A Centennial Colorado Mortgage Deed for Individual to Individual is a legal document that outlines the terms and conditions of a mortgage loan agreement between two individuals within the city of Centennial, Colorado. This specific type of mortgage deed signifies that the loan is being provided by an individual rather than a traditional lending institution. The Centennial Colorado Mortgage Deed for Individual to Individual serves as proof of the loan agreement and outlines key details such as the loan amount, interest rate, repayment terms, and any collateral or property that is serving as security for the loan. This document also includes the names and contact information of both the lender and the borrower, ensuring that both parties are legally bound to the terms of the mortgage loan. Having a Centennial Colorado Mortgage Deed for Individual to Individual can provide flexibility for individuals seeking mortgage financing outside the conventional banking system. This type of mortgage deed may also offer more personalized terms, such as lower interest rates or unique repayment arrangements, which can be advantageous for both parties involved. Different types of Centennial Colorado Mortgage Deed for Individual to Individual may include: 1. Fixed-rate Mortgage Deed: In this type of mortgage deed, the interest rate remains unchanged throughout the loan term, giving the borrower stability and predictability in their monthly mortgage payments. 2. Adjustable-rate Mortgage Deed: Unlike a fixed-rate mortgage, an adjustable-rate mortgage deed allows the interest rate to fluctuate over time based on market conditions. This can lead to potentially lower initial interest rates, but also introduces the risk of higher payments in the future. 3. Balloon Mortgage Deed: A balloon mortgage deed offers lower monthly payments initially, but requires the borrower to make a large lump sum payment at the end of the mortgage term. This type of mortgage deed is generally considered a short-term solution. 4. Interest-only Mortgage Deed: With an interest-only mortgage deed, the borrower is only required to pay the interest on the loan for a specified period, typically between five and ten years. After this initial period, the borrower must begin making principal payments, resulting in higher monthly payments. When entering into a Centennial Colorado Mortgage Deed for Individual to Individual, it is crucial for both the lender and the borrower to seek legal advice to ensure that the deed is accurately drafted, adheres to local laws, and protects the rights and interests of both parties.

Centennial Colorado Mortgage Deed for Individual to Individual

State:

Colorado

City:

Centennial

Control #:

CO-SDEED-8-8

Format:

Word;

Rich Text

Instant download

Description

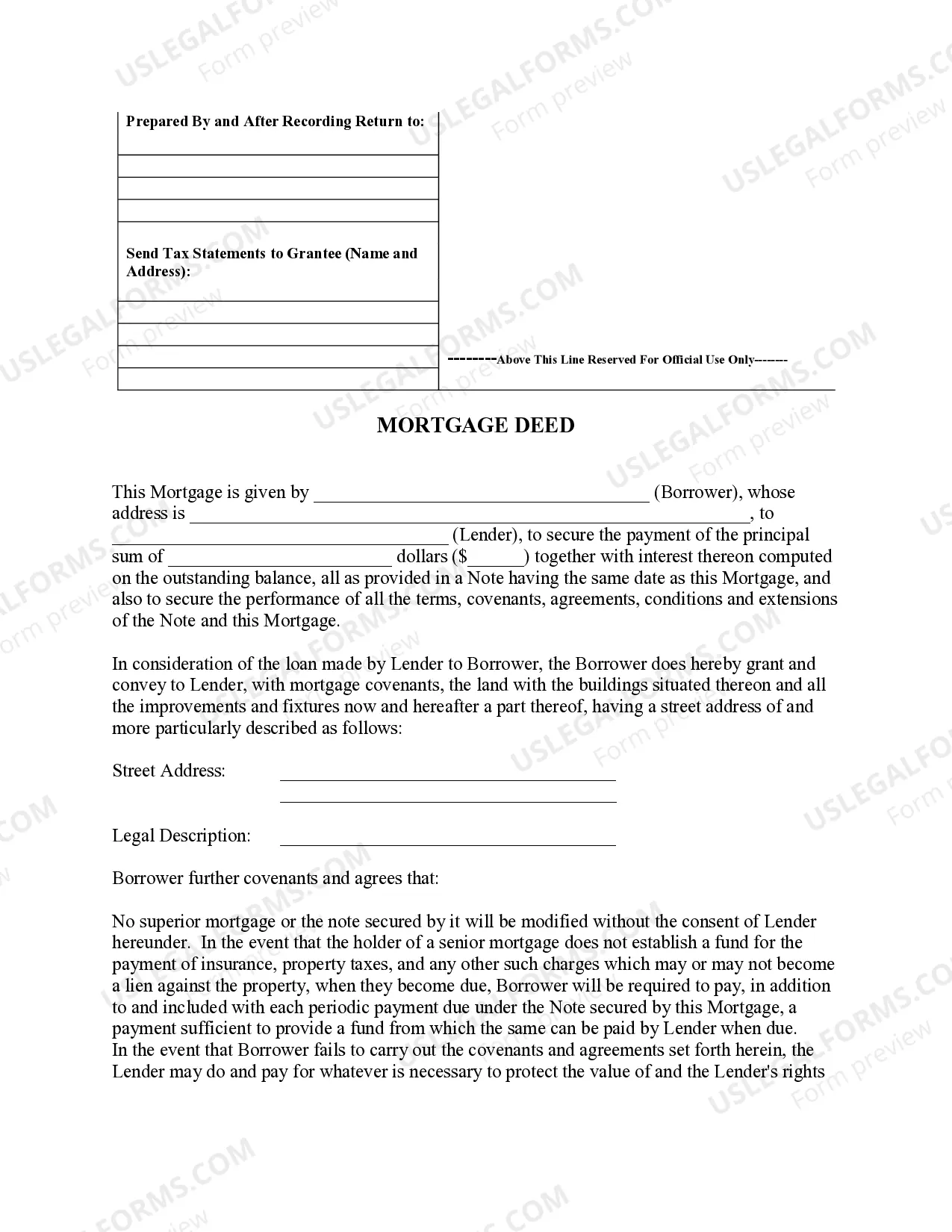

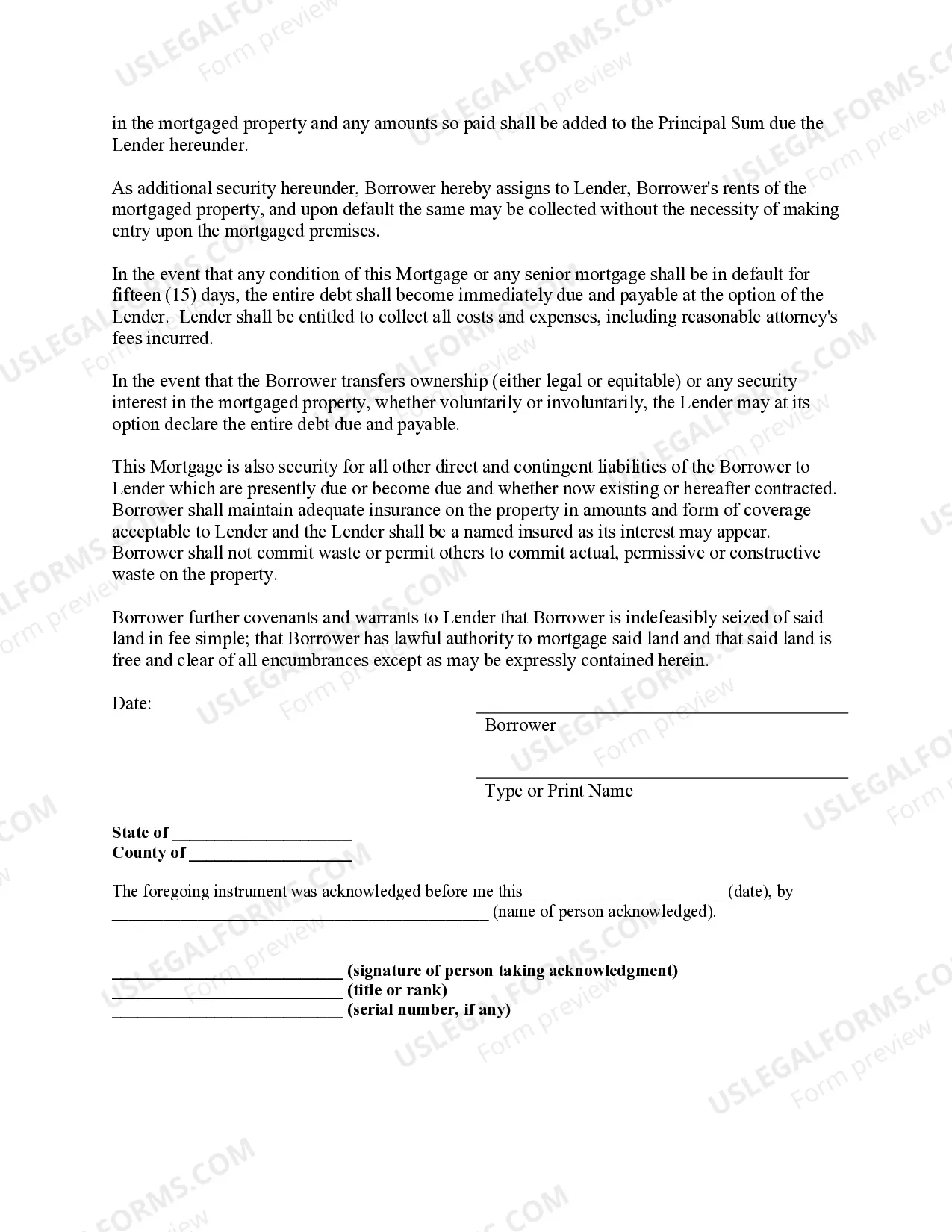

This form is a Mortgage Deed where the grantor is an individual and the grantee is an individual.

A Centennial Colorado Mortgage Deed for Individual to Individual is a legal document that outlines the terms and conditions of a mortgage loan agreement between two individuals within the city of Centennial, Colorado. This specific type of mortgage deed signifies that the loan is being provided by an individual rather than a traditional lending institution. The Centennial Colorado Mortgage Deed for Individual to Individual serves as proof of the loan agreement and outlines key details such as the loan amount, interest rate, repayment terms, and any collateral or property that is serving as security for the loan. This document also includes the names and contact information of both the lender and the borrower, ensuring that both parties are legally bound to the terms of the mortgage loan. Having a Centennial Colorado Mortgage Deed for Individual to Individual can provide flexibility for individuals seeking mortgage financing outside the conventional banking system. This type of mortgage deed may also offer more personalized terms, such as lower interest rates or unique repayment arrangements, which can be advantageous for both parties involved. Different types of Centennial Colorado Mortgage Deed for Individual to Individual may include: 1. Fixed-rate Mortgage Deed: In this type of mortgage deed, the interest rate remains unchanged throughout the loan term, giving the borrower stability and predictability in their monthly mortgage payments. 2. Adjustable-rate Mortgage Deed: Unlike a fixed-rate mortgage, an adjustable-rate mortgage deed allows the interest rate to fluctuate over time based on market conditions. This can lead to potentially lower initial interest rates, but also introduces the risk of higher payments in the future. 3. Balloon Mortgage Deed: A balloon mortgage deed offers lower monthly payments initially, but requires the borrower to make a large lump sum payment at the end of the mortgage term. This type of mortgage deed is generally considered a short-term solution. 4. Interest-only Mortgage Deed: With an interest-only mortgage deed, the borrower is only required to pay the interest on the loan for a specified period, typically between five and ten years. After this initial period, the borrower must begin making principal payments, resulting in higher monthly payments. When entering into a Centennial Colorado Mortgage Deed for Individual to Individual, it is crucial for both the lender and the borrower to seek legal advice to ensure that the deed is accurately drafted, adheres to local laws, and protects the rights and interests of both parties.

Free preview

How to fill out Centennial Colorado Mortgage Deed For Individual To Individual?

If you’ve already used our service before, log in to your account and save the Centennial Colorado Mortgage Deed for Individual to Individual on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Centennial Colorado Mortgage Deed for Individual to Individual. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!