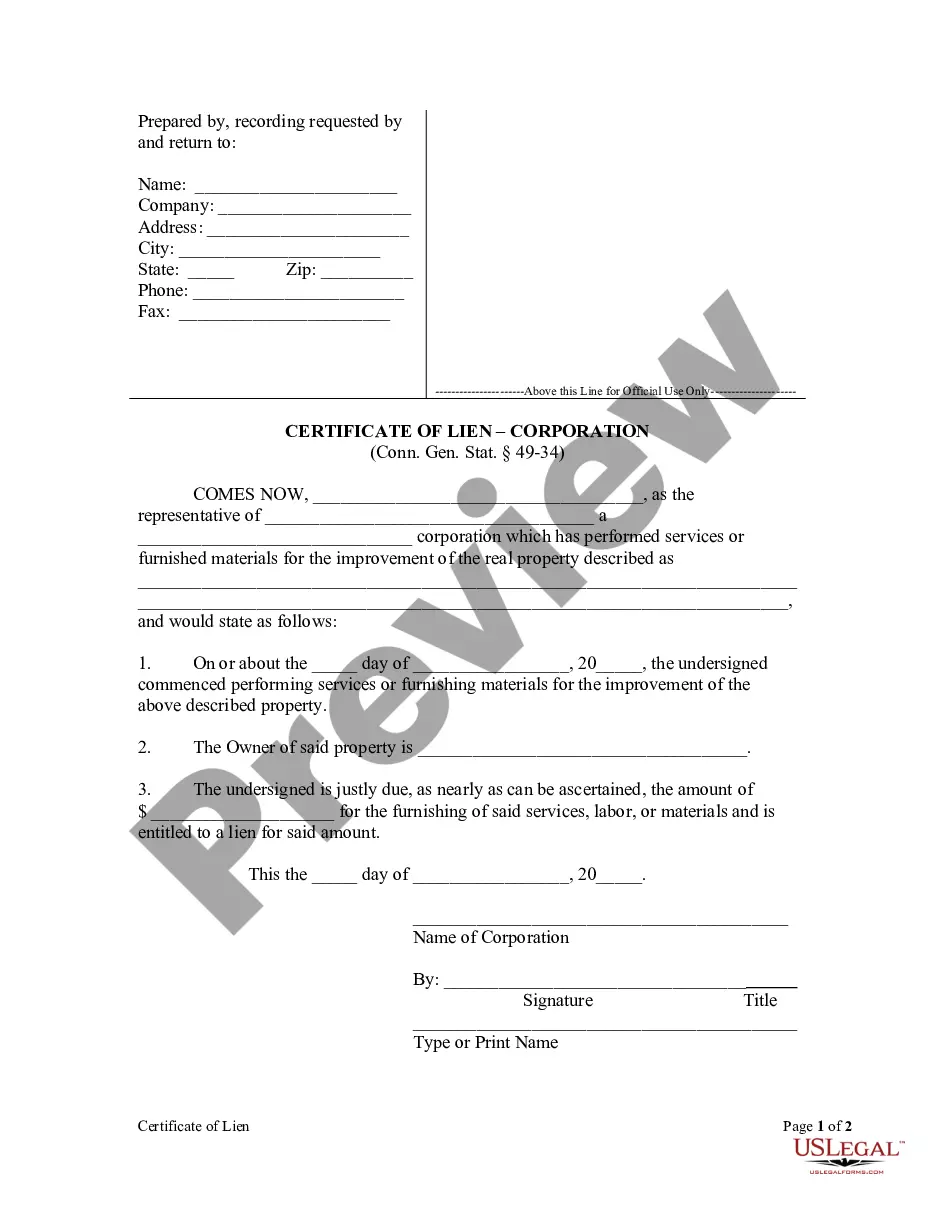

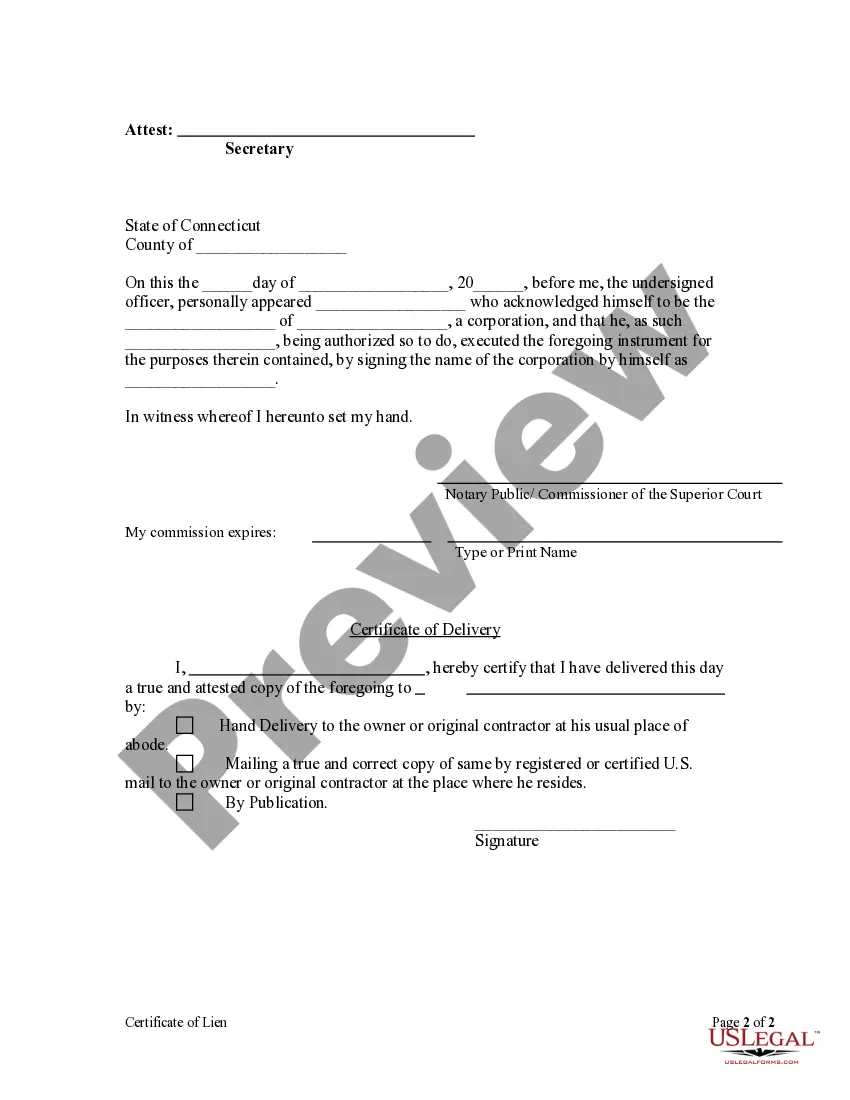

Conn. Gen. Stat. §49-34 states that a mechanic's lien is invalid without the filing of a certificate of lien within ninety (90) days after the cessation of work. The certificate must be recorded with the town clerk of the town in which the building, lot or plot is situated, and must be subscribed and sworn to by the lien claimant. The certificate must be served on the property owner, (a) within (90) days of the cessation of work, or (b) prior to the lodging of the certificate but not later than thirty (30) days after the lodging of the certificate. This form is for use by a corporation or limited liability company.

Stamford Connecticut Certificate of Lien by Corporation or LLC is a legal document used to secure a claim against a property or asset owned by an individual or business entity in the city of Stamford, Connecticut. When a Corporation or Limited Liability Company (LLC) believes it is owed a debt or has a legal right to place a lien on a property, they can file a Certificate of Lien with the appropriate authorities to ensure their claim is recognized and protected. This certificate serves as a public record of the debt or claim and alerts potential buyers or lenders about the existing lien on the property. It prevents the property owner from selling or transferring the property without resolving the outstanding debt or obtaining the consent of the lien holder. The Certificate of Lien acts as a legal tool for the Corporation or LLC to recover the debt owed or assert their legal rights regarding the property or asset. Types of Stamford Connecticut Certificates of Lien by Corporation or LLC: 1. Tax Lien: This type of lien is filed by the Corporation or LLC when the property owner fails to pay their taxes to the local government. The corporation or LLC will place a lien on the property to ensure the payment of outstanding tax obligations, including property taxes. 2. Mechanic's Lien: If a Corporation or LLC provided labor, materials, or services to improve or repair a property and was not fully compensated, they can file a mechanic's lien. This type of lien protects the corporation or LLC's right to recover the unpaid amount by laying claim on the property until the debt is settled. 3. Mortgage Lien: When a Corporation or LLC extends a loan or financial assistance to a property owner, they may file a mortgage lien against the property to secure their investment. The lien ensures that if the property owner defaults on their loan repayment, the corporation or LLC has the right to foreclose on the property in order to recover their money. 4. Judgment Lien: If a Corporation or LLC wins a lawsuit against an individual or entity and is awarded a monetary judgment, they can file a judgment lien against their debtor's property. This lien assists in enforcing the court's decision and ensures the successful party receives the owed amount through the sale of the property. It is important for both property owners and prospective buyers to be aware of Stamford Connecticut Certificates of Lien by Corporation or LLC. Buyers should conduct thorough due diligence before purchasing a property to identify any existing liens, while property owners should address any unpaid debts or disputes promptly to avoid potential legal complications.Stamford Connecticut Certificate of Lien by Corporation or LLC is a legal document used to secure a claim against a property or asset owned by an individual or business entity in the city of Stamford, Connecticut. When a Corporation or Limited Liability Company (LLC) believes it is owed a debt or has a legal right to place a lien on a property, they can file a Certificate of Lien with the appropriate authorities to ensure their claim is recognized and protected. This certificate serves as a public record of the debt or claim and alerts potential buyers or lenders about the existing lien on the property. It prevents the property owner from selling or transferring the property without resolving the outstanding debt or obtaining the consent of the lien holder. The Certificate of Lien acts as a legal tool for the Corporation or LLC to recover the debt owed or assert their legal rights regarding the property or asset. Types of Stamford Connecticut Certificates of Lien by Corporation or LLC: 1. Tax Lien: This type of lien is filed by the Corporation or LLC when the property owner fails to pay their taxes to the local government. The corporation or LLC will place a lien on the property to ensure the payment of outstanding tax obligations, including property taxes. 2. Mechanic's Lien: If a Corporation or LLC provided labor, materials, or services to improve or repair a property and was not fully compensated, they can file a mechanic's lien. This type of lien protects the corporation or LLC's right to recover the unpaid amount by laying claim on the property until the debt is settled. 3. Mortgage Lien: When a Corporation or LLC extends a loan or financial assistance to a property owner, they may file a mortgage lien against the property to secure their investment. The lien ensures that if the property owner defaults on their loan repayment, the corporation or LLC has the right to foreclose on the property in order to recover their money. 4. Judgment Lien: If a Corporation or LLC wins a lawsuit against an individual or entity and is awarded a monetary judgment, they can file a judgment lien against their debtor's property. This lien assists in enforcing the court's decision and ensures the successful party receives the owed amount through the sale of the property. It is important for both property owners and prospective buyers to be aware of Stamford Connecticut Certificates of Lien by Corporation or LLC. Buyers should conduct thorough due diligence before purchasing a property to identify any existing liens, while property owners should address any unpaid debts or disputes promptly to avoid potential legal complications.