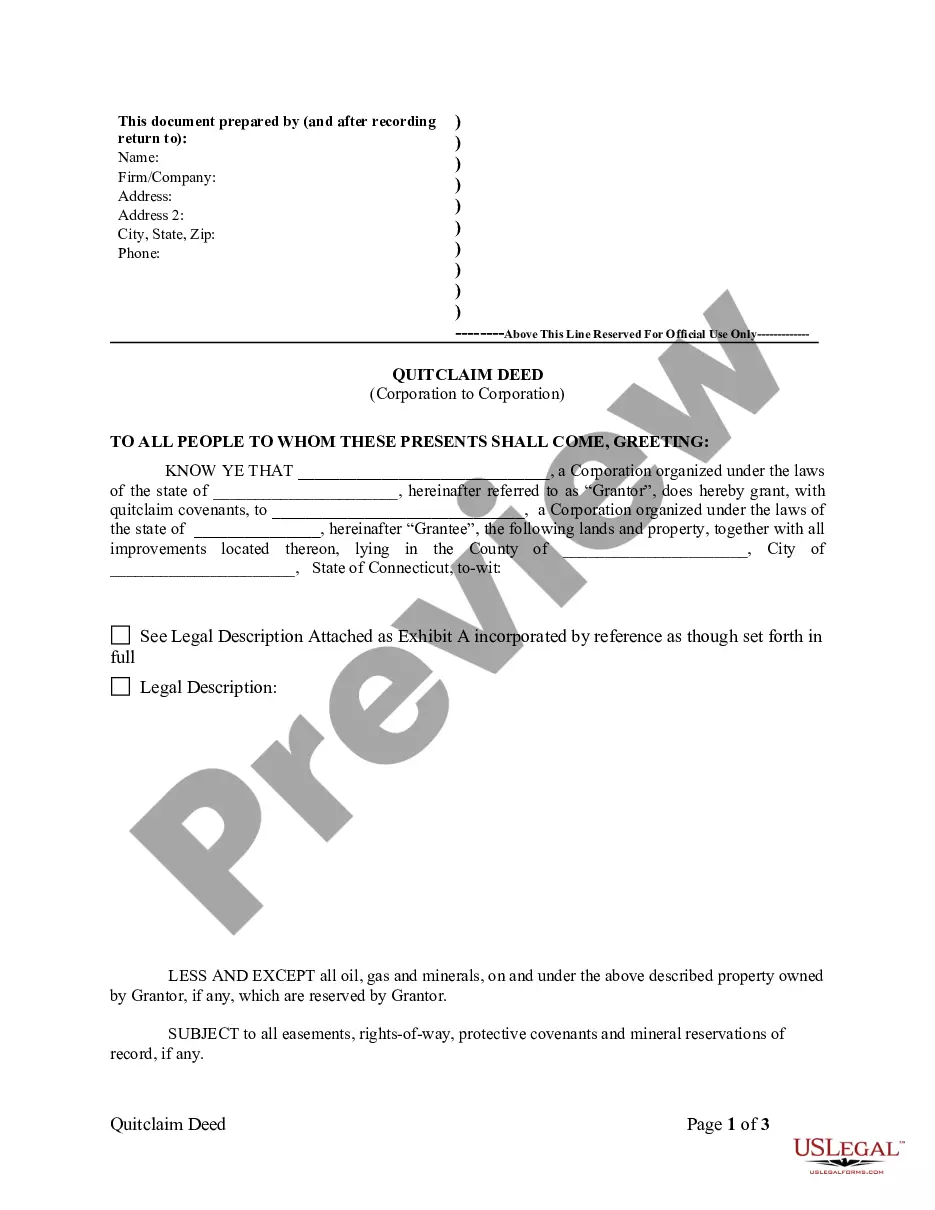

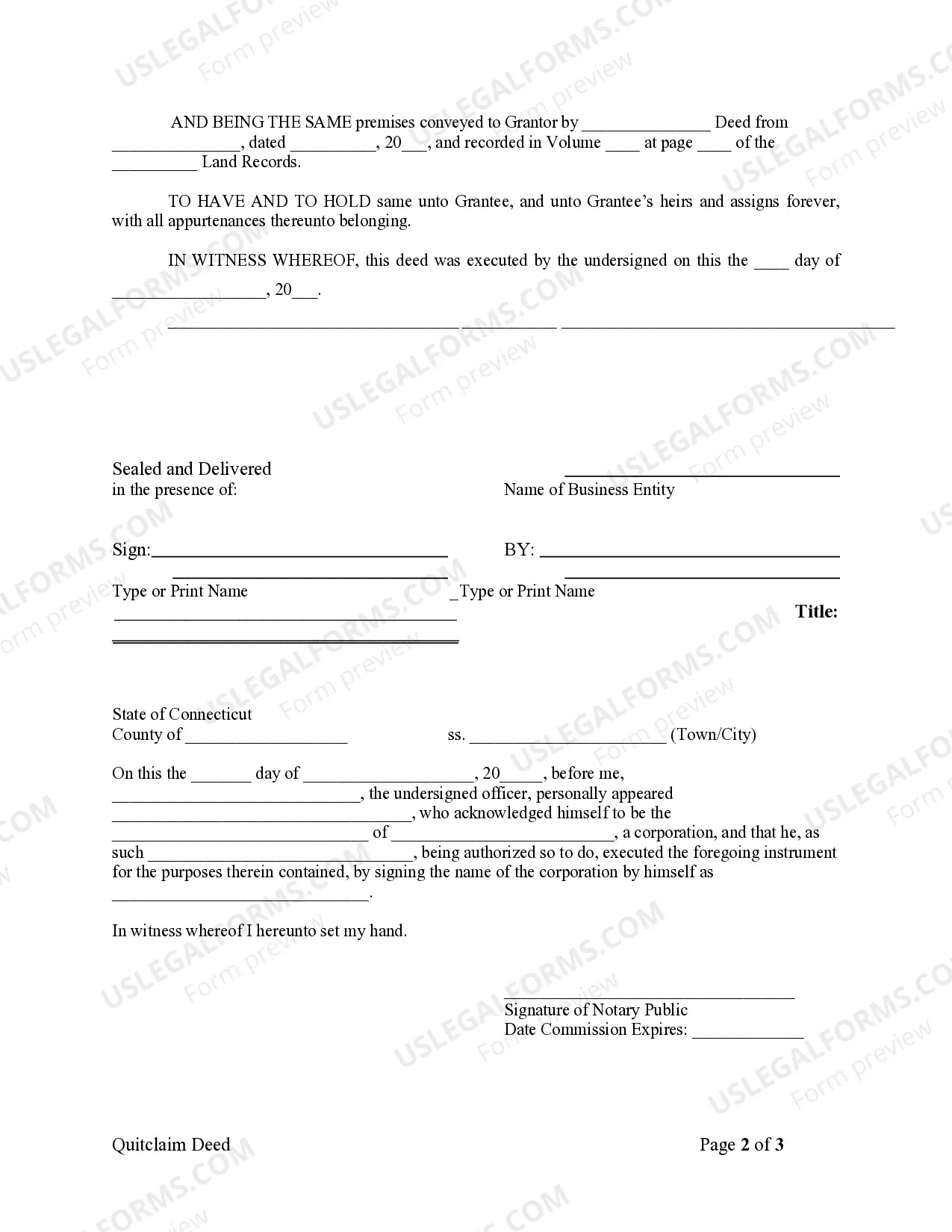

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Stamford Connecticut Quitclaim Deed from Corporation to Corporation is a legal document used for the transfer of real estate property between two corporations in Stamford, Connecticut. This type of deed provides a quick and efficient way for one corporation to transfer its interest in a property to another corporation without making any warranties or guarantees about the property's title. A Stamford Connecticut Quitclaim Deed from Corporation to Corporation is often used in situations where there is an internal restructuring within a corporation, such as a merger or acquisition, resulting in the transfer of a property from one entity to another within the same parent corporation. It can also be used when a subsidiary corporation wishes to transfer ownership of a property to its parent company. The main characteristic of a quitclaim deed is that it transfers only the interest the granter (the corporation transferring the property) has in the property, without making any guarantees about the title or any potential legal issues associated with the property. This means that if there are any liens, encumbrances, or disputes related to the property's ownership, the grantee (the corporation receiving the property) will assume responsibility for resolving those issues. Some key points to be aware of when dealing with Stamford Connecticut Quitclaim Deed from Corporation to Corporation are: 1. Title Insurance: Unlike other types of deeds, a quitclaim deed does not provide any form of title insurance. It is essential for the grantee to conduct a thorough title search and consider purchasing title insurance to protect against any potential title defects. 2. Due Diligence: Both parties should engage in due diligence before executing the quitclaim deed. The grantee should evaluate the property's condition, any existing agreements or leases, and verify that there are no hidden liabilities or legal complications associated with the property. 3. Legal Counsel: It is highly advisable for both the granter and the grantee to seek legal counsel before entering into a quitclaim deed. An experienced attorney specialized in real estate law can ensure that all necessary steps are taken, legal requirements are met, and potential risks are mitigated. While Stamford Connecticut Quitclaim Deed from Corporation to Corporation is the general term for this type of transfer, there may not be specific variations of this deed. However, it is crucial to carefully review the terms and conditions of the quitclaim deed as they may vary depending on the specific circumstances of the transfer and the agreements reached between the involved corporations. In conclusion, a Stamford Connecticut Quitclaim Deed from Corporation to Corporation provides a straightforward means for corporations to transfer real estate property without warranties regarding title. Due diligence and legal counsel are essential to ensure a smooth and secure transfer process.Stamford Connecticut Quitclaim Deed from Corporation to Corporation is a legal document used for the transfer of real estate property between two corporations in Stamford, Connecticut. This type of deed provides a quick and efficient way for one corporation to transfer its interest in a property to another corporation without making any warranties or guarantees about the property's title. A Stamford Connecticut Quitclaim Deed from Corporation to Corporation is often used in situations where there is an internal restructuring within a corporation, such as a merger or acquisition, resulting in the transfer of a property from one entity to another within the same parent corporation. It can also be used when a subsidiary corporation wishes to transfer ownership of a property to its parent company. The main characteristic of a quitclaim deed is that it transfers only the interest the granter (the corporation transferring the property) has in the property, without making any guarantees about the title or any potential legal issues associated with the property. This means that if there are any liens, encumbrances, or disputes related to the property's ownership, the grantee (the corporation receiving the property) will assume responsibility for resolving those issues. Some key points to be aware of when dealing with Stamford Connecticut Quitclaim Deed from Corporation to Corporation are: 1. Title Insurance: Unlike other types of deeds, a quitclaim deed does not provide any form of title insurance. It is essential for the grantee to conduct a thorough title search and consider purchasing title insurance to protect against any potential title defects. 2. Due Diligence: Both parties should engage in due diligence before executing the quitclaim deed. The grantee should evaluate the property's condition, any existing agreements or leases, and verify that there are no hidden liabilities or legal complications associated with the property. 3. Legal Counsel: It is highly advisable for both the granter and the grantee to seek legal counsel before entering into a quitclaim deed. An experienced attorney specialized in real estate law can ensure that all necessary steps are taken, legal requirements are met, and potential risks are mitigated. While Stamford Connecticut Quitclaim Deed from Corporation to Corporation is the general term for this type of transfer, there may not be specific variations of this deed. However, it is crucial to carefully review the terms and conditions of the quitclaim deed as they may vary depending on the specific circumstances of the transfer and the agreements reached between the involved corporations. In conclusion, a Stamford Connecticut Quitclaim Deed from Corporation to Corporation provides a straightforward means for corporations to transfer real estate property without warranties regarding title. Due diligence and legal counsel are essential to ensure a smooth and secure transfer process.