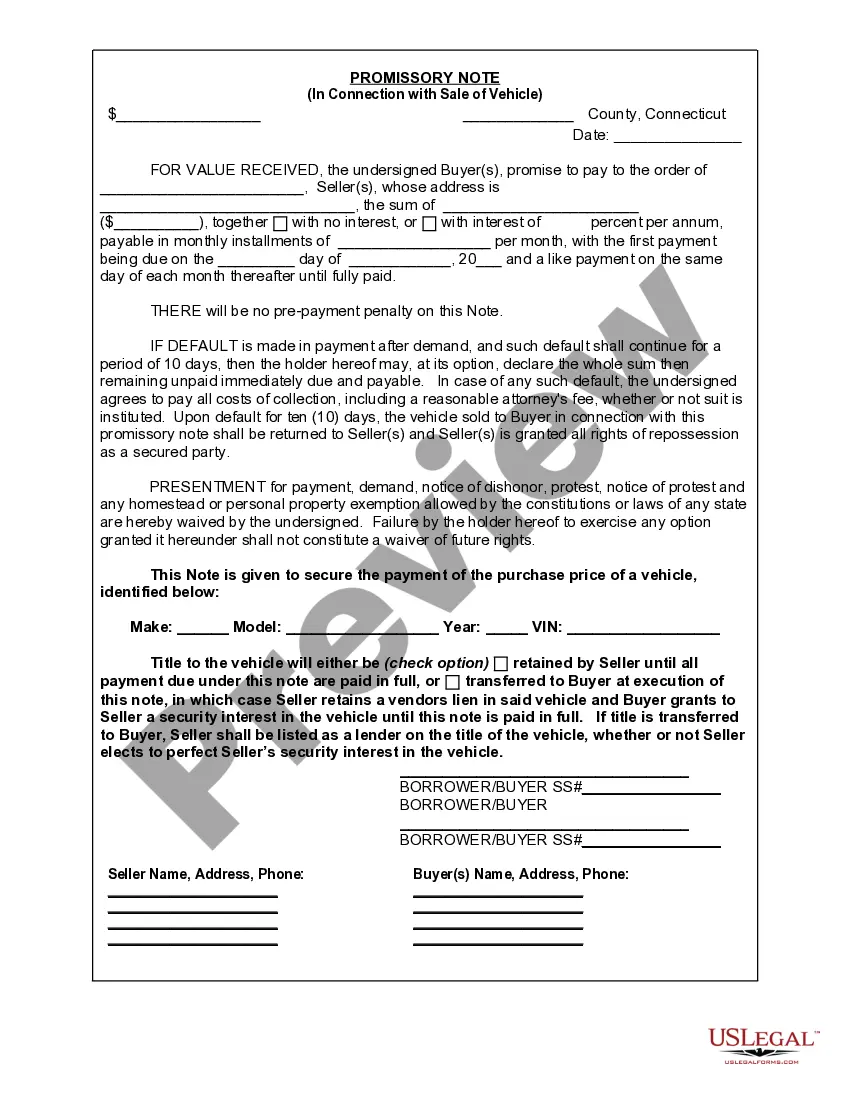

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Waterbury Connecticut Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document used when a person sells a vehicle or automobile and agrees to receive payments from the buyer over a specified period of time. It is a written agreement that outlines the terms and conditions of the sale, including the purchase price, payment schedule, and consequences for non-payment. When creating a Waterbury Connecticut Promissory Note, it is crucial to include certain key elements to ensure its validity and effectiveness. These include: 1. Identification of Parties: The promissory note should clearly identify the seller (also known as the "lender" or "payee") and the buyer (also known as the "borrower" or "promise"). Include their legal names and addresses. 2. Vehicle Description: Provide a detailed description of the vehicle being sold, including the make, model, year, VIN (vehicle identification number), and any other relevant details that uniquely identify the vehicle. 3. Purchase Price: State the agreed-upon purchase price for the vehicle in both numerical and written form. Clearly outline if any deposit has been made and subtract it from the total purchase price. 4. Payment Terms: Specify the payment terms, including the amount of each installment, the due date for each payment, and the total duration of the payment schedule. Additionally, indicate whether interest will be charged on the outstanding balance and, if so, the applicable interest rate. 5. Late Payments and Default: Define the consequences for late payments or default on the agreed-upon payment plan. Include details regarding any late payment fees or charges, the grace period (if any), and the actions that can be taken by the seller in the event of non-payment. 6. Collateral and Security: If the promissory note is secured by the vehicle itself (meaning the seller can repossess the vehicle in the event of default), include specific language outlining this provision. This will legally protect the seller's interest in the vehicle. Please note that there might be variations or additional types of promissory notes specific to different situations or circumstances in Waterbury, Connecticut. For instance, you may find variations for private party vehicle sales, dealership financing, or lease-to-own agreements. To ensure compliance with local laws, it is advisable to consult with a legal professional or utilize pre-approved promissory note templates specifically designed for Waterbury, Connecticut. This will help ensure that the document covers all necessary aspects and holds up in a court of law if disputes arise. In conclusion, a Waterbury Connecticut Promissory Note in Connection with Sale of Vehicle or Automobile serves as a legal contract between a seller and a buyer when selling a vehicle with a payment plan. This document safeguards the rights and obligations of both parties throughout the sale process, providing clarity and legal protection.A Waterbury Connecticut Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document used when a person sells a vehicle or automobile and agrees to receive payments from the buyer over a specified period of time. It is a written agreement that outlines the terms and conditions of the sale, including the purchase price, payment schedule, and consequences for non-payment. When creating a Waterbury Connecticut Promissory Note, it is crucial to include certain key elements to ensure its validity and effectiveness. These include: 1. Identification of Parties: The promissory note should clearly identify the seller (also known as the "lender" or "payee") and the buyer (also known as the "borrower" or "promise"). Include their legal names and addresses. 2. Vehicle Description: Provide a detailed description of the vehicle being sold, including the make, model, year, VIN (vehicle identification number), and any other relevant details that uniquely identify the vehicle. 3. Purchase Price: State the agreed-upon purchase price for the vehicle in both numerical and written form. Clearly outline if any deposit has been made and subtract it from the total purchase price. 4. Payment Terms: Specify the payment terms, including the amount of each installment, the due date for each payment, and the total duration of the payment schedule. Additionally, indicate whether interest will be charged on the outstanding balance and, if so, the applicable interest rate. 5. Late Payments and Default: Define the consequences for late payments or default on the agreed-upon payment plan. Include details regarding any late payment fees or charges, the grace period (if any), and the actions that can be taken by the seller in the event of non-payment. 6. Collateral and Security: If the promissory note is secured by the vehicle itself (meaning the seller can repossess the vehicle in the event of default), include specific language outlining this provision. This will legally protect the seller's interest in the vehicle. Please note that there might be variations or additional types of promissory notes specific to different situations or circumstances in Waterbury, Connecticut. For instance, you may find variations for private party vehicle sales, dealership financing, or lease-to-own agreements. To ensure compliance with local laws, it is advisable to consult with a legal professional or utilize pre-approved promissory note templates specifically designed for Waterbury, Connecticut. This will help ensure that the document covers all necessary aspects and holds up in a court of law if disputes arise. In conclusion, a Waterbury Connecticut Promissory Note in Connection with Sale of Vehicle or Automobile serves as a legal contract between a seller and a buyer when selling a vehicle with a payment plan. This document safeguards the rights and obligations of both parties throughout the sale process, providing clarity and legal protection.