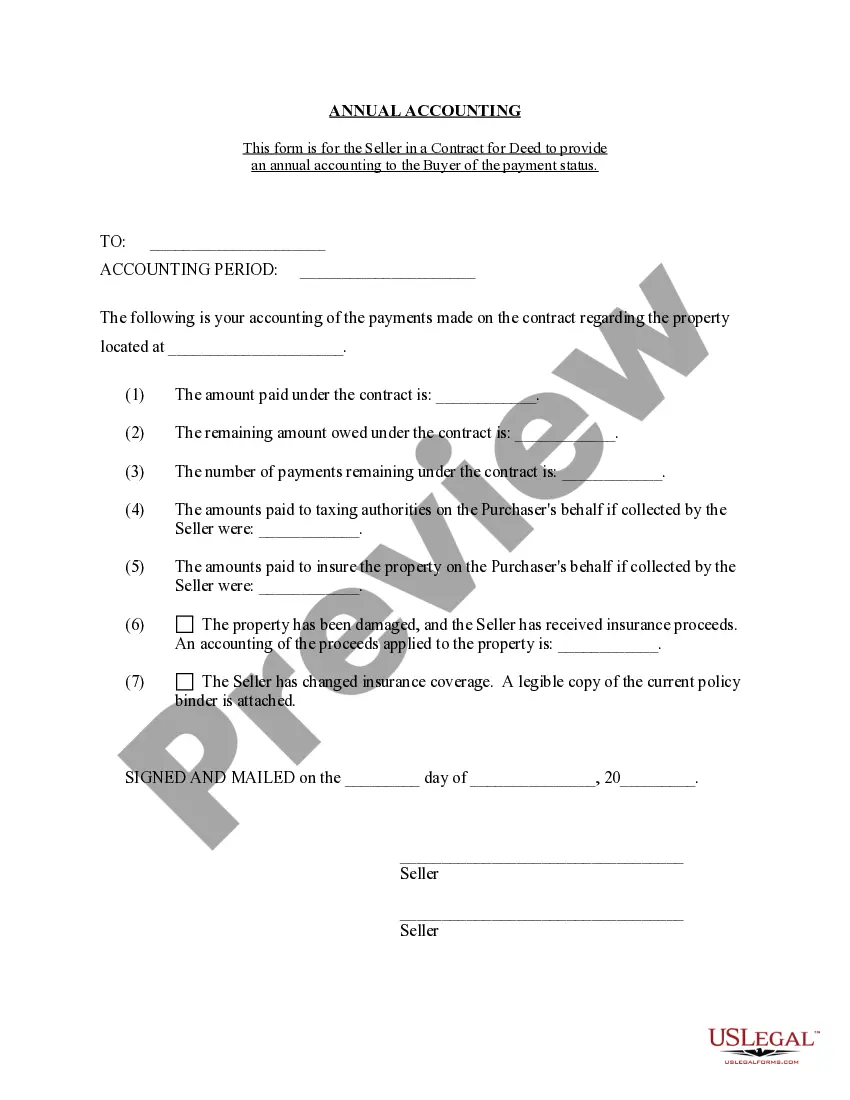

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement refers to a comprehensive document designed for sellers who offer properties through a contract for deed arrangement in Stamford, Connecticut. This accounting statement provides a detailed summary of the financial transactions and obligations related to the contract for deed agreement over a specific annual period. Here, we will explore the key components and important aspects of a Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement. The Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement typically includes the following information: 1. Property Details: This section details the specific property covered by the contract for deed agreement, including the address, legal description, and any relevant identification numbers. 2. Seller Information: The accounting statement itemizes the seller's contact information, including their name, address, phone number, and email. 3. Buyer Information: This section lists the buyer's contact details, including their name, address, phone number, and email. It is important to accurately identify the buyer to ensure correct tracking of financial transactions. 4. Payment Summary: The accounting statement provides a summarized overview of all payments made by the buyer over the annual period of the contract for deed. This includes the total amount received, the breakdown of principal and interest payments, and any additional fees or charges. 5. Expenses and Deductions: This section outlines any expenses incurred by the seller and any appropriate deductions from the buyer's payments. Possible expenses may include property taxes, insurance premiums, maintenance costs, or legal fees related to the contract for deed. 6. Escrow Account Details: If an escrow account is established as part of the contract for deed agreement, this section provides a summary of its activity. It includes any deposits or disbursements made from the account, such as property tax payments or insurance premiums. 7. Balance and Delinquencies: The accounting statement includes a calculation of the remaining principal balance owed by the buyer, along with any delinquencies or missed payments. This information is crucial for tracking the buyer's financial obligations and identifying any potential issues. Different types or variations of Stamford Connecticut Contract for Deed Seller's Annual Accounting Statements may exist based on specific contractual terms, additional clauses, or unique requirements put forth by the parties involved. Some variations may include: 1. Enhanced Expense Tracking: This type of accounting statement may provide a more detailed breakdown of expenses, such as repair and maintenance costs, utilities, or any other specified financial obligations. 2. Amortization Schedule: In some cases, sellers may choose to include an amortization schedule within the accounting statement to outline the gradual payment of principal and interest, showcasing the remaining balance after each payment. 3. Customized Addenda: Additional addenda to the accounting statement may be included to outline specific terms related to the contract for deed arrangement. This could include provisions for late fees, prepayment penalties, or any other relevant contractual terms. Overall, a Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement is a vital financial tool that helps both sellers and buyers monitor and maintain a clear record of all financial transactions, ensuring transparency and accountability throughout the contract for deed agreement.Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement refers to a comprehensive document designed for sellers who offer properties through a contract for deed arrangement in Stamford, Connecticut. This accounting statement provides a detailed summary of the financial transactions and obligations related to the contract for deed agreement over a specific annual period. Here, we will explore the key components and important aspects of a Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement. The Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement typically includes the following information: 1. Property Details: This section details the specific property covered by the contract for deed agreement, including the address, legal description, and any relevant identification numbers. 2. Seller Information: The accounting statement itemizes the seller's contact information, including their name, address, phone number, and email. 3. Buyer Information: This section lists the buyer's contact details, including their name, address, phone number, and email. It is important to accurately identify the buyer to ensure correct tracking of financial transactions. 4. Payment Summary: The accounting statement provides a summarized overview of all payments made by the buyer over the annual period of the contract for deed. This includes the total amount received, the breakdown of principal and interest payments, and any additional fees or charges. 5. Expenses and Deductions: This section outlines any expenses incurred by the seller and any appropriate deductions from the buyer's payments. Possible expenses may include property taxes, insurance premiums, maintenance costs, or legal fees related to the contract for deed. 6. Escrow Account Details: If an escrow account is established as part of the contract for deed agreement, this section provides a summary of its activity. It includes any deposits or disbursements made from the account, such as property tax payments or insurance premiums. 7. Balance and Delinquencies: The accounting statement includes a calculation of the remaining principal balance owed by the buyer, along with any delinquencies or missed payments. This information is crucial for tracking the buyer's financial obligations and identifying any potential issues. Different types or variations of Stamford Connecticut Contract for Deed Seller's Annual Accounting Statements may exist based on specific contractual terms, additional clauses, or unique requirements put forth by the parties involved. Some variations may include: 1. Enhanced Expense Tracking: This type of accounting statement may provide a more detailed breakdown of expenses, such as repair and maintenance costs, utilities, or any other specified financial obligations. 2. Amortization Schedule: In some cases, sellers may choose to include an amortization schedule within the accounting statement to outline the gradual payment of principal and interest, showcasing the remaining balance after each payment. 3. Customized Addenda: Additional addenda to the accounting statement may be included to outline specific terms related to the contract for deed arrangement. This could include provisions for late fees, prepayment penalties, or any other relevant contractual terms. Overall, a Stamford Connecticut Contract for Deed Seller's Annual Accounting Statement is a vital financial tool that helps both sellers and buyers monitor and maintain a clear record of all financial transactions, ensuring transparency and accountability throughout the contract for deed agreement.