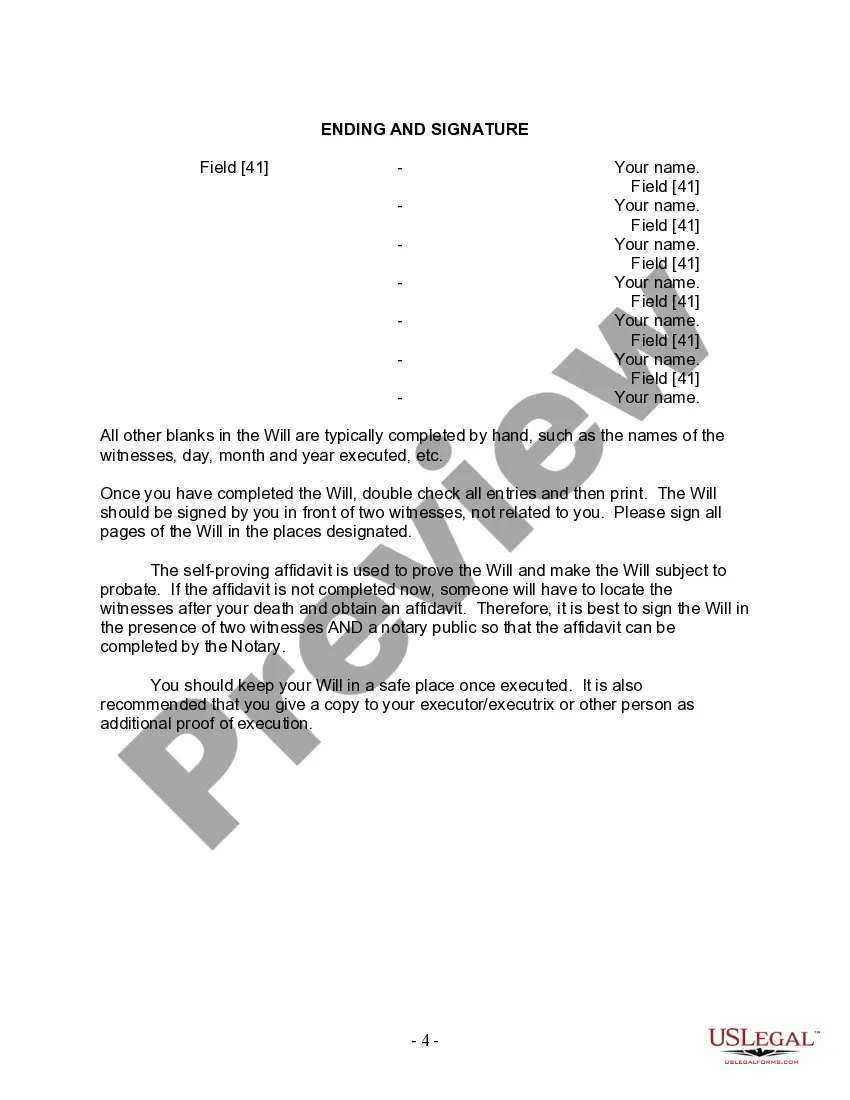

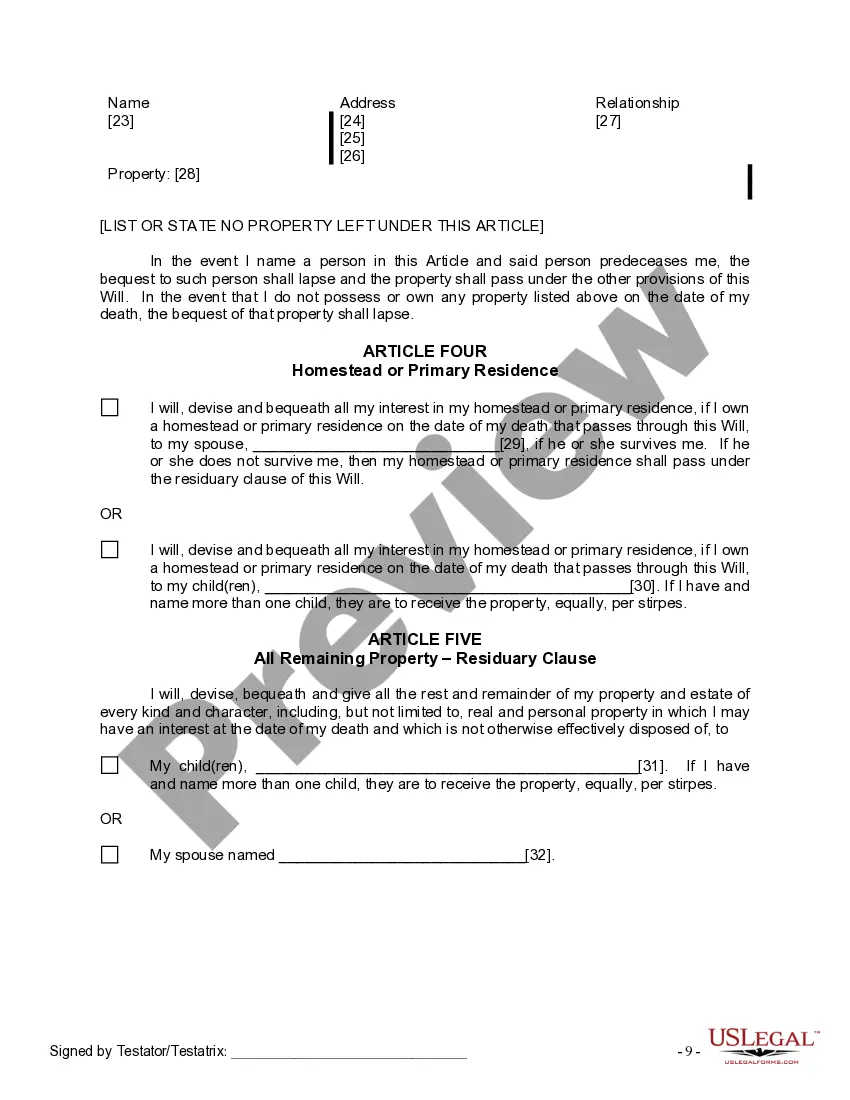

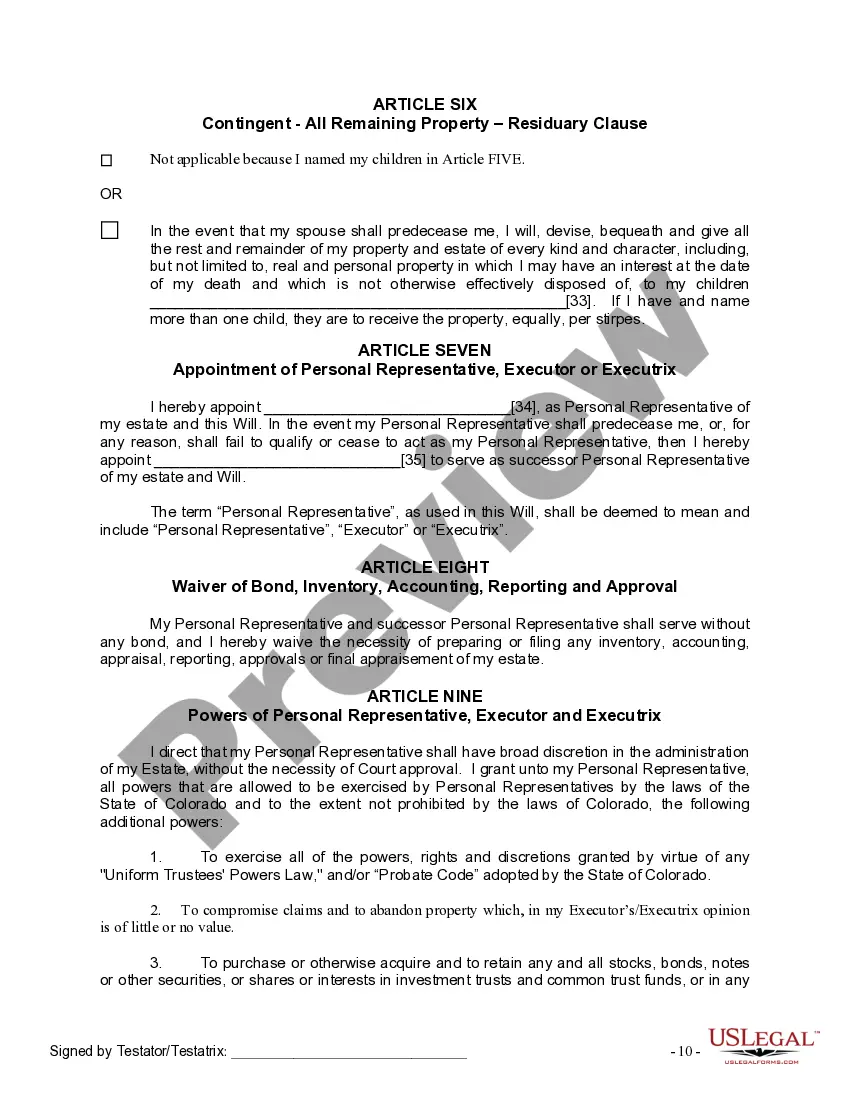

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage is a legal document that allows married individuals with adult children from a previous marriage to outline their wishes regarding the distribution of their assets, property, and guardianship of any minor children. This comprehensive document ensures that the individual's estate is distributed in accordance with their desires and provides a clear plan for the division of assets among the surviving spouse, adult children, and any other beneficiaries. The Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage takes into account the unique circumstances of individuals in blended families. It addresses potential challenges and concerns related to stepchildren and helps prevent disputes and conflicts that may arise after the individual's passing. The form includes clauses for specifying the distribution of specific assets, such as real estate, bank accounts, investments, and personal belongings. Additionally, it allows individuals to name an executor who will be responsible for carrying out the instructions outlined in the will. Key elements and considerations covered in the Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage may include: 1. Identification of the individual making the will (testator) and their spouse, including full legal names and contact information. 2. Details about any prior marriages, including names of previous spouses and children from those marriages. 3. Appointment of an executor to oversee the administration of the estate and ensure the instructions outlined in the will are carried out. 4. Guardianship provisions for any minor children from the current or previous marriage. 5. Provisions for the surviving spouse, including any specific gifts or bequests. 6. Distribution of assets among adult children from prior marriages, ensuring a fair and equitable division. 7. Consideration of stepchildren and their inclusion in the inheritance plan. 8. Establishment of trusts to manage assets and ensure their proper distribution. 9. Contingency plans in case a named beneficiary or executor predeceases the testator. 10. Appointment of alternate or successor beneficiaries, should primary beneficiaries be unable to inherit. 11. Any additional specific instructions, such as preferences for funeral arrangements or charitable donations. While there may not be specific variations of the Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage, individuals can customize the document based on their unique circumstances and wishes. Some variations may arise when considering different family structures, additional beneficiaries, or specific asset distribution requirements. It is essential to consult with a legal professional to ensure that the form meets all necessary legal requirements and accurately reflects the individual's intentions.

Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage is a legal document that allows married individuals with adult children from a previous marriage to outline their wishes regarding the distribution of their assets, property, and guardianship of any minor children. This comprehensive document ensures that the individual's estate is distributed in accordance with their desires and provides a clear plan for the division of assets among the surviving spouse, adult children, and any other beneficiaries. The Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage takes into account the unique circumstances of individuals in blended families. It addresses potential challenges and concerns related to stepchildren and helps prevent disputes and conflicts that may arise after the individual's passing. The form includes clauses for specifying the distribution of specific assets, such as real estate, bank accounts, investments, and personal belongings. Additionally, it allows individuals to name an executor who will be responsible for carrying out the instructions outlined in the will. Key elements and considerations covered in the Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage may include: 1. Identification of the individual making the will (testator) and their spouse, including full legal names and contact information. 2. Details about any prior marriages, including names of previous spouses and children from those marriages. 3. Appointment of an executor to oversee the administration of the estate and ensure the instructions outlined in the will are carried out. 4. Guardianship provisions for any minor children from the current or previous marriage. 5. Provisions for the surviving spouse, including any specific gifts or bequests. 6. Distribution of assets among adult children from prior marriages, ensuring a fair and equitable division. 7. Consideration of stepchildren and their inclusion in the inheritance plan. 8. Establishment of trusts to manage assets and ensure their proper distribution. 9. Contingency plans in case a named beneficiary or executor predeceases the testator. 10. Appointment of alternate or successor beneficiaries, should primary beneficiaries be unable to inherit. 11. Any additional specific instructions, such as preferences for funeral arrangements or charitable donations. While there may not be specific variations of the Arvada Colorado Legal Last Will and Testament Form for Married Person with Adult Children from Prior Marriage, individuals can customize the document based on their unique circumstances and wishes. Some variations may arise when considering different family structures, additional beneficiaries, or specific asset distribution requirements. It is essential to consult with a legal professional to ensure that the form meets all necessary legal requirements and accurately reflects the individual's intentions.