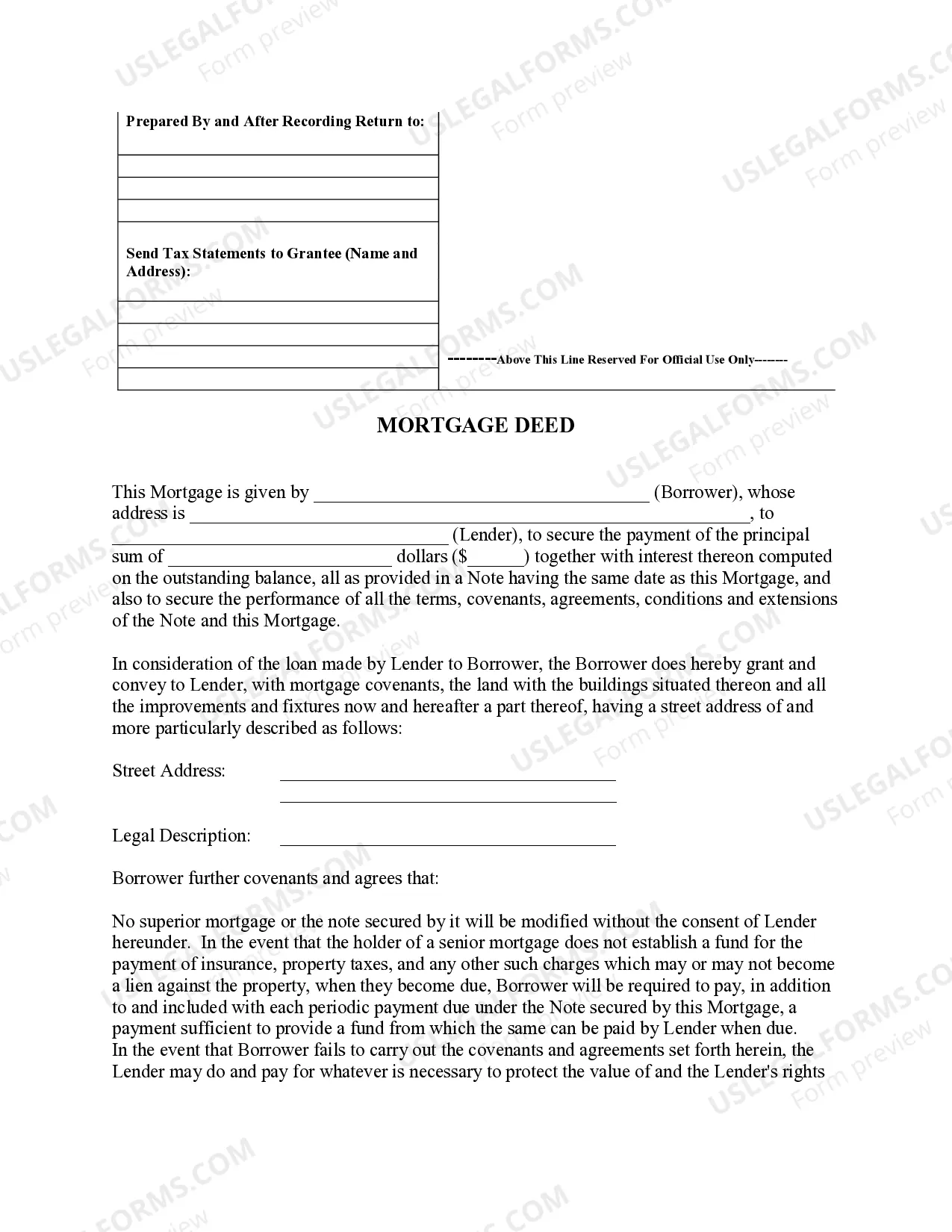

A Lakewood Colorado Mortgage Deed for Individual to Individual is a legal document that outlines the terms and conditions of a mortgage loan between two individuals in the city of Lakewood, Colorado. This type of mortgage transaction occurs when an individual borrower seeks to obtain financing for a property from another individual, rather than a traditional lending institution such as a bank or mortgage company. The Lakewood Colorado Mortgage Deed for Individual to Individual serves as a binding agreement between the borrower (mortgagor) and the lender (mortgagee) and contains essential information related to the loan. This document typically includes details such as the names, contact information, and addresses of both parties involved, the loan amount, interest rate, repayment terms, and any specific clauses or conditions agreed upon. One of the significant benefits of a Lakewood Colorado Mortgage Deed for Individual to Individual is the potential flexibility it offers compared to conventional mortgages. Borrowers and lenders have the opportunity to negotiate customized terms that may suit their individual financial situations and needs. This type of arrangement can be particularly appealing for individuals who may have difficulty obtaining a mortgage from a traditional lender due to factors such as credit history, income sources, or property type. In Lakewood, Colorado, there are several variants of Mortgage Deeds for Individual to Individual. These may include: 1. Fixed-rate Mortgage Deeds: This type of mortgage deed provides a fixed interest rate for the duration of the loan, ensuring that the borrower's monthly payments remain consistent over time. 2. Adjustable-rate Mortgage Deeds (ARM): Unlike fixed-rate mortgages, ARM deeds have an interest rate that can fluctuate periodically over the loan term based on specific factors such as market conditions or an agreed-upon index. This can result in varying monthly payments throughout the loan tenure. 3. Balloon Mortgage Deeds: Balloon mortgage deeds involve an initial period of smaller, fixed monthly payments followed by a larger "balloon" payment at the end of the term. This option can be suitable for borrowers who anticipate a significant influx of funds in the future or plan to sell the property before the balloon payment becomes due. 4. Interest-only Mortgage Deeds: This type of mortgage deed allows borrowers to make interest-only payments for a specified period, typically five to ten years. After the initial interest-only period, the borrower then begins to make regular principal and interest payments. Lakewood Colorado Mortgage Deed for Individual to Individual transactions can provide greater flexibility, personalized terms, and a more streamlined process compared to traditional lending institutions. However, it is crucial for both parties to seek legal advice and ensure they understand all the obligations and potential risks involved in this type of mortgage arrangement.

Lakewood Colorado Mortgage Deed for Individual to Individual

Description

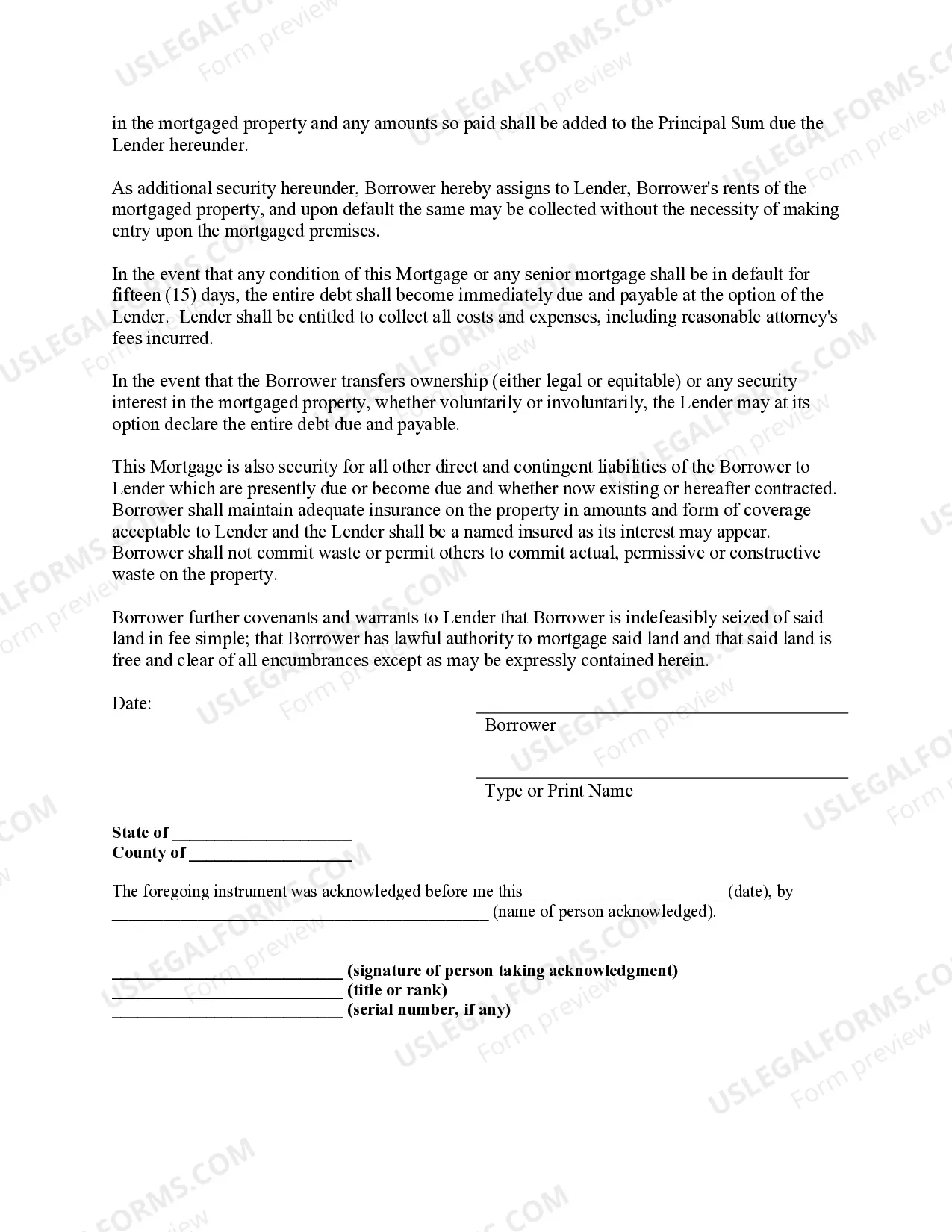

How to fill out Lakewood Colorado Mortgage Deed For Individual To Individual?

Benefit from the US Legal Forms and obtain instant access to any form sample you require. Our beneficial platform with thousands of templates makes it simple to find and get virtually any document sample you will need. You are able to save, fill, and certify the Lakewood Colorado Mortgage Deed for Individual to Individual in just a couple of minutes instead of surfing the Net for several hours looking for an appropriate template.

Utilizing our collection is a superb way to increase the safety of your record filing. Our experienced legal professionals regularly check all the documents to ensure that the templates are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Lakewood Colorado Mortgage Deed for Individual to Individual? If you have a subscription, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Open the page with the template you require. Ensure that it is the template you were seeking: examine its headline and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the file. Pick the format to obtain the Lakewood Colorado Mortgage Deed for Individual to Individual and modify and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the web. We are always happy to assist you in any legal case, even if it is just downloading the Lakewood Colorado Mortgage Deed for Individual to Individual.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!