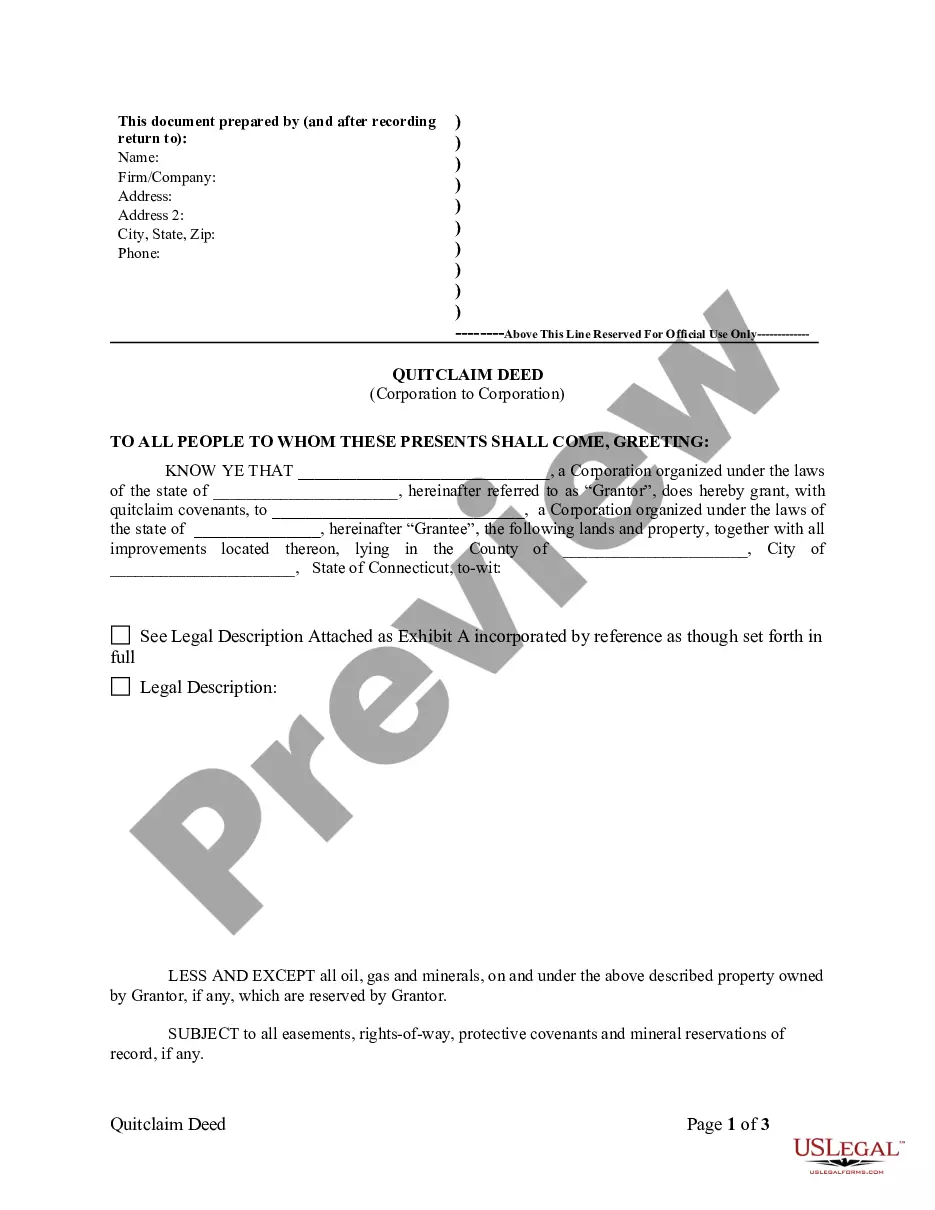

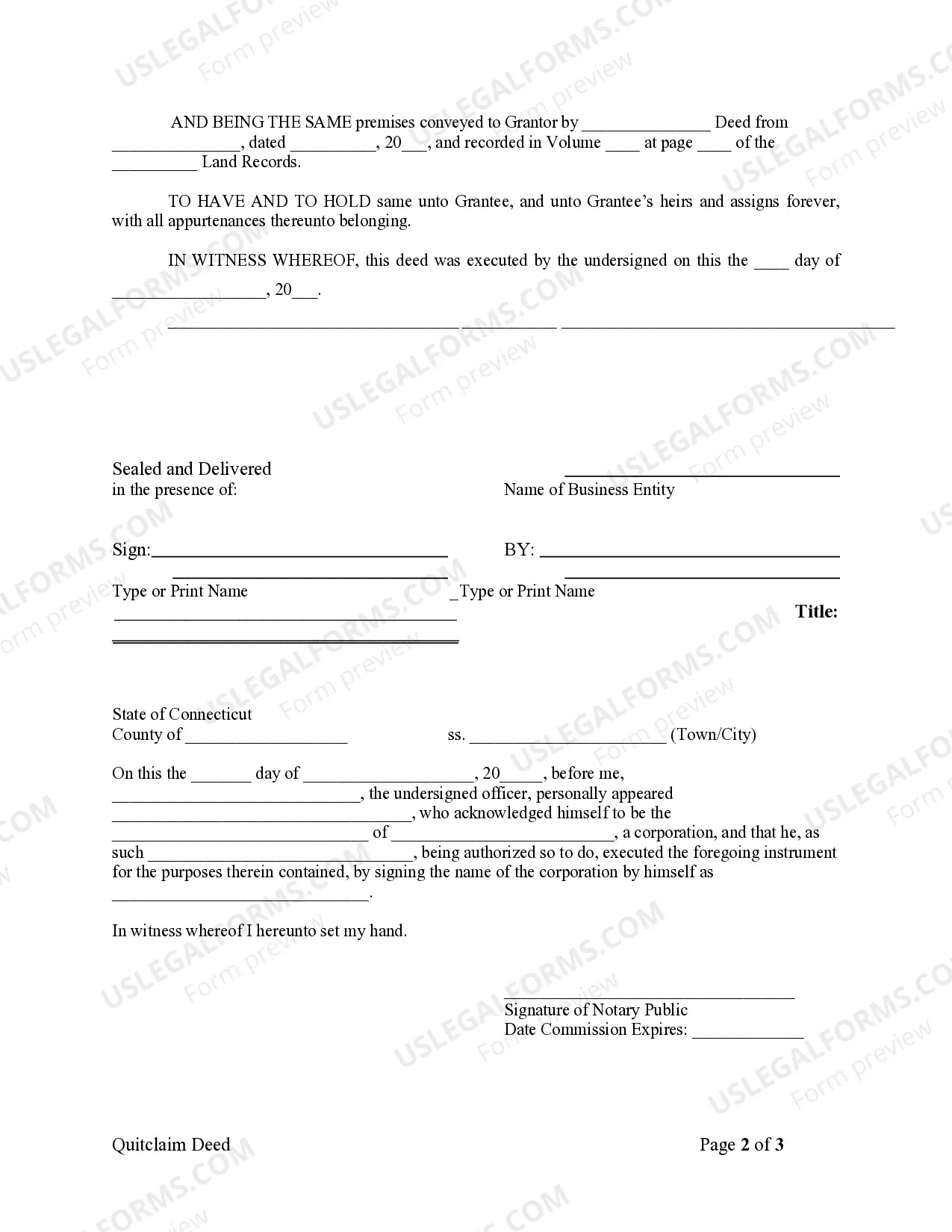

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Waterbury Connecticut Quitclaim Deed from Corporation to Corporation is a legal document that facilitates the transfer of property ownership rights from one corporation to another. This type of deed is commonly used when a corporation wants to transfer property without making any guarantees about the title or potential liens on the property. In Waterbury, Connecticut, there are two main types of Quitclaim Deeds from Corporation to Corporation, which are as follows: 1. General Quitclaim Deed: This type of deed transfers the entire interest, if any, the granting corporation has in the property to the receiving corporation. It makes no warranties or guarantees about the title or any encumbrances on the property. The receiving corporation accepts the property "as is," assuming all risks and responsibilities associated with ownership. 2. Special Quitclaim Deed: Unlike a general quitclaim deed, a special quitclaim deed specifies certain conditions or limitations on the transfer of property. For example, the granting corporation may include specific provisions such as excluding a portion of the property or reserving certain rights. These conditions are outlined explicitly within the deed and agreed upon by both parties involved. When utilizing a Waterbury Connecticut Quitclaim Deed from Corporation to Corporation, certain keywords play a crucial role in understanding the process and implications. Here are some relevant keywords: — Waterbury, Connecticut: Refers to the specific location where the property is situated, providing local context for the deed. — Quitclaim Deed: This legal document relinquishes the granting corporation's interest in the property to the receiving corporation without any warranties or guarantees. — Corporation to Corporation: Signifies the involvement of two corporate entities in the property transfer. — Property Ownership: Refers to the legal rights and responsibilities associated with possessing a specific property. — Title: Indicates legal ownership of a property and any potential claims or encumbrances. — Liens: Legal claims or debts imposed on the property that may affect its ownership or transfer process. — GeneralQuitclaim Deed: The type of deed that transfers the entire interest of the corporation without any warranties or guarantees. — Special Quitclaim Deed: A deed that includes specific conditions or limitations on the transfer of property, agreed upon by both parties. — Encumbrances: Any legal claims or burdens, such as mortgages or liens, that exist on the property. Understanding the intricacies of a Waterbury Connecticut Quitclaim Deed from Corporation to Corporation, including its types and keywords, is essential for a successful property transfer between two corporate entities. It is always advisable to consult legal professionals or real estate experts to ensure compliance with local laws and regulations throughout the process.