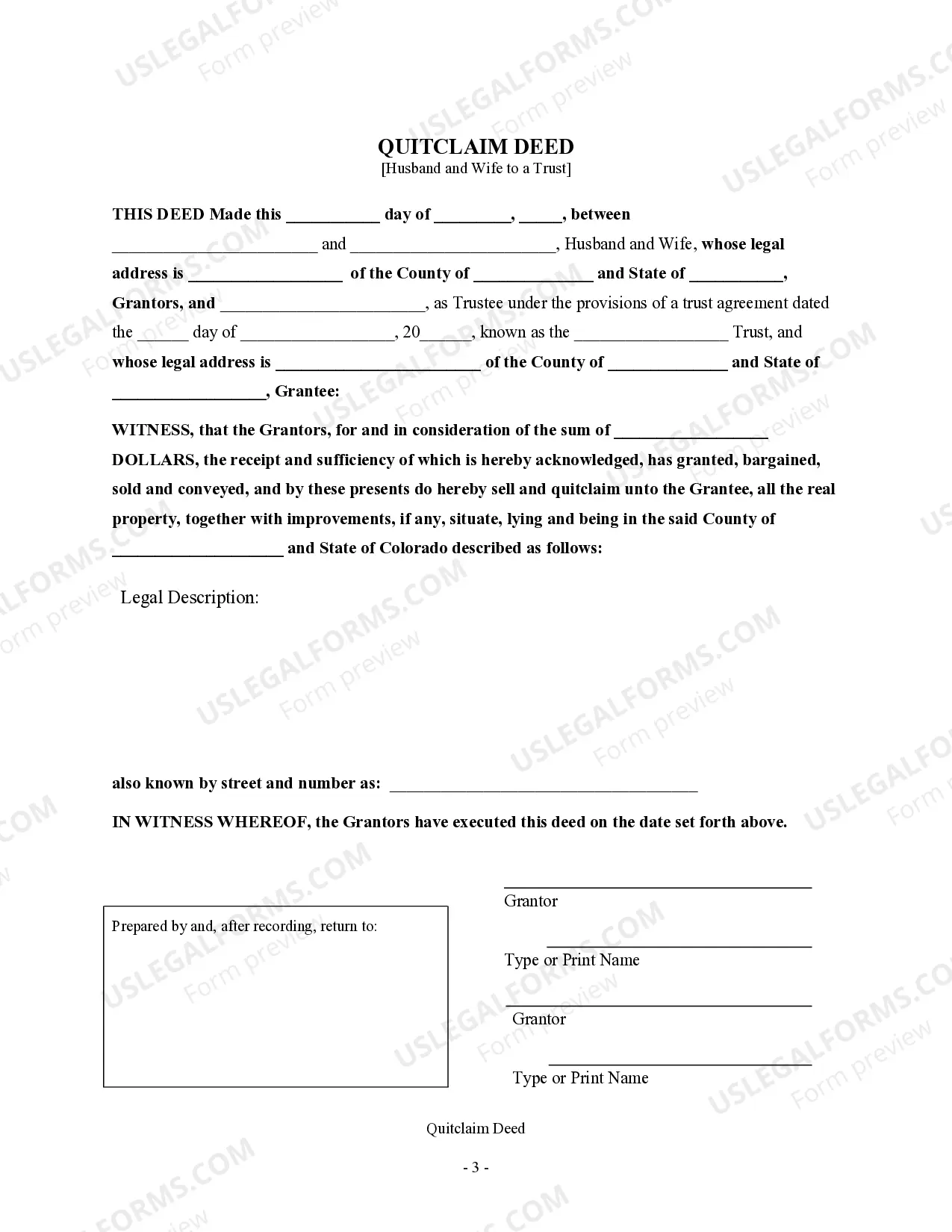

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Centennial Colorado Quitclaim Deed — Husband and Wife to a Trust is a legal document that facilitates the transfer of property rights from a married couple to a trust entity. By creating this type of deed, spouses can effectively transfer property ownership into a trust, providing many benefits such as asset protection, estate planning, and probate avoidance. This particular deed is commonly used in Centennial, Colorado, and it ensures that the property is held by the trust instead of the individual spouses. This arrangement allows the trust to manage, distribute, or sell the property according to the terms and instructions specified in the trust agreement. It also helps streamline the transfer process should the husband and wife pass away, as the property ownership will remain within the trust, thus avoiding going through probate. There are a few different variations of the Centennial Colorado Quitclaim Deed — Husband and Wife to a Trust, each catering to specific circumstances or objectives. These may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is designed for couples who want to establish a revocable living trust and transfer their property into it. The trust can be modified or revoked during the lifetimes of the spouses. 2. Irrevocable Trust Quitclaim Deed: This variation is for couples who wish to establish an irrevocable trust, which cannot be altered once created. An irrevocable trust provides additional asset protection and may have certain tax advantages. 3. Testamentary Trust Quitclaim Deed: Specifically created for couples who want to establish a testamentary trust, this deed transfers the property to the trust at the time of their deaths, as specified in their wills. Testamentary trusts only come into effect upon the death of the granter(s). 4. Special Needs Trust Quitclaim Deed: If a couple has a dependent with special needs, this variation allows them to transfer the property to a special needs trust, ensuring that the individual's eligibility for government benefits remains intact. In conclusion, a Centennial Colorado Quitclaim Deed — Husband and Wife to a Trust is a valuable legal tool to transfer property ownership to a trust entity. Its variations cater to different needs and objectives, allowing couples to protect their assets, plan their estates, and avoid the complexities of probate.A Centennial Colorado Quitclaim Deed — Husband and Wife to a Trust is a legal document that facilitates the transfer of property rights from a married couple to a trust entity. By creating this type of deed, spouses can effectively transfer property ownership into a trust, providing many benefits such as asset protection, estate planning, and probate avoidance. This particular deed is commonly used in Centennial, Colorado, and it ensures that the property is held by the trust instead of the individual spouses. This arrangement allows the trust to manage, distribute, or sell the property according to the terms and instructions specified in the trust agreement. It also helps streamline the transfer process should the husband and wife pass away, as the property ownership will remain within the trust, thus avoiding going through probate. There are a few different variations of the Centennial Colorado Quitclaim Deed — Husband and Wife to a Trust, each catering to specific circumstances or objectives. These may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is designed for couples who want to establish a revocable living trust and transfer their property into it. The trust can be modified or revoked during the lifetimes of the spouses. 2. Irrevocable Trust Quitclaim Deed: This variation is for couples who wish to establish an irrevocable trust, which cannot be altered once created. An irrevocable trust provides additional asset protection and may have certain tax advantages. 3. Testamentary Trust Quitclaim Deed: Specifically created for couples who want to establish a testamentary trust, this deed transfers the property to the trust at the time of their deaths, as specified in their wills. Testamentary trusts only come into effect upon the death of the granter(s). 4. Special Needs Trust Quitclaim Deed: If a couple has a dependent with special needs, this variation allows them to transfer the property to a special needs trust, ensuring that the individual's eligibility for government benefits remains intact. In conclusion, a Centennial Colorado Quitclaim Deed — Husband and Wife to a Trust is a valuable legal tool to transfer property ownership to a trust entity. Its variations cater to different needs and objectives, allowing couples to protect their assets, plan their estates, and avoid the complexities of probate.