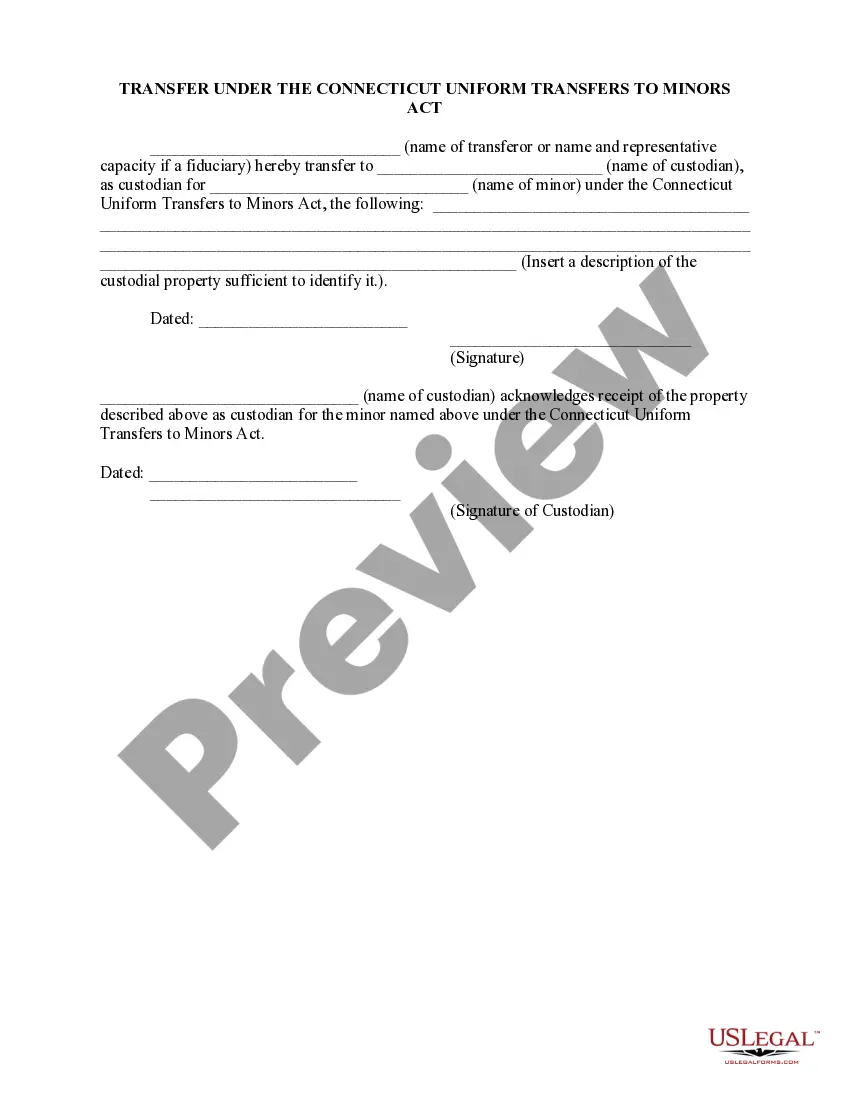

Section 45a-558f: Creation and Transfer of Custodial Property: This document is used when transfering property to a minor. In reality, the Transferor is transfering the property to a Custodian for the minor child. That Custodian will take care of the property for the minor child until such time the child becomes of legal age. This form is available in both Word and Rich Text formats.

Bridgeport Connecticut Sec. 45a-558f is a crucial provision under Connecticut law that pertains to the creation and transfer of custodial property in the Bridgeport area. This statute outlines the legal guidelines and requirements for establishing and transferring custodial property, ensuring the protection of assets held for beneficiaries. Under this statute, there are different types of Bridgeport Connecticut Sec. 45a-558f regarding the creation and transfer of custodial property. Here are some key variations recognized within the provision: 1. Bridgeport Connecticut Sec. 45a-558f for Real Estate: This type of custodial property focuses on immovable assets, such as land and permanent structures. The statute lays out the necessary procedures and regulations for the creation and transfer of real estate custodial accounts in Bridgeport. 2. Bridgeport Connecticut Sec. 45a-558f for Financial Assets: This category pertains to monetary assets, including cash, stocks, bonds, and other securities held in custodial accounts. The statute offers specific guidelines for the establishment, management, and transfer of financial custodial property in Bridgeport. 3. Bridgeport Connecticut Sec. 45a-558f for Personal Property: This type of custodial property encompasses tangible movable assets like vehicles, jewelry, artwork, and other valuable possessions. The statute addresses the procedures for creating and transferring custodial accounts for personal property in Bridgeport. 4. Bridgeport Connecticut Sec. 45a-558f for Intellectual Property: This variant covers intangible assets such as copyrights, patents, trademarks, and other forms of intellectual property. The statute ensures the appropriate creation and proper transfer of custodial property associated with intellectual assets in Bridgeport. Bridgeport Connecticut Sec. 45a-558f requires adherence to specific requirements when establishing and transferring custodial property. These requirements include identifying the custodian, clearly specifying the property involved, and ensuring compliance with any additional regulations imposed by the Connecticut law. It is crucial for individuals and entities involved in creating or transferring custodial property in Bridgeport to consult with experienced legal professionals. Qualified attorneys can provide guidance on the application of Bridgeport Connecticut Sec. 45a-558f and ensure compliance with the law while protecting the interests of all parties involved.

Bridgeport Connecticut Sec. 45a-558f is a crucial provision under Connecticut law that pertains to the creation and transfer of custodial property in the Bridgeport area. This statute outlines the legal guidelines and requirements for establishing and transferring custodial property, ensuring the protection of assets held for beneficiaries. Under this statute, there are different types of Bridgeport Connecticut Sec. 45a-558f regarding the creation and transfer of custodial property. Here are some key variations recognized within the provision: 1. Bridgeport Connecticut Sec. 45a-558f for Real Estate: This type of custodial property focuses on immovable assets, such as land and permanent structures. The statute lays out the necessary procedures and regulations for the creation and transfer of real estate custodial accounts in Bridgeport. 2. Bridgeport Connecticut Sec. 45a-558f for Financial Assets: This category pertains to monetary assets, including cash, stocks, bonds, and other securities held in custodial accounts. The statute offers specific guidelines for the establishment, management, and transfer of financial custodial property in Bridgeport. 3. Bridgeport Connecticut Sec. 45a-558f for Personal Property: This type of custodial property encompasses tangible movable assets like vehicles, jewelry, artwork, and other valuable possessions. The statute addresses the procedures for creating and transferring custodial accounts for personal property in Bridgeport. 4. Bridgeport Connecticut Sec. 45a-558f for Intellectual Property: This variant covers intangible assets such as copyrights, patents, trademarks, and other forms of intellectual property. The statute ensures the appropriate creation and proper transfer of custodial property associated with intellectual assets in Bridgeport. Bridgeport Connecticut Sec. 45a-558f requires adherence to specific requirements when establishing and transferring custodial property. These requirements include identifying the custodian, clearly specifying the property involved, and ensuring compliance with any additional regulations imposed by the Connecticut law. It is crucial for individuals and entities involved in creating or transferring custodial property in Bridgeport to consult with experienced legal professionals. Qualified attorneys can provide guidance on the application of Bridgeport Connecticut Sec. 45a-558f and ensure compliance with the law while protecting the interests of all parties involved.