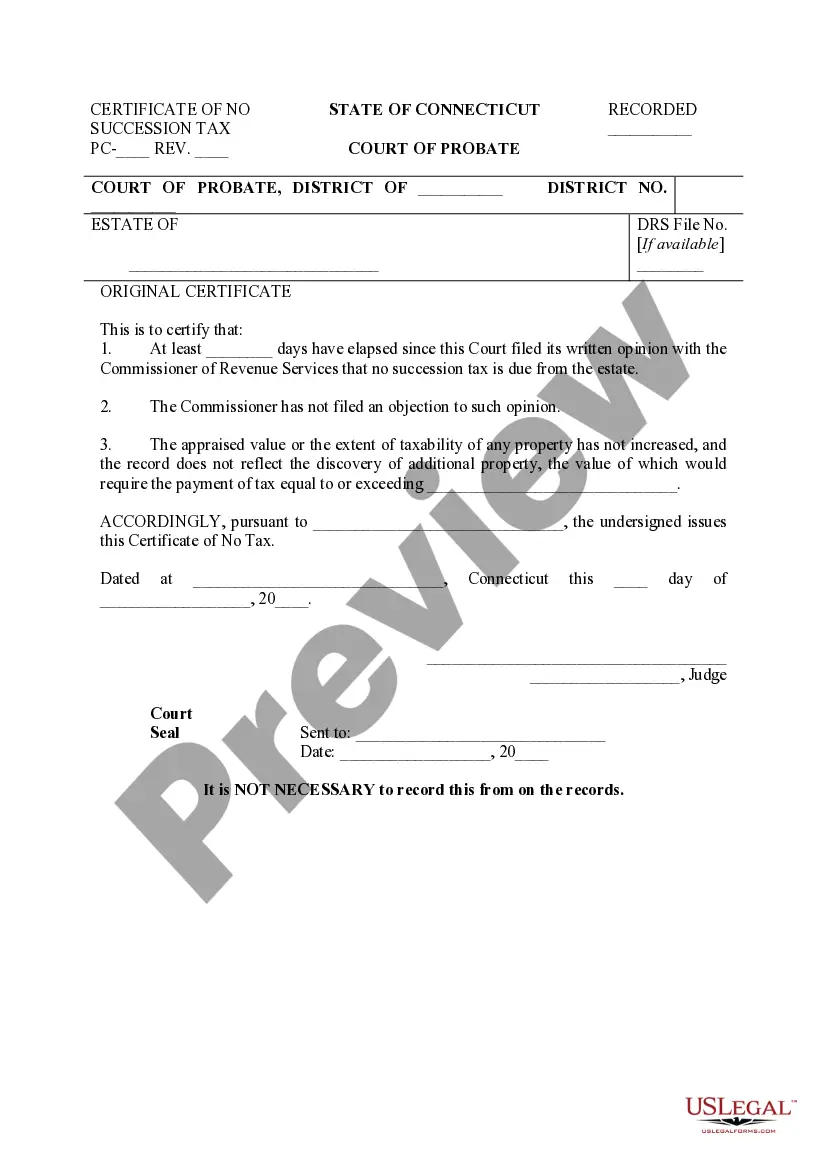

Bridgeport, Connecticut Certificate of No Succession Tax serves as an important legal document that aids in the proper administration of an individual's estate after their death. This certificate provides crucial information regarding the tax status of the estate, specifically in terms of succession tax obligations. The Bridgeport, Connecticut Certificate of No Succession Tax verifies whether any taxes need to be paid by the estate or if it qualifies as tax-exempt. In Bridgeport, Connecticut, the Certificate of No Succession Tax is divided into two main types: 1. Individual Certificate of No Succession Tax: This type of certificate is applicable when an individual passes away, and their estate falls under the jurisdiction of Bridgeport, Connecticut. It is mandatory for the executor of the estate to apply for this certificate to determine if the estate is liable for any succession taxes. 2. Business Certificate of No Succession Tax: This type of certificate is specifically designed for businesses located within Bridgeport, Connecticut. When a business owner passes away, the executor or representative of the estate must obtain this certificate to assess the potential succession tax liabilities of the business's assets. The process of obtaining a Certificate of No Succession Tax in Bridgeport, Connecticut involves several steps. The executor or representative of the estate is required to gather all relevant documentation related to the deceased person's assets, such as property deeds, bank statements, investment portfolios, and business records. The next step is to complete the necessary application forms, providing comprehensive information about the deceased person's estate. This includes details of all assets and liabilities, the value of the estate, and the relationship of any beneficiaries to the deceased. Additionally, the executor must disclose any previous or ongoing succession tax proceedings related to the estate. Once the application is submitted, the Bridgeport, Connecticut tax authorities will review the information provided thoroughly. They will assess the estate's eligibility for a Certificate of No Succession Tax by evaluating if the estate's value exceeds the threshold set by Connecticut's tax laws. If the estate qualifies, a Certificate of No Succession Tax will be issued, declaring that no succession taxes are due. It is important to note that this certificate does not exempt the estate from other taxes, such as income tax or estate tax. However, it relieves the estate from the burden of succession taxes specifically. In conclusion, the Bridgeport, Connecticut Certificate of No Succession Tax is a vital document that helps determine the tax obligations of an estate after an individual's demise. By obtaining this certificate, the executor or representative of the estate can ensure compliance with the tax laws of Bridgeport, Connecticut while efficiently managing the distribution of the deceased person's assets.

Bridgeport Connecticut Certificate of No Succession Tax

Category:

State:

Connecticut

City:

Bridgeport

Control #:

CT-0187

Format:

Word;

Rich Text

Instant download

Description

This form certifies that the written opinion of the Commissioner of Revenue Services states that no succession tax is due from the estate.

Bridgeport, Connecticut Certificate of No Succession Tax serves as an important legal document that aids in the proper administration of an individual's estate after their death. This certificate provides crucial information regarding the tax status of the estate, specifically in terms of succession tax obligations. The Bridgeport, Connecticut Certificate of No Succession Tax verifies whether any taxes need to be paid by the estate or if it qualifies as tax-exempt. In Bridgeport, Connecticut, the Certificate of No Succession Tax is divided into two main types: 1. Individual Certificate of No Succession Tax: This type of certificate is applicable when an individual passes away, and their estate falls under the jurisdiction of Bridgeport, Connecticut. It is mandatory for the executor of the estate to apply for this certificate to determine if the estate is liable for any succession taxes. 2. Business Certificate of No Succession Tax: This type of certificate is specifically designed for businesses located within Bridgeport, Connecticut. When a business owner passes away, the executor or representative of the estate must obtain this certificate to assess the potential succession tax liabilities of the business's assets. The process of obtaining a Certificate of No Succession Tax in Bridgeport, Connecticut involves several steps. The executor or representative of the estate is required to gather all relevant documentation related to the deceased person's assets, such as property deeds, bank statements, investment portfolios, and business records. The next step is to complete the necessary application forms, providing comprehensive information about the deceased person's estate. This includes details of all assets and liabilities, the value of the estate, and the relationship of any beneficiaries to the deceased. Additionally, the executor must disclose any previous or ongoing succession tax proceedings related to the estate. Once the application is submitted, the Bridgeport, Connecticut tax authorities will review the information provided thoroughly. They will assess the estate's eligibility for a Certificate of No Succession Tax by evaluating if the estate's value exceeds the threshold set by Connecticut's tax laws. If the estate qualifies, a Certificate of No Succession Tax will be issued, declaring that no succession taxes are due. It is important to note that this certificate does not exempt the estate from other taxes, such as income tax or estate tax. However, it relieves the estate from the burden of succession taxes specifically. In conclusion, the Bridgeport, Connecticut Certificate of No Succession Tax is a vital document that helps determine the tax obligations of an estate after an individual's demise. By obtaining this certificate, the executor or representative of the estate can ensure compliance with the tax laws of Bridgeport, Connecticut while efficiently managing the distribution of the deceased person's assets.

How to fill out Bridgeport Connecticut Certificate Of No Succession Tax?

If you’ve already used our service before, log in to your account and save the Bridgeport Connecticut Certificate of No Succession Tax on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Bridgeport Connecticut Certificate of No Succession Tax. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!