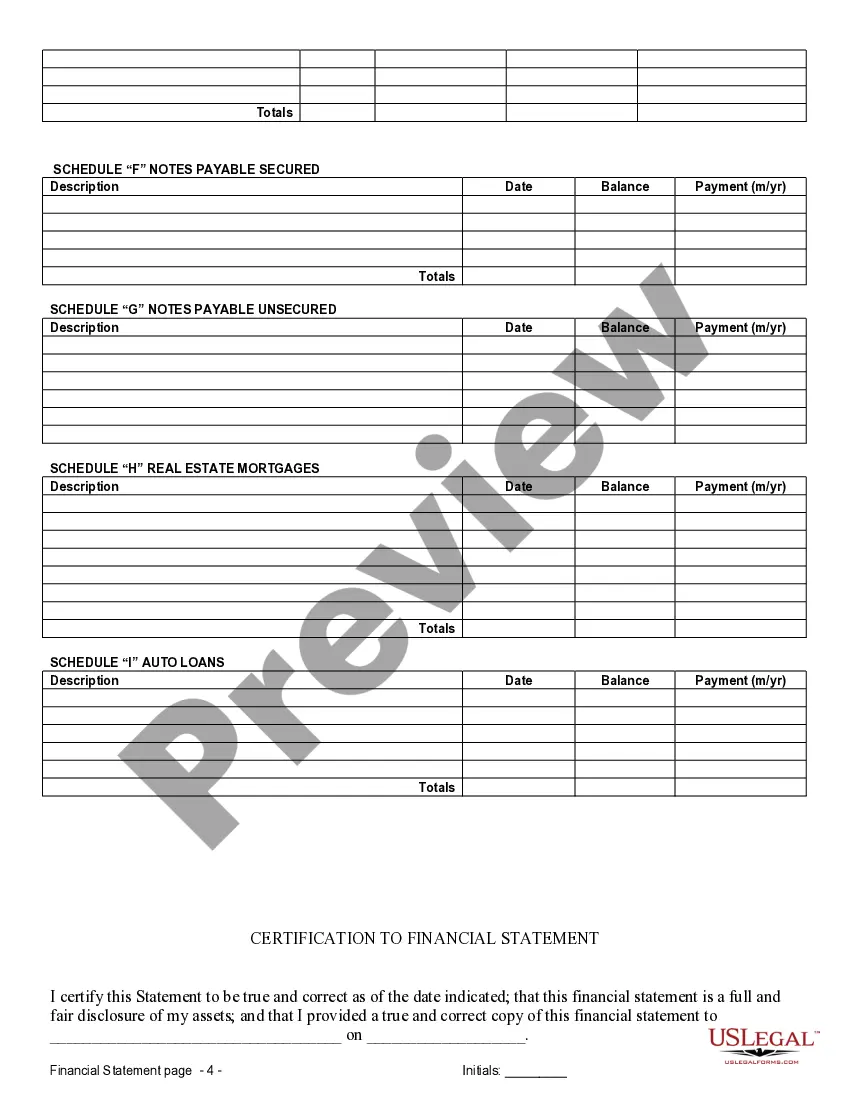

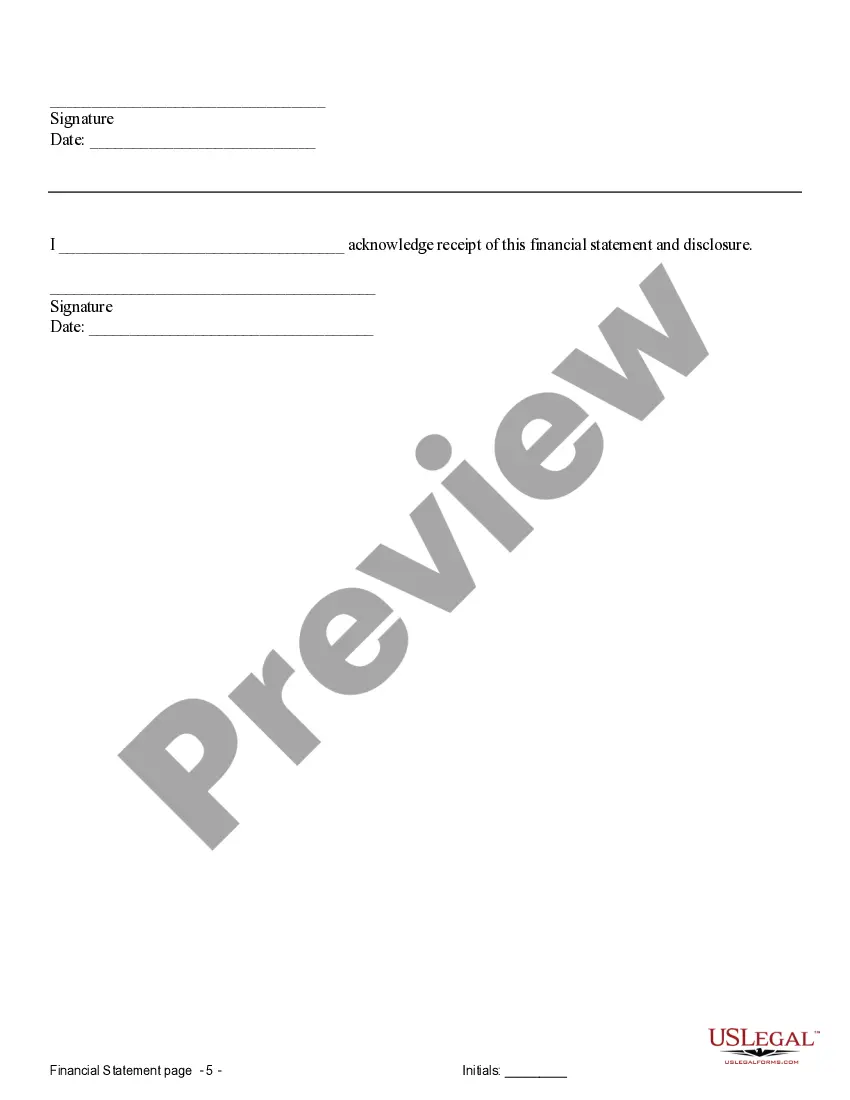

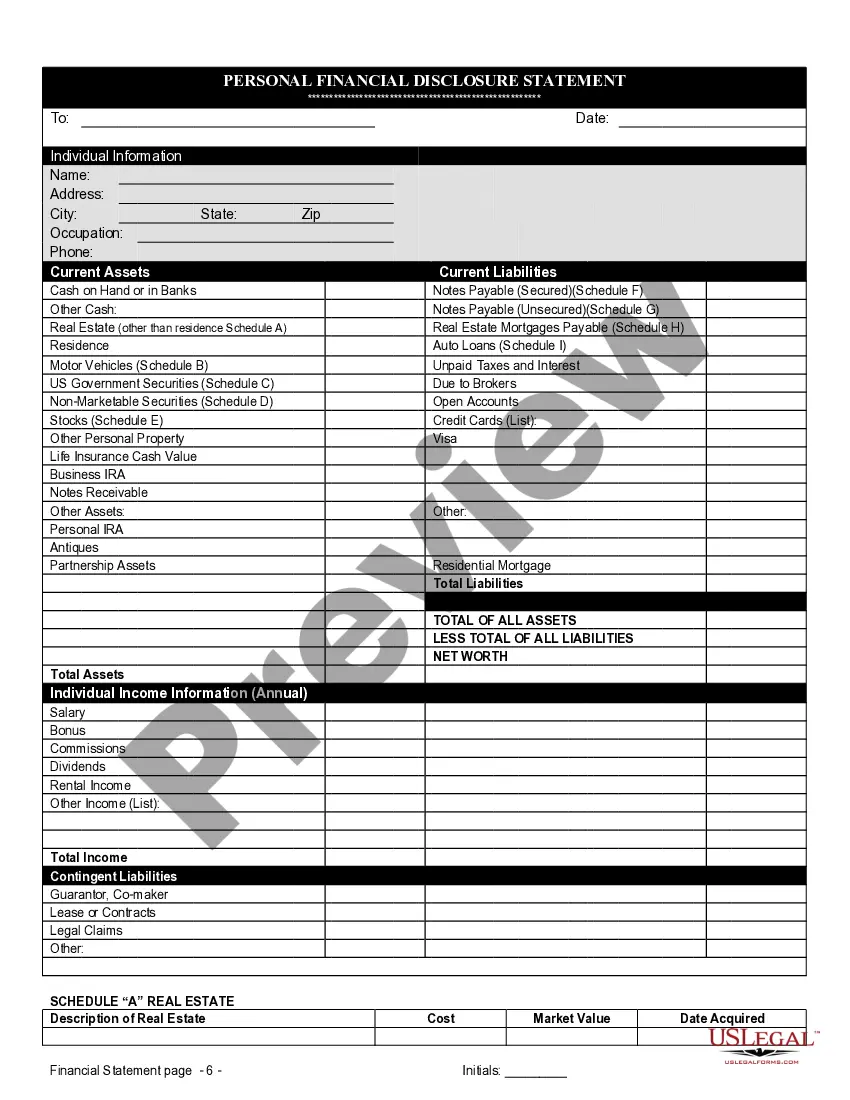

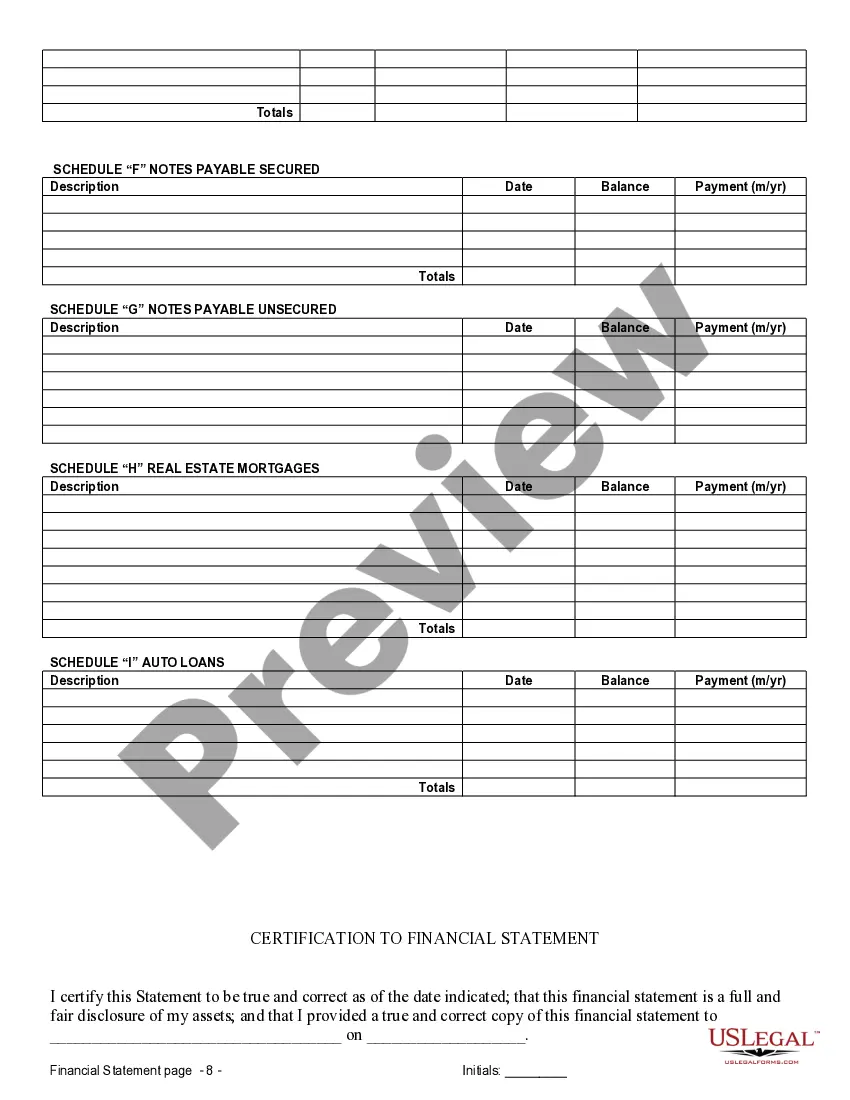

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Waterbury Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Connecticut Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our efficient platform with numerous documents enables you to locate and acquire nearly any document example you seek.

You can download, fill out, and sign the Waterbury Connecticut Financial Statements exclusively related to Prenuptial Premarital Agreement within just a few minutes rather than spending hours online searching for a suitable template.

Leveraging our collection is an excellent way to enhance the security of your document management.

Locate the template you need. Verify that it is the document you are looking for: examine its title and description, and use the Preview feature if available. Otherwise, utilize the Search box to find the suitable one.

Initiate the download process. Click Buy Now and select the pricing plan you prefer. Then, create an account and complete your purchase using a credit card or PayPal.

- Our expert legal professionals frequently evaluate all the files to ensure that the forms are applicable for a specific state and adhere to new laws and regulations.

- How can you acquire the Waterbury Connecticut Financial Statements solely in Relation to Prenuptial Premarital Agreement.

- If you possess a subscription, simply Log In to your account. The Download option will be accessible on all the samples you view.

- Additionally, you can find all the previously saved documents in the My documents section.

- If you don't have an account yet, follow the instructions below.

Form popularity

FAQ

To fill out an affidavit of financial means, provide a comprehensive overview of your financial situation, including income, expenses, and current debts. Accurately reflecting your financial health is vital, especially in Waterbury, Connecticut, where financial statements only in connection with premarital agreements must adhere to specific legal standards. Using a reliable platform like uslegalforms can simplify this process and ensure your affidavit meets all legal requirements.

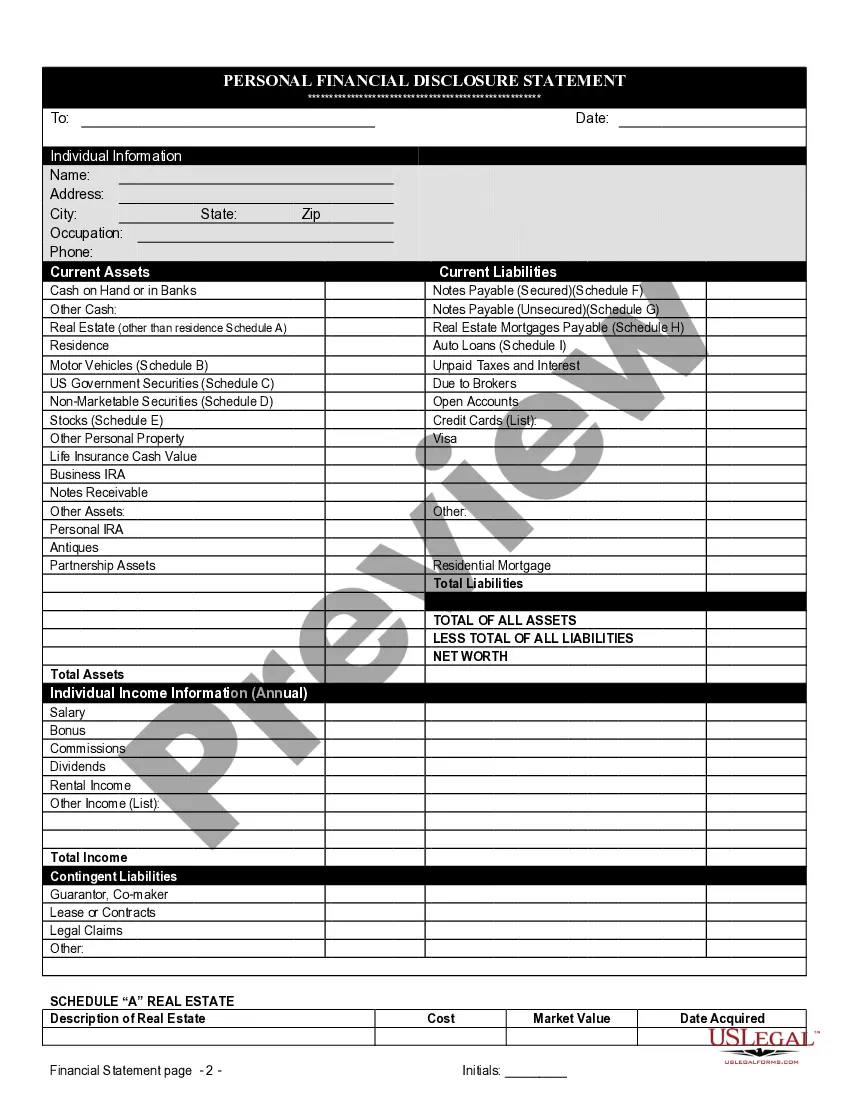

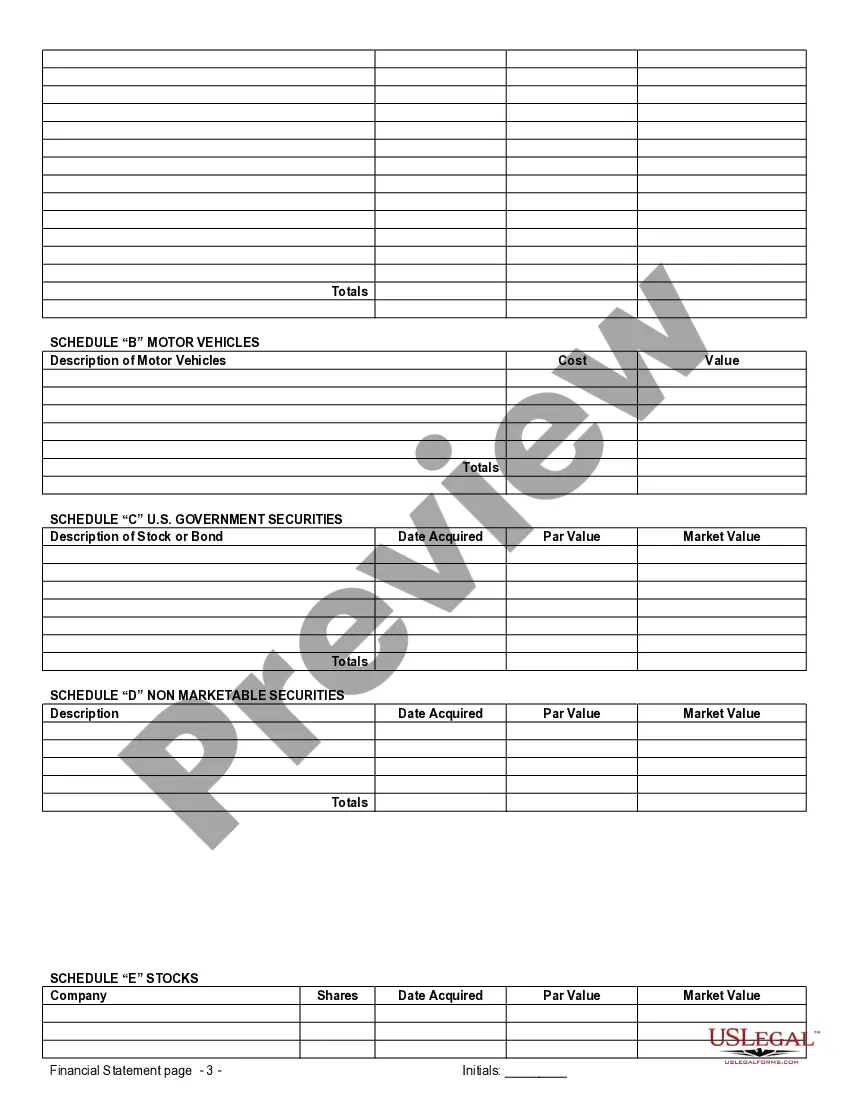

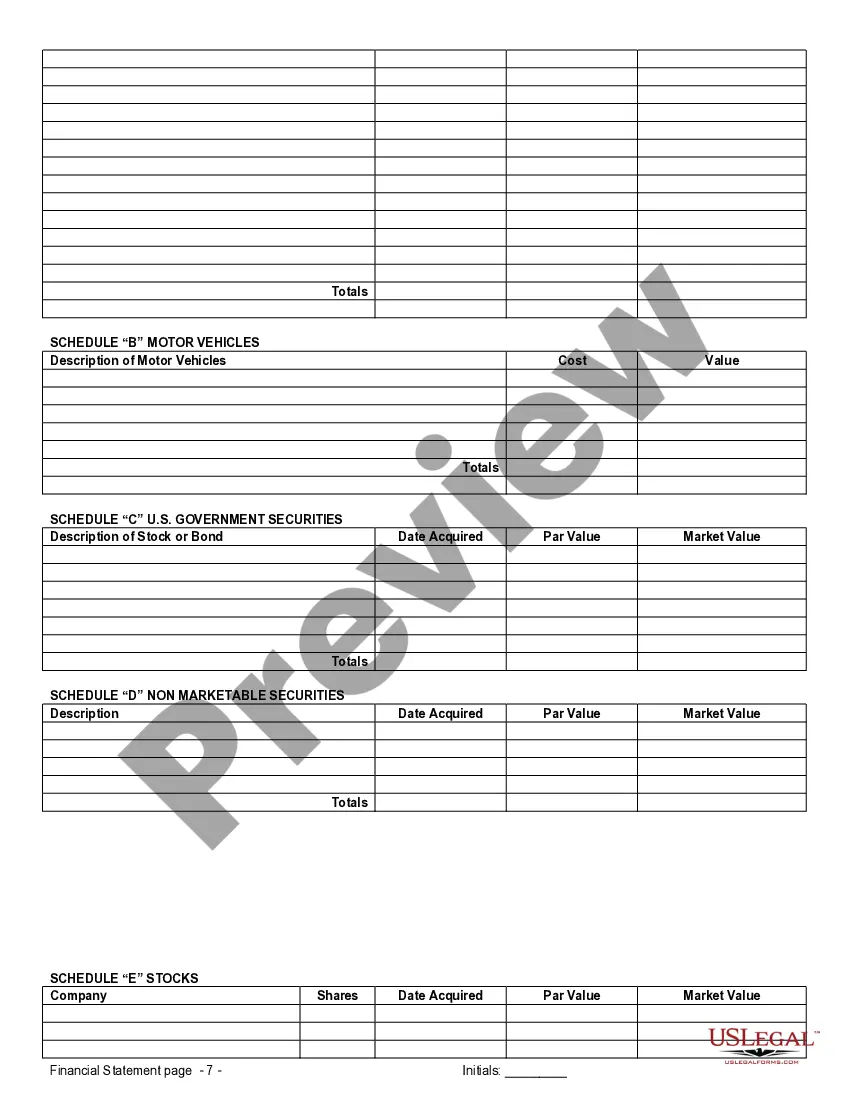

When listing assets for a prenup, identify all property, bank accounts, investments, and valuable items you own. It is essential to be as detailed as possible, ensuring each asset is accounted for transparently. This approach is critical for Waterbury, Connecticut financial statements only in connection with a prenuptial premarital agreement, as it helps clarify ownership and responsibilities.

Filling out an affidavit example requires following a clear structure. Start with the title, followed by a statement of facts and your personal affirmation. Ensure your affidavit reflects your situation, particularly in relation to Waterbury, Connecticut financial statements only in connection with prenuptial premarital agreements, as these documents often demand clarity and precision.

To fill out an affidavit of claim, clearly state your name, address, and the nature of your claim. Include details about the amount being claimed and any supporting evidence or documentation. Remember, accuracy is crucial, especially when relating to Waterbury, Connecticut financial statements only in connection with prenuptial premarital agreements, as this can play a vital role in legal negotiations.

Filling out a financial affidavit involves detailing your financial situation, including debts and assets. Start by documenting all sources of income, expenses, and liabilities. It is essential to be thorough, as this information may affect your legal standing in matters related to Waterbury, Connecticut financial statements only in connection with a prenuptial premarital agreement.

To fill out a child support affidavit, begin by gathering all necessary financial documents, including income statements and expenses. Clearly list your income sources and any deductions, such as tax obligations. Ensure that you provide accurate and truthful information, as this affidavit may impact your financial obligations related to a prenup in Waterbury, Connecticut, particularly concerning financial statements only in connection with a prenuptial premarital agreement.

Typically, personal matters like pet custody or lifestyle choices cannot be enforced in a prenuptial agreement. Additionally, any clauses that infringe on legal rights or obligations, such as those involving illegal activities or unconscionable terms, are not valid. When structuring Waterbury Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement, focus on the financial aspects for stronger legal standing.

Exceptions to prenuptial agreements usually include any provisions that conflict with child support or custody arrangements. Courts can also disregard agreements that were deemed signed under duress or without legal counsel. In navigating documents like Waterbury Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement, understanding these exceptions is vital for enforceability.

Prenuptial agreements may not be fully enforceable in certain states, including those that have stringent requirements for validity or public policy considerations. States like Montana, where specific formalities apply, can create challenges. Always refer to local laws, particularly regarding Waterbury Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement, to ensure compliance and validity.

You cannot include matters that violate public policy or laws, such as stipulations regarding child custody or personal matters like lifestyle preferences. Additionally, agreements that aim to defraud creditors are unenforceable. In context, Waterbury Connecticut Financial Statements only in Connection with Prenuptial Premarital Agreement should focus on financial matters and asset division to remain valid.