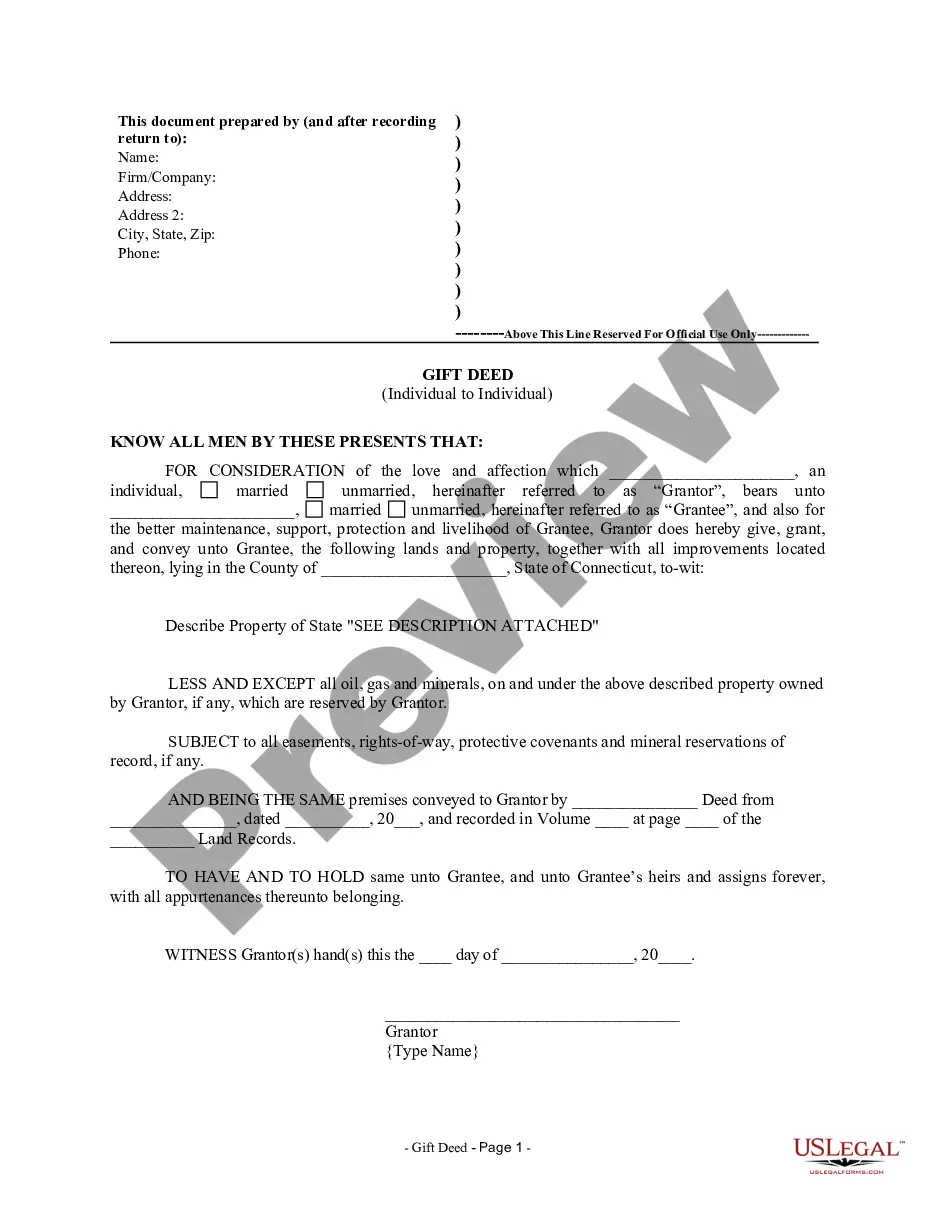

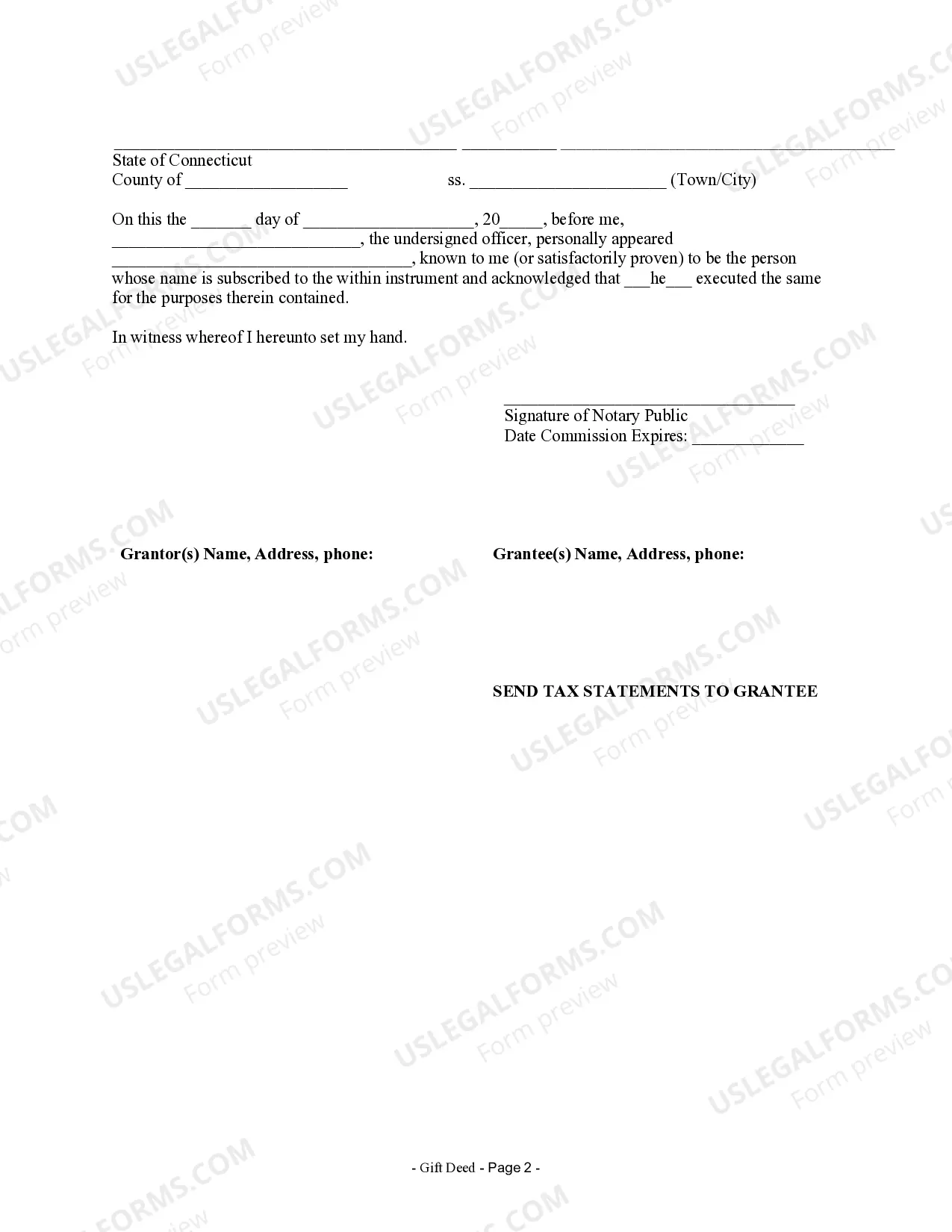

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Connecticut - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. CT-020-77

A Waterbury Connecticut Gift Deed for Individual to Individual is a legal document used to transfer ownership of real estate or personal property from one individual to another as a gift. This type of deed is commonly used when a person decides to gift their property to a family member, friend, or someone else without any financial consideration. The Waterbury Connecticut Gift Deed for Individual to Individual must meet specific requirements to be valid. Firstly, it must clearly state that the transfer is a gift and not a sale. It should include the names and addresses of both the donor (the person gifting the property) and the done (the person receiving the gift). Additionally, the deed must contain an accurate description of the property being gifted. This description typically includes the property's address, boundaries, and any other relevant identifying information. There are several types of Gift Deeds that may be used in Waterbury, Connecticut, depending on the specific situation: 1. Residential Property Gift Deed: This type of gift deed is used when an individual wants to gift their residential property, such as a house or condominium, to another person. It involves transferring the title and ownership of the property without any monetary exchange. Both parties must meet the legal requirements for the transfer to be valid. 2. Commercial Property Gift Deed: Similar to a residential property gift deed, this type of deed is used when an individual wishes to gift their commercial property, such as an office building or retail space, to another person. The transfer is done without any financial consideration, but the legal procedures and requirements remain the same. 3. Personal Property Gift Deed: This type of gift deed is used when an individual wants to gift personal property, such as a vehicle, artwork, or any other valuable possessions as a gift. The deed must include a clear description of the item being gifted, including any unique identifying information such as serial numbers or specific details. 4. Gift Deed with Reserved Life Estate: In some cases, an individual might wish to gift their property while retaining the right to live in or use it for the remainder of their life. This type of deed, known as a gift deed with a reserved life estate, allows the donor to gift the property immediately but specify that they retain a life interest. Upon the donor's death, full ownership of the property automatically transfers to the done. It is important to consult with a qualified attorney or legal expert familiar with Waterbury, Connecticut's laws and regulations to ensure that the gift deed meets all necessary requirements and is legally binding.