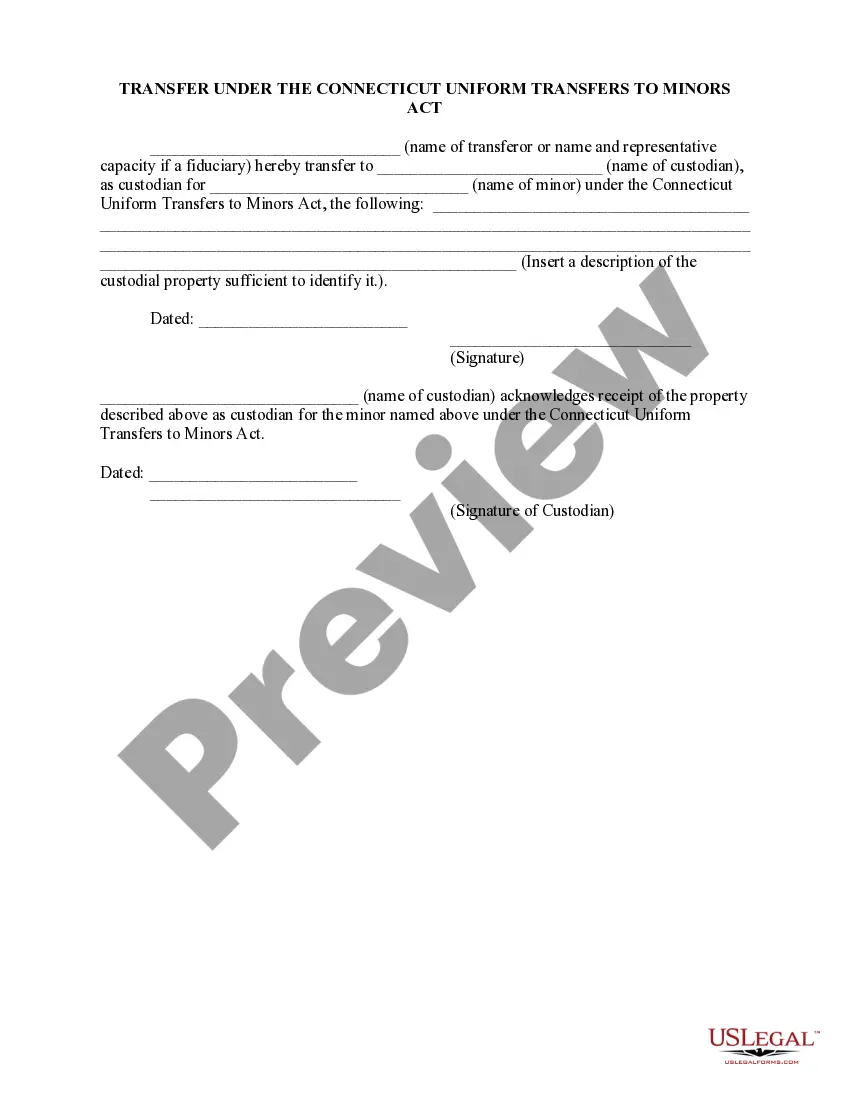

Section 45a-558f: Creation and Transfer of Custodial Property: This document is used when transfering property to a minor. In reality, the Transferor is transfering the property to a Custodian for the minor child. That Custodian will take care of the property for the minor child until such time the child becomes of legal age. This form is available in both Word and Rich Text formats.

Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property

Description

How to fill out Connecticut Sec. 45a-558f. Creation And Transfer Of Custodial Property?

If you have previously employed our service, sign in to your account and store the Stamford Connecticut Sec. 45a-558f. Formation and Transfer of Custodial Property on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your first interaction with our service, follow these straightforward steps to obtain your document.

You possess indefinite access to every document you have purchased: you can locate it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to effortlessly find and save any template for your individual or professional requirements!

- Ensure you have located an appropriate document. Review the description and utilize the Preview option, if accessible, to verify if it suits your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal choice to finalize the transaction.

- Obtain your Stamford Connecticut Sec. 45a-558f. Formation and Transfer of Custodial Property. Choose the file format for your document and save it to your device.

- Complete your template. Print it out or make use of professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Connecticut's statutes regarding interference with an officer outline the legal consequences of obstructing law enforcement in the performance of their duties. Understanding these laws is essential for maintaining public safety and order. When related to custodial property issues, adhering to such statutes complements the proper execution of the Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property.

Connecticut General Statutes 45a-436 lays out the legal requirements for creating and managing trusts in the state. This statute is vital for anyone looking to secure assets for future beneficiaries. For those navigating custodial property matters, the principles outlined in Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property may align closely with trust management.

Connecticut General Statutes 7-465 covers the indemnification of municipal employees under certain conditions. This provision ensures that employees are protected when performing their duties, thereby promoting accountability and trust in public service. When dealing with custodial property matters, understanding these protections can aid in proper planning under Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property.

Connecticut General Statutes 45a-175 addresses the appointment of conservators for individuals who cannot manage their affairs. This statute is essential for families seeking guidance on protecting loved ones. In the context of Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property, it highlights the importance of proper management and transfer of custodial assets.

Section 47a-16 of the Connecticut General Statutes outlines the rights and responsibilities of landlords and tenants in Connecticut. It details the procedures for eviction and related matters, ensuring fair treatment for both parties. Understanding these laws is crucial for anyone involved in rental agreements in Stamford, especially when it comes to managing custodial property under Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property.

Choosing between a 529 plan and a custodial account depends on your financial goals. A 529 plan offers tax benefits specifically for education expenses, while custodial accounts provide more flexible usage of funds. It's essential to consider the implications of Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property when making your decision, as each option serves different purposes and comes with unique regulations.

The UTMA rule in Connecticut allows for the establishment of custodial accounts under the Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. This rule enables individuals to transfer assets to minors without immediate taxation requirements. Understanding the UTMA will help you make informed decisions about how to manage custodial transfers effectively.

While custodial accounts offer benefits such as tax advantages, they also come with some downsides. Under Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property, these accounts can limit your financial flexibility. Additionally, once assets are transferred, they cannot be taken back, which may restrict your financial options later on.

Once you reach the age of 18, your custodial account will transition to your control under the Stamford Connecticut Sec. 45a-558f. Creation and Transfer of Custodial Property. You will now be responsible for managing the assets in the account. It's crucial to understand the implications of this control, as you can withdraw funds or make investments at your discretion.

Under Stamford Connecticut Sec. 45a-558f, Creation and Transfer of Custodial Property, UTMA accounts serve as a means for transferring assets to minors. These accounts allow custodians to manage properties until the minor reaches the age of majority. It is important to note that the funds in UTMA accounts must be used for the benefit of the minor, ensuring proper management and use. Additionally, once the minor reaches the specified age, they gain full control over the assets, providing a clear transition of ownership.