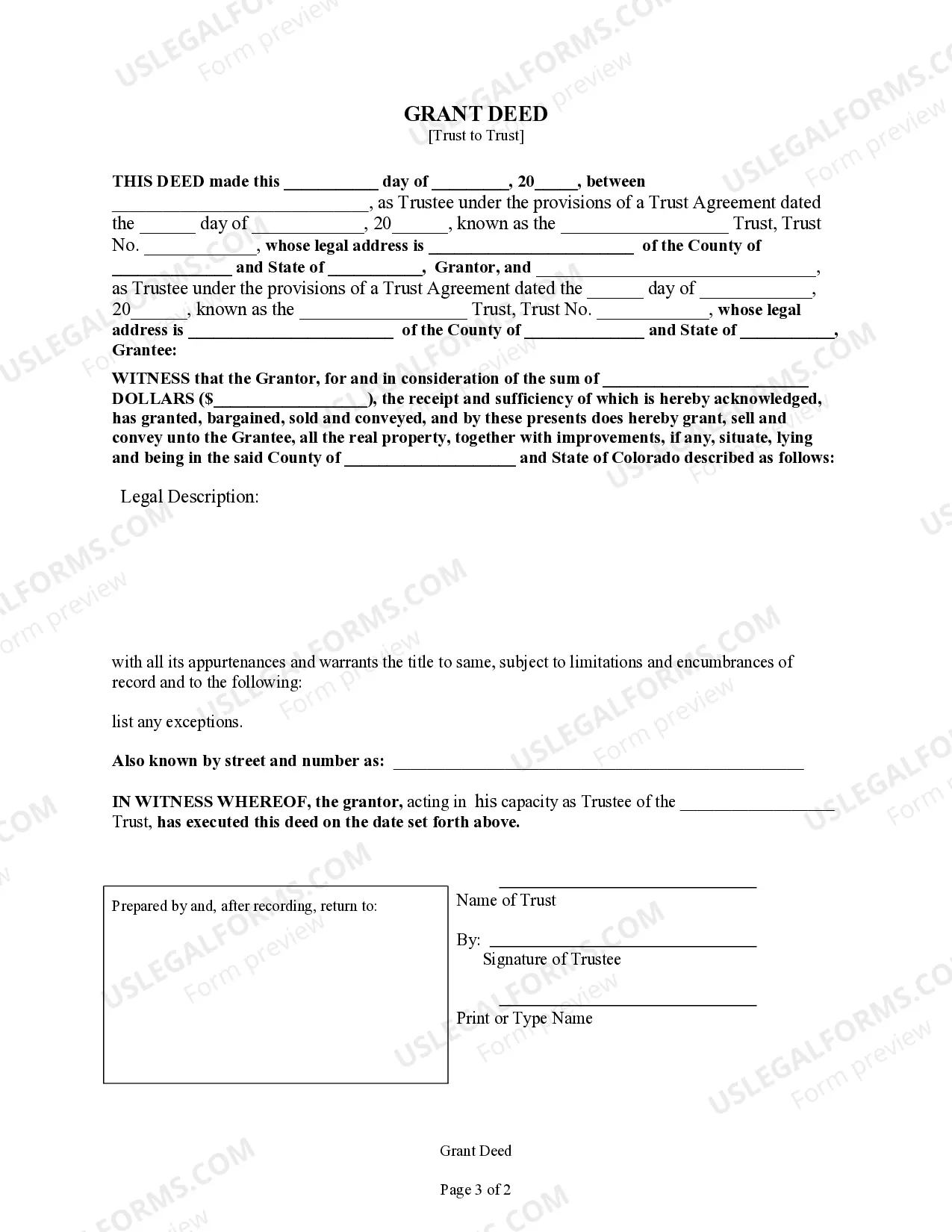

This form is a Grant Deed where the grantor is a trust and the grantee is also a trust. Grantor grants and conveys the described property to the grantee. This deed complies with all state statutory laws.

A Fort Collins Colorado Grant Deed — Trust to a Trust is a legal document used to transfer ownership of real estate from an individual or entity to a trust. This type of deed involves conveying the property to a trust, allowing the trust to hold and manage the property for the beneficiaries named in the trust agreement. It is a common method of transferring real estate assets while maintaining privacy and ensuring efficient estate planning. The Fort Collins Colorado Grant Deed — Trust to a Trust serves as proof of the property transfer and is recorded with the local county recorder's office. This official recording establishes the trust as the property owner and provides notice to the public of the change in ownership. There are several types of Fort Collins Colorado Grant Deed — Trust to a Trust, each designed to meet specific needs and circumstances: 1. Revocable Living Trust Grant Deed: With this type of grant deed, the property owner transfers ownership to a revocable living trust, which allows flexibility to amend or revoke the trust during the owner's lifetime. Revocable living trusts are commonly used for estate planning purposes to avoid probate and provide for the efficient transfer of assets upon the owner's death. 2. Irrevocable Trust Grant Deed: In contrast to a revocable trust, an irrevocable trust is one that cannot be modified or revoked without the consent of the named beneficiaries. Transferring property to an irrevocable trust through a grant deed can provide benefits such as asset protection, tax planning, and eligibility for Medicaid. 3. Charitable Remainder Trust Grant Deed: This type of grant deed is used when the property owner wishes to make a charitable gift while retaining an income interest in the property. By transferring the property to a charitable remainder trust, the owner can receive income from the trust for a specified period and then ensure that the remaining assets ultimately go to the chosen charity. 4. Special Needs Trust Grant Deed: For individuals with disabilities who require government assistance, a special needs trust grant deed can ensure that the inherited property does not disqualify them from receiving means-tested benefits. The trust is specifically designed to supplement the individual's needs without affecting their eligibility for programs like Medicaid or Supplemental Security Income (SSI). It is important to consult with an experienced attorney or legal professional specializing in estate planning and trust administration when considering a Fort Collins Colorado Grant Deed — Trust to a Trust. They can provide guidance on selecting the appropriate type of trust and ensure compliance with state laws and regulations.A Fort Collins Colorado Grant Deed — Trust to a Trust is a legal document used to transfer ownership of real estate from an individual or entity to a trust. This type of deed involves conveying the property to a trust, allowing the trust to hold and manage the property for the beneficiaries named in the trust agreement. It is a common method of transferring real estate assets while maintaining privacy and ensuring efficient estate planning. The Fort Collins Colorado Grant Deed — Trust to a Trust serves as proof of the property transfer and is recorded with the local county recorder's office. This official recording establishes the trust as the property owner and provides notice to the public of the change in ownership. There are several types of Fort Collins Colorado Grant Deed — Trust to a Trust, each designed to meet specific needs and circumstances: 1. Revocable Living Trust Grant Deed: With this type of grant deed, the property owner transfers ownership to a revocable living trust, which allows flexibility to amend or revoke the trust during the owner's lifetime. Revocable living trusts are commonly used for estate planning purposes to avoid probate and provide for the efficient transfer of assets upon the owner's death. 2. Irrevocable Trust Grant Deed: In contrast to a revocable trust, an irrevocable trust is one that cannot be modified or revoked without the consent of the named beneficiaries. Transferring property to an irrevocable trust through a grant deed can provide benefits such as asset protection, tax planning, and eligibility for Medicaid. 3. Charitable Remainder Trust Grant Deed: This type of grant deed is used when the property owner wishes to make a charitable gift while retaining an income interest in the property. By transferring the property to a charitable remainder trust, the owner can receive income from the trust for a specified period and then ensure that the remaining assets ultimately go to the chosen charity. 4. Special Needs Trust Grant Deed: For individuals with disabilities who require government assistance, a special needs trust grant deed can ensure that the inherited property does not disqualify them from receiving means-tested benefits. The trust is specifically designed to supplement the individual's needs without affecting their eligibility for programs like Medicaid or Supplemental Security Income (SSI). It is important to consult with an experienced attorney or legal professional specializing in estate planning and trust administration when considering a Fort Collins Colorado Grant Deed — Trust to a Trust. They can provide guidance on selecting the appropriate type of trust and ensure compliance with state laws and regulations.