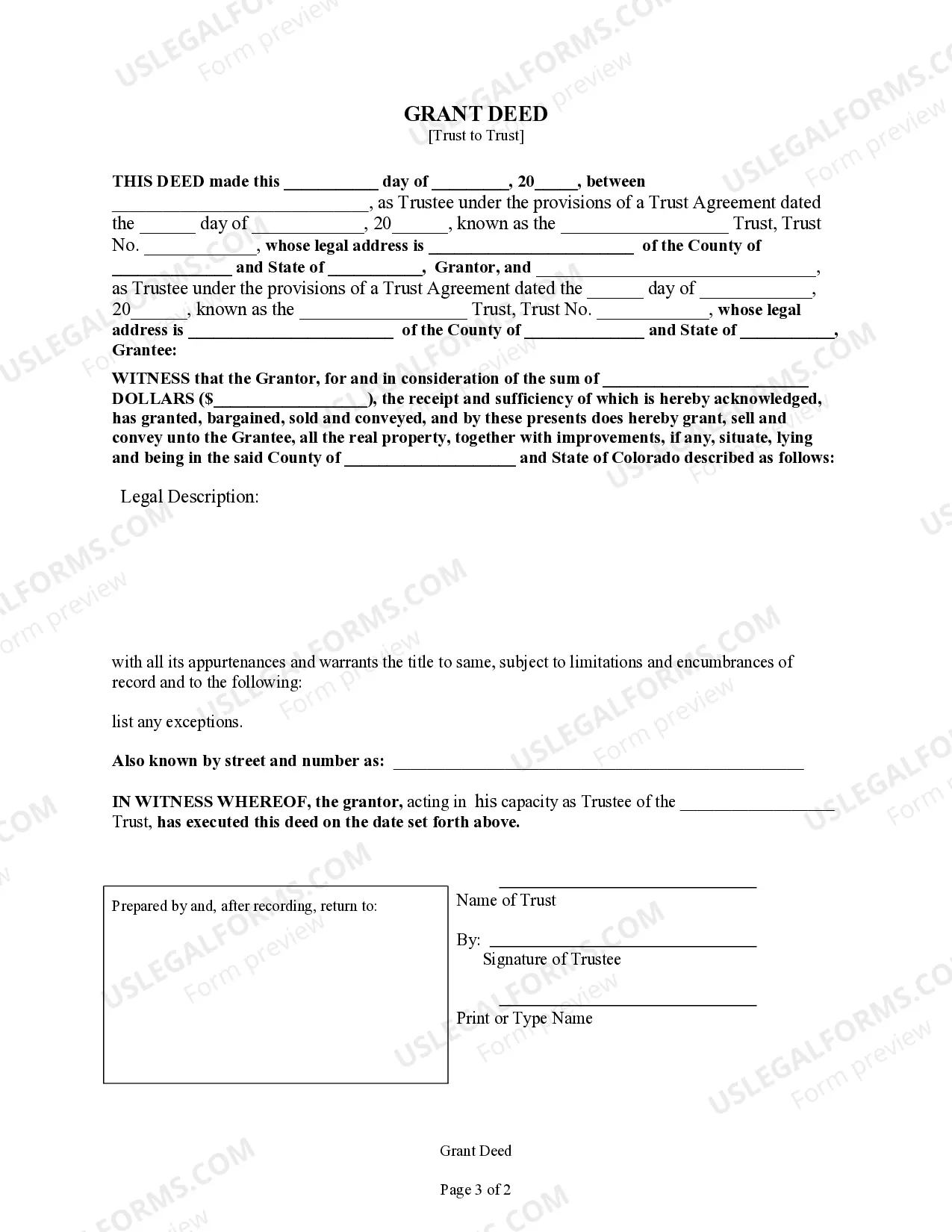

This form is a Grant Deed where the grantor is a trust and the grantee is also a trust. Grantor grants and conveys the described property to the grantee. This deed complies with all state statutory laws.

A Centennial Colorado Grant Deed — Trust to a Trust is a legal document used to transfer ownership of real property from an individual or entity to a trust. This type of trust deed serves as a crucial component of estate planning, allowing individuals to transfer assets and minimize probate proceedings. A grant deed is a common form of real estate transfer deed that ensures a clear transfer of ownership rights. When combined with a trust, this deed becomes an effective means for securely transferring property to a trust entity. The Centennial Colorado Grant Deed — Trust to a Trust provides numerous benefits for individuals looking to protect assets, manage property, and plan for the future. By creating a trust, individuals can ensure efficient and hassle-free transfer of assets, specifically real estate, to their chosen beneficiaries. In Centennial, Colorado, there are several types of Grant Deed — Trust to a Trust options available to meet various estate planning needs: 1. Revocable Trust: This type of trust deed allows the granter (property owner) to retain control over the assets transferred. The granter can modify, revoke, or dissolve the trust at any time during their lifetime. A Revocable Trust offers flexibility and helps avoid probate proceedings. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be amended or revoked without the consent of beneficiaries or a court order. Once assets are transferred to an irrevocable trust, the granter relinquishes control over them. This type of trust offers potential tax benefits and asset protection. 3. Living Trust: A living trust, also known as an inter vivos trust, is created and takes effect during the granter's lifetime. This type of grant deed allows for the seamless transfer of ownership, avoiding probate and ensuring privacy. 4. Testamentary Trust: Unlike a living trust, a testamentary trust is established through the granter's last will and testament. It takes effect only after the granter's death. The Centennial Colorado Grant Deed — Trust to a Trust can facilitate the transfer of real estate into a testamentary trust, allowing for the distribution of assets per the granter's wishes. By utilizing a Centennial Colorado Grant Deed — Trust to a Trust, individuals can effectively protect and manage their real estate assets within a trust structure. It is crucial to consult with an experienced attorney to determine the most appropriate trust type and structure to meet specific estate planning goals and legal requirements.A Centennial Colorado Grant Deed — Trust to a Trust is a legal document used to transfer ownership of real property from an individual or entity to a trust. This type of trust deed serves as a crucial component of estate planning, allowing individuals to transfer assets and minimize probate proceedings. A grant deed is a common form of real estate transfer deed that ensures a clear transfer of ownership rights. When combined with a trust, this deed becomes an effective means for securely transferring property to a trust entity. The Centennial Colorado Grant Deed — Trust to a Trust provides numerous benefits for individuals looking to protect assets, manage property, and plan for the future. By creating a trust, individuals can ensure efficient and hassle-free transfer of assets, specifically real estate, to their chosen beneficiaries. In Centennial, Colorado, there are several types of Grant Deed — Trust to a Trust options available to meet various estate planning needs: 1. Revocable Trust: This type of trust deed allows the granter (property owner) to retain control over the assets transferred. The granter can modify, revoke, or dissolve the trust at any time during their lifetime. A Revocable Trust offers flexibility and helps avoid probate proceedings. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be amended or revoked without the consent of beneficiaries or a court order. Once assets are transferred to an irrevocable trust, the granter relinquishes control over them. This type of trust offers potential tax benefits and asset protection. 3. Living Trust: A living trust, also known as an inter vivos trust, is created and takes effect during the granter's lifetime. This type of grant deed allows for the seamless transfer of ownership, avoiding probate and ensuring privacy. 4. Testamentary Trust: Unlike a living trust, a testamentary trust is established through the granter's last will and testament. It takes effect only after the granter's death. The Centennial Colorado Grant Deed — Trust to a Trust can facilitate the transfer of real estate into a testamentary trust, allowing for the distribution of assets per the granter's wishes. By utilizing a Centennial Colorado Grant Deed — Trust to a Trust, individuals can effectively protect and manage their real estate assets within a trust structure. It is crucial to consult with an experienced attorney to determine the most appropriate trust type and structure to meet specific estate planning goals and legal requirements.