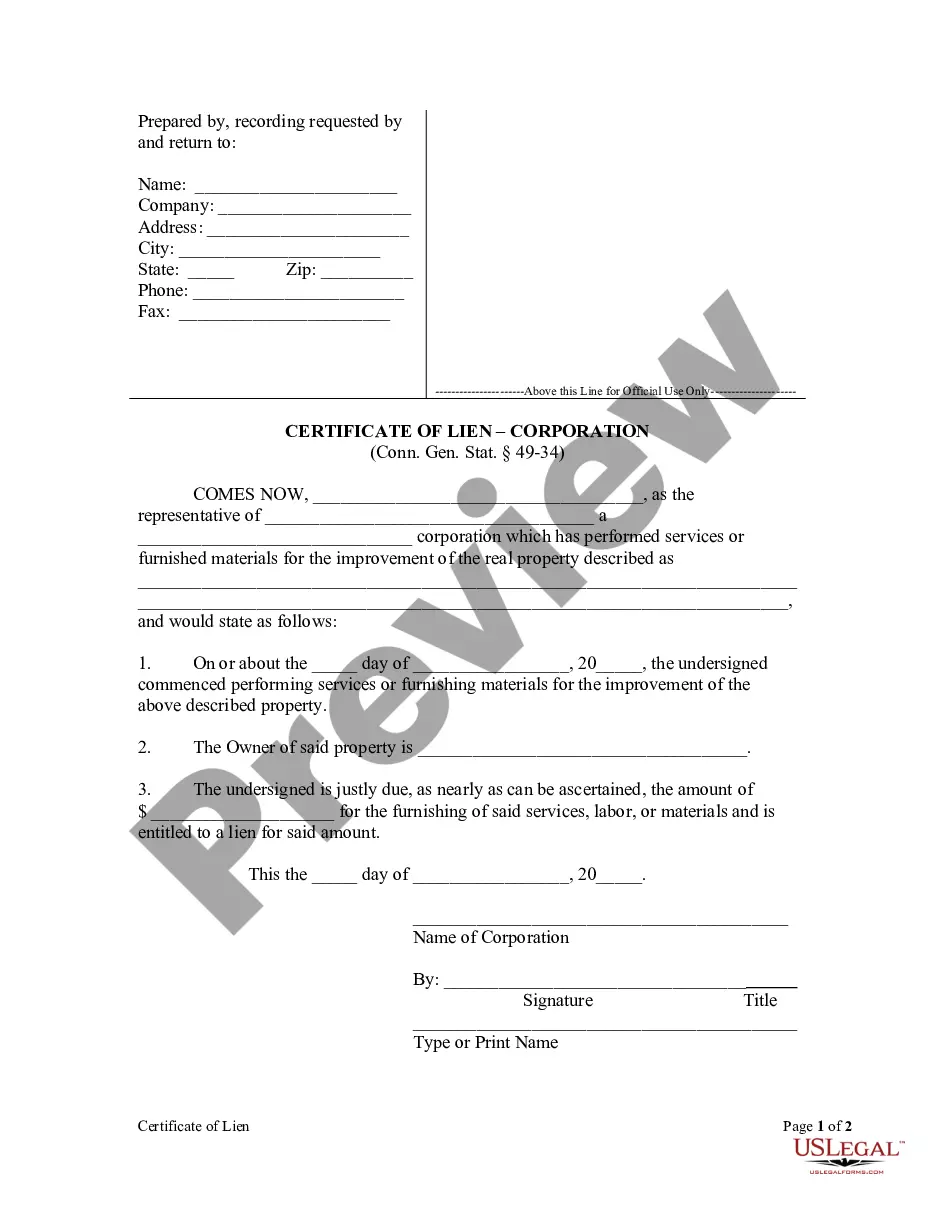

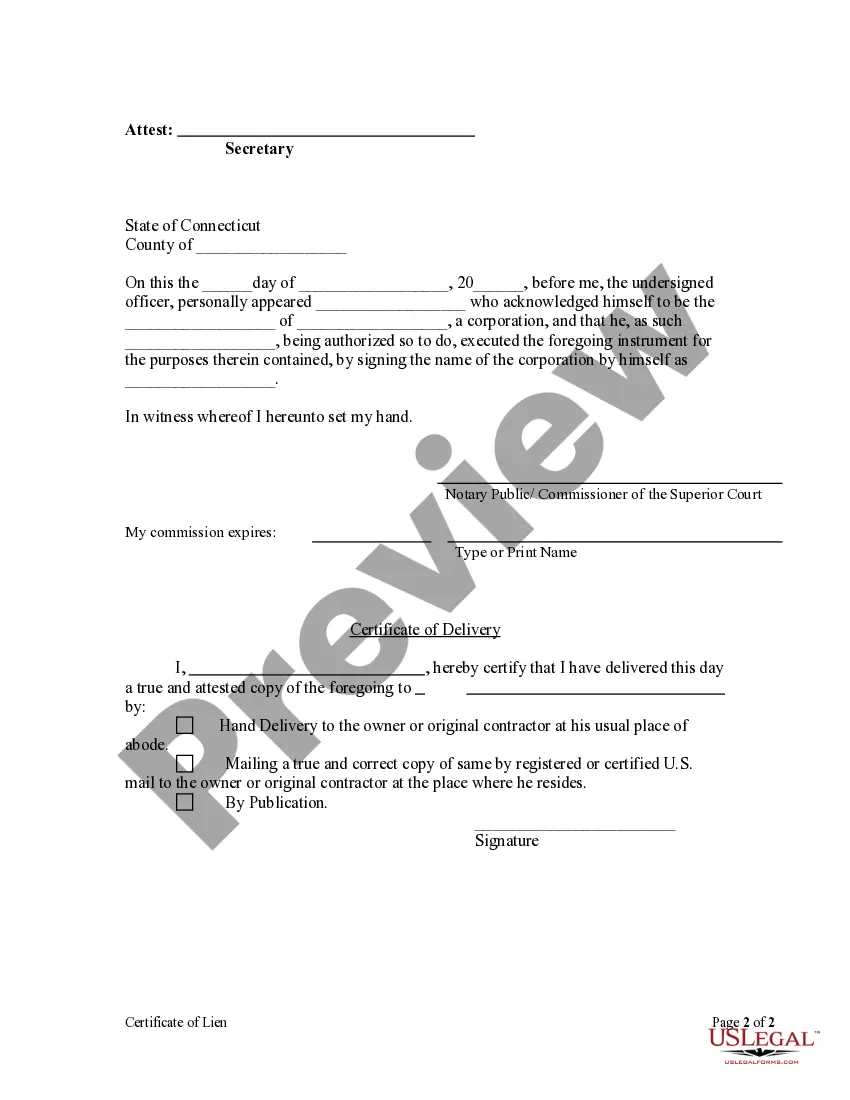

Conn. Gen. Stat. §49-34 states that a mechanic's lien is invalid without the filing of a certificate of lien within ninety (90) days after the cessation of work. The certificate must be recorded with the town clerk of the town in which the building, lot or plot is situated, and must be subscribed and sworn to by the lien claimant. The certificate must be served on the property owner, (a) within (90) days of the cessation of work, or (b) prior to the lodging of the certificate but not later than thirty (30) days after the lodging of the certificate. This form is for use by a corporation or limited liability company.

Bridgeport Connecticut Certificate of Lien by Corporation or LLC

Description

How to fill out Connecticut Certificate Of Lien By Corporation Or LLC?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our user-friendly platform featuring thousands of documents streamlines the way to discover and obtain nearly any document sample you need.

You can download, complete, and validate the Bridgeport Connecticut Certificate of Lien by Corporation or LLC in just a few minutes instead of spending hours searching online for a suitable template.

Using our library is an excellent method to enhance the security of your record submissions. Our knowledgeable attorneys routinely review all documents to verify that the templates conform to specific state standards and are aligned with recent statutes and regulations.

If you don't have an account yet, follow the instructions below.

1. Open the page with the form you need. Ensure it is the document you intended to find: check its title and description, and use the Preview function when it is available. Otherwise, utilize the Search field to find the correct one.

- How can you obtain the Bridgeport Connecticut Certificate of Lien by Corporation or LLC.

- If you have a subscription, simply Log In to your account. The Download button will be visible on all documents you examine.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

In Connecticut, the form required for the release of a lien is known as a Release of Lien form. This form must be filled out and recorded with the appropriate town clerk to officially remove the lien from the property. Understanding the Bridgeport Connecticut Certificate of Lien by Corporation or LLC is crucial, as it ensures that you have complied with all requirements for a smooth release of the lien.

Looking up an LLC in Connecticut is straightforward through the state’s Secretary of State's website. You can search by the LLC's name or its identification number to get the necessary information. This process is beneficial, especially if you are checking for any liens, including the Bridgeport Connecticut Certificate of Lien by Corporation or LLC, that could influence your business decisions.

To lookup an LLC in Connecticut, you should access the Connecticut Secretary of State's business entity search tool online. Enter the name or registration number of the LLC in question. This will provide you with vital information such as filing history and status, including any liens, like the Bridgeport Connecticut Certificate of Lien by Corporation or LLC, that may affect the business.

Filing a lien on property in Connecticut involves preparing a Certificate of Lien and submitting it to the town clerk in the municipality where the property is located. You must include specific information, such as the debtor's name and the amount owed. Additionally, it is essential to understand how the Bridgeport Connecticut Certificate of Lien by Corporation or LLC functions, as it can provide you with legal standing in recovering debts.

To verify a business in Connecticut, you can visit the Connecticut Secretary of State's website. There, you can use their business lookup tool to search for corporations and LLCs. Simply enter the business name or the identification number, and you will find the details you need, including information related to the Bridgeport Connecticut Certificate of Lien by Corporation or LLC.

Connecticut does not legally require an LLC to have an operating agreement, but it is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC. By having this document, you can help prevent misunderstandings among members, especially when dealing with aspects like a Bridgeport Connecticut Certificate of Lien by Corporation or LLC. Using platforms like uslegalforms can assist you in creating a comprehensive operating agreement.

Establishing an LLC in Connecticut typically takes about 1 to 2 weeks if you file online. However, processing times may vary based on the state’s workload and your specific circumstances. It's advisable to prepare your documents accurately to avoid delays, especially when you need to file for a Bridgeport Connecticut Certificate of Lien by Corporation or LLC. Utilizing services like uslegalforms can streamline the application process.

CT UCC stands for Connecticut Uniform Commercial Code. This set of laws governs commercial transactions in Connecticut. When dealing with a Bridgeport Connecticut Certificate of Lien by Corporation or LLC, understanding UCC filings is crucial. They help protect creditors by establishing priority for secured interests in personal property.

A Certificate of Organization in Connecticut is a formal document that certifies the formation of a limited liability company (LLC). It outlines key information such as the LLC's name, registered agent, and business purpose. This certificate establishes the company as a legal entity, enabling it to operate in the state. Knowing how the Bridgeport Connecticut Certificate of Lien by Corporation or LLC relates to such documents can enhance your understanding of business regulations.

To fill out a notice of lien, gather relevant property and creditor information, including the nature of the debt. Start by accurately detailing the parties involved, property description, and the amount owed. Ensuring correctness in this document is vital, as errors can result in delays or complications. Resources like USLegalForms can guide you through creating a Bridgeport Connecticut Certificate of Lien by Corporation or LLC to ensure compliance.