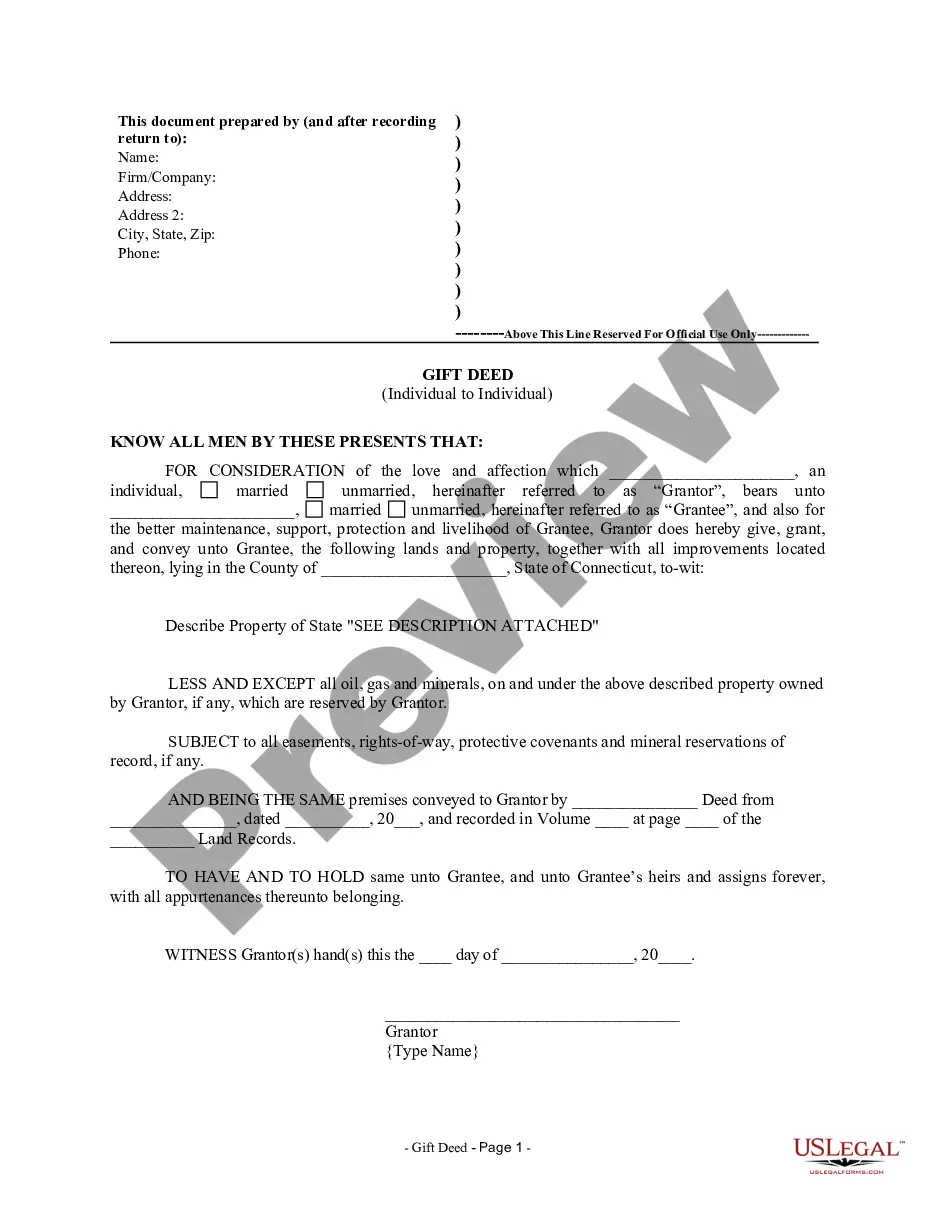

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Connecticut - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CT-020-77

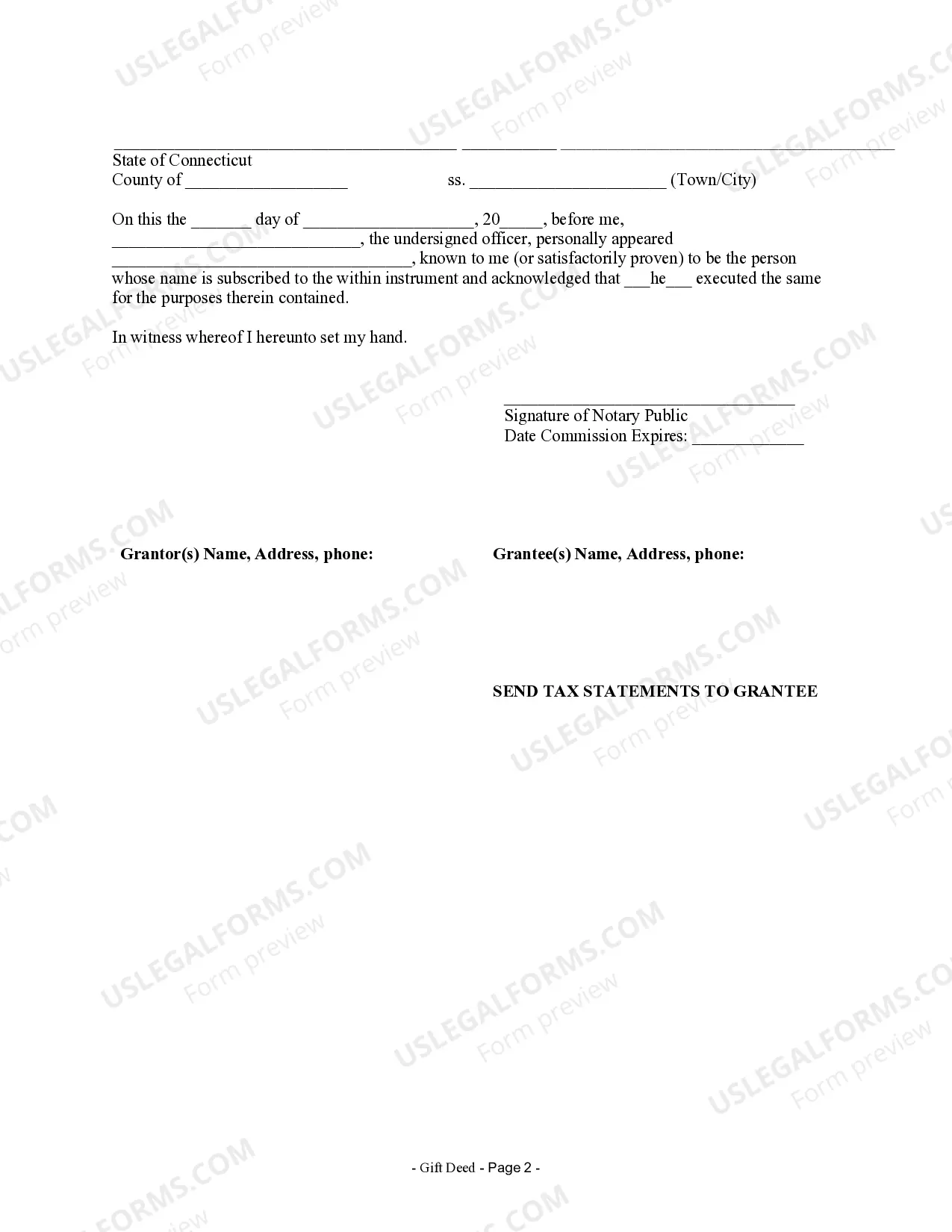

A Bridgeport Connecticut Gift Deed for Individual to Individual is a legal document that allows an individual to transfer ownership of a property as a gift to another individual. It is a way to transfer ownership without any monetary exchange taking place. This type of gift deed is commonly used when a person wants to transfer property to a family member, friend, or someone they wish to gift the property to. It is essential to have a written and signed gift deed to ensure the transfer is legally binding and to provide proof of the transfer for future reference. There are various types of Bridgeport Connecticut Gift Deeds for Individual to Individual, each serving a specific purpose. Some common types include: 1. Simple Gift Deed: This is a straightforward document that transfers ownership of a property from one individual to another without any conditions or restrictions. 2. Conditional Gift Deed: In this type of gift deed, the transfer of ownership is subject to certain conditions that both parties agree upon. These conditions can include restrictions on the use of the property, obligations to maintain the property, or any other mutually agreed-upon terms. 3. Partial Gift Deed: This deed is used when an individual wants to gift only a portion of their property to another person. It sets out the specific boundaries of the gifted portion and ensures there is no confusion regarding the ownership of the remaining part. 4. Life Estate Gift Deed: This type of deed allows an individual to transfer ownership of a property to another person, while retaining the right to occupy and use the property for their lifetime. After the original owner passes away, the gift recipient becomes the full owner of the property. 5. Gift Deed with Reservation of Life Estate: This deed allows the owner to transfer the property as a gift, but reserves the right to continue living on the property until they pass away. After which, the recipient becomes the sole owner of the property. It is crucial to consult with a real estate attorney to understand the specific requirements and regulations regarding Bridgeport Connecticut Gift Deeds for Individual to Individual. They can ensure that the deed is drafted correctly, all necessary information is included, and both parties' interests are protected throughout the transfer process.