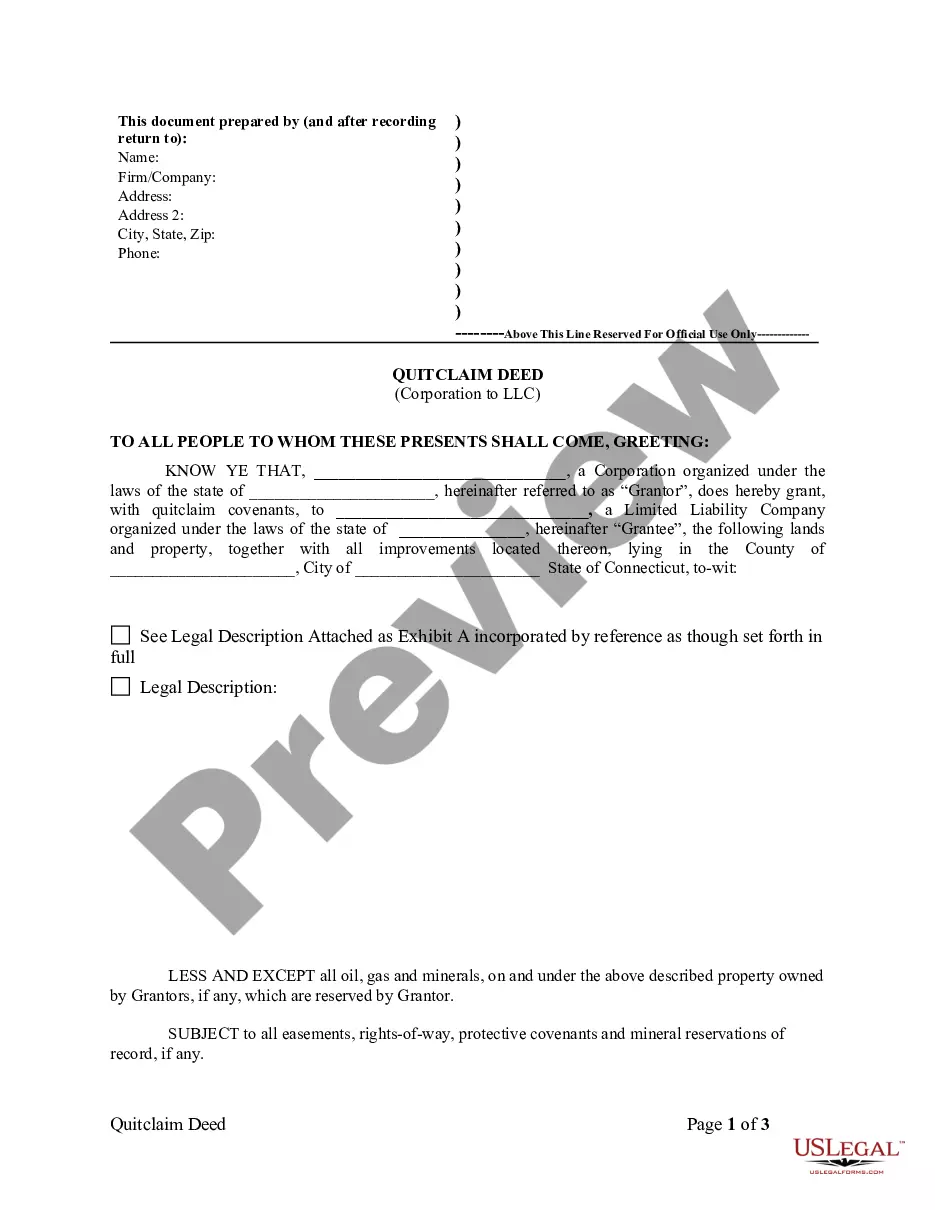

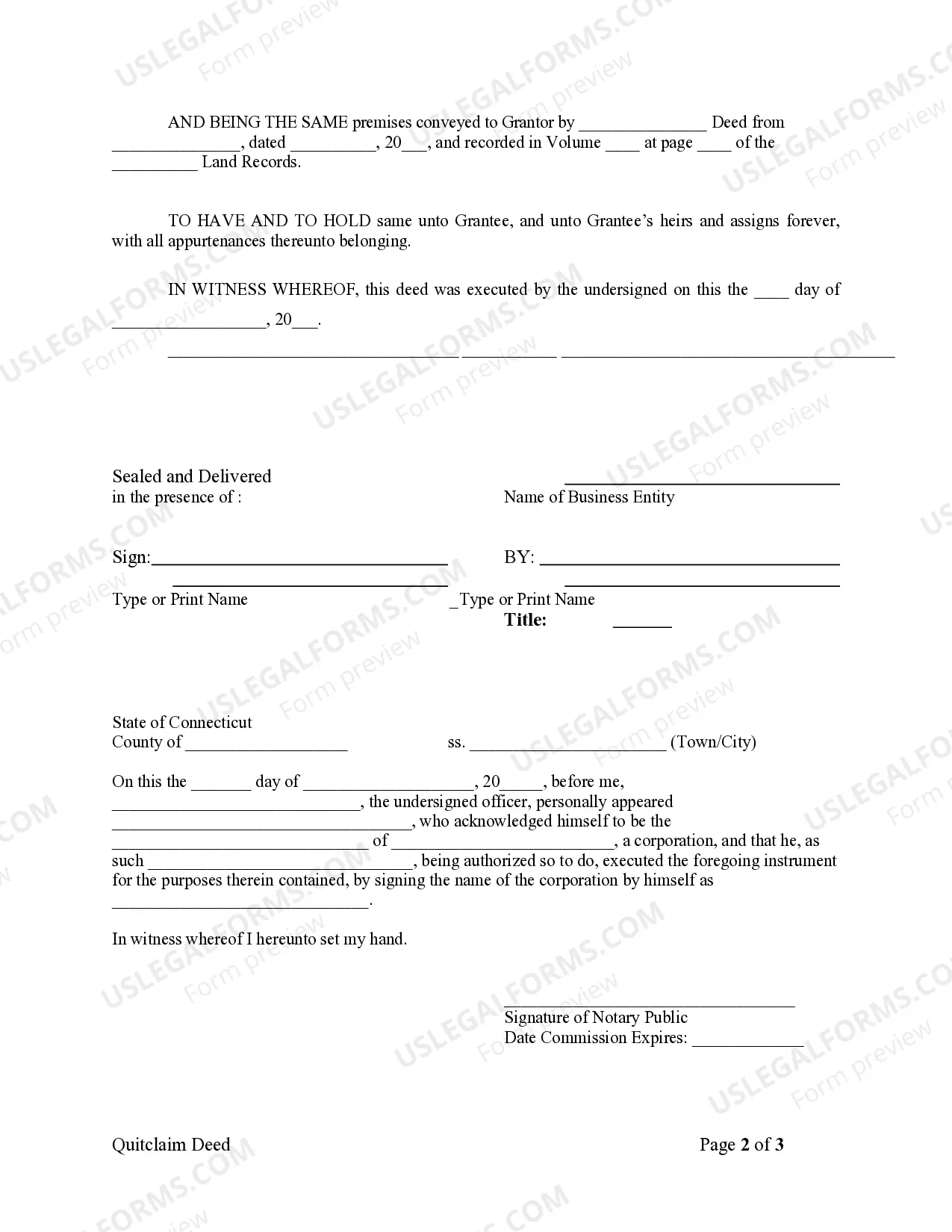

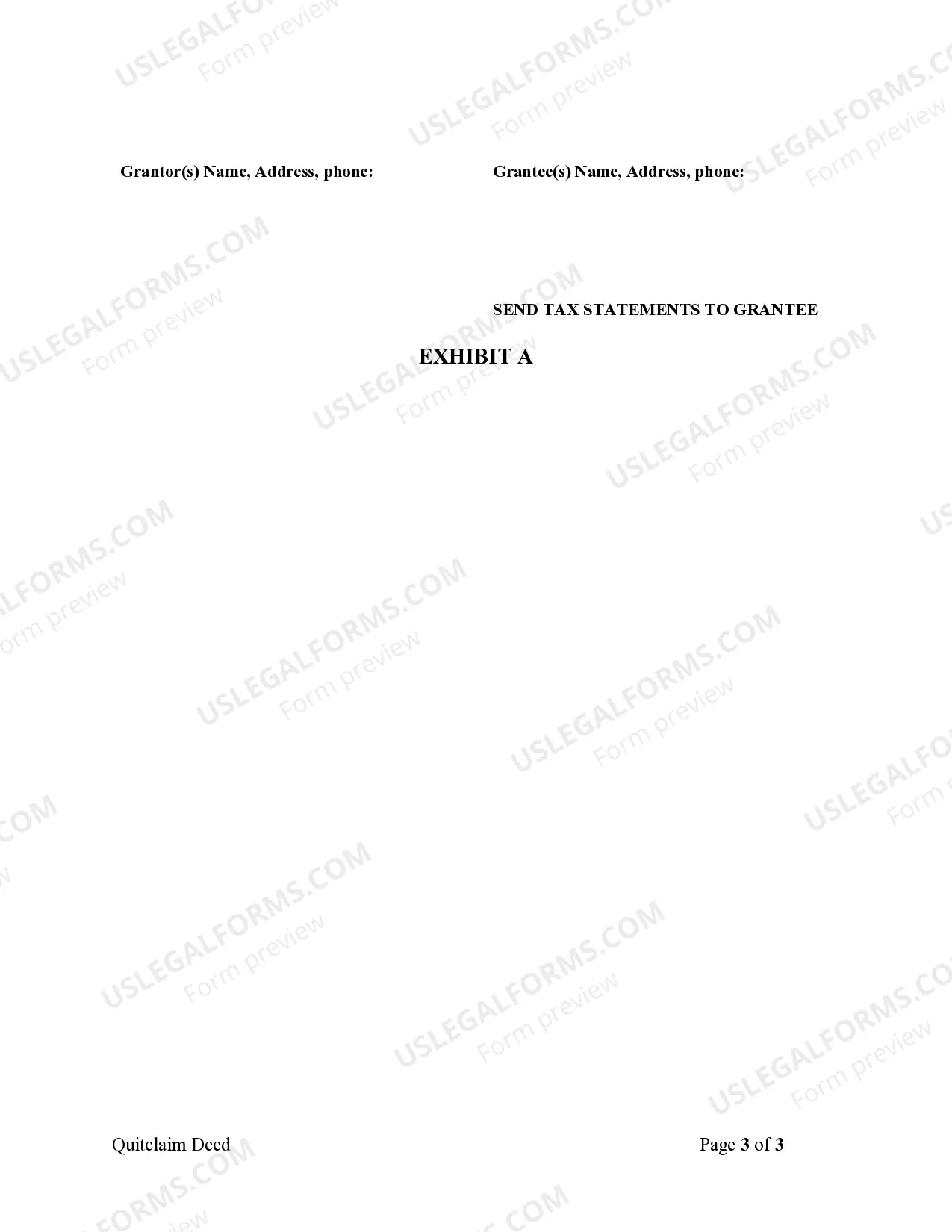

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Stamford Connecticut quitclaim deed from a corporation to an LLC is a legal document that transfers ownership of a property from a corporation to a limited liability company (LLC) located in Stamford, Connecticut. This type of deed is commonly used when a corporation wishes to transfer a property it owns to an LLC for various reasons, such as restructuring its assets or transferring ownership to a subsidiary company. A quitclaim deed essentially serves as a release of any interest, claim, or rights the corporation has on the property, transferring those rights to the LLC. It guarantees that the corporation will not make any future claims on the property, but it does not provide any warranties or guarantees about the property's title or condition—it only transfers whatever ownership interest the corporation has. When it comes to different types of Stamford Connecticut quitclaim deeds from a corporation to an LLC, they can include variations based on specific factors and circumstances. For example: 1. Stamford Connecticut Partial Quitclaim Deed from Corporation to LLC: This type of deed is used when the corporation wishes to transfer only a portion of its interest in the property to the LLC. This could be relevant if the corporation wants to retain partial ownership while allocating the rest to the LLC for asset protection or management purposes. 2. Stamford Connecticut Full Quitclaim Deed from Corporation to LLC: This type of deed is the most common and straightforward, as it transfers the entire ownership interest held by the corporation to the LLC. It effectively transfers all rights, claims, and interest the corporation possesses in the property to the LLC. 3. Stamford Connecticut Quitclaim Deed with Reserved Rights from Corporation to LLC: In some cases, a corporation may wish to transfer ownership of the property to the LLC but reserve certain limited rights for itself. These reserved rights can include things like access easements, usage restrictions, or mineral rights. This type of deed ensures that while the corporation transfers ownership to the LLC, it retains specific rights relating to the property. Overall, a Stamford Connecticut quitclaim deed from a corporation to an LLC is an essential legal document when transferring property ownership from a corporation to an LLC entity. It is crucial to consult with a qualified real estate attorney to ensure the deed accurately reflects the intentions and interests of all parties involved.A Stamford Connecticut quitclaim deed from a corporation to an LLC is a legal document that transfers ownership of a property from a corporation to a limited liability company (LLC) located in Stamford, Connecticut. This type of deed is commonly used when a corporation wishes to transfer a property it owns to an LLC for various reasons, such as restructuring its assets or transferring ownership to a subsidiary company. A quitclaim deed essentially serves as a release of any interest, claim, or rights the corporation has on the property, transferring those rights to the LLC. It guarantees that the corporation will not make any future claims on the property, but it does not provide any warranties or guarantees about the property's title or condition—it only transfers whatever ownership interest the corporation has. When it comes to different types of Stamford Connecticut quitclaim deeds from a corporation to an LLC, they can include variations based on specific factors and circumstances. For example: 1. Stamford Connecticut Partial Quitclaim Deed from Corporation to LLC: This type of deed is used when the corporation wishes to transfer only a portion of its interest in the property to the LLC. This could be relevant if the corporation wants to retain partial ownership while allocating the rest to the LLC for asset protection or management purposes. 2. Stamford Connecticut Full Quitclaim Deed from Corporation to LLC: This type of deed is the most common and straightforward, as it transfers the entire ownership interest held by the corporation to the LLC. It effectively transfers all rights, claims, and interest the corporation possesses in the property to the LLC. 3. Stamford Connecticut Quitclaim Deed with Reserved Rights from Corporation to LLC: In some cases, a corporation may wish to transfer ownership of the property to the LLC but reserve certain limited rights for itself. These reserved rights can include things like access easements, usage restrictions, or mineral rights. This type of deed ensures that while the corporation transfers ownership to the LLC, it retains specific rights relating to the property. Overall, a Stamford Connecticut quitclaim deed from a corporation to an LLC is an essential legal document when transferring property ownership from a corporation to an LLC entity. It is crucial to consult with a qualified real estate attorney to ensure the deed accurately reflects the intentions and interests of all parties involved.