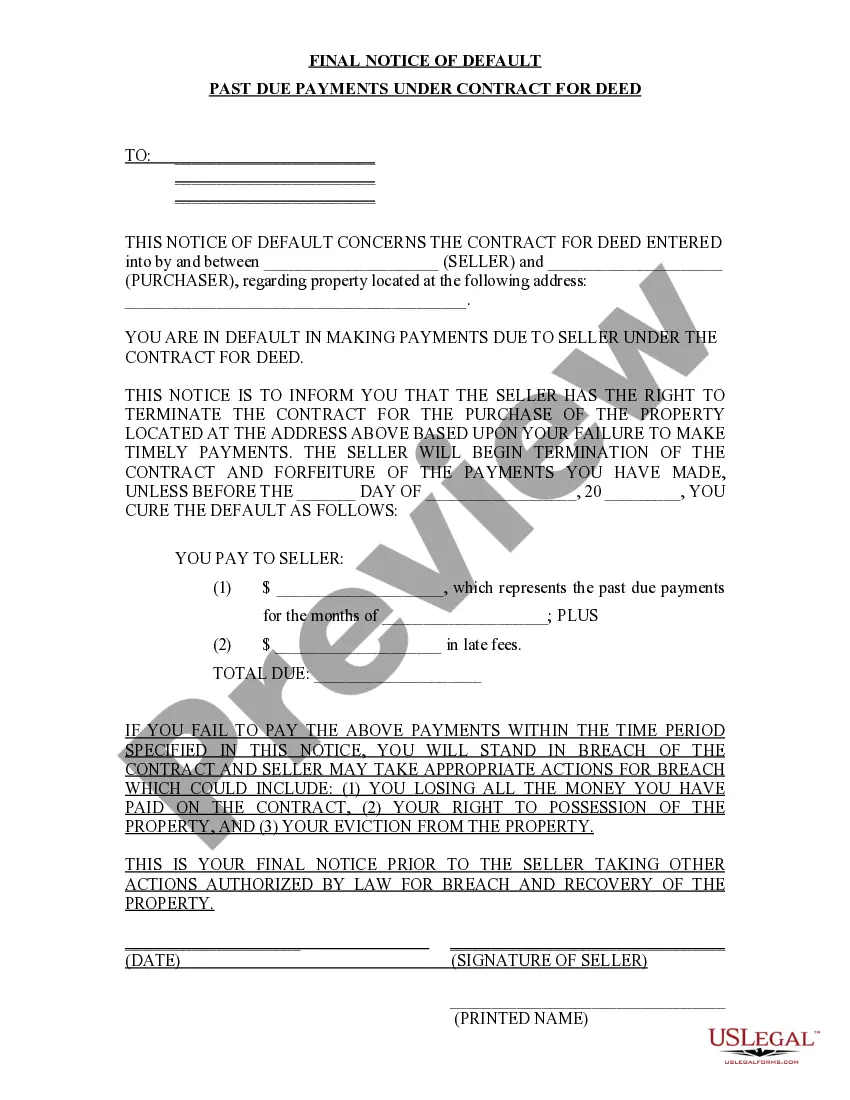

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Stamford Connecticut Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Stamford Connecticut, Final Notice of Default, Past Due Payments, Contract for Deed, Types Introduction: A Stamford Connecticut Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an official document issued when a buyer fails to make timely payments on a property purchased through a Contract for Deed agreement. This notice serves as a warning to the buyer that they are in default and that further action may be taken if the overdue payments are not settled promptly. It is important to understand the ramifications of receiving such a notice and the potential consequences involved. This article provides a detailed description of what a Stamford Connecticut Final Notice of Default for Past Due Payments in connection with a Contract for Deed entails. Description: 1. Purpose and Content of the Notice: The Stamford Connecticut Final Notice of Default for Past Due Payments is issued by the seller or their representative to inform the buyer that they have failed to make their monthly payments according to the terms of the Contract for Deed. The notice outlines the overdue payments, including the amount owed and the due date for each missed payment. It also specifies the grace period, if any, during which the buyer can rectify their default before further actions are initiated. 2. Legal Implications: Receiving a Final Notice of Default can have serious legal consequences. It is crucial for the buyer to review their Contract for Deed and consult with legal counsel to understand the rights and obligations of both parties during default. Failure to resolve the past due payments within the specified timeframe may result in significant legal actions, such as foreclosure or termination of the Contract for Deed. 3. Remedies and Options for the Buyer: When facing a Final Notice of Default, the buyer has a few options to address the issue. They can either pay off the outstanding amount in full to reinstate the contract, negotiate a repayment plan with the seller, or seek legal guidance to explore alternatives that may prevent foreclosure. Additionally, the buyer may choose to dispute the alleged default if they believe there are valid reasons for the missed payments. Types of Stamford Connecticut Final Notice of Default for Past Due Payments: 1. Initial Notice of Default: This is the first notice sent to the buyer, typically indicating the first missed payment or default. It serves as a warning and may include a grace period for the buyer to bring their payments up to date without any penalties or legal actions. 2. Final Notice of Default: If the buyer fails to address the defaulted payments within the grace period mentioned in the Initial Notice, a Final Notice of Default is issued. This notice signifies that the buyer has exhausted all opportunities to rectify their default, and immediate action could be initiated by the seller if the outstanding amount remains unpaid. Conclusion: A Stamford Connecticut Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a formal notification issued to a buyer who has failed to make timely payments as per the terms of their agreement. The consequences of receiving such a notice can be severe, potentially leading to foreclosure or termination of the contract. It is crucial for the buyer to seek legal advice and explore available options to resolve the default promptly.Title: Stamford Connecticut Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Stamford Connecticut, Final Notice of Default, Past Due Payments, Contract for Deed, Types Introduction: A Stamford Connecticut Final Notice of Default for Past Due Payments in connection with a Contract for Deed is an official document issued when a buyer fails to make timely payments on a property purchased through a Contract for Deed agreement. This notice serves as a warning to the buyer that they are in default and that further action may be taken if the overdue payments are not settled promptly. It is important to understand the ramifications of receiving such a notice and the potential consequences involved. This article provides a detailed description of what a Stamford Connecticut Final Notice of Default for Past Due Payments in connection with a Contract for Deed entails. Description: 1. Purpose and Content of the Notice: The Stamford Connecticut Final Notice of Default for Past Due Payments is issued by the seller or their representative to inform the buyer that they have failed to make their monthly payments according to the terms of the Contract for Deed. The notice outlines the overdue payments, including the amount owed and the due date for each missed payment. It also specifies the grace period, if any, during which the buyer can rectify their default before further actions are initiated. 2. Legal Implications: Receiving a Final Notice of Default can have serious legal consequences. It is crucial for the buyer to review their Contract for Deed and consult with legal counsel to understand the rights and obligations of both parties during default. Failure to resolve the past due payments within the specified timeframe may result in significant legal actions, such as foreclosure or termination of the Contract for Deed. 3. Remedies and Options for the Buyer: When facing a Final Notice of Default, the buyer has a few options to address the issue. They can either pay off the outstanding amount in full to reinstate the contract, negotiate a repayment plan with the seller, or seek legal guidance to explore alternatives that may prevent foreclosure. Additionally, the buyer may choose to dispute the alleged default if they believe there are valid reasons for the missed payments. Types of Stamford Connecticut Final Notice of Default for Past Due Payments: 1. Initial Notice of Default: This is the first notice sent to the buyer, typically indicating the first missed payment or default. It serves as a warning and may include a grace period for the buyer to bring their payments up to date without any penalties or legal actions. 2. Final Notice of Default: If the buyer fails to address the defaulted payments within the grace period mentioned in the Initial Notice, a Final Notice of Default is issued. This notice signifies that the buyer has exhausted all opportunities to rectify their default, and immediate action could be initiated by the seller if the outstanding amount remains unpaid. Conclusion: A Stamford Connecticut Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a formal notification issued to a buyer who has failed to make timely payments as per the terms of their agreement. The consequences of receiving such a notice can be severe, potentially leading to foreclosure or termination of the contract. It is crucial for the buyer to seek legal advice and explore available options to resolve the default promptly.