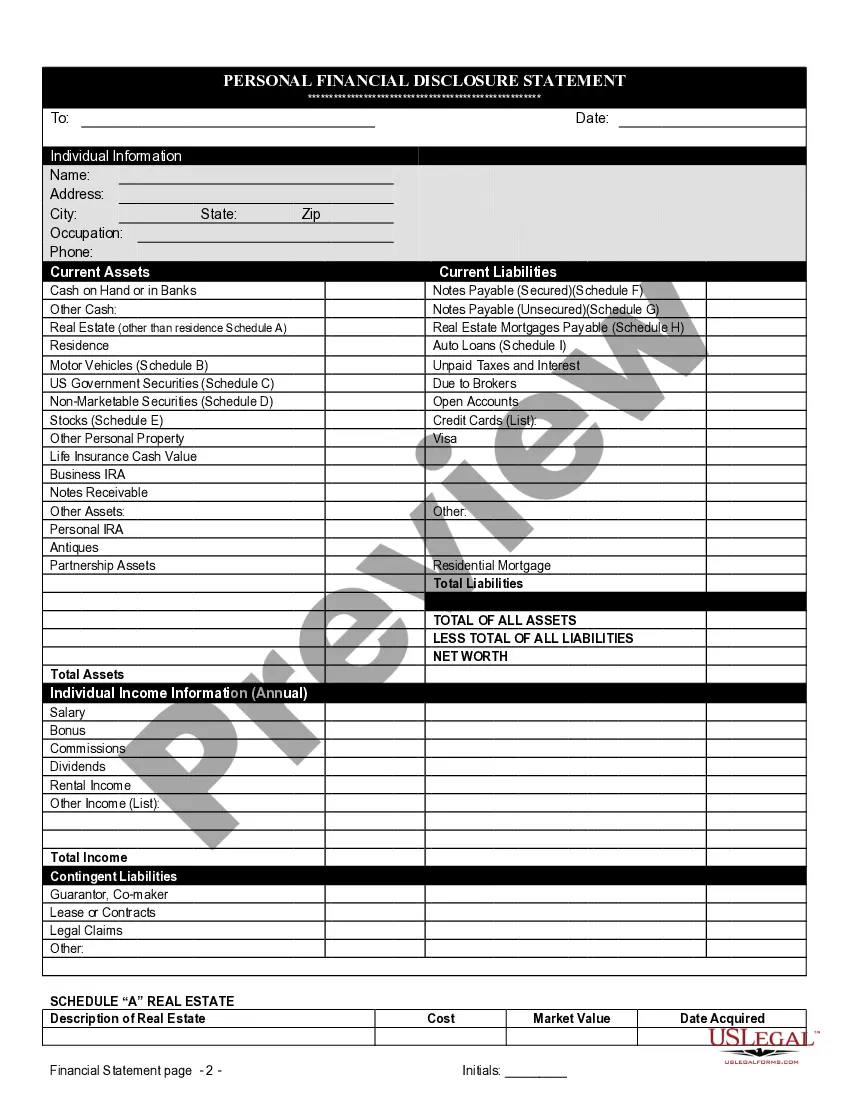

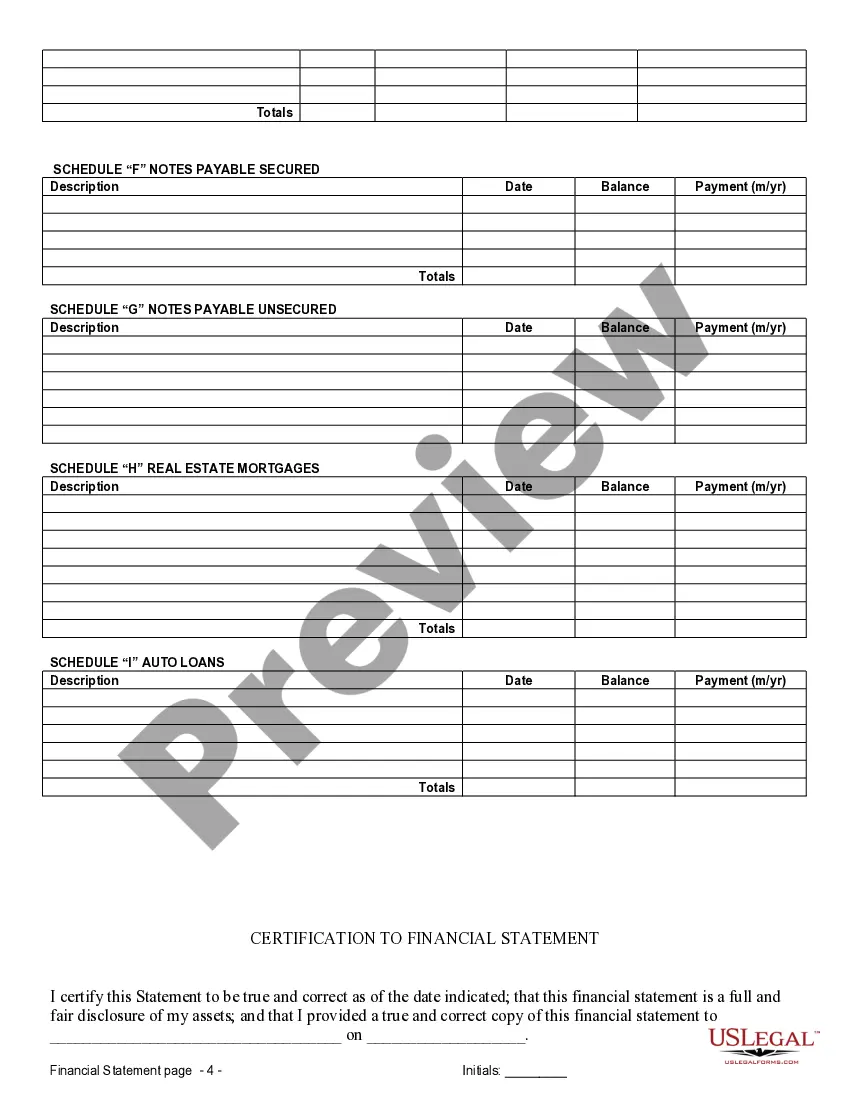

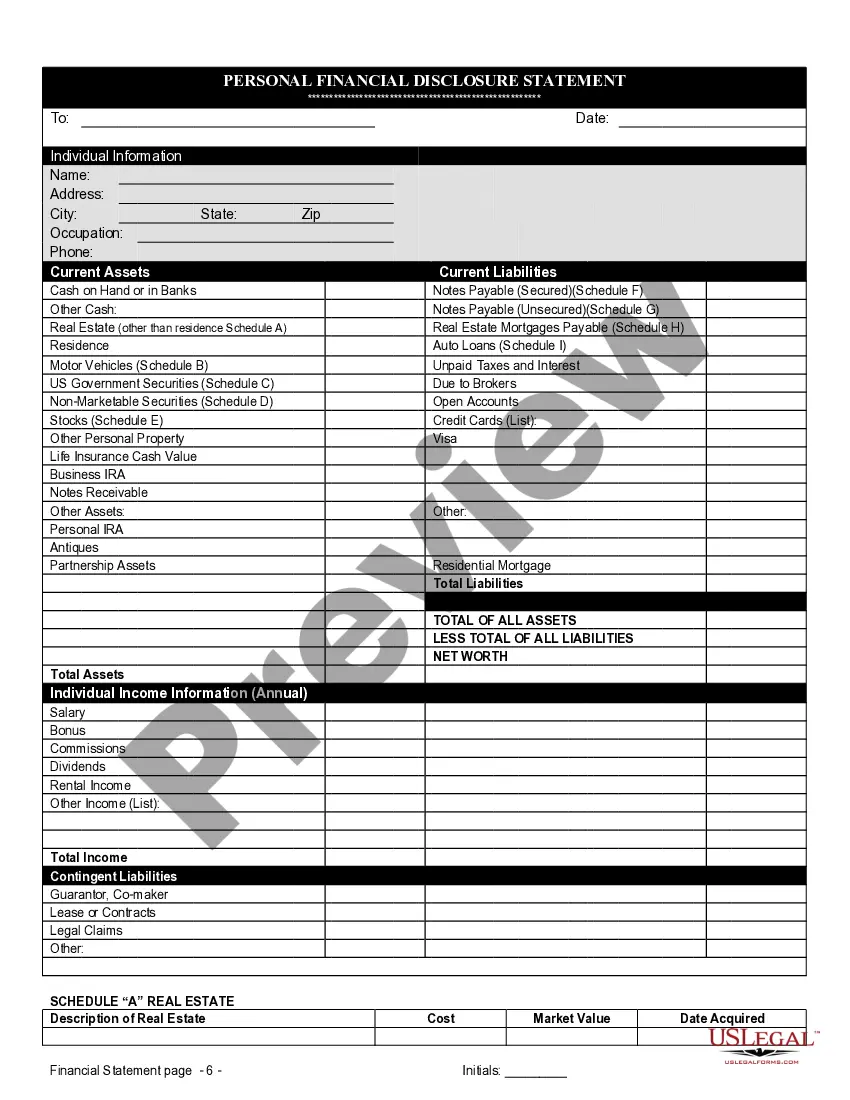

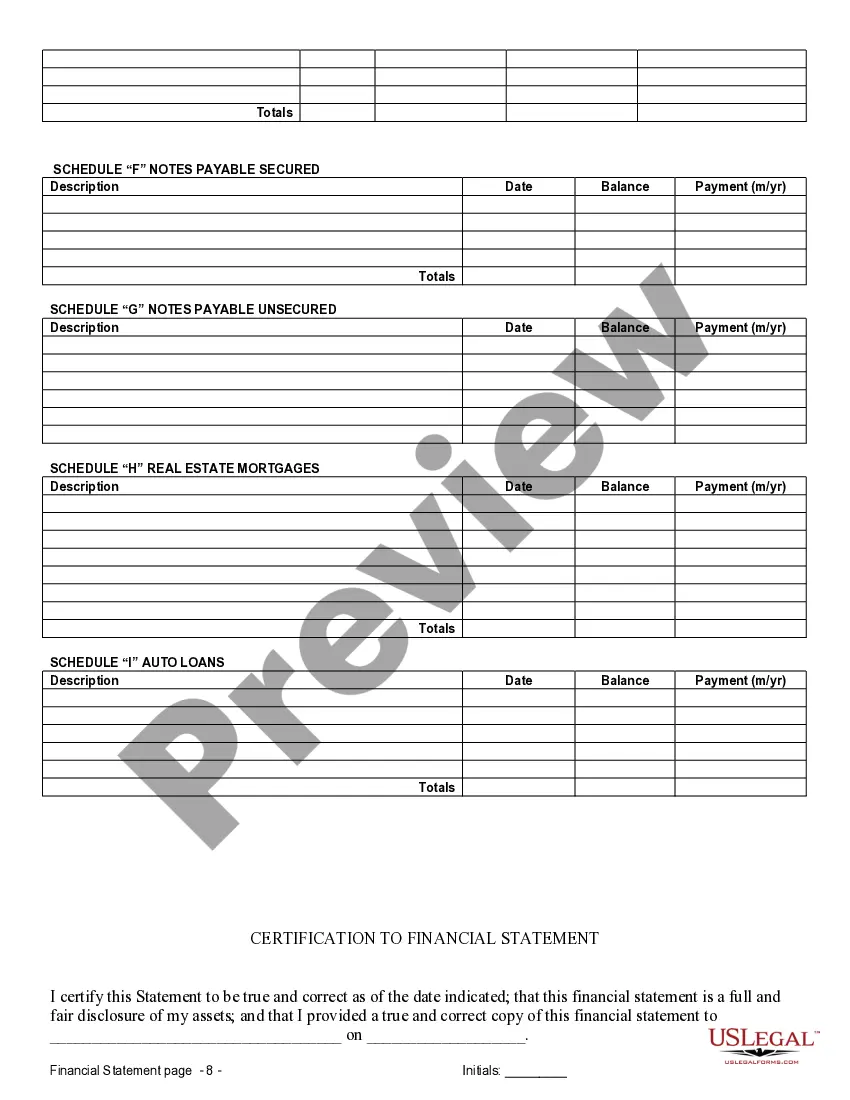

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

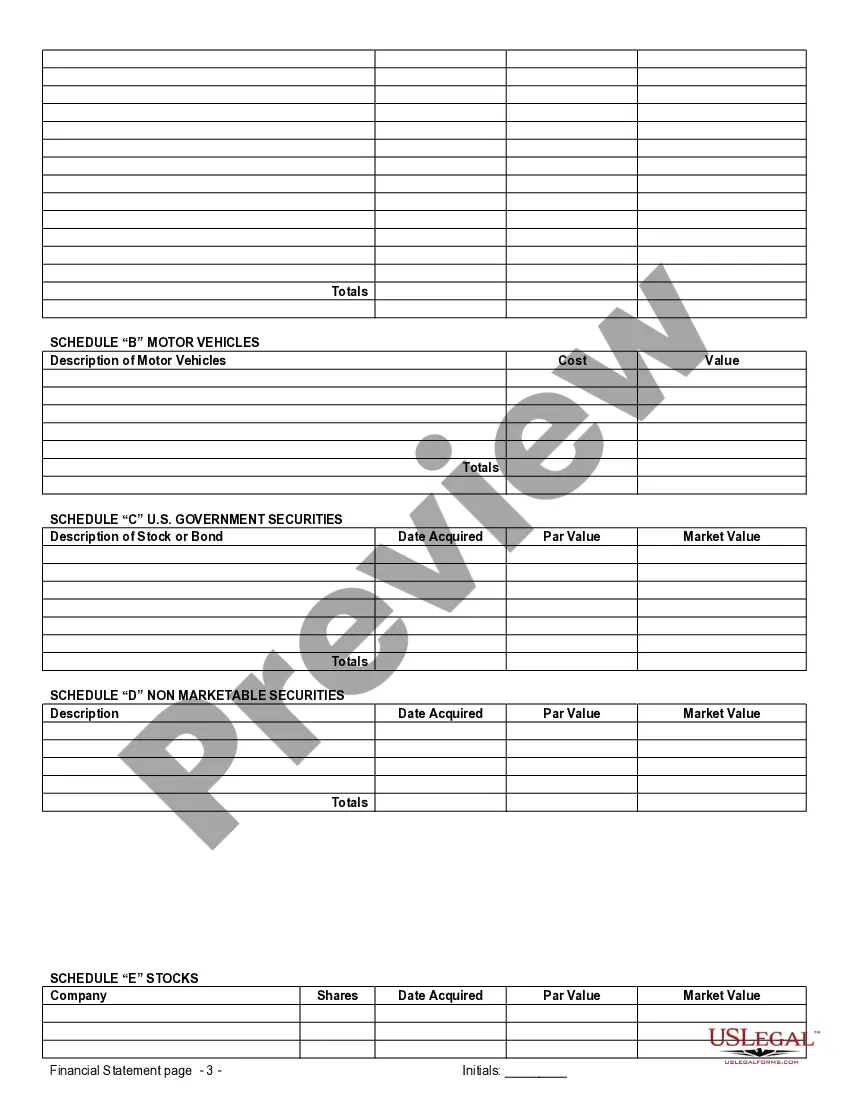

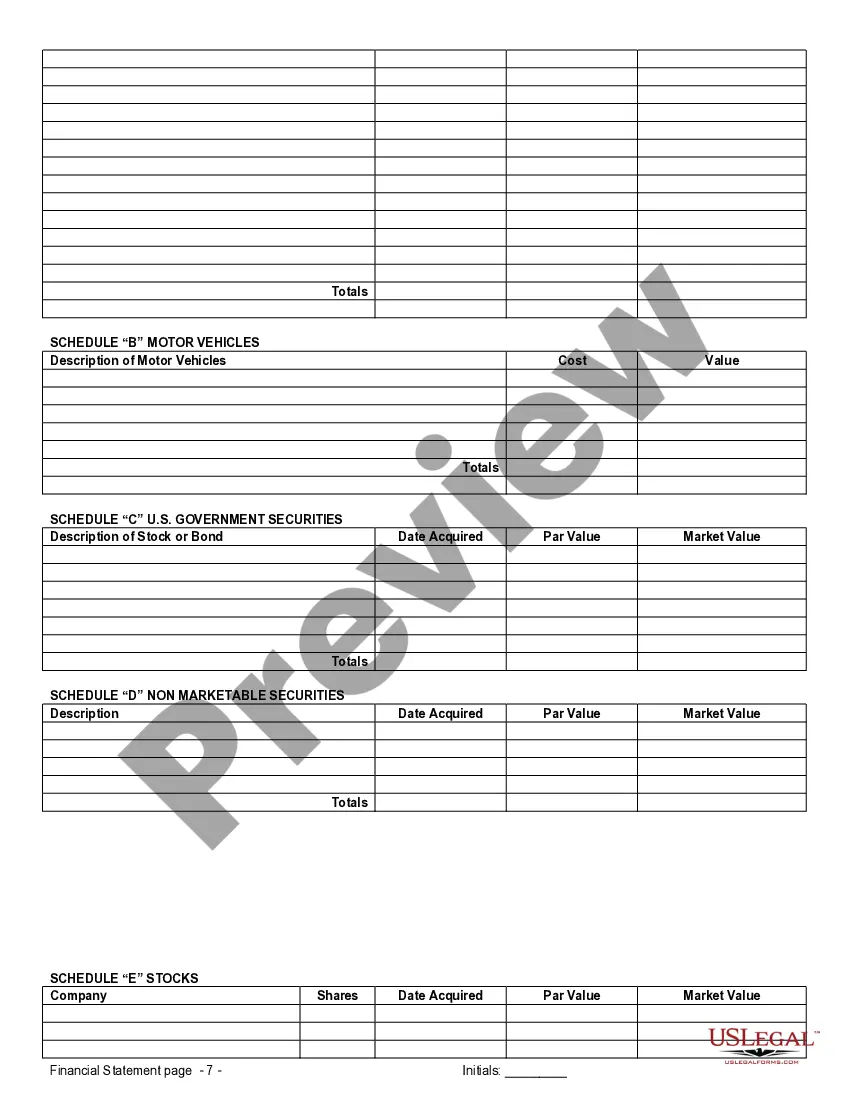

Stamford Connecticut Financial Statements in Connection with Prenuptial Premarital Agreement When it comes to entering into a prenuptial or premarital agreement in Stamford, Connecticut, the inclusion of financial statements is of paramount importance. Financial statements serve as crucial documents that disclose the financial standing of both parties involved in the agreement. They provide a comprehensive and detailed overview of each individual's financial health, assets, liabilities, and income. Stamford Connecticut recognizes the significance of financial statements as they ensure transparency, fairness, and informed decision-making during the creation of a prenuptial or premarital agreement. These statements are meticulously prepared and must adhere to the legal framework of the state. Types of Stamford Connecticut Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Personal Balance Sheets: This type of financial statement outlines an individual's assets, liabilities, and net worth. It includes information about real estate properties, vehicles, investments, bank accounts, debts, and other financial obligations. 2. Income Statements: Income statements provide a detailed breakdown of an individual's income from various sources such as employment, investments, rent, or other revenue streams. This statement helps evaluate the earning capacity of each party and assess potential alimony or spousal support considerations. 3. Tax Returns: Tax returns serve as a critical component of the financial statement, revealing details about an individual's tax obligations, income sources, deductions, and other financial aspects related to their taxes. This information assists in ensuring accuracy and verifying the financial information provided in other statements. 4. Bank Statements: Bank statements offer a comprehensive overview of an individual's financial transactions, including deposits, withdrawals, and account balances. They aid in verifying the accuracy of the personal balance sheet, providing insights into spending habits, and identifying individual financial patterns. 5. Investment Statements: These statements provide a breakdown of an individual's investment portfolio, including stocks, bonds, mutual funds, real estate, and any other investment assets. Investment statements are essential in understanding the value, growth, and potential risks associated with an individual's financial assets. 6. Retirement Account Statements: Stamford Connecticut financial statements for prenuptial or premarital agreements often require disclosure of retirement account statements. These statements provide details about contributions, vested amounts, and potential future benefits associated with retirement plans such as 401(k)s, IRAs, or pension plans. Including these various types of financial statements ensures that parties involved in a Stamford Connecticut prenuptial or premarital agreement have a comprehensive understanding of each other's financial situation. By disclosing assets, liabilities, income, and financial obligations, these statements enable both parties to make informed decisions that protect their rights and assets. It is crucial to work with experienced professionals such as attorneys and financial advisors who are well-versed in Stamford Connecticut family law to ensure accuracy, compliance, and fairness in the preparation and inclusion of financial statements within the prenuptial or premarital agreement.Stamford Connecticut Financial Statements in Connection with Prenuptial Premarital Agreement When it comes to entering into a prenuptial or premarital agreement in Stamford, Connecticut, the inclusion of financial statements is of paramount importance. Financial statements serve as crucial documents that disclose the financial standing of both parties involved in the agreement. They provide a comprehensive and detailed overview of each individual's financial health, assets, liabilities, and income. Stamford Connecticut recognizes the significance of financial statements as they ensure transparency, fairness, and informed decision-making during the creation of a prenuptial or premarital agreement. These statements are meticulously prepared and must adhere to the legal framework of the state. Types of Stamford Connecticut Financial Statements in Connection with Prenuptial Premarital Agreement: 1. Personal Balance Sheets: This type of financial statement outlines an individual's assets, liabilities, and net worth. It includes information about real estate properties, vehicles, investments, bank accounts, debts, and other financial obligations. 2. Income Statements: Income statements provide a detailed breakdown of an individual's income from various sources such as employment, investments, rent, or other revenue streams. This statement helps evaluate the earning capacity of each party and assess potential alimony or spousal support considerations. 3. Tax Returns: Tax returns serve as a critical component of the financial statement, revealing details about an individual's tax obligations, income sources, deductions, and other financial aspects related to their taxes. This information assists in ensuring accuracy and verifying the financial information provided in other statements. 4. Bank Statements: Bank statements offer a comprehensive overview of an individual's financial transactions, including deposits, withdrawals, and account balances. They aid in verifying the accuracy of the personal balance sheet, providing insights into spending habits, and identifying individual financial patterns. 5. Investment Statements: These statements provide a breakdown of an individual's investment portfolio, including stocks, bonds, mutual funds, real estate, and any other investment assets. Investment statements are essential in understanding the value, growth, and potential risks associated with an individual's financial assets. 6. Retirement Account Statements: Stamford Connecticut financial statements for prenuptial or premarital agreements often require disclosure of retirement account statements. These statements provide details about contributions, vested amounts, and potential future benefits associated with retirement plans such as 401(k)s, IRAs, or pension plans. Including these various types of financial statements ensures that parties involved in a Stamford Connecticut prenuptial or premarital agreement have a comprehensive understanding of each other's financial situation. By disclosing assets, liabilities, income, and financial obligations, these statements enable both parties to make informed decisions that protect their rights and assets. It is crucial to work with experienced professionals such as attorneys and financial advisors who are well-versed in Stamford Connecticut family law to ensure accuracy, compliance, and fairness in the preparation and inclusion of financial statements within the prenuptial or premarital agreement.