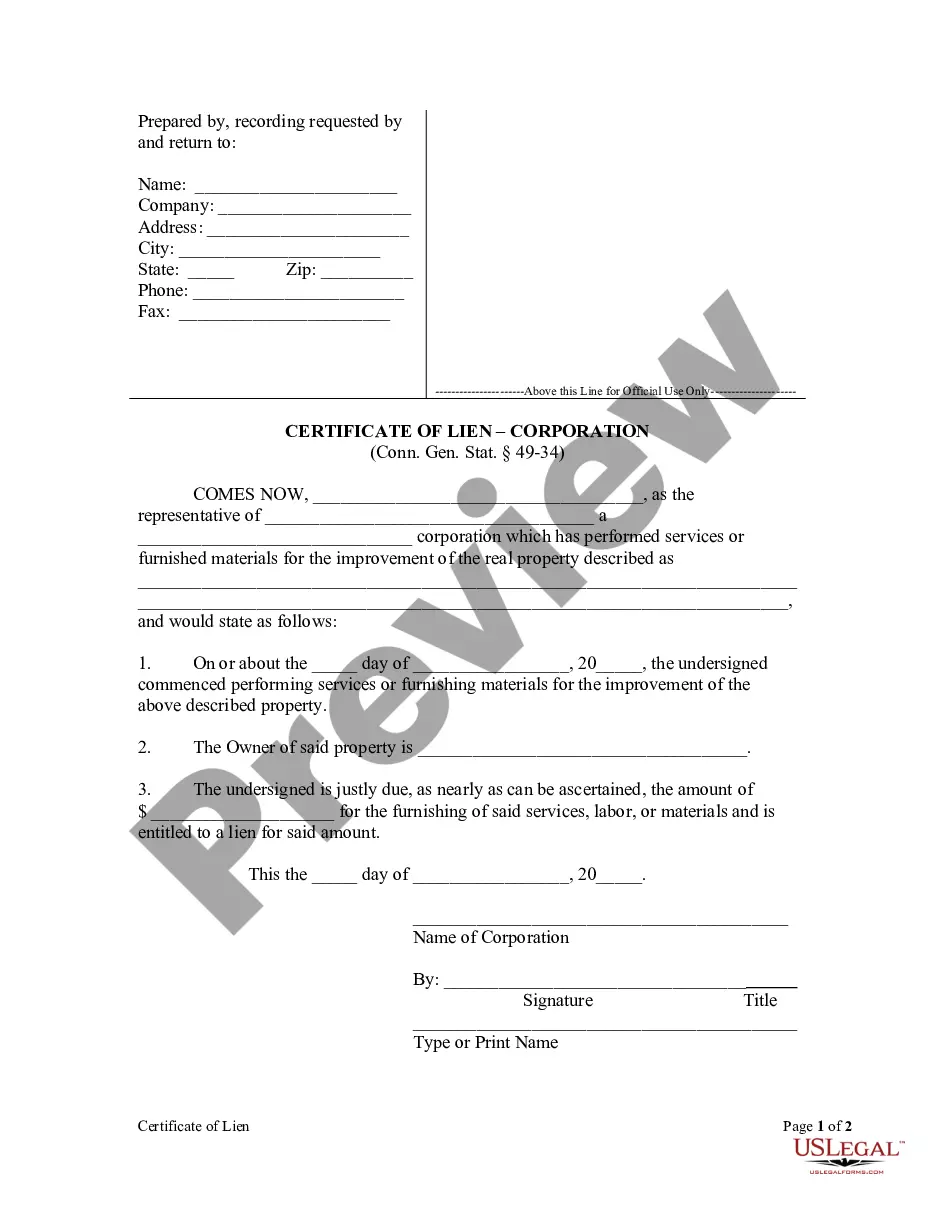

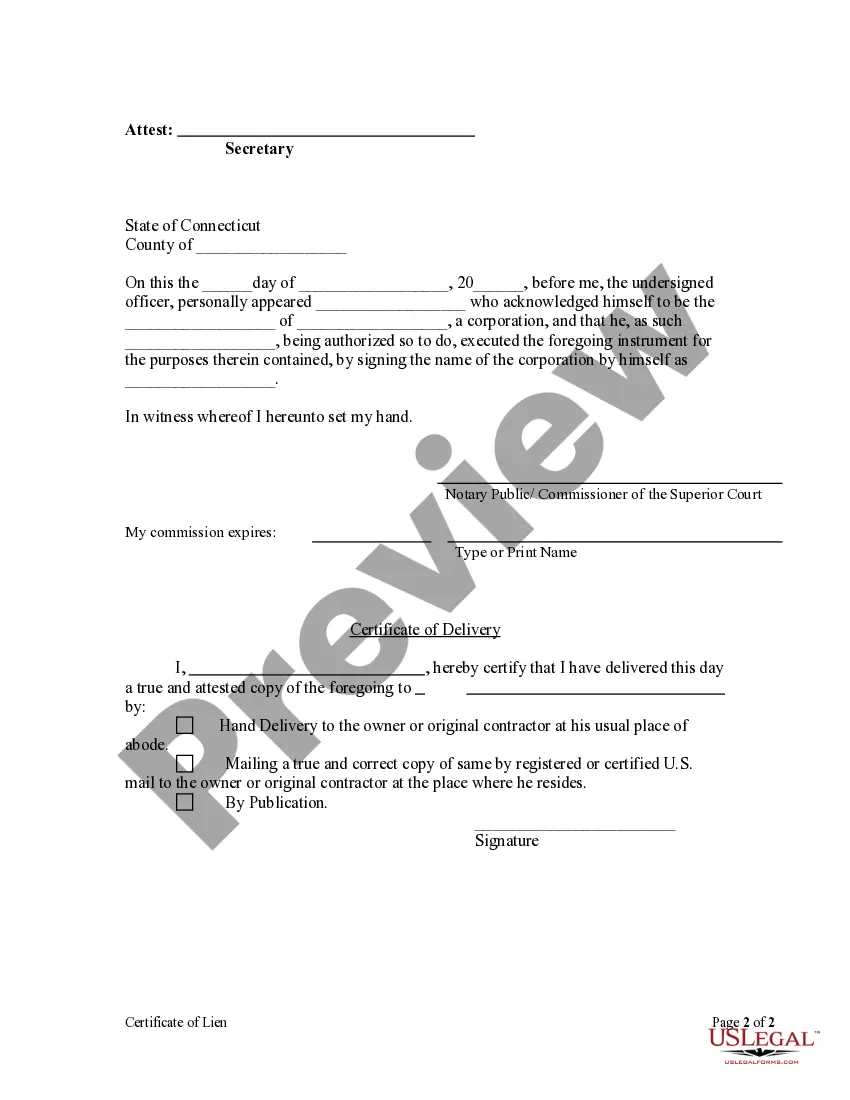

Conn. Gen. Stat. §49-34 states that a mechanic's lien is invalid without the filing of a certificate of lien within ninety (90) days after the cessation of work. The certificate must be recorded with the town clerk of the town in which the building, lot or plot is situated, and must be subscribed and sworn to by the lien claimant. The certificate must be served on the property owner, (a) within (90) days of the cessation of work, or (b) prior to the lodging of the certificate but not later than thirty (30) days after the lodging of the certificate. This form is for use by a corporation or limited liability company.

The Waterbury Connecticut Certificate of Lien by Corporation or LLC is a legal document that serves as a public notice of a corporation or limited liability company's claim against a particular property in Waterbury, Connecticut. When a corporation or LLC has outstanding debts, it may choose to file a certificate of lien to secure the repayment of those debts. The certificate of lien is an important tool for businesses to protect their interests and ensure that they receive payment for services rendered or goods provided. By filing this document with the appropriate governmental agency, the corporation or LLC establishes a legal claim on the property mentioned in the certificate. Keywords: Waterbury Connecticut, Certificate of Lien, Corporation, LLC, legal document, public notice, outstanding debts, repayment, secure, services rendered, goods provided, governmental agency, legal claim. Different types of Waterbury Connecticut Certificate of Lien by Corporation or LLC: 1. General Certificate of Lien: This is the most common type of certificate of lien used by corporations or LCS in Waterbury, Connecticut. It allows businesses to claim a lien on a property to secure the repayment of any outstanding debts. 2. Construction Lien Certificate: This specific type of certificate of lien is commonly used by construction companies or contractors working on a project in Waterbury, Connecticut. It grants them a lien on the property where the construction is taking place to ensure payment for their services and materials. 3. Mechanic's Lien Certificate: This type of certificate of lien is filed by businesses such as auto mechanics or repair shops. It establishes a legal claim on a vehicle or property for unpaid repair or maintenance expenses. 4. Tax Lien Certificate: In certain cases, corporations or LCS may file a certificate of lien to claim outstanding tax payments owed to the Waterbury, Connecticut tax authorities. This ensures that the government has a legal claim on the property until the tax debt is fully resolved. 5. Judgment Lien Certificate: If a corporation or LLC wins a lawsuit and is awarded a monetary judgment, they may file a certificate of lien to enforce payment. This type of lien extends the claimant's rights to the debtor's property until the judgment is satisfied. Keywords: General Certificate of Lien, Construction Lien Certificate, Mechanic's Lien Certificate, Tax Lien Certificate, Judgment Lien Certificate, corporation, LLC, Waterbury, Connecticut, legal claim, outstanding debts, repayment, property.The Waterbury Connecticut Certificate of Lien by Corporation or LLC is a legal document that serves as a public notice of a corporation or limited liability company's claim against a particular property in Waterbury, Connecticut. When a corporation or LLC has outstanding debts, it may choose to file a certificate of lien to secure the repayment of those debts. The certificate of lien is an important tool for businesses to protect their interests and ensure that they receive payment for services rendered or goods provided. By filing this document with the appropriate governmental agency, the corporation or LLC establishes a legal claim on the property mentioned in the certificate. Keywords: Waterbury Connecticut, Certificate of Lien, Corporation, LLC, legal document, public notice, outstanding debts, repayment, secure, services rendered, goods provided, governmental agency, legal claim. Different types of Waterbury Connecticut Certificate of Lien by Corporation or LLC: 1. General Certificate of Lien: This is the most common type of certificate of lien used by corporations or LCS in Waterbury, Connecticut. It allows businesses to claim a lien on a property to secure the repayment of any outstanding debts. 2. Construction Lien Certificate: This specific type of certificate of lien is commonly used by construction companies or contractors working on a project in Waterbury, Connecticut. It grants them a lien on the property where the construction is taking place to ensure payment for their services and materials. 3. Mechanic's Lien Certificate: This type of certificate of lien is filed by businesses such as auto mechanics or repair shops. It establishes a legal claim on a vehicle or property for unpaid repair or maintenance expenses. 4. Tax Lien Certificate: In certain cases, corporations or LCS may file a certificate of lien to claim outstanding tax payments owed to the Waterbury, Connecticut tax authorities. This ensures that the government has a legal claim on the property until the tax debt is fully resolved. 5. Judgment Lien Certificate: If a corporation or LLC wins a lawsuit and is awarded a monetary judgment, they may file a certificate of lien to enforce payment. This type of lien extends the claimant's rights to the debtor's property until the judgment is satisfied. Keywords: General Certificate of Lien, Construction Lien Certificate, Mechanic's Lien Certificate, Tax Lien Certificate, Judgment Lien Certificate, corporation, LLC, Waterbury, Connecticut, legal claim, outstanding debts, repayment, property.