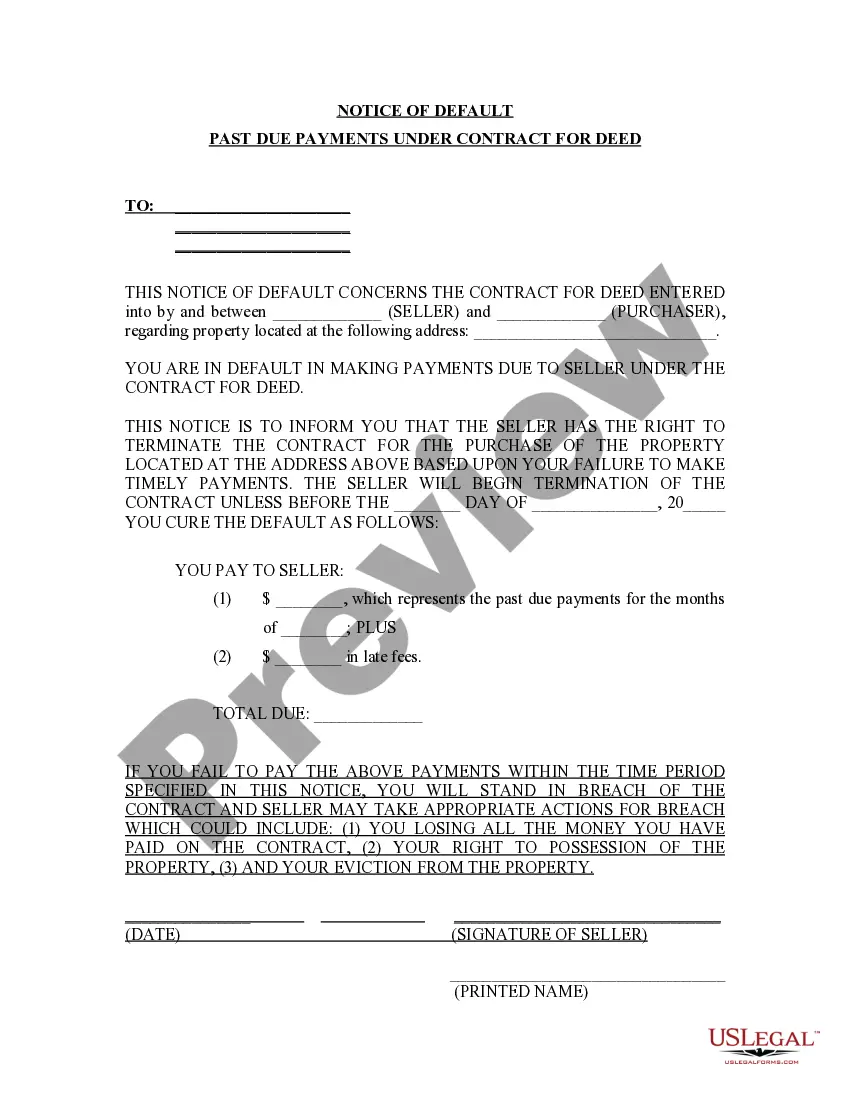

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Waterbury Connecticut Notice of Default for Past Due Payments in connection with Contract for Deed A Notice of Default for Past Due Payments in connection with a Contract for Deed is an official notification served to the buyer by the seller in the event of non-payment or default under the terms of a Contract for Deed agreement. This notice outlines the buyer's failure to meet their financial obligations and serves as a warning that legal action may be taken. In Waterbury, Connecticut, there are several types of Notices of Default for Past Due Payments in connection with a Contract for Deed, depending on the specific circumstances: 1. Initial Notice of Default: This notice is typically sent after the buyer has failed to make a payment within the agreed-upon grace period. It states the outstanding amount, due date, and specific payment terms that have been violated. This notice gives the buyer an opportunity to rectify the default within a specified time frame to avoid further actions. 2. Second Notice of Default: If the buyer fails to cure the default within the allotted time frame mentioned in the initial notice, a second notice is sent. This notice emphasizes the seriousness of the situation and warns the buyer of potential legal consequences if the default remains unresolved. 3. Notice of Acceleration: If the buyer fails to cure the default even after receiving both the initial and second notices, the seller may issue a Notice of Acceleration. This notice states that the entire remaining balance of the contract is now due and payable. It provides a final opportunity for the buyer to resolve the default and bring all payments up to date to avoid the initiation of foreclosure proceedings. 4. Notice of Foreclosure: If the buyer fails to rectify the default and bring the payments up to date as per the Notice of Acceleration, the seller may initiate foreclosure proceedings. A Notice of Foreclosure is typically served, indicating the commencement of legal action to reclaim the property due to the buyer's continuous default on payments. Failure to respond to any of these notices may lead to the buyer losing their rights to the property and facing potential legal consequences. In conclusion, a Waterbury Connecticut Notice of Default for Past Due Payments in connection with a Contract for Deed serves as a formal communication to the buyer regarding their failure to meet their financial obligations. It is important for buyers to understand the seriousness of these notices and take prompt action to resolve any outstanding defaults to protect their rights and avoid further legal consequences.Waterbury Connecticut Notice of Default for Past Due Payments in connection with Contract for Deed A Notice of Default for Past Due Payments in connection with a Contract for Deed is an official notification served to the buyer by the seller in the event of non-payment or default under the terms of a Contract for Deed agreement. This notice outlines the buyer's failure to meet their financial obligations and serves as a warning that legal action may be taken. In Waterbury, Connecticut, there are several types of Notices of Default for Past Due Payments in connection with a Contract for Deed, depending on the specific circumstances: 1. Initial Notice of Default: This notice is typically sent after the buyer has failed to make a payment within the agreed-upon grace period. It states the outstanding amount, due date, and specific payment terms that have been violated. This notice gives the buyer an opportunity to rectify the default within a specified time frame to avoid further actions. 2. Second Notice of Default: If the buyer fails to cure the default within the allotted time frame mentioned in the initial notice, a second notice is sent. This notice emphasizes the seriousness of the situation and warns the buyer of potential legal consequences if the default remains unresolved. 3. Notice of Acceleration: If the buyer fails to cure the default even after receiving both the initial and second notices, the seller may issue a Notice of Acceleration. This notice states that the entire remaining balance of the contract is now due and payable. It provides a final opportunity for the buyer to resolve the default and bring all payments up to date to avoid the initiation of foreclosure proceedings. 4. Notice of Foreclosure: If the buyer fails to rectify the default and bring the payments up to date as per the Notice of Acceleration, the seller may initiate foreclosure proceedings. A Notice of Foreclosure is typically served, indicating the commencement of legal action to reclaim the property due to the buyer's continuous default on payments. Failure to respond to any of these notices may lead to the buyer losing their rights to the property and facing potential legal consequences. In conclusion, a Waterbury Connecticut Notice of Default for Past Due Payments in connection with a Contract for Deed serves as a formal communication to the buyer regarding their failure to meet their financial obligations. It is important for buyers to understand the seriousness of these notices and take prompt action to resolve any outstanding defaults to protect their rights and avoid further legal consequences.