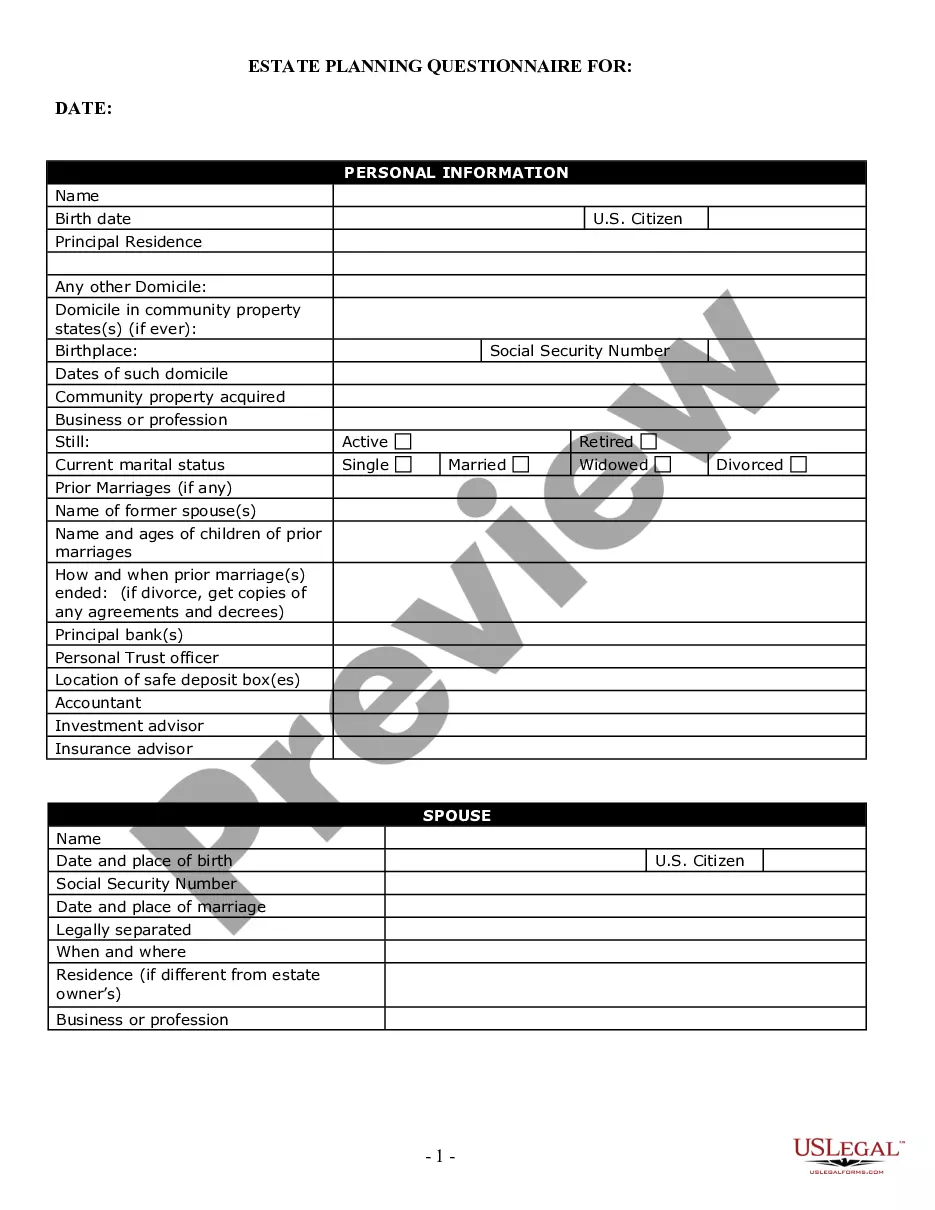

Centennial Colorado Estate Planning Questionnaire and Worksheets are comprehensive tools designed to assist individuals and families in organizing and planning their estates effectively. These questionnaires and worksheets act as detailed guides, ensuring that no crucial aspect of estate planning is overlooked. The Centennial Colorado Estate Planning Questionnaire and Worksheets encompass various key areas, including: 1. Personal Information: These documents gather vital personal details such as full legal names, addresses, contact information, and social security numbers of individuals involved in the estate planning process. 2. Asset Inventory: This section prompts individuals to comprehensively list and categorize their assets, including real estate properties, bank accounts, investments, insurance policies, retirement funds, and personal belongings. It helps in assessing the overall value of the estate and facilitates proper distribution and management. 3. Beneficiary Designation: The worksheets provide space to specify beneficiaries and their relationship to the estate owner. It ensures that the intentions for the distribution of assets are clearly documented, minimizing the potential for disputes and confusion. 4. Guardianship Provisions: These documents offer a structured approach for naming guardians for minor children. They allow individuals to express their desires regarding the care and upbringing of their children in the event of their untimely demise. 5. Healthcare Directives: Centennial Colorado Estate Planning Questionnaire and Worksheets also emphasize medical and end-of-life decision-making. They include sections for designating a healthcare power of attorney and outlining specific wishes regarding medical treatments, life support, and organ donation. 6. Tax Planning: In this section, individuals are encouraged to identify potential tax implications on their estates and explore strategies to minimize such liabilities. It enables efficient tax planning to preserve the maximum value of the estate for the intended beneficiaries. 7. Executor Appointment: These worksheets guide individuals in selecting a trusted person as their executor, whose responsibility is to oversee the distribution of assets and ensure adherence to the established estate plan. Furthermore, there might be additional types of Centennial Colorado Estate Planning Questionnaire and Worksheets customized to cater to specific estate planning needs. These may include: — Trust Planning Questionnaire and Worksheets: Focused on establishing and managing trusts to efficiently transfer assets and minimize probate. — Business Succession Planning Questionnaire and Worksheets: Tailored for business owners to plan for the smooth transition or continuity of their businesses. — Charitable Giving Questionnaire and Worksheets: Geared towards individuals interested in incorporating philanthropic endeavors within their estate plan. Centennial Colorado Estate Planning Questionnaire and Worksheets provide a comprehensive approach to estate planning, ensuring that individuals can confidently and efficiently organize their assets, protect their loved ones, and leave a lasting legacy according to their wishes.

Centennial Colorado Estate Planning Questionnaire and Worksheets

Description

How to fill out Centennial Colorado Estate Planning Questionnaire And Worksheets?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents for both personal and professional requirements as well as various real-life situations.

All files are skillfully categorized by usage area and jurisdiction, making the search for the Centennial Colorado Estate Planning Questionnaire and Worksheets as simple as one, two, three.

Maintaining documentation organized and compliant with legal standards is of utmost significance. Leverage the US Legal Forms library to always have vital document templates readily available for any requirement!

- Examine the Preview feature and form description.

- Ensure you’ve selected the right one that meets your requirements and fully aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- Should you notice any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the following step.

- Purchase the form. Click on the Buy Now button and choose the subscription plan you wish.

Form popularity

FAQ

You can write your own will in Colorado, but it is crucial to follow specific state laws to ensure your will is valid. By using the Centennial Colorado Estate Planning Questionnaire and Worksheets, you can create a clear and legally sound document that reflects your wishes. This resource provides structured guidance, making the process straightforward and accessible. If you need assistance, consider using uslegalforms, where you can find templates and tools tailored for Colorado residents.

Basic estate planning tools typically include wills, trusts, powers of attorney, and advance healthcare directives. Each tool serves a unique purpose in managing your estate and ensuring your wishes are followed. By utilizing the Centennial Colorado Estate Planning Questionnaire and Worksheets, you can easily identify which tools are best suited for your needs. Understanding these tools helps in creating a balanced estate plan that protects your interests and reduces complications for your loved ones.

The four essential steps in effective estate planning include assessing your assets, determining your beneficiaries, creating necessary documents, and regularly reviewing your plan. First, you should compile a comprehensive list of your assets. Next, decide who will benefit from your estate and any future guardianship arrangements. By employing the Centennial Colorado Estate Planning Questionnaire and Worksheets, you can simplify each step while ensuring thoroughness and clarity throughout the planning process.

An estate questionnaire is a vital tool that helps individuals gather important information about their assets, debts, and personal wishes regarding their estate. By utilizing the Centennial Colorado Estate Planning Questionnaire and Worksheets, you can streamline the process of documenting your estate details. This questionnaire prompts you to consider various aspects such as beneficiaries, guardianship, and specific bequests. Completing it can clarify your intentions and streamline your estate planning process.

Organizing documents for estate planning requires a systematic approach. Begin by creating labeled folders for various categories such as wills, trusts, financial accounts, and healthcare directives. Implement the Centennial Colorado Estate Planning Questionnaire and Worksheets to assist in documenting and structuring your files effectively, making it easier for your loved ones to access them when needed.

Filling out an estate planning questionnaire can seem daunting, but it is straightforward with the right guidance. Start by gathering relevant documents that detail your assets, liabilities, and personal wishes. Utilize the Centennial Colorado Estate Planning Questionnaire and Worksheets to systematically record this information, ensuring you cover all crucial aspects of your estate plan.

The 5 by 5 rule is a provision regarding trusts that allows beneficiaries to withdraw up to five percent of the trust assets or $5,000 annually, whichever is greater. This rule can enhance flexibility in managing trust distributions. Understanding this concept is essential when using the Centennial Colorado Estate Planning Questionnaire and Worksheets, as it defines how advantages can be provided to your heirs.

The 5 and 5 rule refers to a tax provision that allows a person to gift a certain amount without incurring gift tax. Specifically, you can gift up to $15,000 per year to as many individuals as you wish without triggering taxes. However, it is crucial to understand how this rule works when you're filling out the Centennial Colorado Estate Planning Questionnaire and Worksheets, as it may impact your estate planning strategy.

To list your assets in a will, begin by conducting a thorough inventory of your belongings. Include real estate, bank accounts, investments, personal items, and any valuable possessions. With the help of the Centennial Colorado Estate Planning Questionnaire and Worksheets, you can systematically categorize these assets to ensure clarity and compliance with your wishes.

Preparing estate planning documents involves several critical steps. First, gather essential information about your assets and liabilities. Next, use the Centennial Colorado Estate Planning Questionnaire and Worksheets to identify your wishes regarding asset distribution, healthcare, and guardianship. Completing these worksheets helps ensure that you address all necessary components of your estate plan.