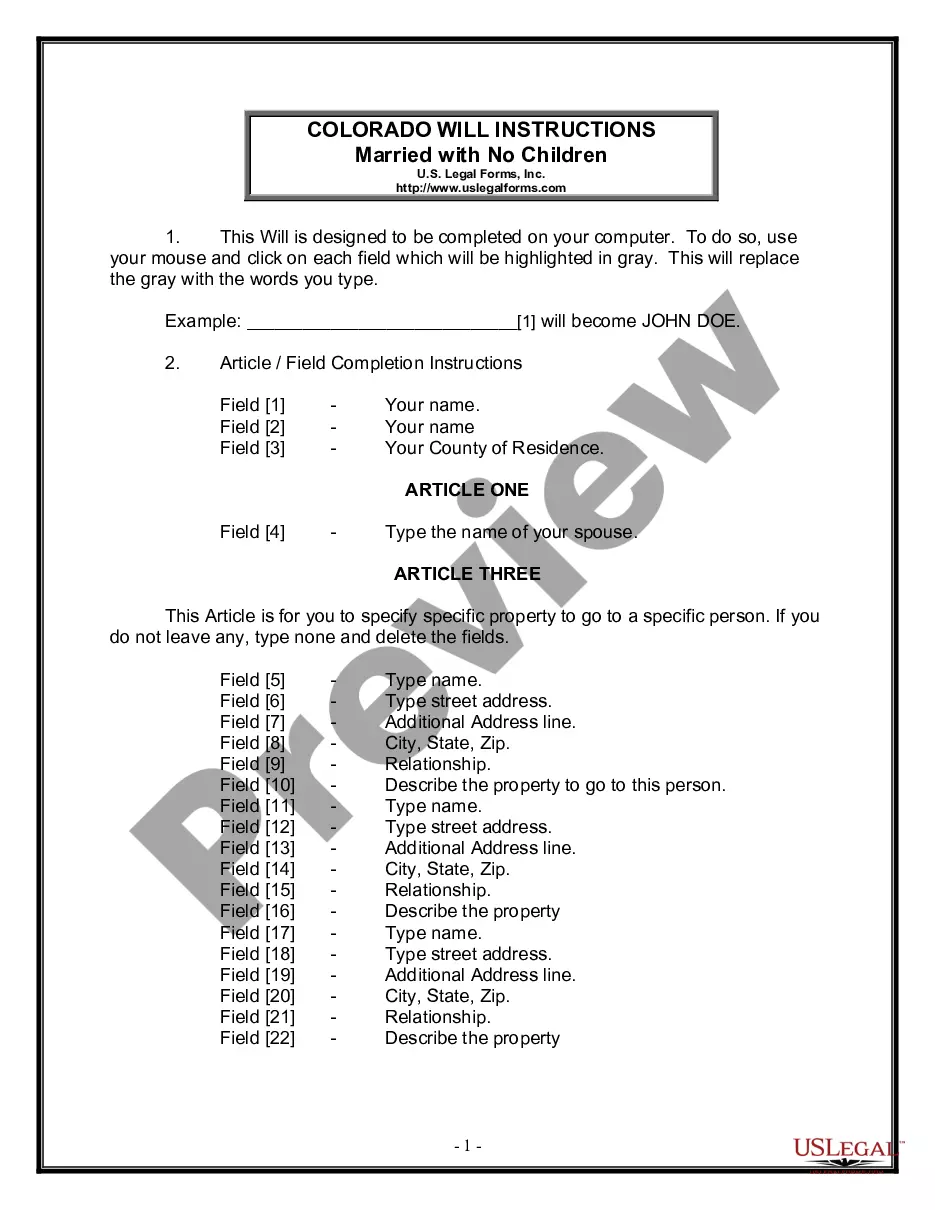

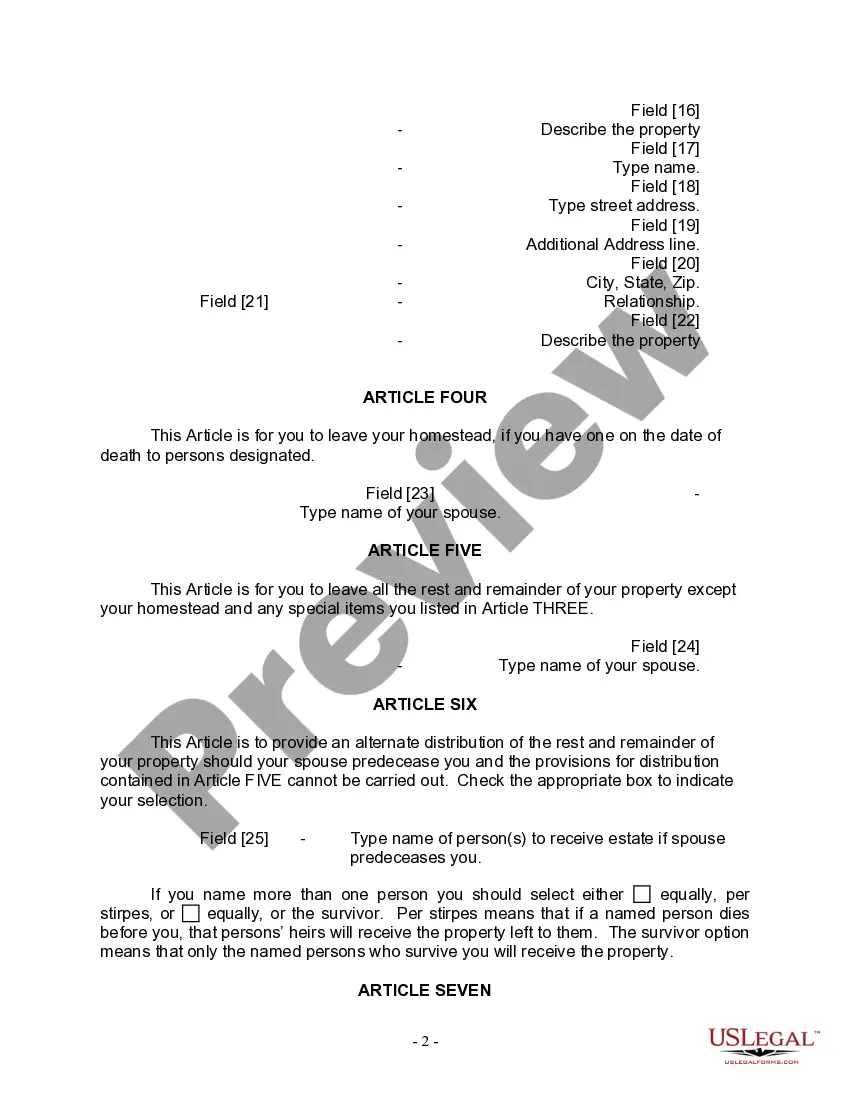

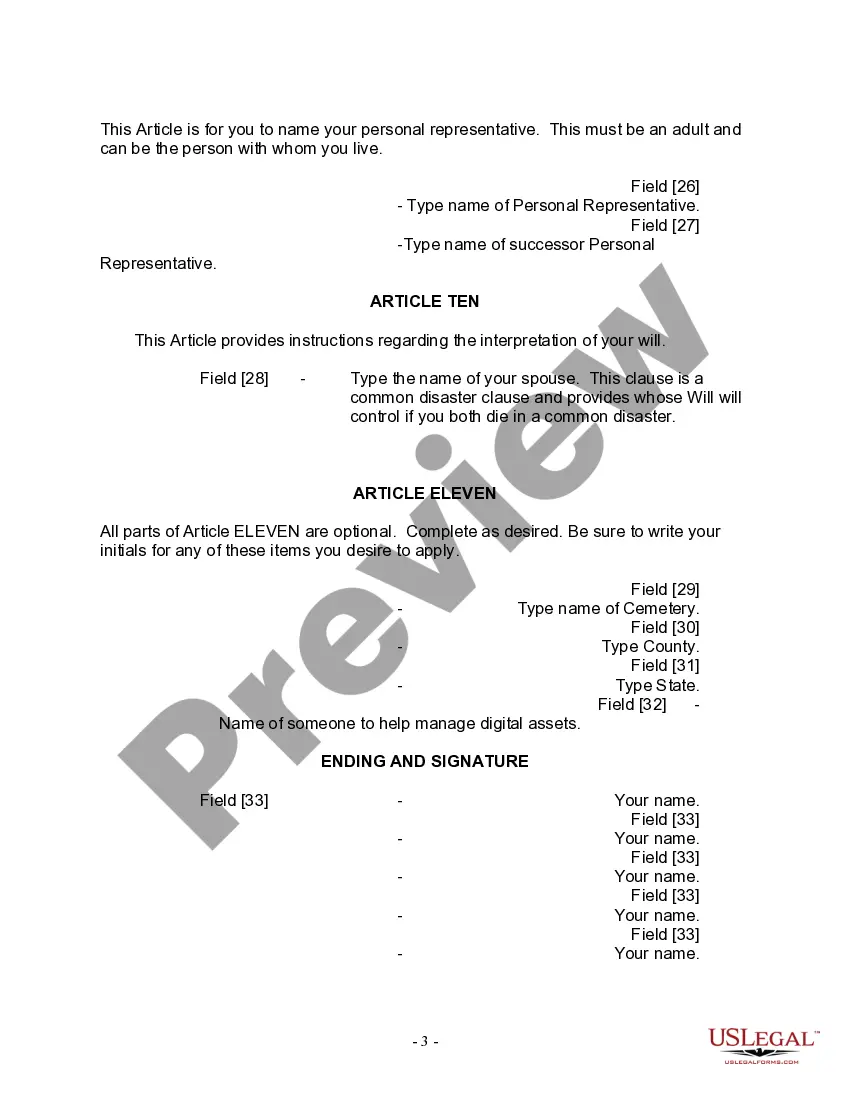

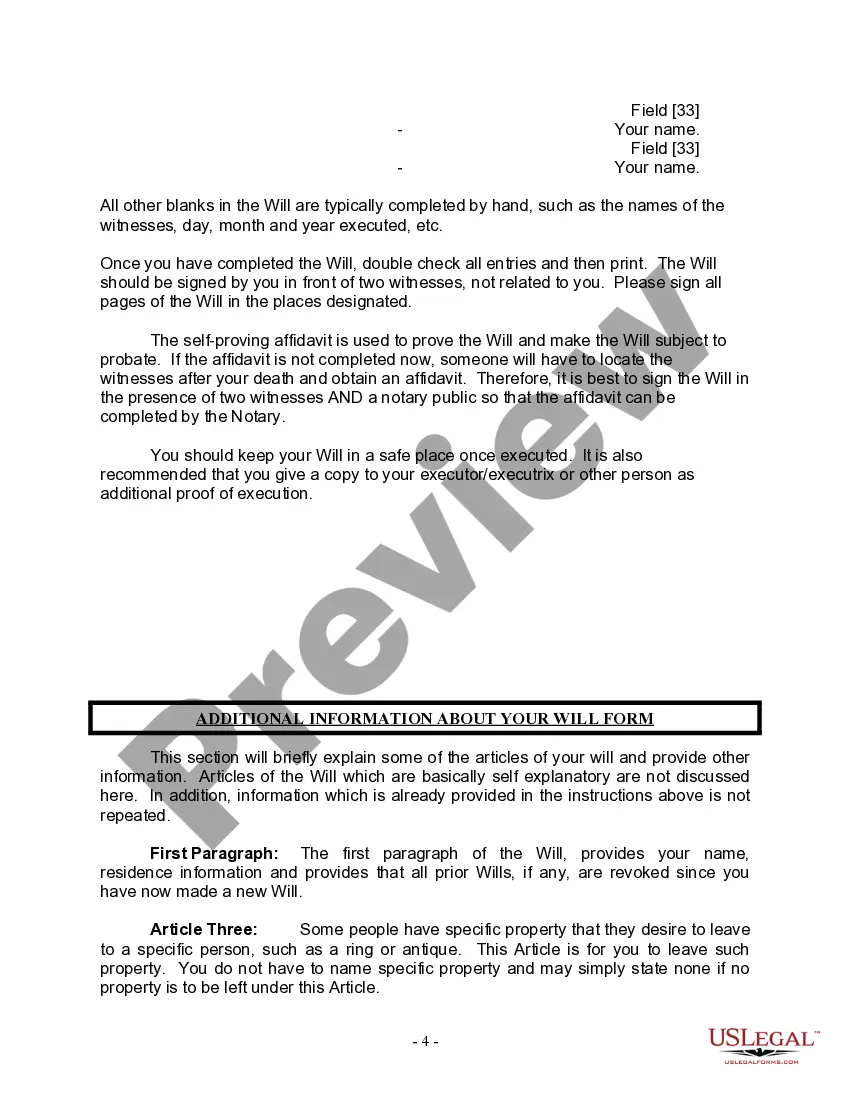

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Arvada Colorado Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows individuals in Arvada, Colorado, who are married and have no children, to outline their wishes regarding the distribution of their assets, appointment of executors, guardianship of dependents, and other important matters after their demise. This particular type of last will and testament form is specifically designed for married individuals who do not have any children, ensuring that their estate is properly handled and allocated according to their wishes. While variations may exist depending on specific preferences and circumstances, the core components of this form typically include: 1. Personal Information: This section collects the individual's personal details, such as their full name, address, and marital status. 2. Appointment of Executor: The individual can designate an executor, who will be responsible for managing the estate, ensuring debts and taxes are paid, and distributing assets as directed in the will. 3. Distribution of Assets: In this section, the individual can specify how their assets, including real estate, bank accounts, investments, and personal belongings, should be distributed among beneficiaries, such as their spouse, relatives, friends, or charitable organizations. 4. Healthcare Directive: This portion allows the individual to express their healthcare preferences, such as the appointment of a healthcare proxy or instructions for end-of-life medical treatment. 5. Alternative Beneficiaries: If a designated beneficiary predeceases the individual or is unable to receive the assets, alternative beneficiaries can be named to ensure that the assets are distributed as intended. 6. Funeral and Burial Wishes: This section allows individuals to document their preferences for funeral arrangements, burial or cremation options, and any specific rituals or ceremonies they wish to be observed. It's essential to note that there might be variations of this specific last will and testament form tailored to the unique requirements of individuals with no children but specific circumstances, such as property ownership, businesses, or complex financial situations. However, these variations are typically based on the core components mentioned above and serve to provide a more comprehensive and accurate representation of one's wishes when distributing their estate. It is advisable to consult with an attorney or legal professional experienced in estate planning in Arvada to ensure that the Last Will and Testament Form complies with Colorado state laws and accurately reflects the individual's intentions. This professional guidance will help ensure the document's validity and provide peace of mind that one's wishes will be carried out as intended.

Arvada Colorado Legal Last Will and Testament Form for a Married Person with No Children is a legally binding document that allows individuals in Arvada, Colorado, who are married and have no children, to outline their wishes regarding the distribution of their assets, appointment of executors, guardianship of dependents, and other important matters after their demise. This particular type of last will and testament form is specifically designed for married individuals who do not have any children, ensuring that their estate is properly handled and allocated according to their wishes. While variations may exist depending on specific preferences and circumstances, the core components of this form typically include: 1. Personal Information: This section collects the individual's personal details, such as their full name, address, and marital status. 2. Appointment of Executor: The individual can designate an executor, who will be responsible for managing the estate, ensuring debts and taxes are paid, and distributing assets as directed in the will. 3. Distribution of Assets: In this section, the individual can specify how their assets, including real estate, bank accounts, investments, and personal belongings, should be distributed among beneficiaries, such as their spouse, relatives, friends, or charitable organizations. 4. Healthcare Directive: This portion allows the individual to express their healthcare preferences, such as the appointment of a healthcare proxy or instructions for end-of-life medical treatment. 5. Alternative Beneficiaries: If a designated beneficiary predeceases the individual or is unable to receive the assets, alternative beneficiaries can be named to ensure that the assets are distributed as intended. 6. Funeral and Burial Wishes: This section allows individuals to document their preferences for funeral arrangements, burial or cremation options, and any specific rituals or ceremonies they wish to be observed. It's essential to note that there might be variations of this specific last will and testament form tailored to the unique requirements of individuals with no children but specific circumstances, such as property ownership, businesses, or complex financial situations. However, these variations are typically based on the core components mentioned above and serve to provide a more comprehensive and accurate representation of one's wishes when distributing their estate. It is advisable to consult with an attorney or legal professional experienced in estate planning in Arvada to ensure that the Last Will and Testament Form complies with Colorado state laws and accurately reflects the individual's intentions. This professional guidance will help ensure the document's validity and provide peace of mind that one's wishes will be carried out as intended.