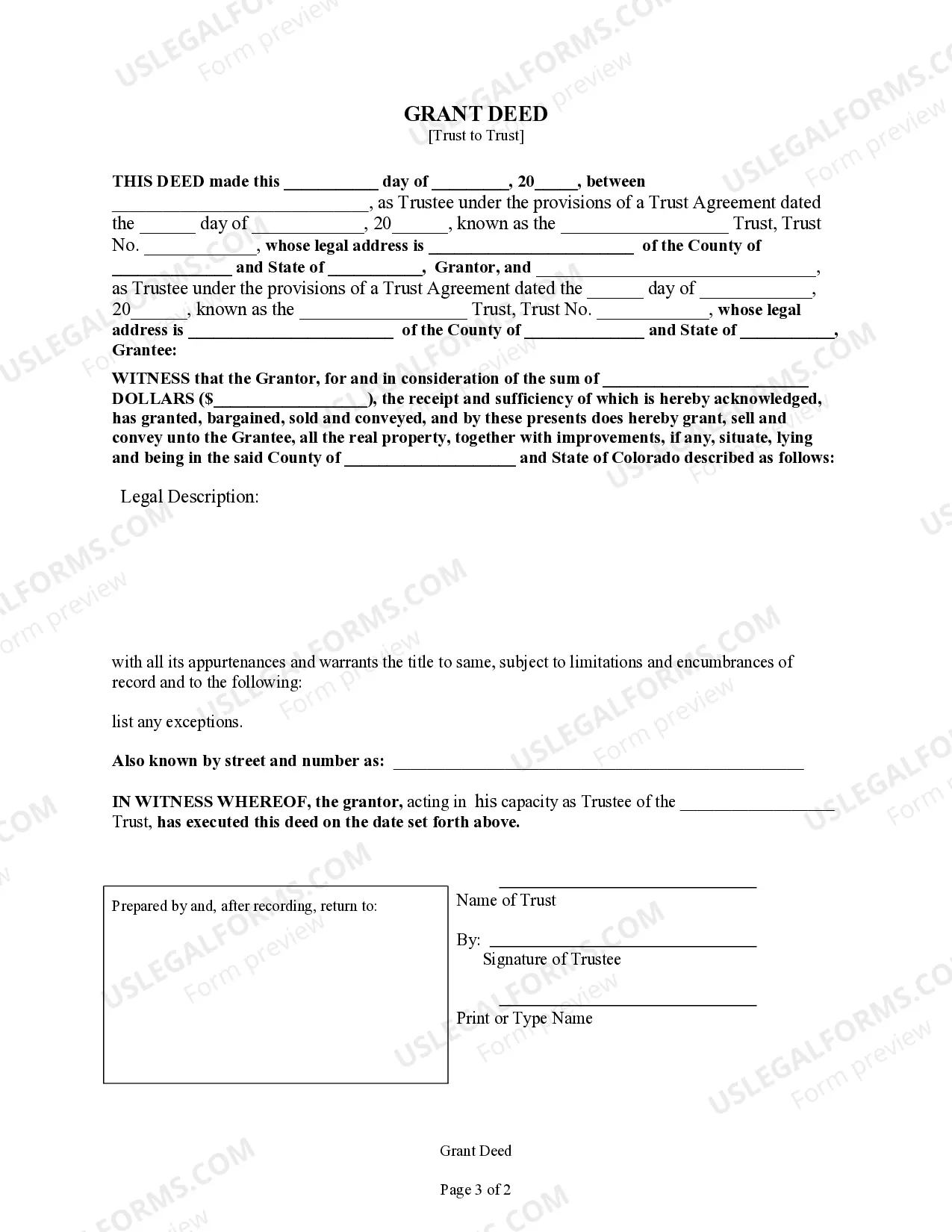

This form is a Grant Deed where the grantor is a trust and the grantee is also a trust. Grantor grants and conveys the described property to the grantee. This deed complies with all state statutory laws.

A grant deed trust to a trust in Lakewood, Colorado refers to a legally binding document used in real estate transactions to transfer ownership of a property from one party to a trust. This type of transfer ensures that the property is held and managed by a trust for the benefit of its beneficiaries. In a grant deed trust to a trust, the property's owner, known as the granter, conveys the property to a trust, also called the grantee. The trust, which holds legal title to the property, is created with specific instructions and provisions outlined by the granter. There are several types of grant deed trust to a trust in Lakewood, Colorado, namely: 1. Revocable Living Trust: This is a common type of grant deed trust used for estate planning purposes. The granter retains the ability to modify or revoke the trust during their lifetime. Upon the granter's death or incapacitation, the trust transfers ownership to specified beneficiaries avoiding probate. 2. Irrevocable Living Trust: In contrast to the revocable trust, an irrevocable living trust cannot be modified or revoked after it is established. Once the property is transferred to the trust, the granter relinquishes control and ownership rights. Irrevocable trusts are often used for tax planning and asset protection purposes. 3. Special Needs Trust: This type of grant deed trust is designed to provide for the ongoing care and support of individuals with special needs. By transferring the property to the trust, the granter ensures that the beneficiary's eligibility for government benefits is not compromised while also securing their long-term financial security. 4. Charitable Trust: A grant deed trust to a charitable trust involves the transfer of property to a trust, the income or proceeds of which are directed towards benefiting a specified charitable organization or cause. This type of trust allows the granter to support their chosen charitable endeavors while potentially reducing their tax liabilities. In conclusion, a grant deed trust to a trust in Lakewood, Colorado is a legal instrument used to transfer property ownership to a trust entity. It offers flexibility and various benefits depending on the specific type of trust created, such as revocable living trusts, irrevocable living trusts, special needs trusts, and charitable trusts.A grant deed trust to a trust in Lakewood, Colorado refers to a legally binding document used in real estate transactions to transfer ownership of a property from one party to a trust. This type of transfer ensures that the property is held and managed by a trust for the benefit of its beneficiaries. In a grant deed trust to a trust, the property's owner, known as the granter, conveys the property to a trust, also called the grantee. The trust, which holds legal title to the property, is created with specific instructions and provisions outlined by the granter. There are several types of grant deed trust to a trust in Lakewood, Colorado, namely: 1. Revocable Living Trust: This is a common type of grant deed trust used for estate planning purposes. The granter retains the ability to modify or revoke the trust during their lifetime. Upon the granter's death or incapacitation, the trust transfers ownership to specified beneficiaries avoiding probate. 2. Irrevocable Living Trust: In contrast to the revocable trust, an irrevocable living trust cannot be modified or revoked after it is established. Once the property is transferred to the trust, the granter relinquishes control and ownership rights. Irrevocable trusts are often used for tax planning and asset protection purposes. 3. Special Needs Trust: This type of grant deed trust is designed to provide for the ongoing care and support of individuals with special needs. By transferring the property to the trust, the granter ensures that the beneficiary's eligibility for government benefits is not compromised while also securing their long-term financial security. 4. Charitable Trust: A grant deed trust to a charitable trust involves the transfer of property to a trust, the income or proceeds of which are directed towards benefiting a specified charitable organization or cause. This type of trust allows the granter to support their chosen charitable endeavors while potentially reducing their tax liabilities. In conclusion, a grant deed trust to a trust in Lakewood, Colorado is a legal instrument used to transfer property ownership to a trust entity. It offers flexibility and various benefits depending on the specific type of trust created, such as revocable living trusts, irrevocable living trusts, special needs trusts, and charitable trusts.