Certificate of Incorporation for a Connecticut Professional Corporation.

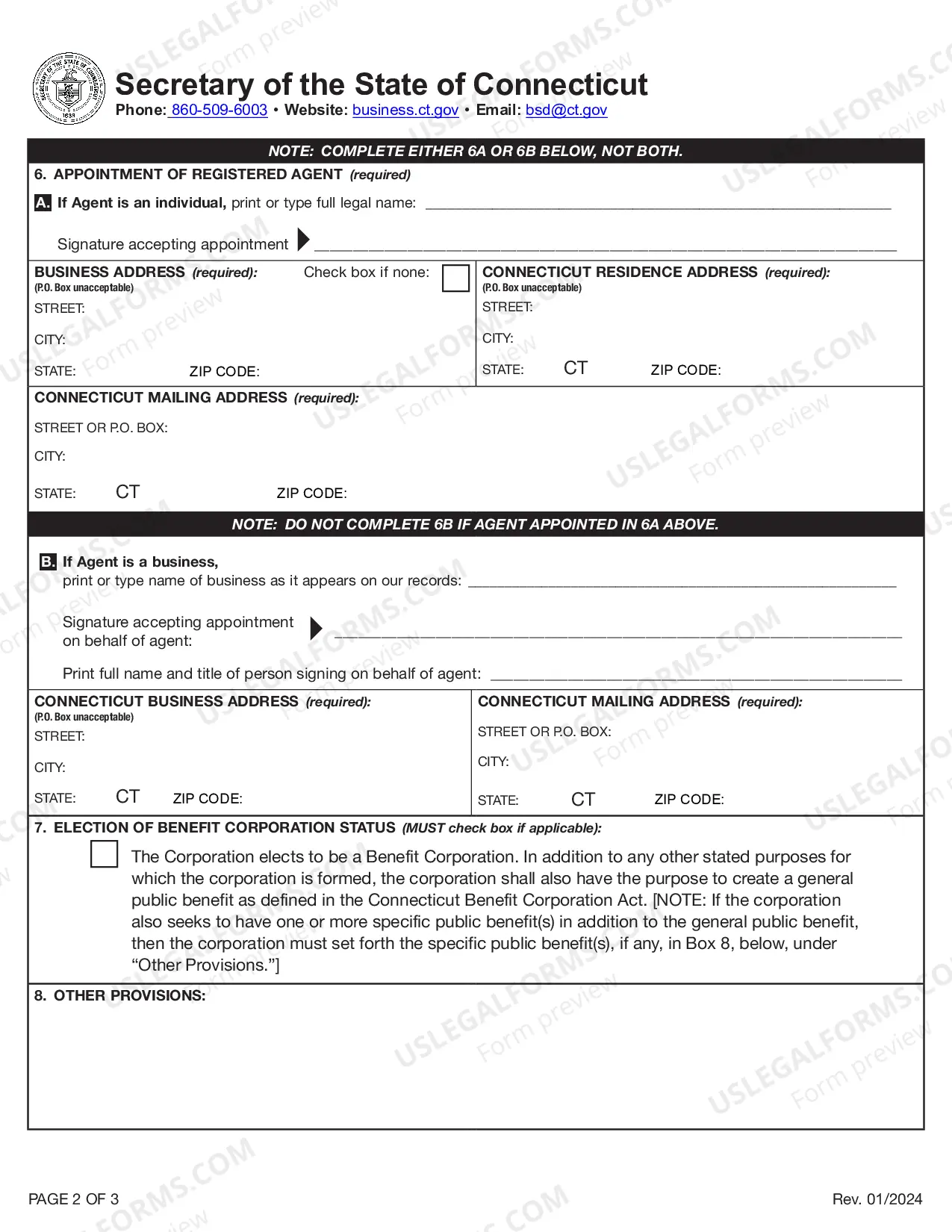

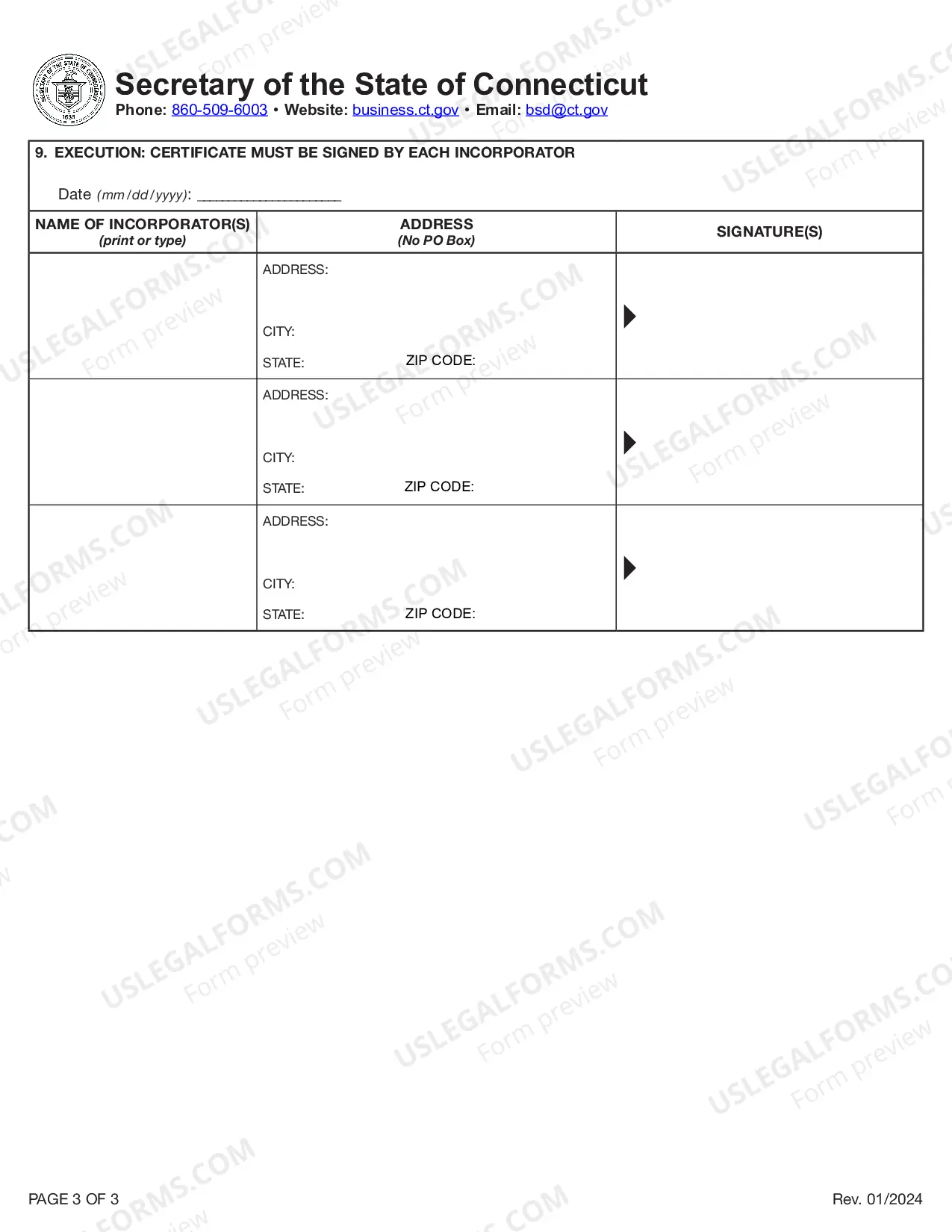

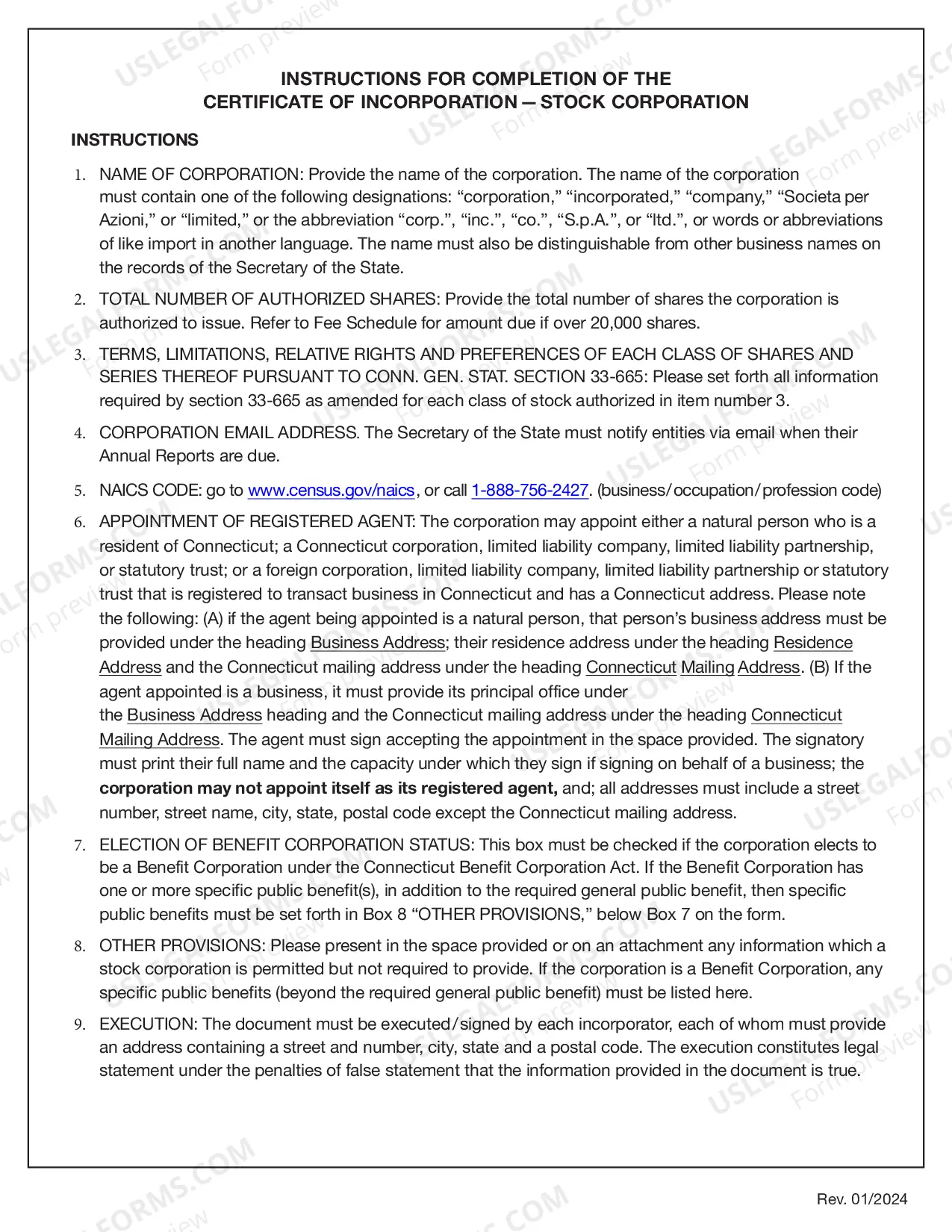

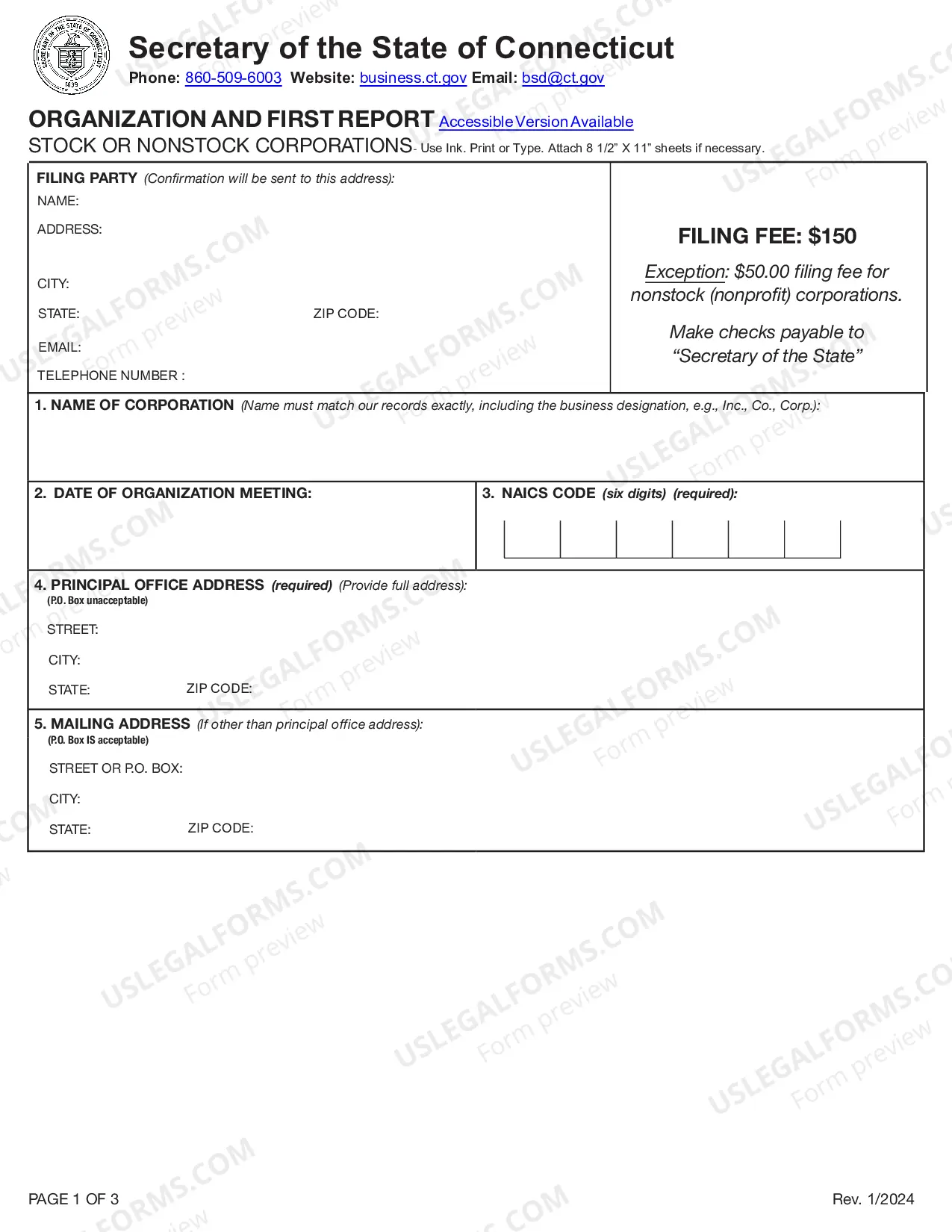

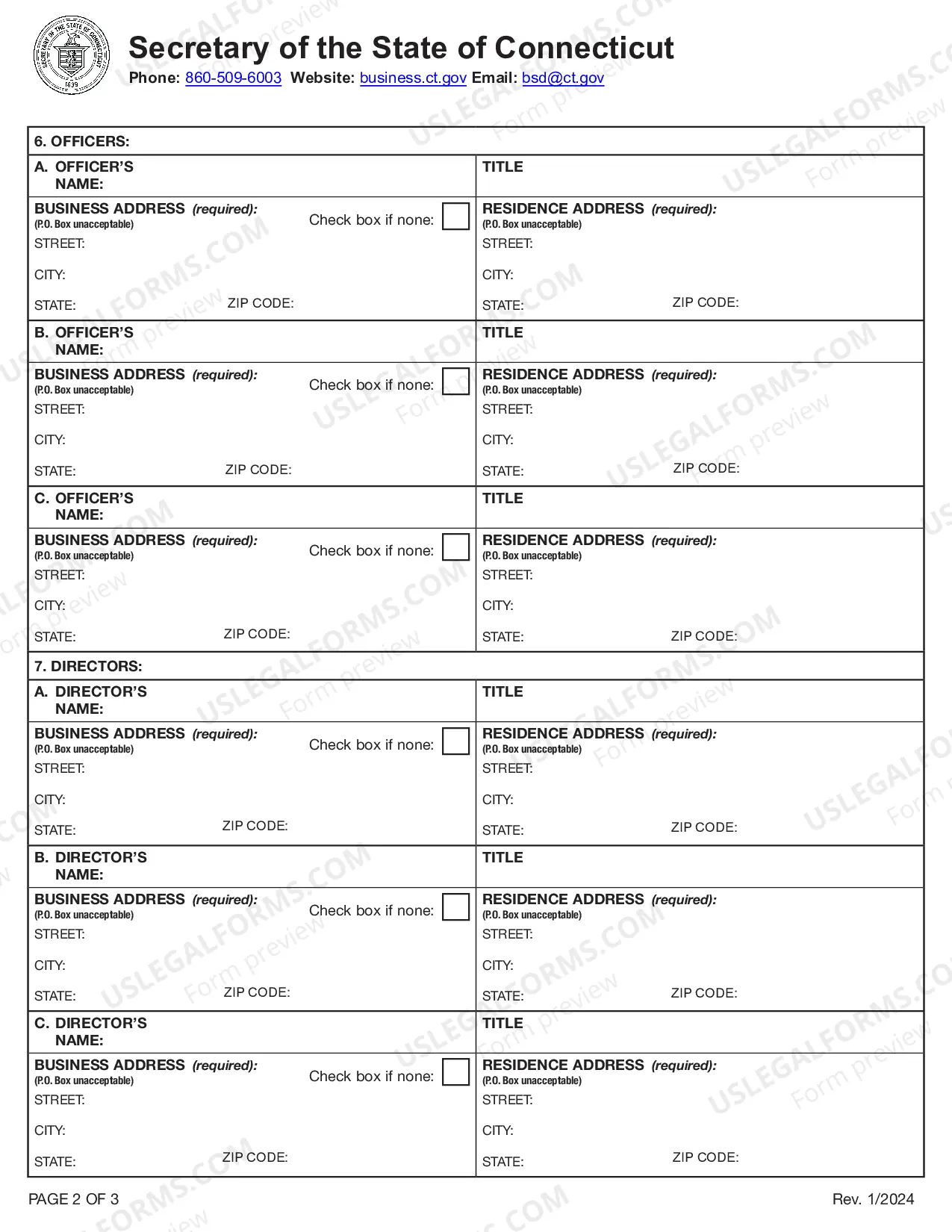

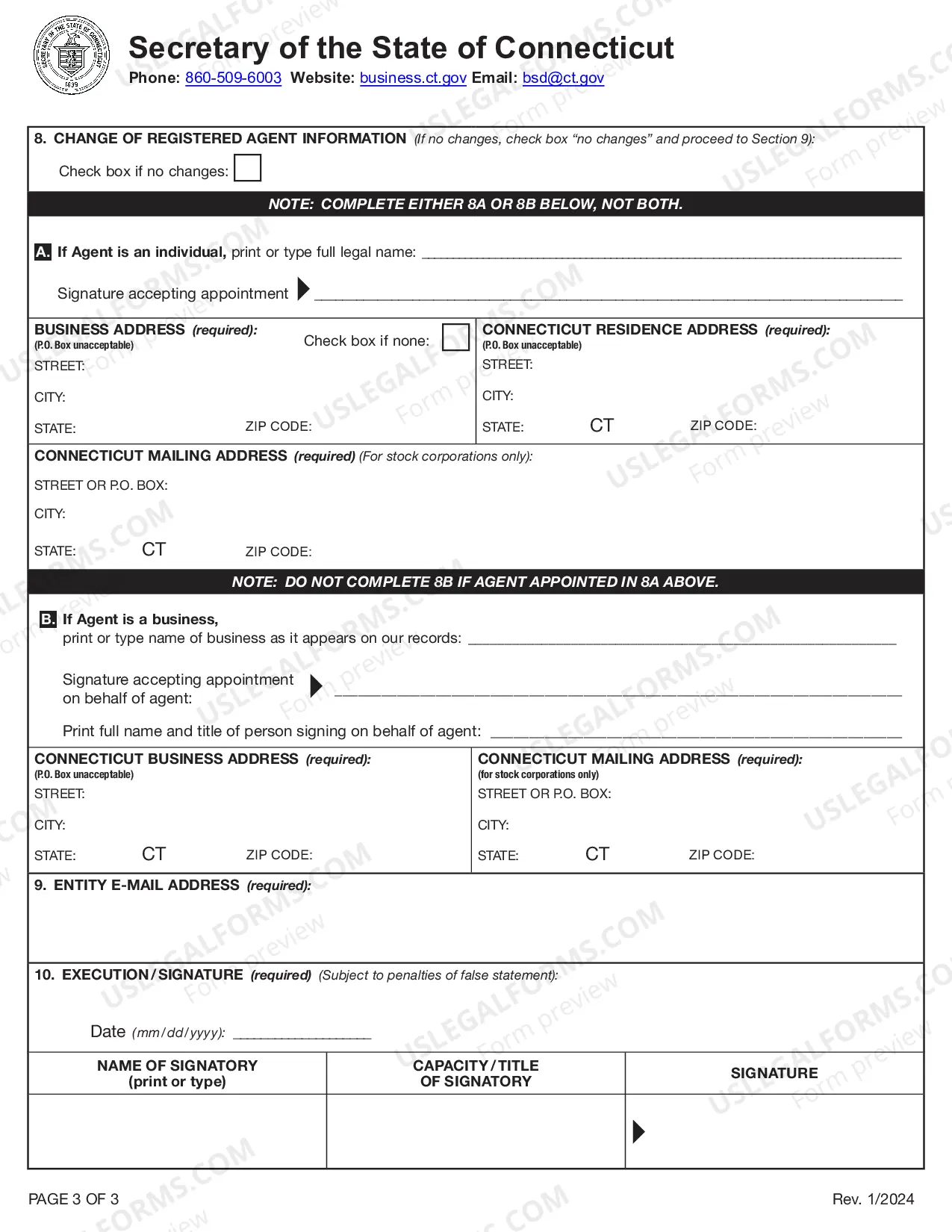

The Bridgeport Connecticut Certificate of Incorporation for Professional Corporation is a legal document that formally establishes the existence of a professional corporation in the city of Bridgeport, Connecticut. This certificate solidifies the creation of a separate entity, separate from its owners, which allows professionals such as doctors, lawyers, or architects to operate their respective businesses while limiting personal liability. Keywords: Bridgeport Connecticut, Certificate of Incorporation, Professional Corporation. The Bridgeport Connecticut Certificate of Incorporation for Professional Corporation outlines specific requirements and regulations that must be met to form a professional corporation in Bridgeport. It provides vital information about the corporation, its name, the purpose for which it is formed, the names and addresses of the corporation's initial directors, and the professional services that the corporation is authorized to provide. There are no specific different types of Bridgeport Connecticut Certificate of Incorporation for Professional Corporation. However, the certificate may vary depending on the nature of the professional services being offered. For example, a medical professional corporation would need to comply with additional regulations set forth by the Connecticut Department of Public Health and provide specific details related to the medical field. Similarly, a legal professional corporation would need to adhere to guidelines established by the Connecticut Judicial Branch. When filing for the Bridgeport Connecticut Certificate of Incorporation for Professional Corporation, it is essential to include all the necessary information and meet the state's requirements. These may include having a registered agent with a physical address in Connecticut, paying the appropriate filing fees, and ensuring that all directors are qualified professionals within their respective fields. Overall, the Bridgeport Connecticut Certificate of Incorporation for Professional Corporation is a crucial legal document that officially establishes a professional corporation in Bridgeport. It helps protect the personal assets of the professionals involved while providing a framework for the operation of their businesses in compliance with state laws and regulations.