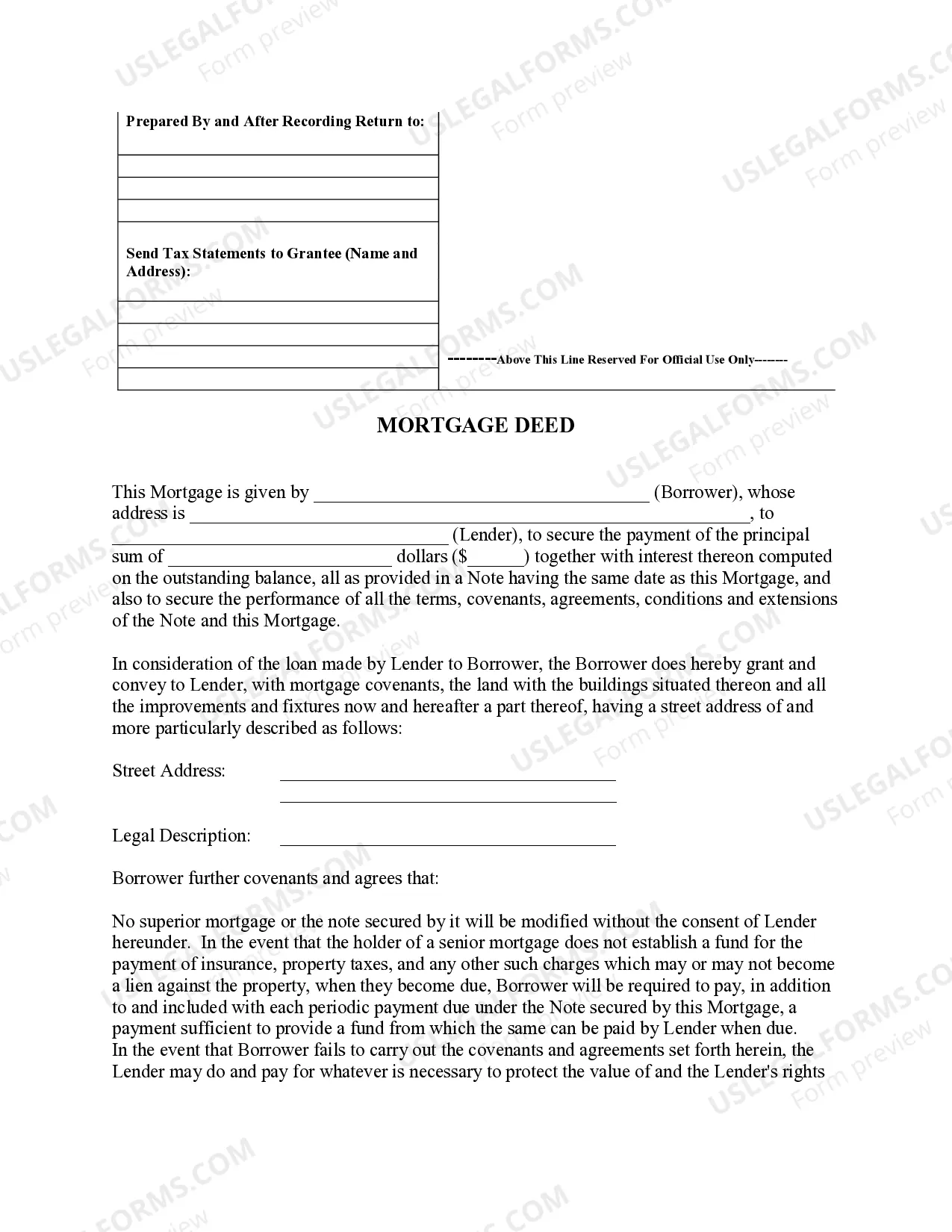

Aurora Colorado Mortgage Deed for Individual to Individual is a legal document that outlines the terms and conditions under which an individual borrower in Aurora, Colorado, can obtain a loan from another individual, referred to as the lender, using their property as collateral. This type of mortgage deed is often used when traditional lenders, such as banks or mortgage companies, are not involved in the lending process. The Aurora Colorado Mortgage Deed for Individual to Individual includes important information about the loan, such as the loan amount, interest rate, repayment terms, and the details of the property being used as collateral. It ensures that both parties fully understand their rights and obligations. There are several types of Aurora Colorado Mortgage Deed for Individual to Individual, including: 1. Fixed-rate Mortgage Deed: This type of mortgage deed establishes a fixed interest rate that remains the same throughout the loan term. Borrowers can expect consistent monthly payments, which can aid in budgeting and financial planning. 2. Adjustable-rate Mortgage Deed: With an adjustable-rate mortgage deed, the interest rate can fluctuate over time, usually based on market conditions. The terms for rate adjustments are specified in the deed, ensuring both parties are aware of potential changes. 3. Balloon Mortgage Deed: In a balloon mortgage deed, the borrower makes smaller monthly payments for a specified period, typically 5 to 7 years, and a large "balloon payment" is due at the end. This arrangement allows borrowers to have lower monthly payments initially, with the expectation of refinancing or selling the property before the balloon payment is due. 4. Interest-only Mortgage Deed: In this type of mortgage deed, the borrower only pays the interest on the loan for a certain period, usually 5 to 10 years, before starting to pay both principal and interest. This can be beneficial for borrowers seeking lower initial payments but should be carefully considered for long-term financial planning. It is important for both the borrower and lender to consult with legal professionals when drafting and executing an Aurora Colorado Mortgage Deed for Individual to Individual. Seeking legal advice ensures that the document complies with local laws and protects the rights and interests of both parties involved. Keywords: mortgage deed, individual to individual, Aurora Colorado, loan, collateral, legal document, terms and conditions, interest rate, repayment terms, fixed-rate, adjustable-rate, balloon, interest-only, property, borrower, lender, local laws, legal professionals.

Aurora Colorado Mortgage Deed for Individual to Individual

Description

How to fill out Aurora Colorado Mortgage Deed For Individual To Individual?

If you are looking for a relevant form template, it’s impossible to find a more convenient platform than the US Legal Forms site – probably the most considerable libraries on the internet. With this library, you can find a huge number of templates for business and personal purposes by types and regions, or key phrases. With the high-quality search option, getting the latest Aurora Colorado Mortgage Deed for Individual to Individual is as elementary as 1-2-3. Moreover, the relevance of each and every record is proved by a group of skilled attorneys that regularly check the templates on our website and revise them according to the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Aurora Colorado Mortgage Deed for Individual to Individual is to log in to your profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the instructions below:

- Make sure you have found the form you want. Check its explanation and use the Preview feature (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the needed document.

- Confirm your decision. Choose the Buy now option. After that, choose the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the template. Select the format and save it to your system.

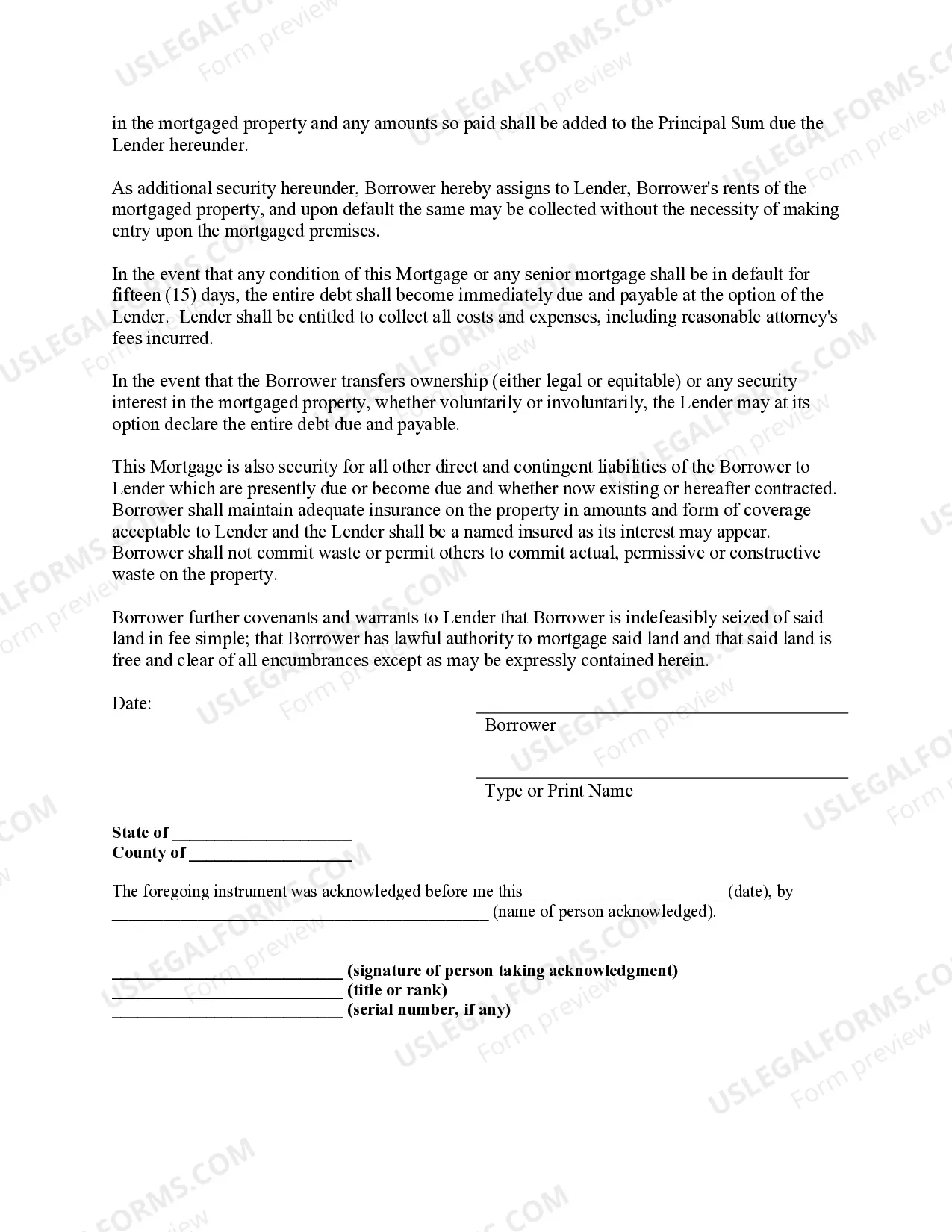

- Make adjustments. Fill out, edit, print, and sign the received Aurora Colorado Mortgage Deed for Individual to Individual.

Every template you save in your profile has no expiration date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you need to have an extra duplicate for enhancing or creating a hard copy, feel free to come back and download it once again whenever you want.

Make use of the US Legal Forms extensive catalogue to gain access to the Aurora Colorado Mortgage Deed for Individual to Individual you were seeking and a huge number of other professional and state-specific templates on a single website!