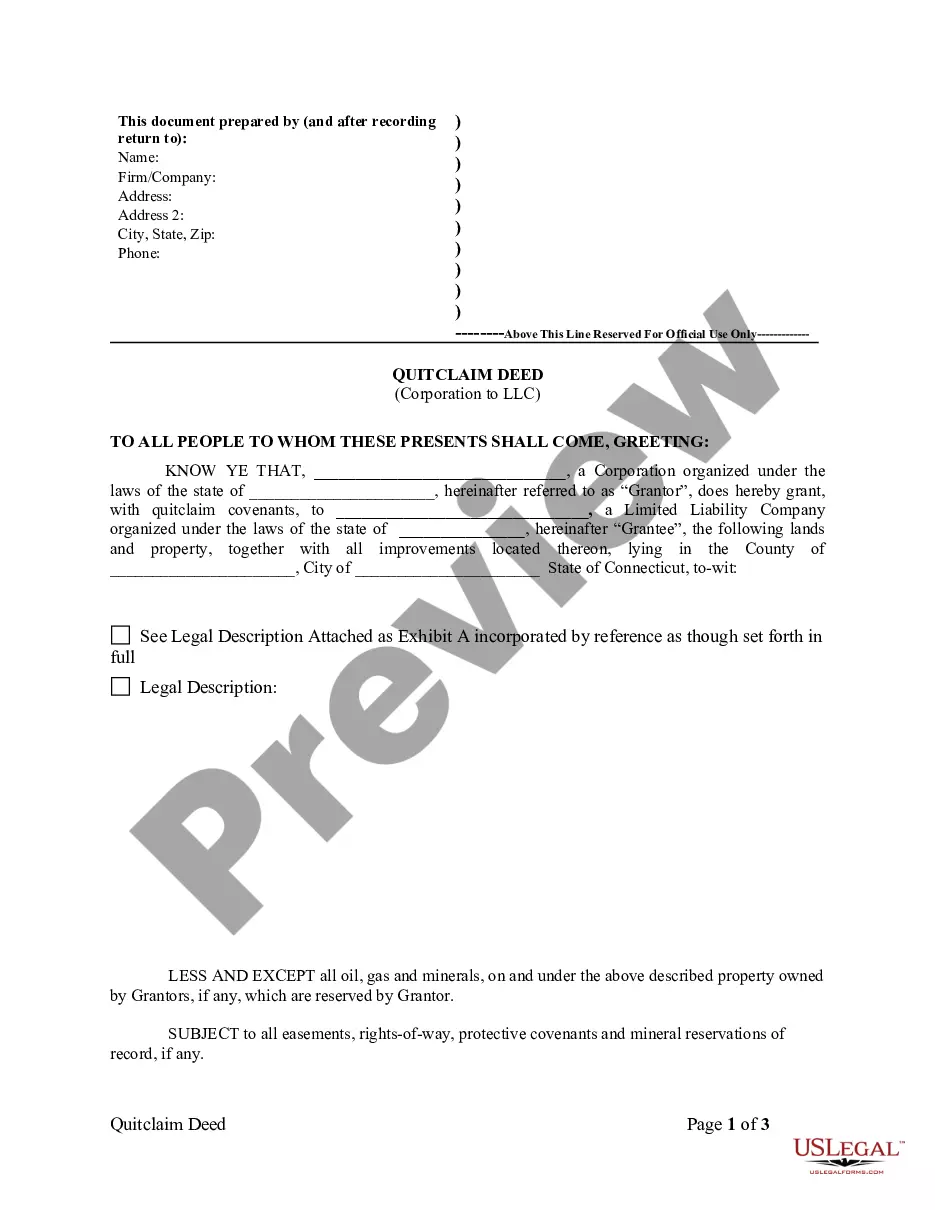

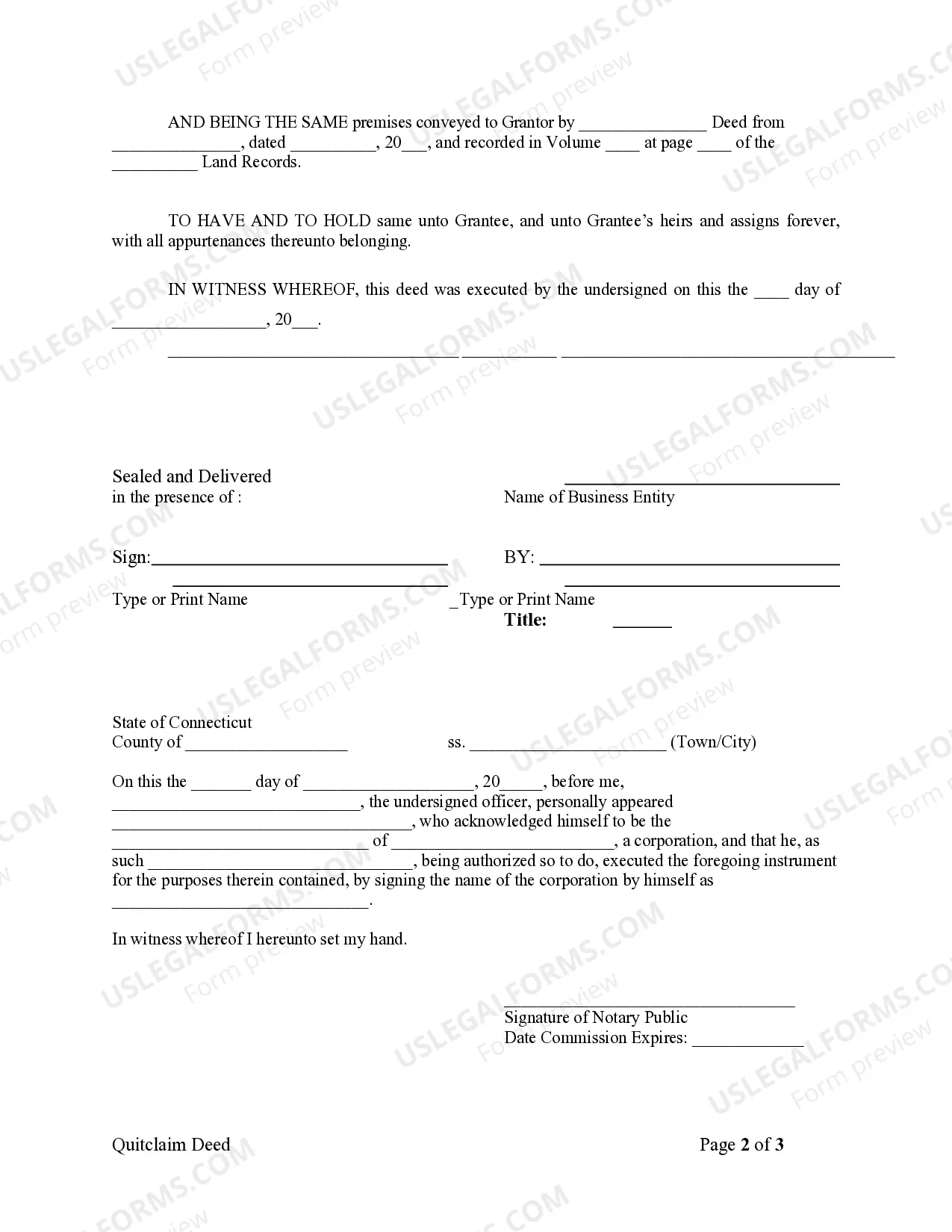

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Bridgeport Connecticut Quitclaim Deed from Corporation to LLC is a legal document used in the state of Connecticut to transfer ownership of real estate property from a corporation to a limited liability company (LLC). This type of transaction commonly occurs when a corporation decides to restructure its assets or transfer property to an LLC for tax or liability purposes. A quitclaim deed is a specific type of deed used to transfer property rights without making any guarantees or warranties about the title's condition. It implies no guarantees that the corporation has clear ownership or that there are no encumbrances on the property. The LLC receives only the rights and interests that the corporation had, without any implied warranty. There are two main types of Bridgeport Connecticut Quitclaim Deeds from Corporation to LLC: 1. Voluntary Transfer: This type of transfer occurs when the corporation willingly chooses to transfer the property to the LLC. It could be for various reasons, such as streamlining asset management, separating liabilities, or aligning with restructuring plans. This process involves drafting a Bridgeport Connecticut Quitclaim Deed document that outlines the details of the transfer, including the legal description of the property, names of both parties, consideration, and any relevant terms or conditions. 2. Judicial Transfer: In some cases, a Bridgeport Connecticut Quitclaim Deed from Corporation to LLC may be the result of a court-ordered judgment or settlement. This can occur when there is a legal dispute, such as a lawsuit or bankruptcy, involving the corporation and its assets. The court may order the transfer of the property to an LLC as part of resolving the legal matter. In such instances, the court's order will form the basis for the deed transfer, which must be executed in compliance with applicable laws and procedures. Both types of Bridgeport Connecticut Quitclaim Deed from Corporation to LLC require careful consideration and legal expertise to ensure a smooth and valid transfer of property rights. It is essential that the parties involved consult with qualified attorneys who specialize in real estate and business law to properly execute the deed and comply with all legal requirements. Keywords: Bridgeport Connecticut, Quitclaim Deed, Corporation, LLC, property transfer, voluntary transfer, judicial transfer, legal document, real estate, limited liability company, restructuring, liability, tax purposes, warranties, guarantees, encumbrances, legal dispute, court-ordered, judgment, settlement, asset management, legal description, terms, conditions, compliance, attorney.Bridgeport Connecticut Quitclaim Deed from Corporation to LLC is a legal document used in the state of Connecticut to transfer ownership of real estate property from a corporation to a limited liability company (LLC). This type of transaction commonly occurs when a corporation decides to restructure its assets or transfer property to an LLC for tax or liability purposes. A quitclaim deed is a specific type of deed used to transfer property rights without making any guarantees or warranties about the title's condition. It implies no guarantees that the corporation has clear ownership or that there are no encumbrances on the property. The LLC receives only the rights and interests that the corporation had, without any implied warranty. There are two main types of Bridgeport Connecticut Quitclaim Deeds from Corporation to LLC: 1. Voluntary Transfer: This type of transfer occurs when the corporation willingly chooses to transfer the property to the LLC. It could be for various reasons, such as streamlining asset management, separating liabilities, or aligning with restructuring plans. This process involves drafting a Bridgeport Connecticut Quitclaim Deed document that outlines the details of the transfer, including the legal description of the property, names of both parties, consideration, and any relevant terms or conditions. 2. Judicial Transfer: In some cases, a Bridgeport Connecticut Quitclaim Deed from Corporation to LLC may be the result of a court-ordered judgment or settlement. This can occur when there is a legal dispute, such as a lawsuit or bankruptcy, involving the corporation and its assets. The court may order the transfer of the property to an LLC as part of resolving the legal matter. In such instances, the court's order will form the basis for the deed transfer, which must be executed in compliance with applicable laws and procedures. Both types of Bridgeport Connecticut Quitclaim Deed from Corporation to LLC require careful consideration and legal expertise to ensure a smooth and valid transfer of property rights. It is essential that the parties involved consult with qualified attorneys who specialize in real estate and business law to properly execute the deed and comply with all legal requirements. Keywords: Bridgeport Connecticut, Quitclaim Deed, Corporation, LLC, property transfer, voluntary transfer, judicial transfer, legal document, real estate, limited liability company, restructuring, liability, tax purposes, warranties, guarantees, encumbrances, legal dispute, court-ordered, judgment, settlement, asset management, legal description, terms, conditions, compliance, attorney.