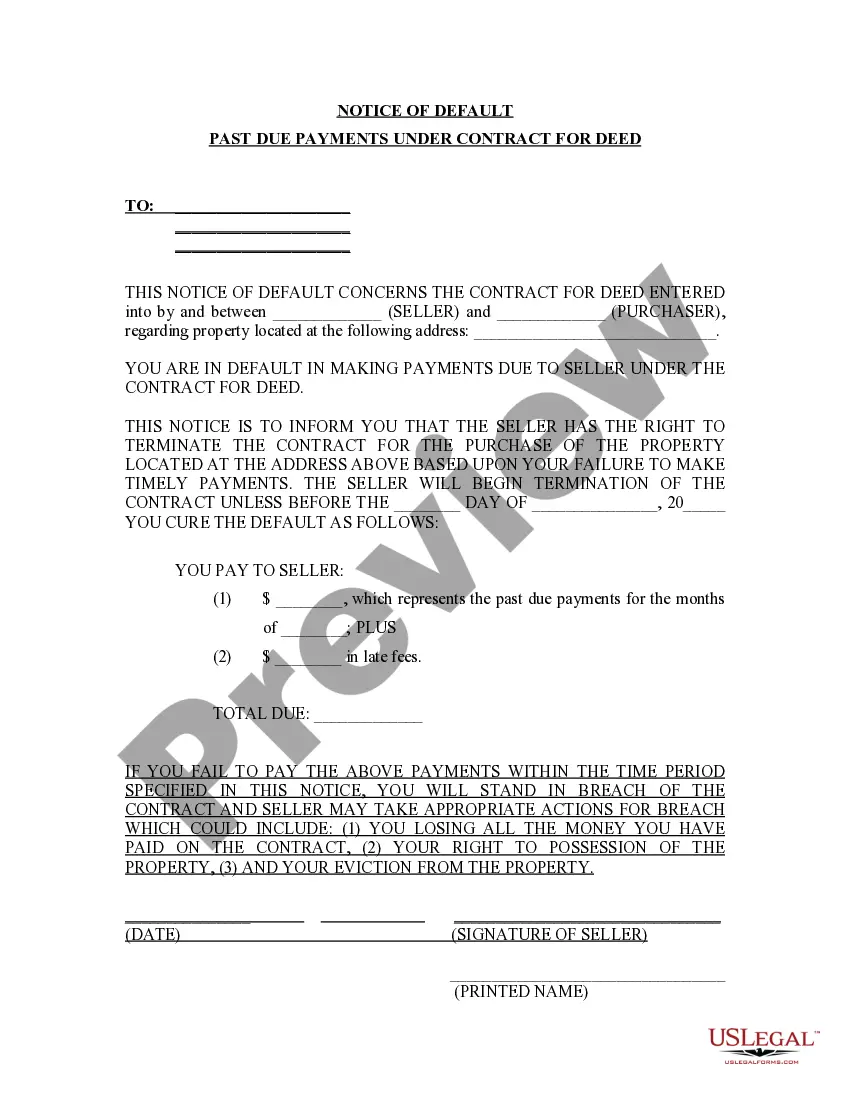

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Bridgeport Connecticut Notice of Default for Past Due Payments in connection with Contract for Deed: A Notice of Default for Past Due Payments is a legal document issued by the Bridgeport, Connecticut authorities to notify the parties involved in a Contract for Deed about the non-payment or past-due status of the agreed-upon payments. It serves as a legal warning to the contracting parties that they have failed to meet their financial obligations as stipulated in the Contract for Deed. The purpose of this notice is to inform the defaulting party of their breach in payment and provide an opportunity for them to rectify the situation within a specific timeframe. Failure to comply with the terms outlined in the Bridgeport Connecticut Notice of Default may result in further legal actions, such as foreclosure proceedings. There are different types of Bridgeport Connecticut Notices of Default for Past Due Payments, categorized based on the severity of the default and the actions required to resolve the issue: 1. Initial Notice of Default: This is the first notice issued when a payment is missed or overdue. It includes details of the missed payment, the outstanding balance, and the grace period within which the defaulting party must take action to correct the situation. 2. Second Notice of Default: If the defaulting party fails to respond or rectify the situation within the grace period provided in the initial notice, a second notice is issued. This notice highlights the continued failure and warns of potential legal consequences if immediate action is not taken. 3. Notice of Intent to Accelerate: If the defaulting party continues to disregard the previous notices, the Notice of Intent to Accelerate is issued. It notifies the defaulting party that the entire outstanding balance, along with any associated fees or penalties, is now due immediately. This notice usually sets a specific timeframe within which the defaulting party must bring the account current to avoid further legal actions. 4. Notice of Foreclosure Proceedings: If the defaulting party fails to comply with the terms outlined in the preceding notices, the lender or the holder of the Contract for Deed may initiate foreclosure proceedings. This notice informs the defaulting party of the legal action being taken, the date of the foreclosure sale, and the potential consequences of not resolving the default. It is important for both parties involved in a Contract for Deed to adhere to the outlined payment obligations. However, if circumstances arise that prevent timely payments, it is crucial for the defaulting party to address the situation promptly and communicate with the other party or their legal representatives in order to avoid further legal complications.