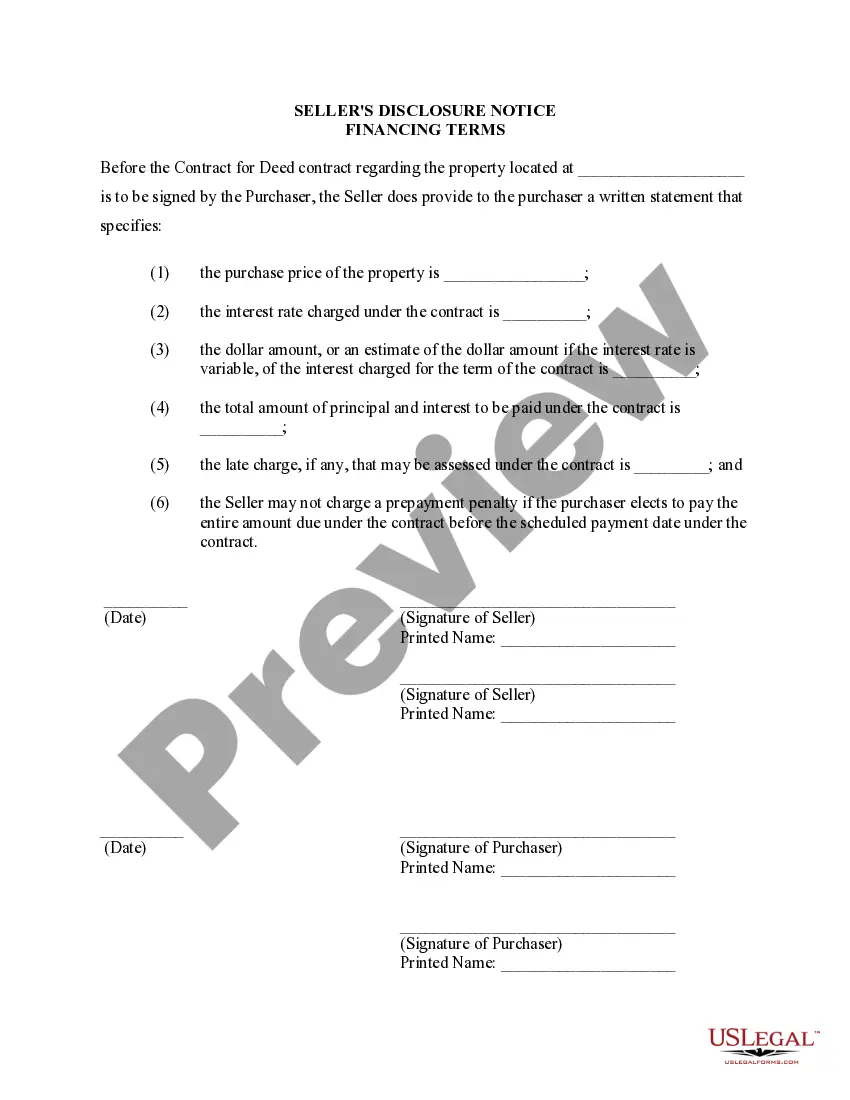

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Stamford Connecticut Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the financing terms and conditions between the seller and the buyer. This disclosure provides transparency and clarity regarding the financial obligations and agreements associated with the purchase of a residential property in Stamford, Connecticut. Below, you will find detailed information about the key components and types of disclosures related to this topic. 1. Understanding Seller's Disclosure of Financing Terms: The Seller's Disclosure of Financing Terms is a legally binding agreement that discloses valuable information about the terms of financing for a residential property purchase in Stamford, Connecticut. It serves to protect the interests of both the buyer and the seller involved in the transaction, ensuring that all financial obligations and expectations are clearly communicated and understood. 2. Key Components of the Stamford Connecticut Seller's Disclosure: a. Financing Method: This section outlines the specific financing method employed in the agreement, such as a Land Contract or Agreement for Deed. b. Purchase Price: The purchase price of the property is detailed here, including any down payments or lump-sum payments required. c. Payment Schedule: The payment schedule specifies the frequency (monthly, quarterly, etc.) and the due date for payments during the agreed-upon term. d. Interest Rate: The interest rate applicable to the financing is stated in this section. It outlines whether it is fixed or variable and specifies any changes or adjustments over time. e. Late Payment Policy: This section explains the consequences or penalties for late payments, including any applicable fees or charges. f. Title and Ownership: The disclosure clarifies the transfer and ownership of the property during the financing period, which may differ from traditional mortgage arrangements. g. Rights and Responsibilities: This section describes the rights and responsibilities of both parties, including maintenance responsibilities, property taxes, insurance requirements, and potential alterations or improvements to the property. h. Default and Remedies: The disclosure includes information about the consequences of default, the conditions under which the agreement can be terminated, and the remedies available to both parties in case of default. 3. Types of Stamford Connecticut Seller's Disclosure of Financing Terms: a. Standard Seller's Disclosure: This is the most common type of disclosure used in residential property transactions. It covers all the essential financing terms and conditions mentioned above. b. Customized Seller's Disclosure: In some cases, the buyer and seller may negotiate specific modifications or additional terms to the standard disclosure to suit their unique needs and circumstances. These customized disclosures ensure that any special agreements or arrangements are written, formalized, and legally binding. In conclusion, the Stamford Connecticut Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed (Land Contract) provides comprehensive information about the financial aspects of purchasing a residential property. Buyers and sellers need to review and understand this disclosure thoroughly to make informed decisions and protect their rights throughout the transaction.Stamford Connecticut Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the financing terms and conditions between the seller and the buyer. This disclosure provides transparency and clarity regarding the financial obligations and agreements associated with the purchase of a residential property in Stamford, Connecticut. Below, you will find detailed information about the key components and types of disclosures related to this topic. 1. Understanding Seller's Disclosure of Financing Terms: The Seller's Disclosure of Financing Terms is a legally binding agreement that discloses valuable information about the terms of financing for a residential property purchase in Stamford, Connecticut. It serves to protect the interests of both the buyer and the seller involved in the transaction, ensuring that all financial obligations and expectations are clearly communicated and understood. 2. Key Components of the Stamford Connecticut Seller's Disclosure: a. Financing Method: This section outlines the specific financing method employed in the agreement, such as a Land Contract or Agreement for Deed. b. Purchase Price: The purchase price of the property is detailed here, including any down payments or lump-sum payments required. c. Payment Schedule: The payment schedule specifies the frequency (monthly, quarterly, etc.) and the due date for payments during the agreed-upon term. d. Interest Rate: The interest rate applicable to the financing is stated in this section. It outlines whether it is fixed or variable and specifies any changes or adjustments over time. e. Late Payment Policy: This section explains the consequences or penalties for late payments, including any applicable fees or charges. f. Title and Ownership: The disclosure clarifies the transfer and ownership of the property during the financing period, which may differ from traditional mortgage arrangements. g. Rights and Responsibilities: This section describes the rights and responsibilities of both parties, including maintenance responsibilities, property taxes, insurance requirements, and potential alterations or improvements to the property. h. Default and Remedies: The disclosure includes information about the consequences of default, the conditions under which the agreement can be terminated, and the remedies available to both parties in case of default. 3. Types of Stamford Connecticut Seller's Disclosure of Financing Terms: a. Standard Seller's Disclosure: This is the most common type of disclosure used in residential property transactions. It covers all the essential financing terms and conditions mentioned above. b. Customized Seller's Disclosure: In some cases, the buyer and seller may negotiate specific modifications or additional terms to the standard disclosure to suit their unique needs and circumstances. These customized disclosures ensure that any special agreements or arrangements are written, formalized, and legally binding. In conclusion, the Stamford Connecticut Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed (Land Contract) provides comprehensive information about the financial aspects of purchasing a residential property. Buyers and sellers need to review and understand this disclosure thoroughly to make informed decisions and protect their rights throughout the transaction.