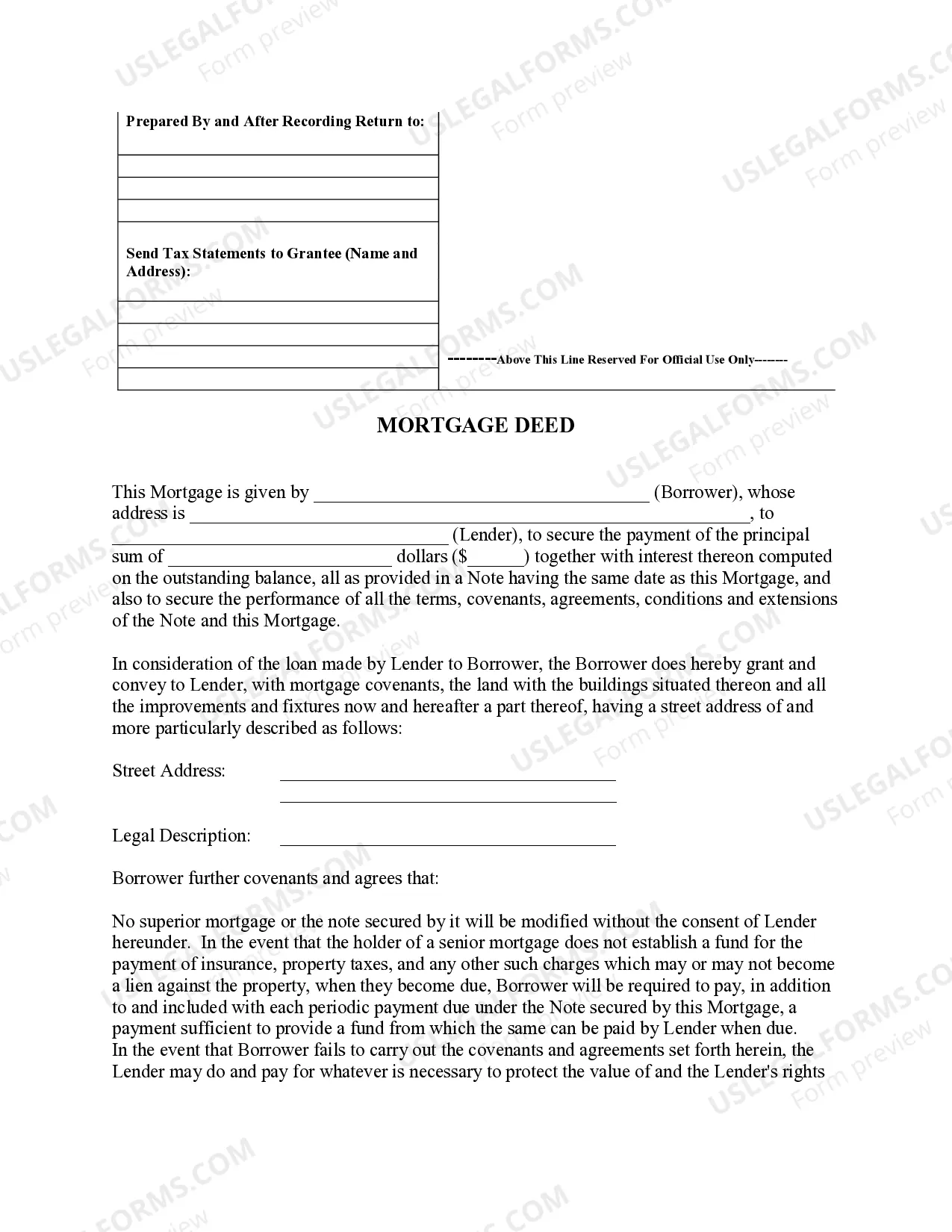

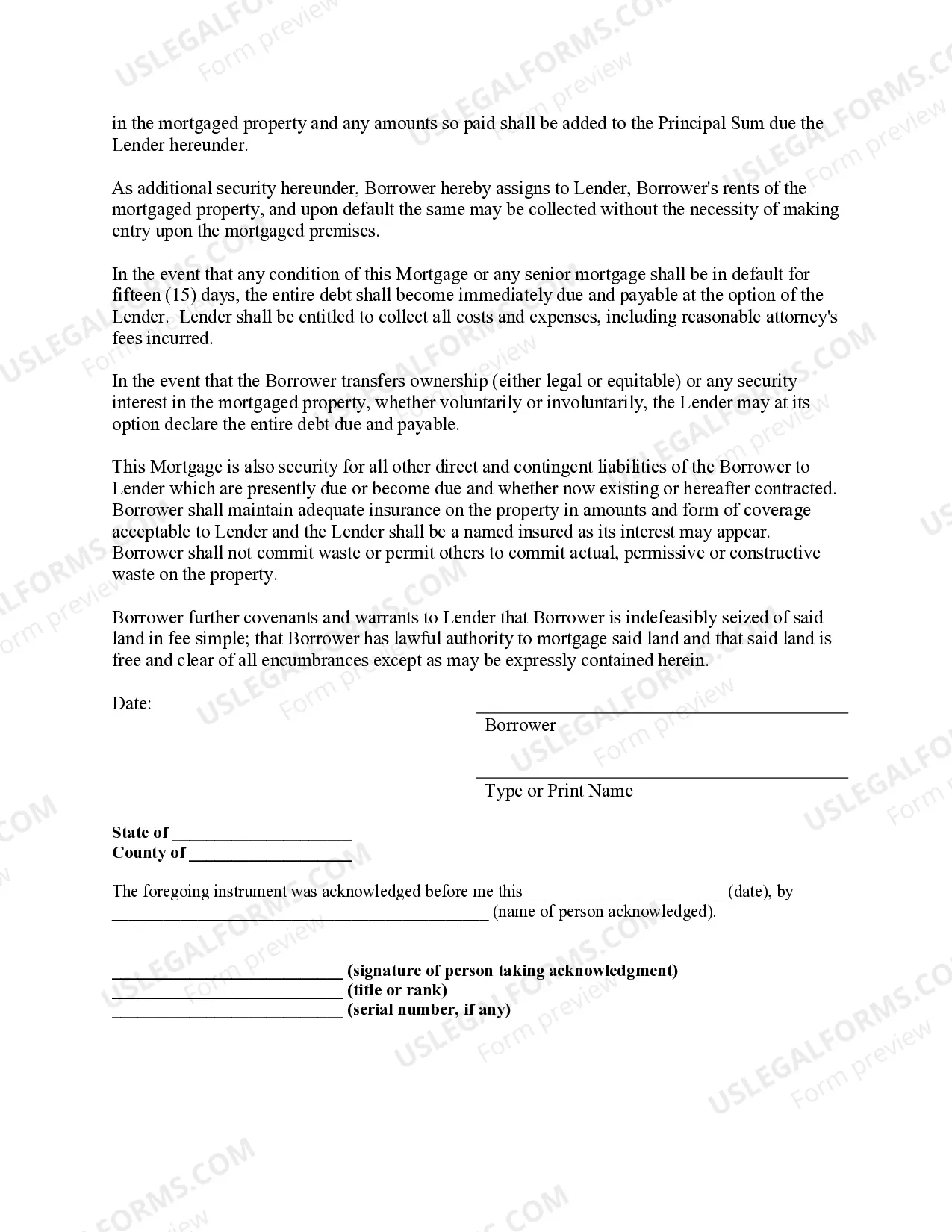

A Fort Collins Colorado Mortgage Deed for Individual to Individual is a legal document that outlines the terms and conditions of a loan agreement between two individuals, where one individual acts as the lender and the other as the borrower. This type of mortgage deed is commonly used in private lending or when individuals want to avoid traditional financial institutions. The Fort Collins Colorado Mortgage Deed for Individual to Individual is a crucial document that protects the interests of both parties involved in the transaction. It clearly defines the loan amount, interest rate, repayment schedule, and any additional terms agreed upon. The mortgage deed also serves as evidence of the loan agreement and provides security for the lender, as it grants them the right to claim the property in case of default. There may be different types of Fort Collins Colorado Mortgage Deeds for Individual to Individual, depending on the specific needs of the parties involved. Common variations may include: 1. Fixed-Rate Mortgage Deed: This type of mortgage deed stipulates a fixed interest rate for the duration of the loan term. It ensures that the borrower's monthly payments remain consistent and predictable. 2. Adjustable-Rate Mortgage Deed: In contrast to a fixed-rate mortgage deed, an adjustable-rate mortgage deed allows for periodic adjustments to the interest rate. These adjustments are typically tied to an index, such as the prime rate, and can result in fluctuating monthly payments. 3. Balloon Mortgage Deed: A balloon mortgage deed involves smaller monthly payments over a specific period, with a large final payment due at the end of the loan term. This type of mortgage deed is well-suited for borrowers who anticipate a significant sum of money in the future or plan to refinance before the balloon payment becomes due. 4. Interest-Only Mortgage Deed: With an interest-only mortgage deed, the borrower is only required to pay the interest accrued on the loan for a certain period, usually for the initial years of the loan. After this period, the borrower starts making payments to cover both the principal and interest. When entering into a Fort Collins Colorado Mortgage Deed for Individual to Individual, it is advisable to consult with legal professionals, such as real estate attorneys or mortgage brokers, to ensure compliance with local laws and to protect the interests of both parties.

Fort Collins Colorado Mortgage Deed for Individual to Individual

Description

How to fill out Fort Collins Colorado Mortgage Deed For Individual To Individual?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Fort Collins Colorado Mortgage Deed for Individual to Individual? US Legal Forms is your go-to option.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Fort Collins Colorado Mortgage Deed for Individual to Individual conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the document is good for.

- Restart the search in case the form isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Fort Collins Colorado Mortgage Deed for Individual to Individual in any available file format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online once and for all.